Starting an LLC (Limited Liability Company) in Maryland is a great way to kick off your business journey, and this guide will walk you through the process step by step.

One of the biggest perks of forming a Maryland LLC is the protection it offers—your personal assets stay safe if the business owes money or faces legal issues. Plus, Maryland has a business-friendly tax structure to help you grow.

The process is simple, with easy online filing and low fees.

Here’s everything you need to know about setting up your Maryland LLC, including the required forms, timelines, and costs.

Steps Needed to Create an LLC in Maryland

- Step 1: Choose a name for your Maryland LLC

- Step 2: Pick a registered agent

- Step 3: File Maryland Articles of Organization

- Step 4: Get certified copies of your LLC's registration documents

- Step 5: Create an LLC Operating Agreement

- Step 6: Obtain an EIN (Employer Identification Number) from the IRS

- Costs to form an LLC in Maryland

- Further steps

Need to save time? Hire Northwest to form your LLC.

1. Choose a Name for Your Maryland LLC

Every new business entity needs to have a legal business name. Under Maryland laws, an LLC name must:

- Be unique and distinguishable from other businesses

- Include Limited Liability Company or an abbreviation like LLC or LC

- Avoid using words such as bank or trust, unless you operate in the industry

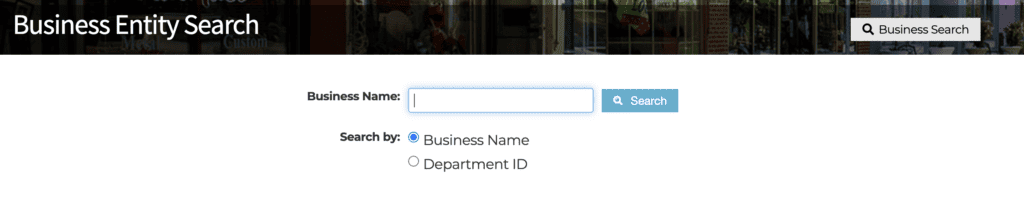

Use the business name search tool to make sure the business name you want to register is available.

If it’s used by an existing company, you’ll need to select something else. It’s best to avoid names that might cause confusion too.

Maryland trade names (optional)

Many business owners choose to operate under a name that’s different from the Maryland LLC’s legal name. This is known as using a doing-business-as (DBA) or trade name.

This can be a great solution for companies that want to sell different product lines. You can use more descriptive names for the marketing materials. While keeping everything under one LLC ownership structure.

To use a trade name in Maryland, use the Trade Name Application form. A $25 filing fee is required. If you need faster processing, expedited service is available for an additional $50 to $75. Once approved, the trade name registration is valid for five years.

Name reservation (optional)

If you need time to prepare other documents, you can reserve an LLC name for 30 days. File the application with the State Department of Assessments and Taxation (DAT). The name reservation fee is $25. You can expedite this request for an extra $20.

2. Pick a Registered Agent

A registered agent is a contact that receives important documents on behalf of your LLC. This can include legal service of process and other critical notices. For Maryland LLCs, registered agents must:

- At least 18 years old

- Be available during business hours every day

- Have a street address (not a P.O. Box) in Maryland

This address will be listed in a public database with the Secretary of State. If you want to change your registered agent, you'll need to let the state know by filing a form and paying a fee.

You can serve as your own registered agent. Or appoint a trusted friend, family member, accountant, or lawyer.

If you don't want to be your own registered agent, you can hire one for about $125-$225/year in Maryland. If you form an LLC with Northwest, they'll give you a free registered agent for the first year. After that, it's $125 per year.

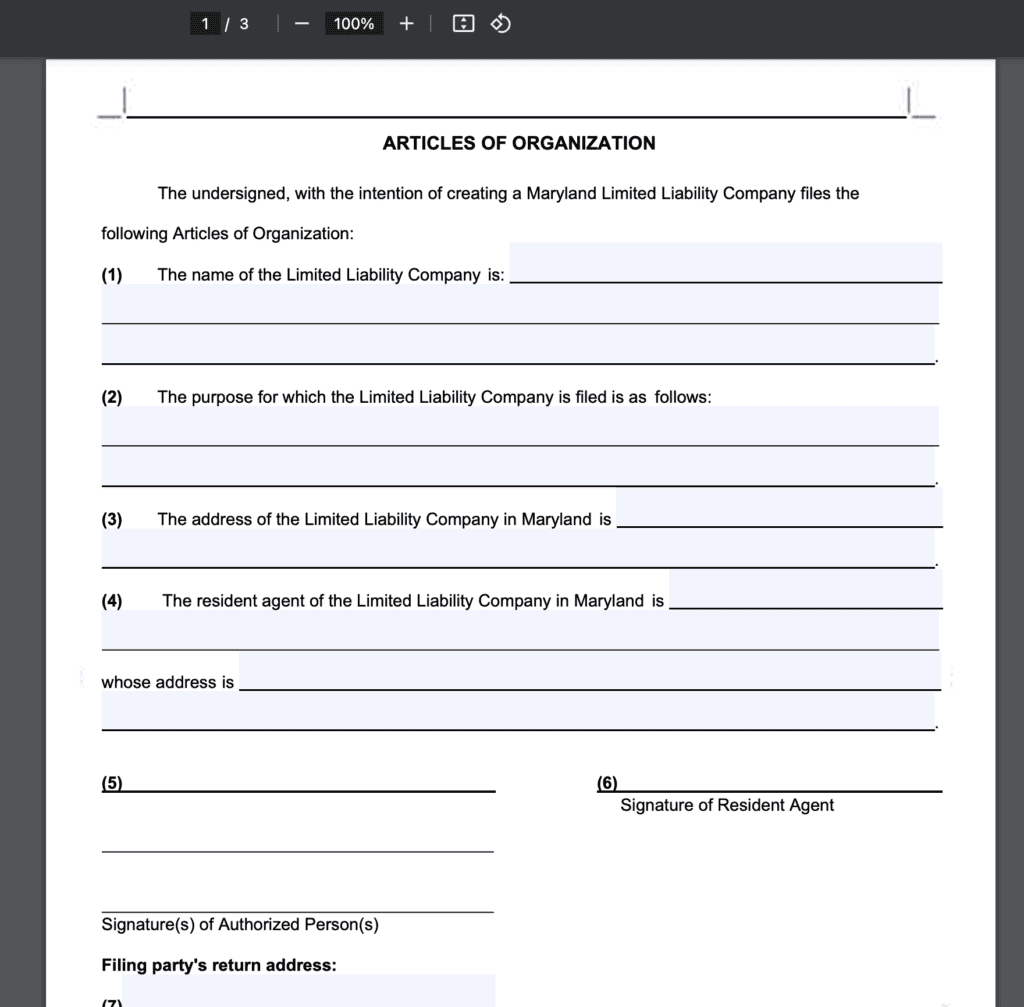

3. File Maryland Articles of Organization

This is one of the most exciting and important steps of starting an LLC in Maryland. The Articles of Organization is the legal document that forms your LLC.

This step can seem intimidating. But it’s much easier than you probably imagine.

To complete your Maryland LLC’s Articles of Organization, you’ll need:

- LLC’s name, purpose, and address

- Resident agent’s name, address, and signature

- Signature of an authorized person

That’s it! This giant step to forming an LLC in Maryland is surprisingly easy.

You can file your articles online via the Business Express Portal. Or in person with the Maryland Department of Assessments and Taxation in Baltimore.

Filing Fees:

- Filing costs $100 (plus processing fee if paid online). These filings will be reviewed during the second calendar month following the month you submitted your paperwork. So if you file in January, the filing will be reviewed in March.

- You can expedite processing for an additional $50, and your filing will be reviewed within 7 to 10 business days.

- Rush processing is an extra $325 and your paperwork will be reviewed within 2 to 24 hours.

To file by mail, send your completed Articles of Organization and payment (payable to “State Department of Assessments and Taxation”) to:

State Department of Assessments and Taxation Charter Division 700 East Pratt Street, Suite 2700 Baltimore, Maryland 21202

4. Get Certified Copies of Your LLC Registration Documents

Once Maryland has processed your Articles of Organization, you’ll want to get proof for your records.

Some banks and lenders might require this before you open an account or accept a loan. It’s also important to have it with your company records.

You can request a Certificate of Status through the Maryland Business Express portal. You can get unofficial documents or request certified copies from there.

Certified documents start at $20.

5. Create an LLC Operating Agreement

An LLC operating agreement is an optional but highly recommended document for LLCs. It specifies key business information and details how the business will run.

It is a contract between LLC members and managers. It lays out all sorts of details and provides ways to deal with disputes. A good operating agreement keeps everyone on the same page.

Having a proper operating agreement in place is especially important for multi-member LLCs. But it’s also a good thing to have for single-member LLCs. It helps to prove the legitimacy of your LLC.

An operating agreement covers things like:

- Ownership structure

- Voting rights

- Management changes

- Distribution methods and timing

- How to add and remove members

- Process to dissolve the LLC

You can find LLC operating agreement templates online for a modest fee. Or you can have one drafted specifically for you by a corporate attorney. It’s more expensive but will leave you fully covered.

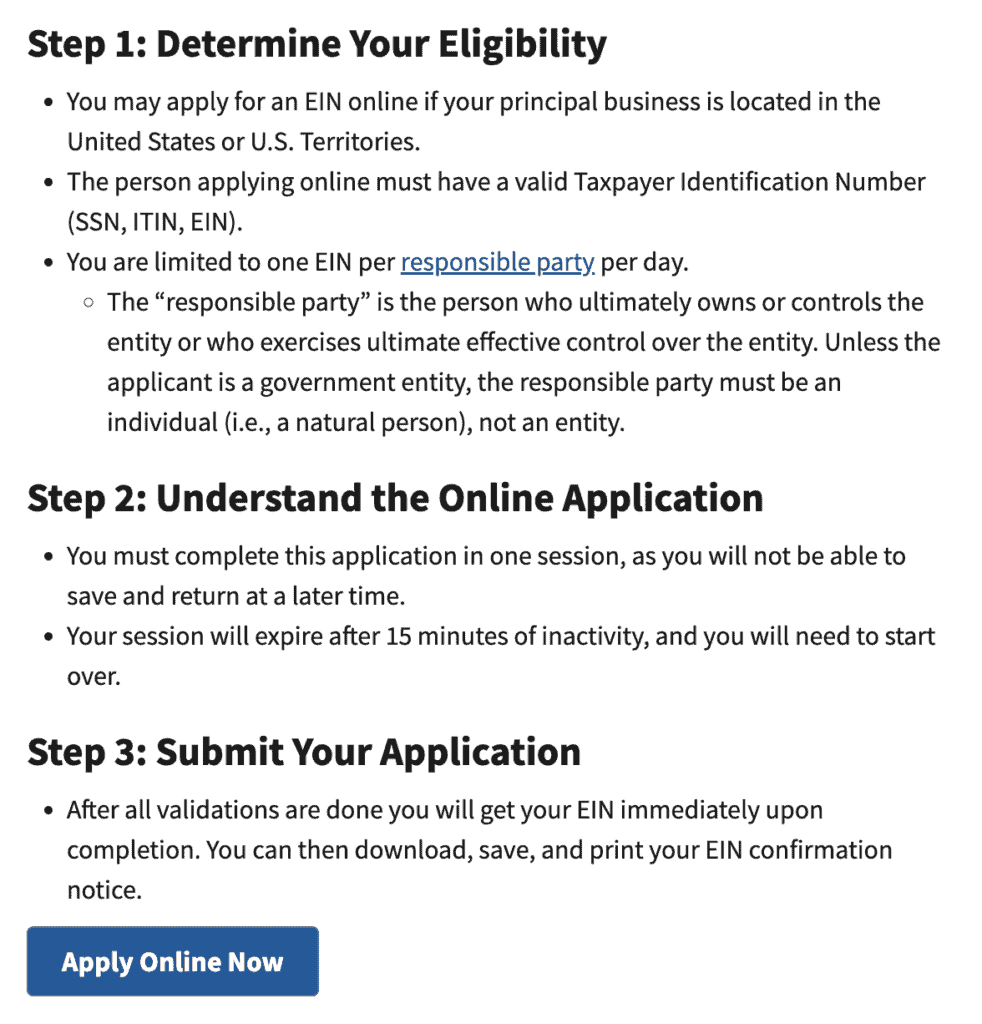

6. Obtain an EIN (Employer Identification Number) from the IRS

An Employer Identification Number (EIN) is a 9-digit number used to track tax information. The Internal Revenue Service (IRS) issues them. They’re like Social Security numbers for businesses.

LLCs need an EIN to file federal and state tax returns, hire employees, or open a business bank account. All multi-member LLCs must get an EIN.

Getting an EIN for your new Maryland LLC is free.

Simply fill in a form on the IRS website and get one issued instantly.

Some single-member LLCs using the default tax classification of a sole proprietorship don’t have to get one. But it’s best practice to get one anyway. And you must if the LLC hires employees or engages in other certain actions.

Costs to form an LLC in Maryland

Your costs to form your Maryland LLC will vary depending on its size, complexity, and use of professional help. At a minimum, the cost to form an LLC in Maryland is $100 to file the Articles of Organization.

Other optional expenses you may incur to start your Maryland LLC are:

- Name reservation: $25 (for 30 days)

- Professional registered agent service: $125 – $225 / annually

- Expedited processing: $50

- Rush processing: $325

- Certified document copies: $20+

Further steps

Open a business bank account for your LLC

As a new legal entity, your Maryland LLC needs a dedicated business bank account.

Tracking your business income and performance is easier with a separate business bank account. It also helps to avoid combining personal and business finances.

Most Maryland banks require copies of your LLC’s approved Articles of Organization and EIN. The business owner’s personal information is usually needed too.

Secure necessary permits or licenses

Maryland doesn't require LLCs to have a general business license. But if your LLC does certain activities, you may need a specialty license or permit to operate. Check the Maryland Division of Occupational and Professional Licensing for more information.

Your LLC may need to register for a sales tax license if you're selling taxable goods or services in Maryland.

And don’t forget local authorities too. Cities and counties may require business licenses or permits. For example, the City of Baltimore and Montgomery County require approval for specific activities. These include things like alcohol sales, food service, and special events.

Make sure to get what your LLC needs before operating.

Other helpful resources

New businesses face many unforeseen obstacles. You can quickly blast through these hurdles by learning from others. Use these organizations to find the secrets to success:

- Maryland Small Business Development Center: No-cost counseling

- Maryland Entrepreneur Hub: Offers resources and connections

- Maryland Chamber of Commerce: Voice of the business community

Another wise step is getting the right insurance to protect you and your new Maryland LLC. Things like workers’ compensation and general liability insurance can step in if a rainy day comes.

Are you ready to start a Maryland LLC? Keep the ball rolling by checking the Maryland database to see if your name idea is available. Then keep plowing through the items on this list.

Before you know it, you’ll have your Maryland LLC formed and can greet your first customers.