Arkansas is a beautiful state, and it’s a thriving hub for small businesses. With its pro-business tax policies, extensive transportation network, and opportunities to partner with major corporations, the state offers a fertile ground for entrepreneurs.

If you're thinking of starting an LLC in Arkansas, there are several steps to follow, such as filing formation documents with the Secretary of State, obtaining necessary permits and licenses, and completing essential administrative tasks.

This guide walks you through the process step by step.

Steps to Create an LLC in Arkansas:

- Step 1: Pick a Name for Your LLC

- Step 2: Choose a Registered Agent

- Step 3: File the Arkansas Certificate of Organization

- Step 4: Get a Certificate of LLC formation

- Step 5: Create an LLC Operating Agreement

- Step 6: Get an Employer Identification Number (EIN) from the IRS

- Costs to Set Up an LLC in Arkansas

- Once Your LLC is Formed

Need to save time? Hire Northwest to form your LLC.

Step 1: Pick a Name for Your LLC

The first order of business is to select a name for your Arkansas LLC.

Your LLC's name must:

- Include Limited Liability Company or one of the abbreviations of LLC, L.L.C.

- Be unique and distinguishable from existing business entities. No duplicate LLC names are allowed.

- Avoid words like bank, engineer, or insurance unless authorized.

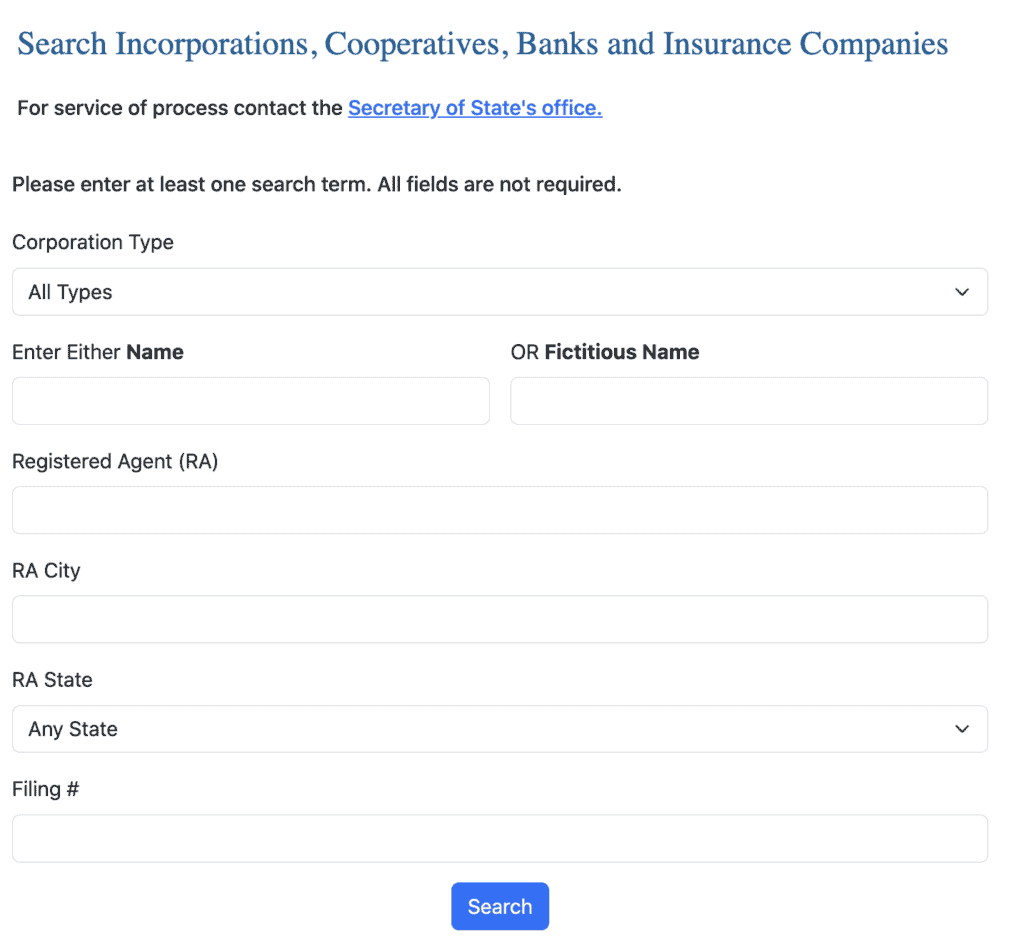

You can use the Arkansas Secretary of State’s name availability tool to see if an LLC name is available. Avoid using names related to existing businesses:

Name Reservation (optional)

If you find an available name to use but aren't ready to launch your business, you can reserve a specific business name for 120 days.

File Form RN-06 to reserve your LLC’s name. There’s a $25 fee for online filings and mail-ins.

If you still are not ready but want to hold on to the name, you can renew your LLC name reservation one more time for an additional $25 fee.

Trade Name (optional)

Some business owners choose to operate under a name different from the LLC's legal name. This is a DBA (doing business as) name or trade name. Arkansas calls it a fictitious name.

Fictitious names offer a lot of flexibility. You can form one LLC and operate different product or service lines under it. For example, Lisa's Enterprises LLC could use trade names like Lisa's Ad Agency and Lisa’s Web Design. You can have an unlimited number of DBAs for each LLC.

File Form DN-18 to register a fictitious name in Arkansas with the Secretary of State. Be prepared to pay a $25 fee. You can pay online or by mail.

Step 2: Choose a Registered Agent

A critical step in starting an LLC in Arkansas is appointing a registered agent. This contact receives official items like tax documents and legal notices.

You can serve as your own registered agent if you’re over 18 and have a physical address in Arkansas. You can’t use a P.O. Box.

Being your own registered agent comes with some downsides:

- You must be available during business hours to receive legal notices

- It lacks privacy as the registered agent’s address is public information

- You’ll have to sort through junk mail without missing any critical documents

- You must update your address if you move

In case you don't want to be your own registered agent, you can hire one for about $99-$199/year in Arkansas.

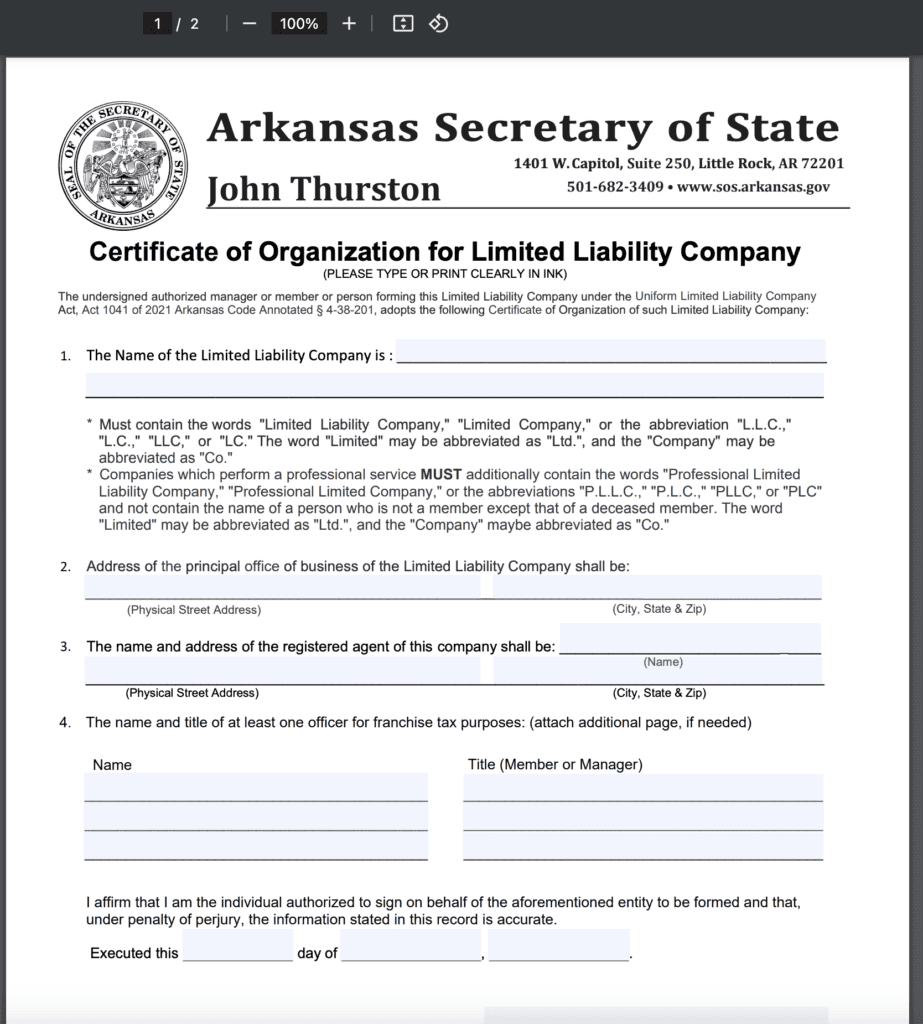

Step 3: File the Arkansas Certificate of Organization

The next step is filing a Certificate of Organization for a domestic LLC in Arkansas. This exciting step turns your business dreams into an actual legal entity. Other states call this the Articles of Organization.

Filing your LLC’s organization documents can seem intimidating, but the process is much easier than you may imagine.

The Certificate of Organization only requires basic information about your business, including:

- Business name

- Principal address

- Registered agent

- LLC owner(s)

The filing fee is $50 for online submissions and paper filings which should be sent to the following address:

Arkansas Secretary of State Business & Commercial Services

Victory Building

1401 W. Capitol Avenue, Suite 250

Little Rock, AR 72201

Companies from other states that wish to do business in Arkansas must register as a Foreign LLC. They’ll need to use the Certificate of Registration of a Foreign LLC. This filing fee is $270 online or $300 by mail (paper).

Both domestic and foreign LLCs will also complete an annual franchise tax registration form attached to the respective company formation document.

Note: Arkansas does not offer expedited processing options for LLC formations. All filings are processed in the order they are received, with typical processing times of 3-7 business days for online submissions and 2-3 weeks for mail filings.

Step 4: Get a Certificate of LLC Formation

Once the Arkansas Secretary of State approves your LLC’s formation, you’ve started an Arkansas LLC. While not required, it's recommended to get a Certified Copy of the Certificate of Organization to keep with your records.

Request certified document copies from the Arkansas Secretary of State. Copies are $0.50 per page, with an additional $5.00 fee if the copies are to be certified.

Some banks or financing opportunities may need this to open an account or receive funds.

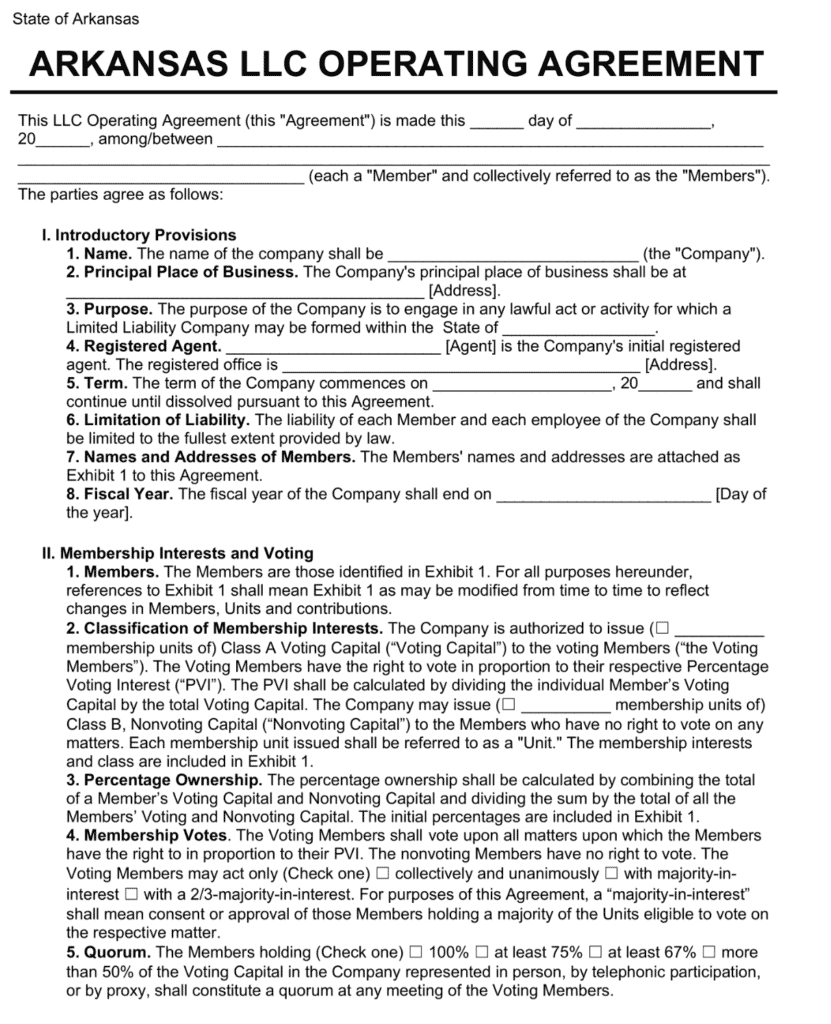

Step 5: Create an LLC Operating Agreement

An operating agreement is a private contract between members. It lays out how the LLC will work. They are especially important for multi-member LLCs.

If you don’t have an operating agreement, state law will apply if disputes arise. This can lead to unexpected results that may not align with your desires. Executing an operating agreement protects your interests and helps avoid surprises.

This legal document includes:

- LLC management structure

- Operating principles

- Profit and loss distribution among members

- Internal administrative processes

- Members’ voting rights

A clear-cut operating agreement establishes the rights and responsibilities of all LLC members. It also minimizes the grounds for disputes.

Free and low-cost LLC operating agreement templates are available online. You can adjust them to meet your needs. If you prefer, you can hire a corporate lawyer to draft a custom document for your LLC.

Step 6: Get an EIN (Employer Identification Number) from the IRS

An Employer Identification Number (EIN) is issued by the Internal Revenue Service (IRS). It is a unique 9-digit number for businesses, like a Social Security number. The IRS uses it to track your LLC's tax information.

You can get an EIN for free from the IRS website. You can also request one through the mail, which can take up to 3 weeks to process.

Arkansas will also use your EIN for state tax withholding purposes.

Costs to Set Up an LLC in Arkansas

The costs to form your LLC in Arkansas vary. They depend on how much professional help you use and your LLC's complexity.

At the minimum, you must pay $50 to file the Certificate of Organization online and another $5 for a copy of the approved certification.

Other (optional) costs to start an Arkansas LLC may include:

- Name reservation: $25

- DBA/trade name registration: $25

- Professional registered agent: $99 – $199 per year

- Certificate of Organization: $50

- Foreign LLC Registration: $270 online or $300 by mail (paper)

- Certified copies of documents: $0.50 per place plus $5 fee

- Operating agreement draft: $0 – $1,000 (if attorney is being used)

Once Your LLC is Formed

Congratulations! You have now successfully created your LLC in Arkansas. Before you start operating, you’ll need to take care of a few more details:

Register with the Arkansas Department of Finance and Administration

All Arkansas LLCs are subject to a minimal annual franchise tax of $150. This tax is due by May 1 each year.

You may also be liable for other state taxes. LLCs that hire employees may be subject to employment taxes.

Some business operations must collect and pay excise taxes, such as sales and use tax. This applies if your LLC:

- Sells goods from a retail location or inventory

- Performs a taxable service

- Leases or rents tangible property

You can also use the Arkansas Taxpayer Access Point (ATAP) online system for business tax registration.

Open a business bank account

LLC members need to keep business and personal finances separate. It’s crucial for maintaining LLC personal asset protection.

If you combine your personal and business finances, you may lose the legal benefits that LLCs offer.

Obtain local licenses and permits

Besides state needs, your LLC must also meet local laws. These may include city licenses and other local permits. For example, the city of Little Rock requires all LLCs to have a business license. Little Rock also issues permits for alcohol sales. Fort Smith has a mandatory business license as well.

Before you launch operations, make sure your LLC gets what it needs to start up.

Other resources

Many LLC owners get insurance policies to protect them during challenging times. Things like general liability and workers’ compensation policies are worth the price.

Connecting with the local business community can also pay dividends. By joining groups like the Chamber of Commerce, you can learn from successful peers. The Arkansas SMTDC provides free consulting.