Essentially, you work for yourself and represent your business. The sole proprietor and the sole proprietorship are not separate legal entities. And so, the business owner is responsible for all aspects of the company.

Separately, a sole proprietorship is also a tax classification used by the IRS to determine the applicable tax regime for the business.

For example, most self-employed individuals report their freelance income as sole proprietors on personal tax returns. And so do members of the limited liability companies (LLCs).

According to the latest government stats, 81.9% of businesses without employees operate as sole proprietorships. This stat, however, also includes single-member LLCs who also report business taxes under this category.

Typical sole proprietorship business examples

Anna Smith decides to start a photography business, while David White wants to become a consultant. After freelancing for several months and generating a profit from these business activities, they both choose to go full-time. Now, they’re sole proprietors.

New business owners with less capital may consider starting as a sole proprietorship.

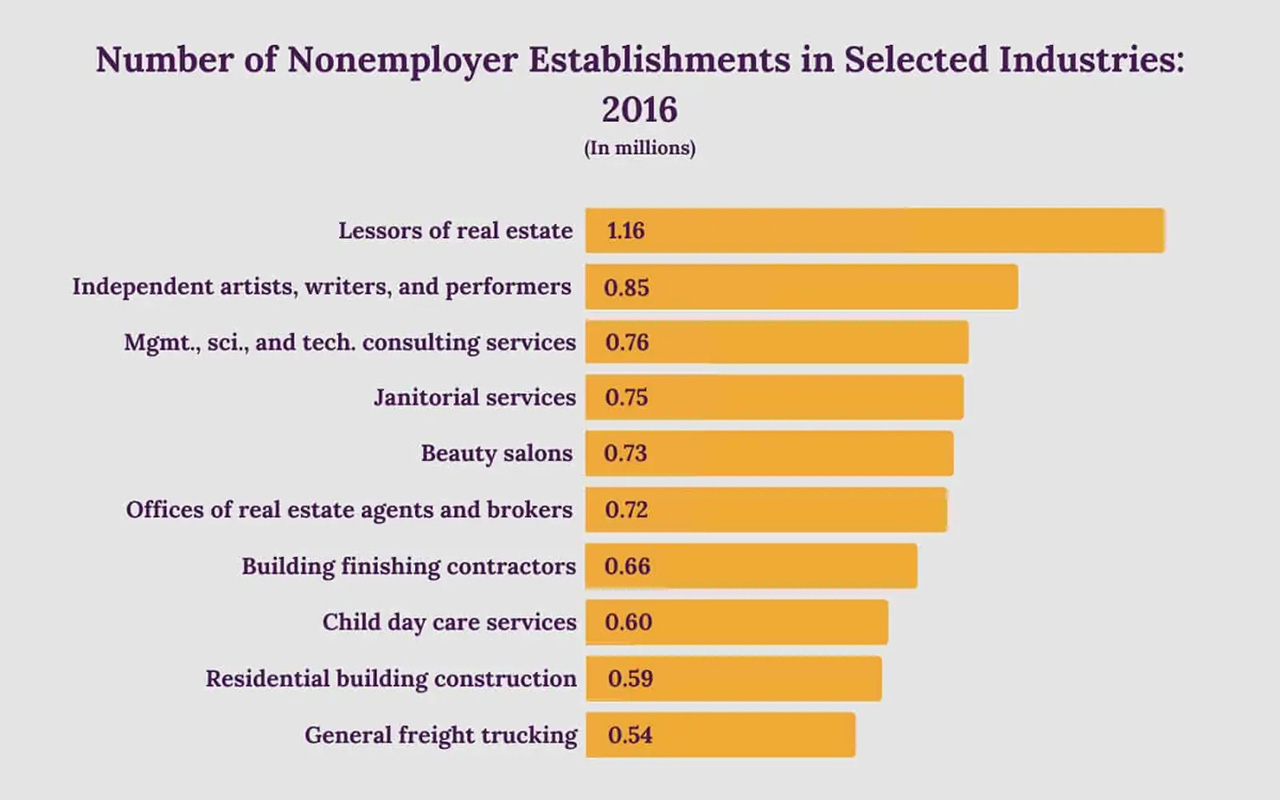

The U.S. Census has stats on the types of industries with high numbers of self-employed individuals:

Who should form a sole proprietorship?

A small business owner just getting started and wants a simple and easy-to-form business structure should consider creating a sole proprietorship.

Some common examples of sole proprietorships include:

- Freelancers

- Consultants

- Small e-commerce store owners (e.g., Etsy)

- Photographers

- Independent contractors

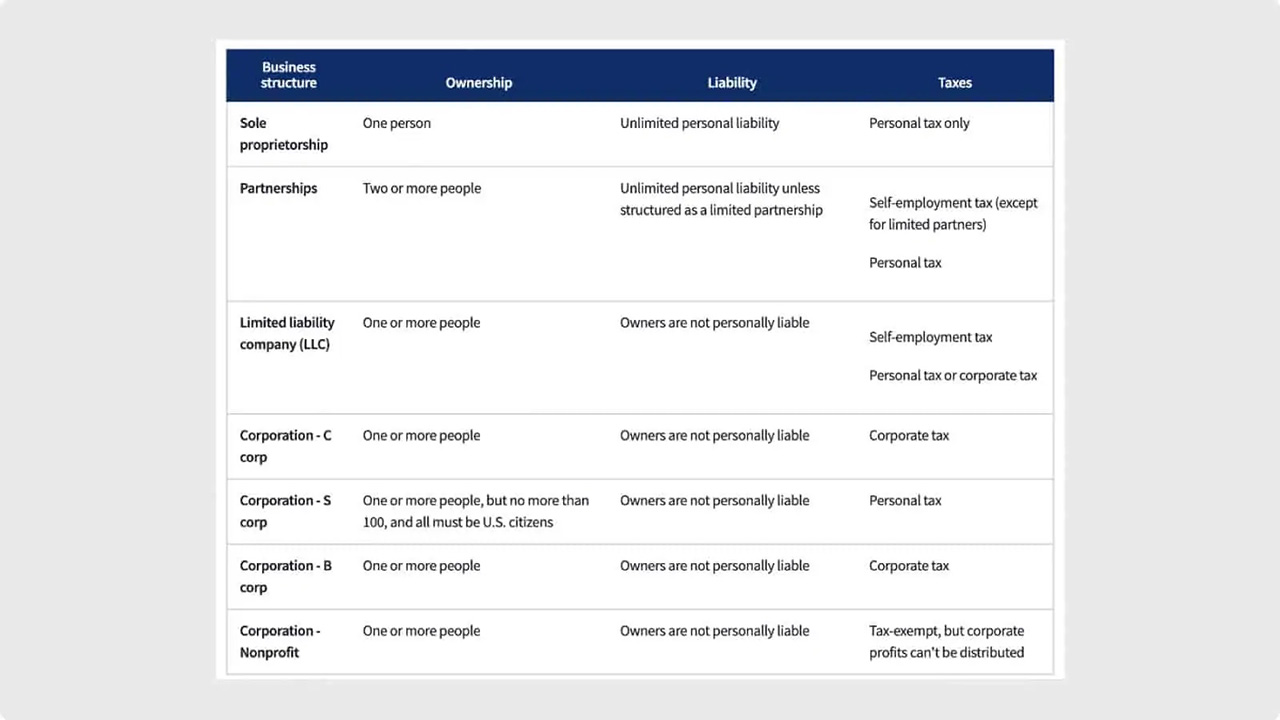

How does a sole proprietorship compare to other business structures?

A sole proprietorship is an informal business structure. Respectively, it doesn’t come with the same legal protection as incorporated entities.

However, sole proprietors don’t need to file any formation documents with the state to get their business started.

Here are some other distinctions between this type of business structure and the other popular options.

Sole proprietorship vs. LLC

A sole proprietorship is an unincorporated business entity with one owner, not a separate legal entity.

A limited liability company (LLC) is a registered business structure formed under applicable state laws. It’s a separate legal entity with one or more business owners.

When operating as an LLC, the company becomes liable for debts or legal claims, not the individual business owner(s). That is not the case with a sole proprietorship.

Sole proprietorship vs. partnership

Sole proprietorships and partnerships are similar in a way that both are unincorporated operational structures. However, a partnership always assumes at least two business owners, when sole proprietorship is always a business of one.

Sole proprietorship vs. corporation

Corporations are registered business structures and are separate taxable entities. As such, income tax is reported much differently compared to sole proprietorships.

Public corporations are also owned by multiple shareholders, which is not an option for sole proprietorships. Likewise, the company formation process and day-to-day operations are very different for a sole proprietor vs. corporation shareholder.

The following chart from SBA.gov compares different business structures:

Doing business as (DBA) vs. sole proprietorship

A sole proprietor may run their small business under a personal name. Alternatively, sole proprietors can apply for a trade name (fictitious name, assumed name) with the state authorities.

By filing a doing business as (DBA) form, you establish a link between your sole proprietorship and the operational name you use with customers. Essentially, a DBA helps you operate under a name different from your own.

Using a DBA trade name doesn’t create a separate legal entity for sole proprietorships.

Sole proprietor taxation

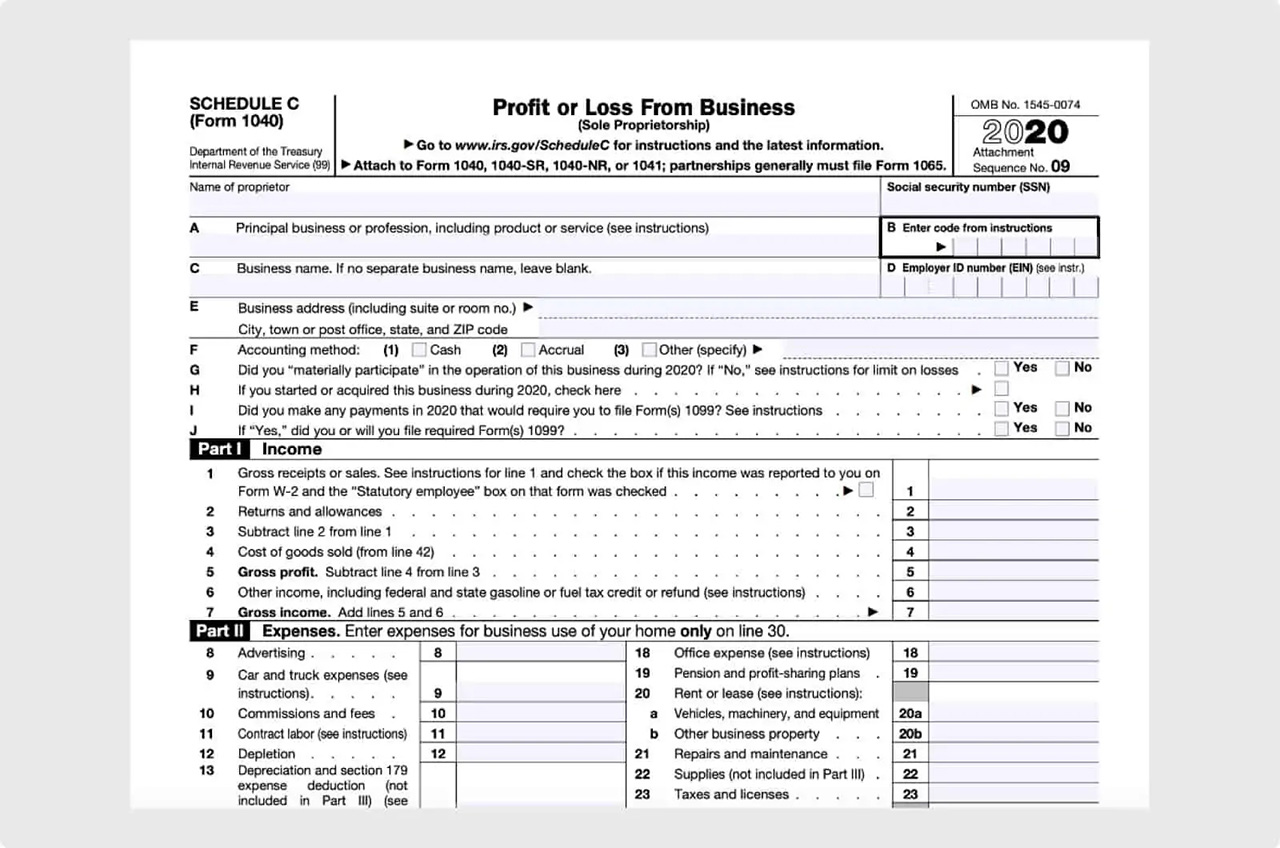

Sole proprietorships are not considered separate entities from the business owner (or sole proprietor) for income tax purposes. As such, the income and expenses of the small business are reported on the business owner’s personal income tax form.

You’ll need to download and fill in a Schedule C (Form 1040) to report your business’s financial activity. Then you’d receive a tax bill based on the income generated from all sources.

How to form a sole proprietorship?

There’s no “formation process” for a sole proprietorship per se since this is an informal business structure. As long as someone else hires you to do some one-off job and pays you cash, you essentially become a sole proprietor.

Essentially, once you turn a profit from any side activity — be it photography, web design, or selling baked goods — you’re expected to report it as business income on Schedule C form with the IRS.

The IRS will consider something a hobby instead of a business if the activities don’t turn a profit. A sole proprietorship is not formed unless the owner later turns a profit.

Get all the proper licenses and permits

Even though there’s no formal incorporation process for sole proprietors, you may still need a business license to provide certain services. The requirements depend on your line of business, federal regulations, and state rules.

The SBA (Small Business Administration) provides a helpful resource listing possible required licenses and permits.

The commonly regulated industries include Agriculture, Finance, Education, Beauty Services, Fishing, Transportation, and Logistics.

Optional: open a business bank account

A sole proprietor can have a separate bank account in their name. But many choose to route business payments into their personal bank account. Legally, that is acceptable. But in practice, having a separate business bank account makes end-of-the-year accounting and tax reporting oh-so-easier.

Key takeaways

Sole proprietorship FAQs

Here are the most frequently asked questions about a sole proprietorship.