As a new business owner, you may have heard people talking about an EIN, federal tax ID number, FEIN, taxpayer identification number (TIN), or something along those lines.

All of these terms refer to the same thing – an Employer Identification Number (EIN), issued by the Internal Revenue Service (IRS).

Some businesses can opt to register an EIN, while others are required to get an EIN to be compliant.

Let’s unpack EIN, when an LLC may need one, and what’s the simplest way to obtain it.

What is an employer identification number (EIN)?

An Employer Identification Number, also known as a Federal Tax Identification Number, is a nine-digit number used by the IRS to identify a business entity.

The IRS uses it to track federal income tax filings, business tax reporting, and employment tax withholding.

A federal employer identification number is different from a state tax ID used to track your tax reporting in the LLC formation state.

You’ll need a state tax ID if you’re required to pay state sales and excise taxes, payroll taxes, or minimal annual franchise taxes. Read more about how LLCs file taxes to understand all your obligations.

Do all businesses need an EIN?

No, not every type of business needs an Employer Identification Number.

If you’re a single-member LLC, reporting taxes as a sole proprietorship, and don’t have any employees on the payroll, you can use your social security number (SSN) for federal tax purposes.

An EIN is required, however, when a business entity meets any of the following criteria:

- Has or plans to hire employees

- Reports taxes as a partnership, S-corp, or C-corporation

- Files employment, excise, or Alcohol, Tobacco, and Firearms tax returns

- Withholds taxes on non-wage income

- Has a Keogh plan

- Is involved with trusts, estates, non-profit organizations, and farmers’ co-ops

Do I automatically get an EIN with my LLC?

No. You need to apply for a new EIN for your LLC separately.

EIN is issued by the IRS, not state authorities such as the Secretary of State (or equivalent office) that processes new company incorporations.

Because the IRS and SOS are two different entities, you don’t automatically get an EIN.

What are the benefits of an EIN?

EIN registrations are mandatory for all multi-member LLCs and optional for single-member LLCs. So the main benefit of getting an EIN is federal tax compliance.

If you are a single-member LLC, there are, however, several advantages of getting an EIN:

- Ability to elect another tax classification such as S-corporation

- Protect your SSN from potential identity theft

- Obtain financing under your business name for new business activities

- Establish extra layer of legal separation between you and your business

How to get an EIN for LLC from the IRS

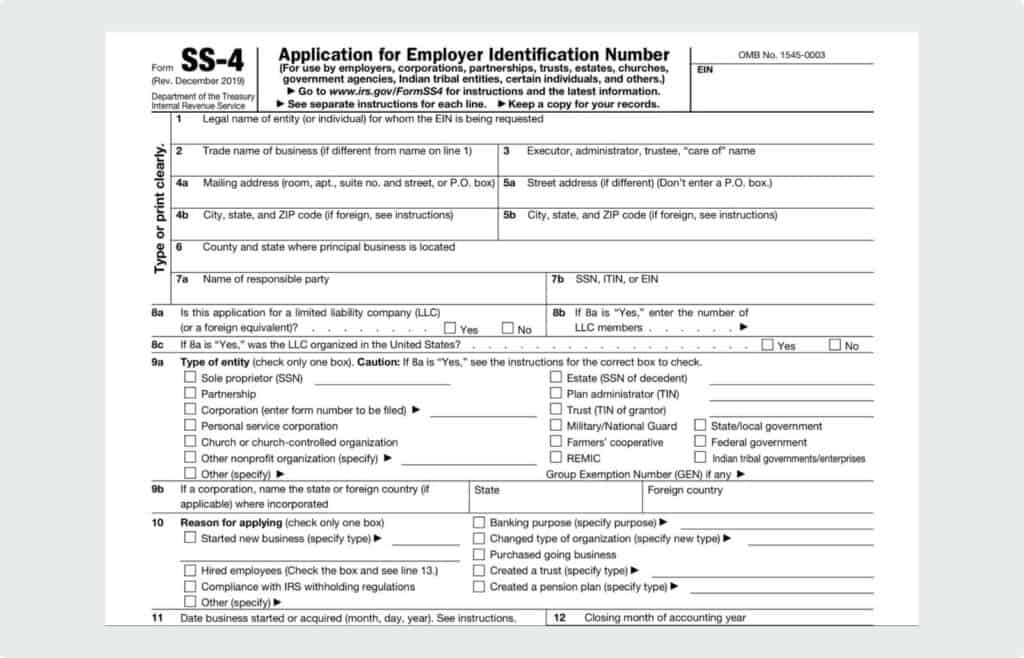

To get an EIN for your LLC, you need to complete Form SS-4 and send it to the IRS.

IRS accepts:

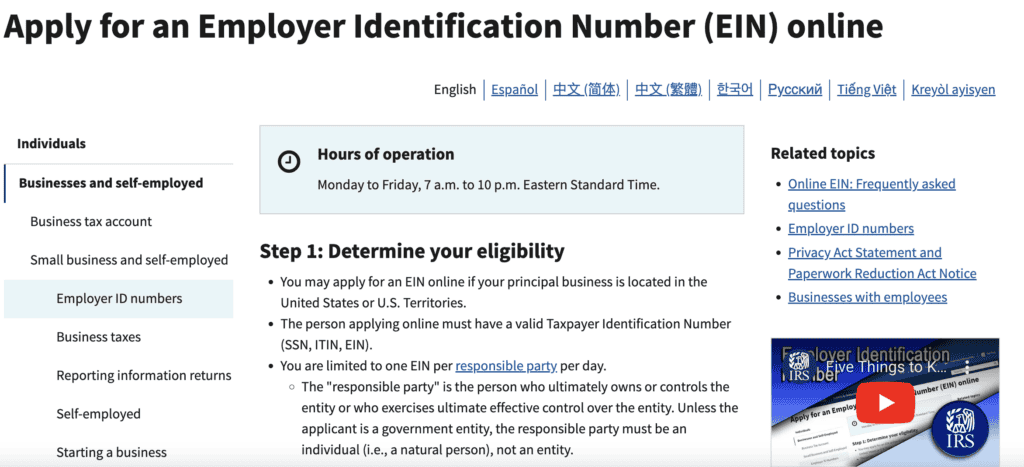

- EIN online registration on the IRS website (processed immediately)

- Mailed-in EIN registration (processed within 4 weeks)

The online application is more convenient, and you get an EIN immediately.

To get your EIN, you need to:

- Answer several simple questions about your business type, trade, or industry

- Provide contact information

- Add details of the responsible party.

A “responsible party” is the business owner (or one of the LLC members). Or a third-party legal entity exercising control and management over the business and its assets (e.g., an appointed LLC manager).

International applicants may call the IRS to obtain an EIN. All applicants can designate a third party – an accountant, tax advisor, or legal firm – to handle the EIN application if needed.

Is there a downside to getting an EIN for LLC?

There’s no downside to getting an Employer ID number for your LLC. It’s free and easy to do. Plus, it provides you with the possibility to hire employees or choose another tax classification.

What happens if I don't use EIN?

If you don’t use your EIN, the IRS can close your account. Closing, however, doesn’t mean canceling your number. Once an EIN is issued to a business entity, it becomes permanently associated with only that entity.

If you didn’t use your EIN but realized that you need it now, you can reopen your account and use the same number again.

Conclusion

Forming a limited liability company (LLC) can overwhelm many small business owners. There are numerous tasks to consider, such as filing Articles of Organization, applying for a DBA, obtaining business licenses and permits, opening a business bank account, and creating an operating agreement.

Registering for an EIN is another essential step, especially for multi-member LLCs. However, if you are a single-owner LLC with no employees, you can delay this step. In such cases, you can report taxes as a sole proprietor.

If you don’t need it now, you can apply for one for free anytime on the IRS.gov website.