The term “member” of a Limited Liability Company (LLC) simply refers to the owners of the LLC.

The members typically own a stake (membership interest) in the company.

But when it comes down to forming a multi-member LLC, many questions pop up. What else do the members do? What are their rights and responsibilities? Who is liable for the company’s debts? How are profits of the business distributed?

This article will dive into the specifics of membership and how that relates to the operation of your LLC.

Who can be a member of an LLC?

Members of an LLC are individuals or other businesses who have exchanged cash, property, or services for an ownership interest in the LLC.

Below is the list of entities and individuals that can legally be listed as a member of an LLC:

- Individuals

- C-corporations

- Another LLC

- Trusts

- Retirement accounts

- Foreign entities

The state where you filed your articles of organization governs who can be a member of your LLC. So consult the list of requirements. If your LLC is taxed as an S-Corporation, there are additional limitations on who can be a member of the LLC. An LLC operating agreement lists all the members and denotes their ownership percentages.

This document also states:

- Who can join as a member

- How membership interests are transferred

- Which rights and responsibilities each member has

- What happens if one member decides to leave the company

Overall, each LLC member has certain rights such as the right to vote, request a business appraisal, or obtain a profit share from the company.

LLC member rights

Membership interests come with specified rights. These can vary from one business to another. But the most common LLC member rights are:

- Financial rights

- Voting rights

- Appraisal rights

Let’s zoom in on each category.

Financial rights

Members of an LLC are usually entitled to share in the company's profits and losses.

The LLC operating agreement states how profits and losses are allocated, plus how and when distributions occur. These allocations can be:

- Equal between partners

- Proportional to capital contributions

- Customized to your business

In addition to the annual profit and loss, the financial right of a member also applies in the case of a liquidation or sale. In other words — you are entitled to some profits after LLC dissolution.

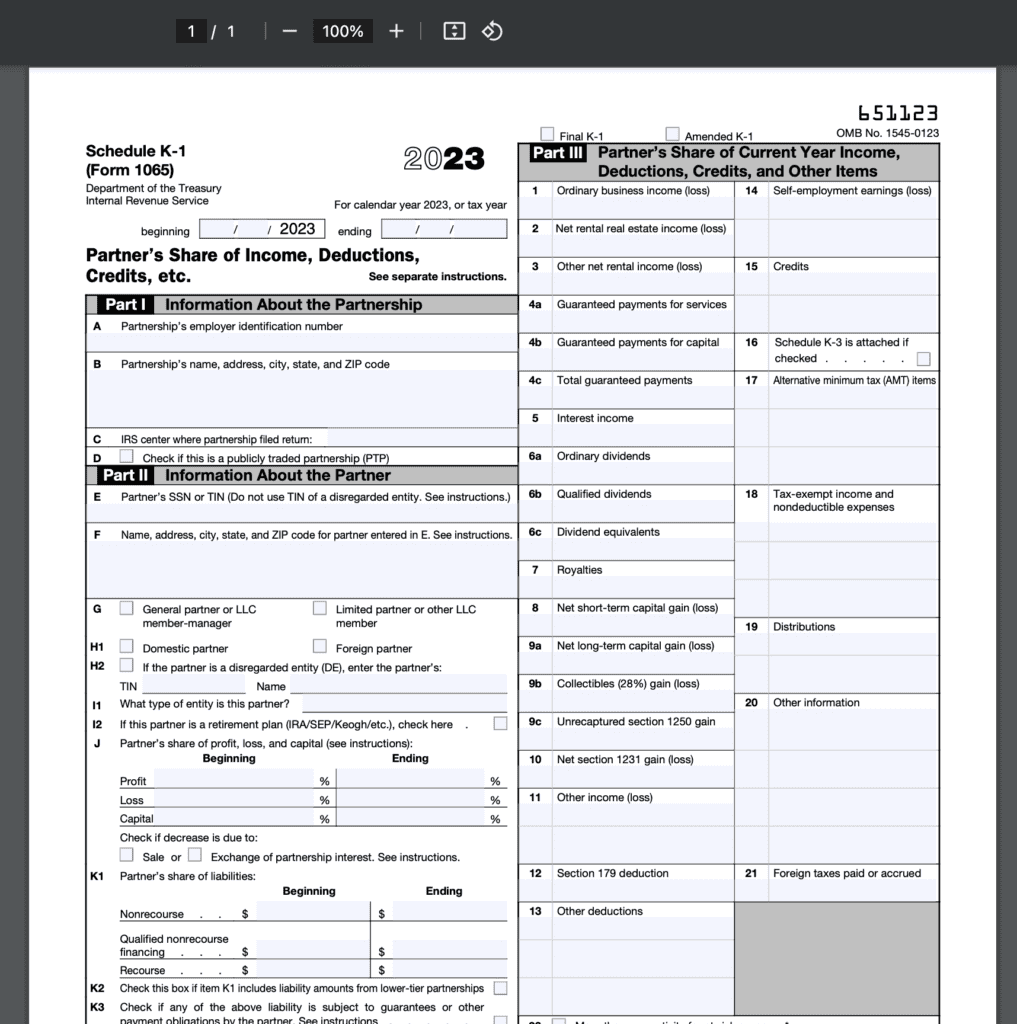

Lastly, LLC members have to report business income on their personal tax returns when it comes to paying taxes.

Voting rights

LLC membership also includes the right to vote.

Voting rights can be critical when it comes to decision-making for company expansion, merger & acquisition activity, or changes in managers and executives.

Voting rights depend on whether the LLC is member-managed or manager-managed. In a manager-managed LLC, the designated manager(s) makes the key decisions rather than the members. This limits the power of the normal members. In a member-managed LLC, the members retain all voting rights and authority.

Right to an appraisal

Most LLC operating agreements include a provision that grants LLC members the right to inspect the company books and records.

This includes the right to request financial records, income tax returns, communication with the IRS, lists of partners (disclosure of the number of members), and documentation around critical decisions made by the LLC.

The right to an appraisal or inspection is one way to keep managers honest and ensure they keep proper records.

LLC member obligations

As a member of the LLC, you may be required to fulfill some duties.

Depending on the skill set, experience, and background, business owners take a certain position in the business, e.g., a CEO, CFO, board member, service provider, etc.

The exact set of LLC member obligations and duties depends on your business structure. If the LLC is member-managed, the members can perform core business duties — ranging from general management to services delivery. If the LLC is manager-managed, one member is elected the manager or hired to be the manager. LLCs can also hire third-party managers who don’t have an interest stake in the company.

The appointed LLC manager typically has the knowledge and experience in business administration. They can receive a salary, a carried interest, or both in exchange for their services. The obligations of the LLC members depend on the company’s management structure and are documented in the operating agreement.

Managerial duties

Not every LLC member can have managerial duties. This is the decision you take internally. LLC members can choose to be passive investors in the business. The manager(s), in turn, are more involved in the day-to-day operations.

An LLC manager is responsible for making decisions for the business entity and overseeing the core operations of the business. They act as a sort of “CEO” for the LLC. Other members, in turn, serve as a sort of unofficial “board of directors” for the LLC. The manager has the right to sign contracts, buy and sell property, execute loans, etc. The duties of the manager are outlined in the operating agreement.

Is an LLC member an employee?

No, typically, a member of an LLC is not an employee.

However, when the member performs services for the LLC or has a full-time or part-time role, they can be registered as employees of the LLC. For example, if a single-member LLC elects to be taxed as an S-corporation, you can enlist yourself as an employee and pay yourself a salary. This limits the amount of earnings subject to self-employment taxes.

Fiduciary duties

As the manager of an LLC, you are deemed to have a fiduciary duty to the other members of the LLC.

This means that you make decisions for the LLC with the members’ best interests as the priority, even above your own as the manager.

Operational duties

Members of an LLC are expected to follow the rules and duties assigned to them in the operating agreement.

It can include tasks such as attending business meetings, reviewing documents, and providing guidance and direction to the business. Overall, operational duties vary depending on the type of business you run.

For example, as a small business owner, you might be directly providing services to clients, plus doing “back office” work — accounting, marketing, inventory management, etc. Or do so together with partners — other entrepreneurs. But as your business grows, your operational duties may become more limited, e.g., you’ll only handle all financial accounts on behalf of the LLC.

Are members responsible for LLC debts?

No, members are not typically responsible for the LLC’s debt unless they personally guaranteed that loan.

Sometimes, lenders require the manager or member to sign as guaranteeing the debt in case the LLC cannot repay their loan. However, members are not typically responsible for the debts of the LLC.

FAQs about LLC members

Below are answers to some frequently asked questions (FAQs) about LLC membership.