Starting an LLC in Arizona is simple and affordable, making it a great choice for entrepreneurs.

With low filing fees and minimal maintenance, Arizona lets business owners focus on growth instead of paperwork. The Arizona Corporation Commission (ACC) handles LLC filings, and resources from the Secretary of State and local associations make the process even easier.

Whether you're starting fresh or expanding, Arizona’s streamlined system and supportive business environment sets you up for success.

This guide will walk you through every step to form your LLC.

Steps to Create an LLC in Arizona

- Step 1: Choose a Name for Your Arizona LLC

- Step 2: Appoint a Statutory (Registered) Agent

- Step 3: File the Arizona LLC Articles of Organization

- Step 4: Publish a Notice of the Filing of the Articles of Organization

- Step 5: Create an LLC Operating Agreement

- Step 6: Get an EIN (Employer Identification Number) from the IRS

- Total Costs to Form an LLC in Arizona

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Choose a Name for Your Arizona LLC

The first step is selecting a name for your LLC.

Let your creativity flow to find one that suits your vision. Additionally, ensure it complies with the following Arizona business regulations:

- Include the word “limited liability company” or an abbreviation such as LLC, etc.

- Avoid words like association, corporation, or incorporated

- Your name must be unique and distinguishable from registered entities

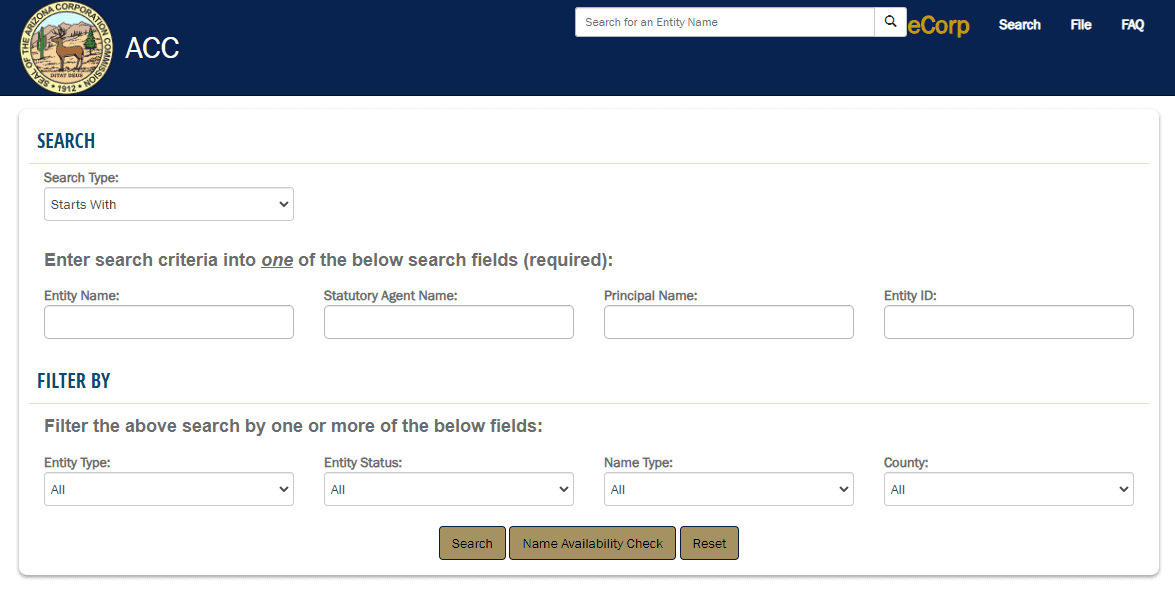

To check if your idea is available, use Arizona’s business name search tool:

Avoid selecting a name that may confuse your business with any existing business.

Name Reservation (optional)

A name reservation isn’t required. But it can secure your top name contender, giving you time to handle other formation needs.

The standard cost to reserve an Arizona LLC name is $10 for standard processing when done by mail or fax. You can also file online through the Arizona Corporation Commission (“ACC”) website. If you pay by card, there is an additional $2 fee.

In Arizona, you can also file request expedited service online, which includes a $10 filing fee and a $35 expedited fee, plus $2 for the card processing fee. This allows for immediate reservation, giving it the fastest processing time compared to paper applications. The name reservation is valid for 120 days, allowing you to handle other formalities without rushing.

A Trade Name (optional)

Registering a trade name, also known as DBA (doing business as), is another optional filing.

Using a trade name allows you to operate under something other than the LLC’s legal name. This is especially helpful when managing several brands or services under one company.

Register a trade name with the Arizona Secretary of State (SOS). The cost is $10 per Trade Name and it may few weeks to process. You can get expedited service for an extra $25.

Step 2: Appoint a Statutory (Registered) Agent

Now shift your attention to appointing a registered agent. This is a critical aspect of your LLC. It serves as the official point of contact for things like legal notices and tax documents.

Arizona calls this role a “statutory agent” and can be fulfilled by:

- An individual residing in the state of Arizona with a physical address (not a P.O. Box)

- An LLC, foreign corporation, or foreign LLC that’s authorized to do business in Arizona

You appoint the statutory agent during the LLC formation process. Then they must respond by filing the Statutory Agent Acceptance form.

If you don't want to be your own registered agent, you can hire one for about $75-$155/year in Arizona.

Step 3: File the Arizona LLC Articles of Organization

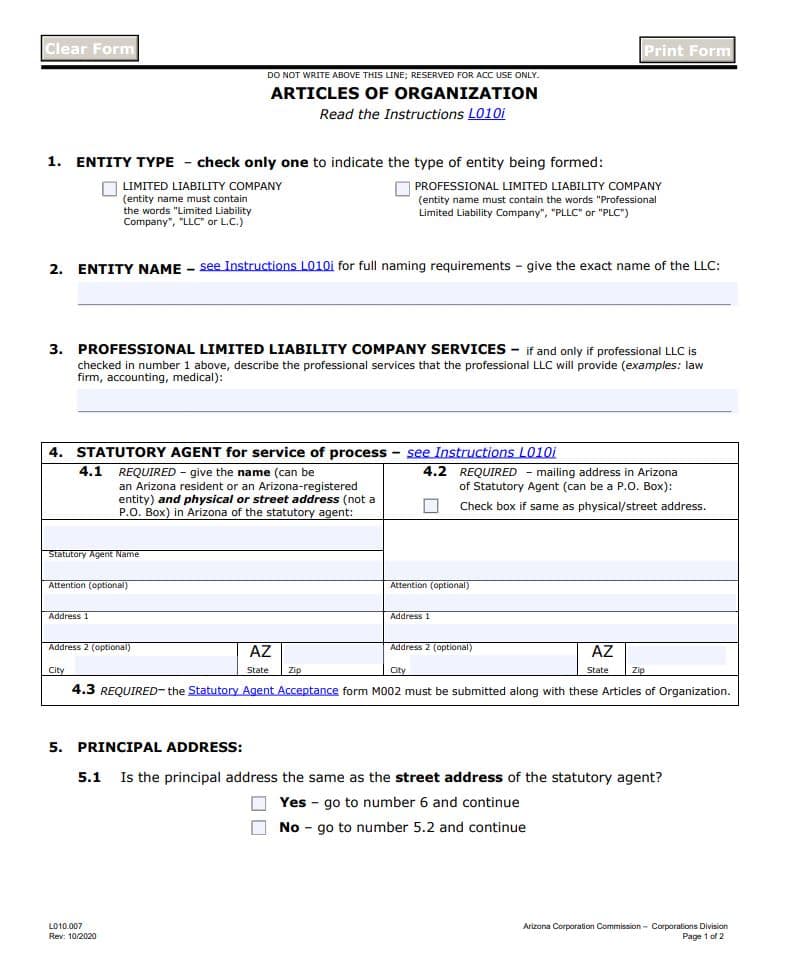

The articles of organization serve as the legal document to form an Arizona LLC. It can be an intimidating step. But the process is likely more straightforward than you imagine.

The application for articles of organization form requires listing:

- Business entity type (LLC or Professional LLC)

- LLC’s name

- A description of services for Professional LLCs

- Statutory agent’s name and contact information

- Business’s principal address

- Member-managed or manager-managed

Use ACC’s eCorp system for online filings and fast processing. Or you can choose to submit a form by mail or fax.

The filing fee for Arizona articles of organization is $50.

The standard processing time is 30 business days. You can buy expedited processing for an extra $35 to get a 5-day turnaround.

If you need them even faster, next day service is $100, same-day filing is $200, and two-hour filing is $400.

Step 4: Publish a Notice of the Filing of the Articles of Organization

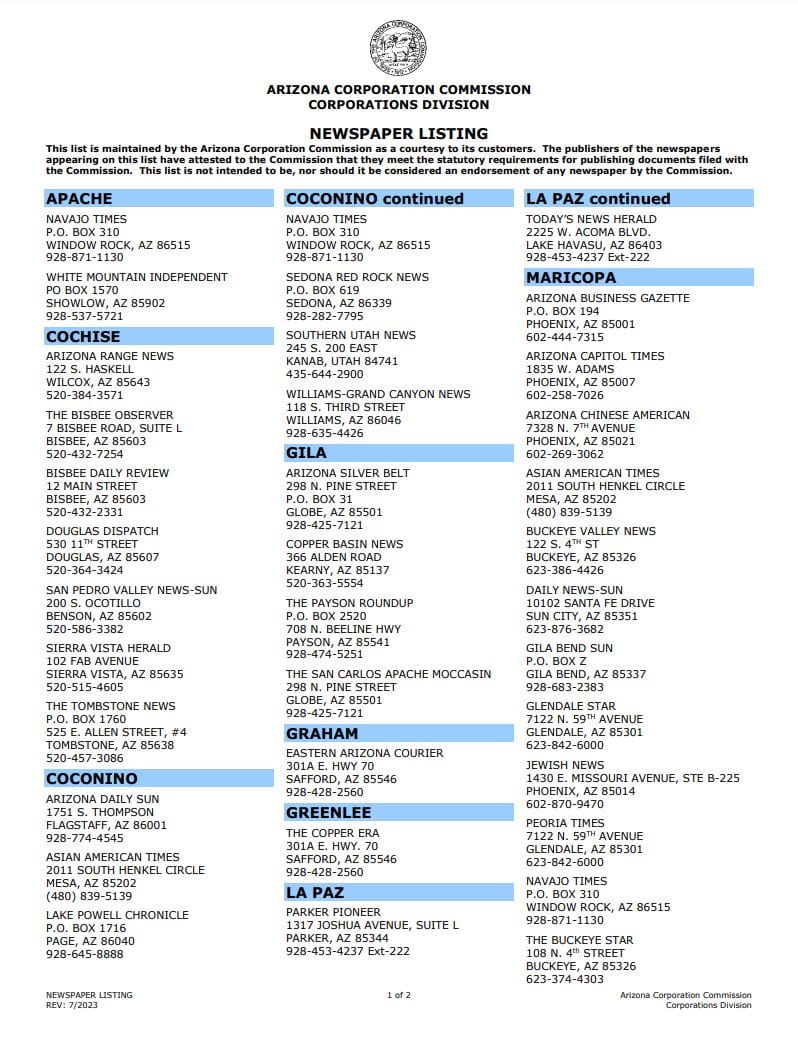

Arizona is one of three states that have a mandatory publication requirement for LLCs. The other states with similar requirements are New York and Nebraska.

After the state approves your formation documents, the ACC will tell you if you need to publish a notice. That’s typically the case for articles of organizations.

You’ll need to pay an approved newspaper for publishing the notice three consecutive papers. The fee for this can range from about $60-$300.

Note: this requirement does not apply to LLCs whose known place of business is in Maricopa or Pima counties.

Once completed, the newspaper will provide an Affidavit of Publication. Although not required, you can file it with the ACC to make it part of your LLC’s public record.

Step 5: Create an LLC Operating Agreement

An operating agreement is a private contract between the LLC members. It lays out the rights and obligations of the LLC members and managers.

Although Arizona law doesn’t force you to get one, don’t overlook an operating agreement. It is critical for a multi-member LLC.

If there’s no operating agreement in place, your LLC falls back to Arizona state law. This may result in unexpected outcomes that don’t align with your desires.

Instead, you can create an operating agreement that dictates how to:

- Add and remove members or managers

- Allocate profits and losses

- Resolve many different types of disputes

You can create an operating agreement using a free or low-cost template. Or seek help from a corporate attorney or LLC formation service to get one customized to your needs.

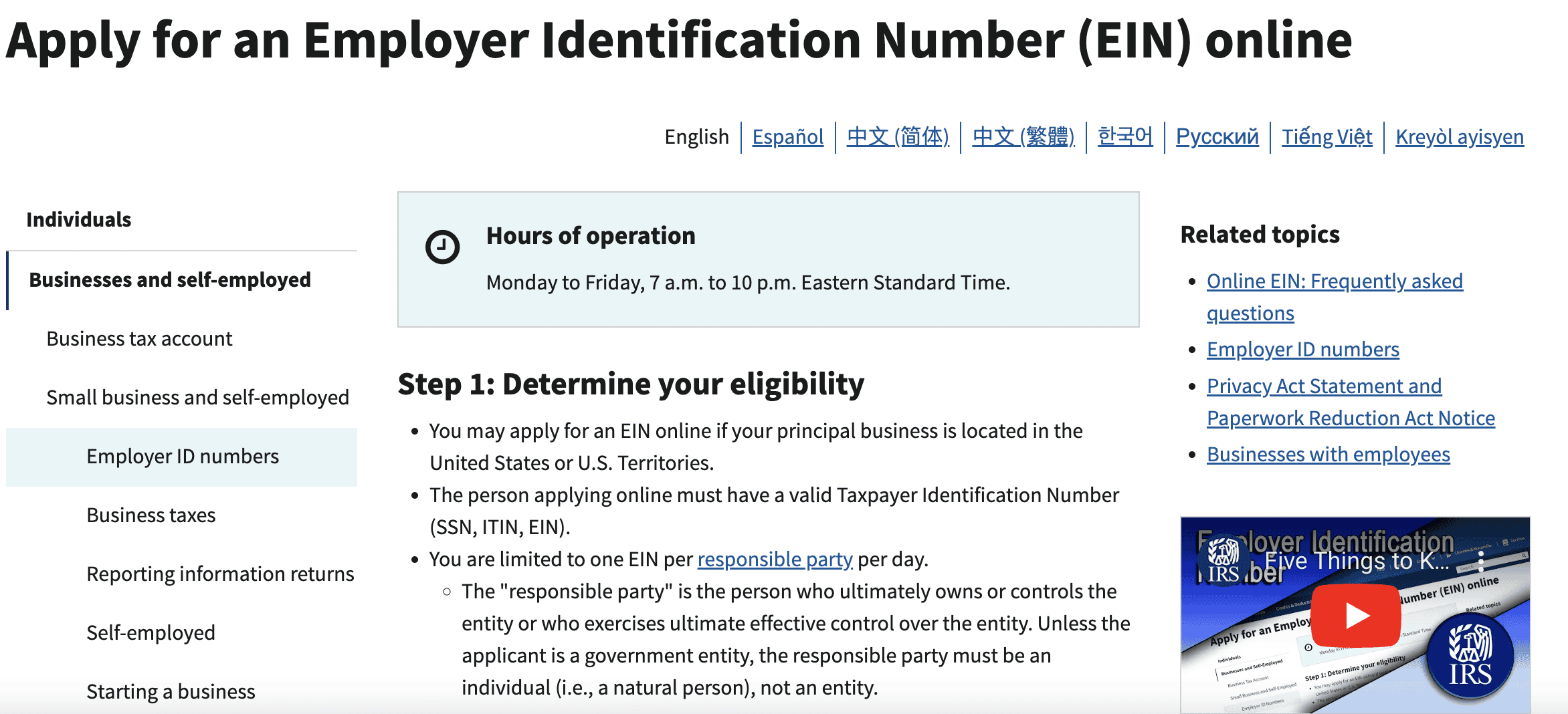

Step 6: Get an EIN (Employer Identification Number) from the IRS

The Internal Revenue Service (IRS) issues Employer Identification Numbers (EINs). It’s like a Social Security number for businesses. The IRS uses EINs to track your tax information.

LLCs with more than one member or any employees must get an EIN.

Getting an EIN is quick and free. You can apply and obtain one on the IRS website.

Some single-member LLCs can use the owner’s personal Social Security number. But the IRS requires an EIN if other specific situations apply. These include certain tax withholding, business activities, and retirement plans.

Total Costs to Form an LLC in Arizona

Forming an LLC in Arizona is cost-effective compared to many other states. Here’s a breakdown of the expenses you can expect:

- State Filing Fee: $50

- Expedited Processing (Optional): $35 (reduces processing time to five business days)

- Publication Requirement: $60 – $300 (only required in counties outside Maricopa and Pima)

- Annual Reports: Not required in Arizona, saving you ongoing costs

For most LLC owners, the total cost to form an LLC in Arizona ranges from $110 to $385, depending on whether you opt for expedited processing and the cost of newspaper publication.

Further Steps

Open a Business Bank Account

Unlike a sole proprietorship, business entities can’t mix personal and business funds. If you do, the LLC’s ability to protect your personal assets from a lawsuit can disappear.

Having a business account also makes paying state fees much more convenient. Without one, you’d have to use a check with a pre-printed name and address to pay state fees.

Fees for local and federal banks range. There are many free options if you meet specific requirements. And if not, the fees are still quite minimal at about $20/mo.

Register with the Arizona Department of Revenue (ADOR)

Many businesses need to register with the Arizona Department of Revenue (ADOR). This authority issues various business licenses.

- A Transaction Privilege Tax (TPT) is like a sales tax. If your LLC sells a product or service that is subject to the TPT, you need a Transaction Privilege Tax License.

- If you hire employees, your LLC has certain withholding requirements. You need to complete the ADOR Withholding Tax Registration.

The registration process is quick and can be done online. Arizona’s Department of Revenue also provides some helpful guides with step-by-step instructions.

Licensing and Permits

Certain businesses must get other licenses and permits. These can come from Arizona state regulatory agencies. But many local authorities have requirements too.

Many professional services need a state license, such as contractors and real estate agents.

Before conducting business, make sure your LLC gets what it needs to operate.