Georgia is an excellent state to consider for starting an LLC, offering a business-friendly environment and numerous advantages for entrepreneurs. From its affordable formation fees and appealing climate to its strong talent pipeline fueled by well-regarded public universities, the Peach State has much to offer both new and seasoned business owners.

These factors, combined with its growing economy, make Georgia an attractive destination for establishing your venture.

Forming a limited liability company (LLC) in Georgia provides personal liability protection and a flexible business structure that suits a variety of industries. Whether you’re launching a small local business or laying the foundation for a larger enterprise, Georgia’s supportive infrastructure can help you succeed.

In this guide, we’ll break down the steps required to register an LLC in Georgia, ensuring that your business is set up correctly to help you hit the ground running.

Steps to Create an LLC in Georgia:

- Step 1: Choose a Name for Your New Georgia LLC

- Step 2: Appoint a Registered Agent

- Step 3: File the Georgia LLC Articles of Organization

- Step 4: Get certified copies of your LLC formation documents

- Step 5: Create an LLC operating agreement

- Step 6: Obtain an EIN (Employer Identification Number) from the IRS

- Costs to form an LLC in Georgia

- Last steps

Need to save time? Hire Northwest to form your LLC.

Step 1. Choose a Name for Your New Georgia LLC

Choosing a name for your LLC is the first step to forming your new company. And you need to make sure it follows Georgia law.

In Georgia, your LLC’s business name needs to:

- Include Limited Liability Company, Limited Company, or an abbreviation like LLC or LC

- Be unique and distinguishable from other registered Georgia entities

- Avoid using words related to regulated industries like banking or insurance, unless authorized

- Consist of no more than 80 characters, including spaces and punctuation

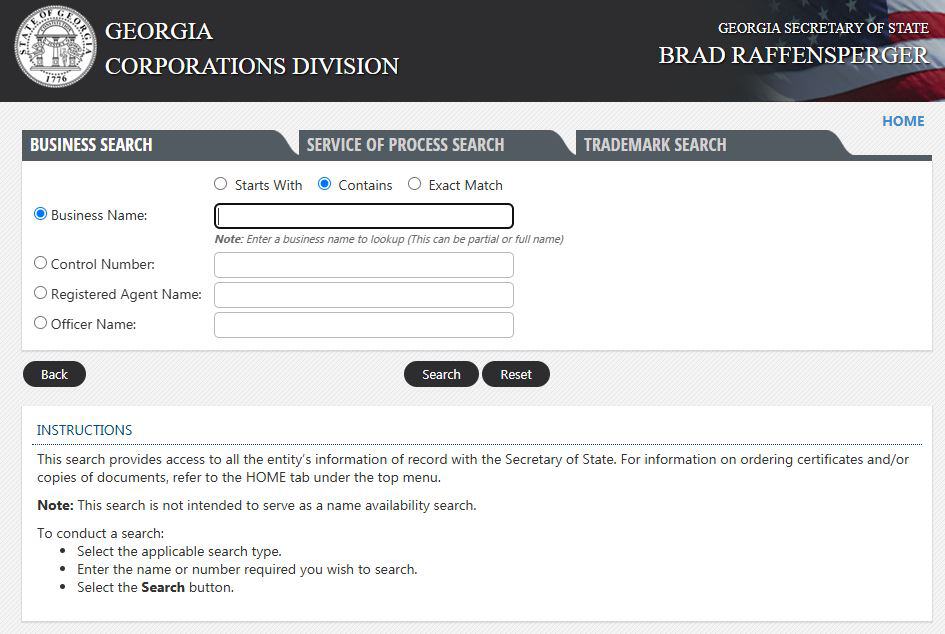

Use the online search tool on the Georgia Secretary of State (SOS) website to see if your name is taken.

Name reservation (optional)

If you have a good idea for a name but aren’t ready to submit the rest of your LLC paperwork, you can file a name reservation request to the Georgia SOS. There’s a $25 fee (online). If you choose to file by mail or in person, the fee is $35, which includes a $10 paper filing service charge.

When filing, you can submit up to three name choices in case some are unavailable. If approved, your name reservation is valid for 30 days. You’ll want to file the rest of your LLC paperwork before then.

If you’re still not ready, you can renew the reservation for an extra 30 days ($25 fee applies).

Trade name (optional)

If you want, you can operate your business under a name different from the LLC’s legal name. This is a common tool known as a trade name, doing-business-as (DBA), or fictitious name.

Georgia law requires companies to register trade names with the local Clerk of Superior Court office. Trade name registration costs differ among different counties in Georgia. In Atlanta’s Fulton County, the rate is $175.

Also, registering a trade name doesn’t provide quite the same legal protection as LLC incorporation. You may also want to trademark your trade name.

Step 2. Appoint a Registered Agent

After picking out a name for your LLC, you’ll need to designate a registered agent. A registered agent is a person or company that receives your official mail. This includes vital legal documents.

Georgia LLC registered agents must:

- Must be at least 18 years old

- Have a physical address in Georgia (not a P.O. Box)

- Be available during regular business hours

You or another member of your LLC can be the registered agent.

If you don't want to be your own registered agent, you can hire one for about $125-$150/year in Georgia. With that fee, you get help handling legal documents and important correspondence. Someone else sorts through your junk mail. And you get to keep your address out of the public record, protecting your privacy.

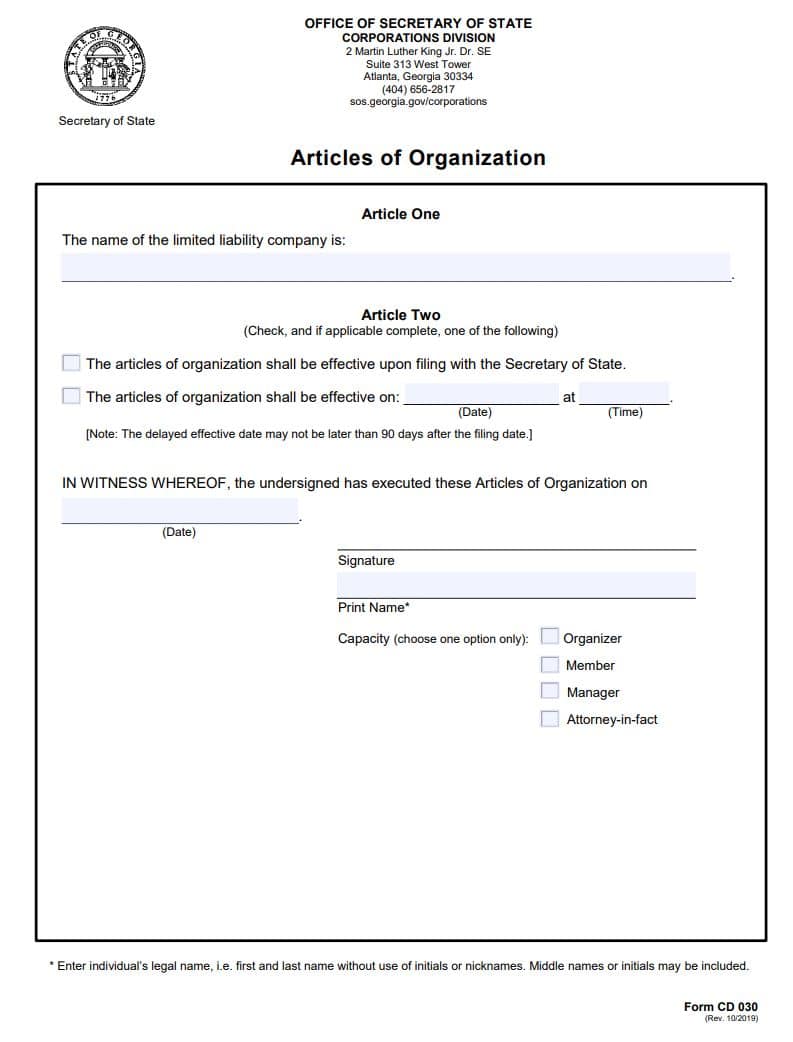

Step 3. File the Georgia LLC Articles of Organization

The next step to forming an LLC in Georgia is to file your Articles of Organization. This filing officially establishes and registers your business in the state. It’s a big step toward opening a business.

Georgia makes it easy, even providing a template you can use. And it only requires very basic information, including:

- The LLC’s name

- The effective date

- Signature of the person filing the form

You’ll also need to have the LLC’s mailing address, the registered agent’s contact information, and member details. Georgia's SOS also recommends consulting with a professional to see if you should add anything else.

You can file online through a streamlined process. You can also file by mail or in person. Make sure to include the state’s transmittal form if you do so.

The fees and processing times for filing the Articles of Organization are as follows:

| Fees and timing for filing Articles of Organization in Georgia | |||

|

Online |

In-person |

||

|

Standard filing fees |

$100 | $110 |

$110 |

|

Standard processing time |

7 business days | 15 business days |

Varies |

|

Expedited options |

|

|

|

Step 4. Get Certified Copies of Your LLC Formation Documents

This is a vital step that's often overlooked.

Once the Secretary of State approves your Articles of Organization, you want to get certified copies for your business records. Certified copies start at $20 in Georgia.

Some banks and financing options may require this document to open an account or work with your LLC.

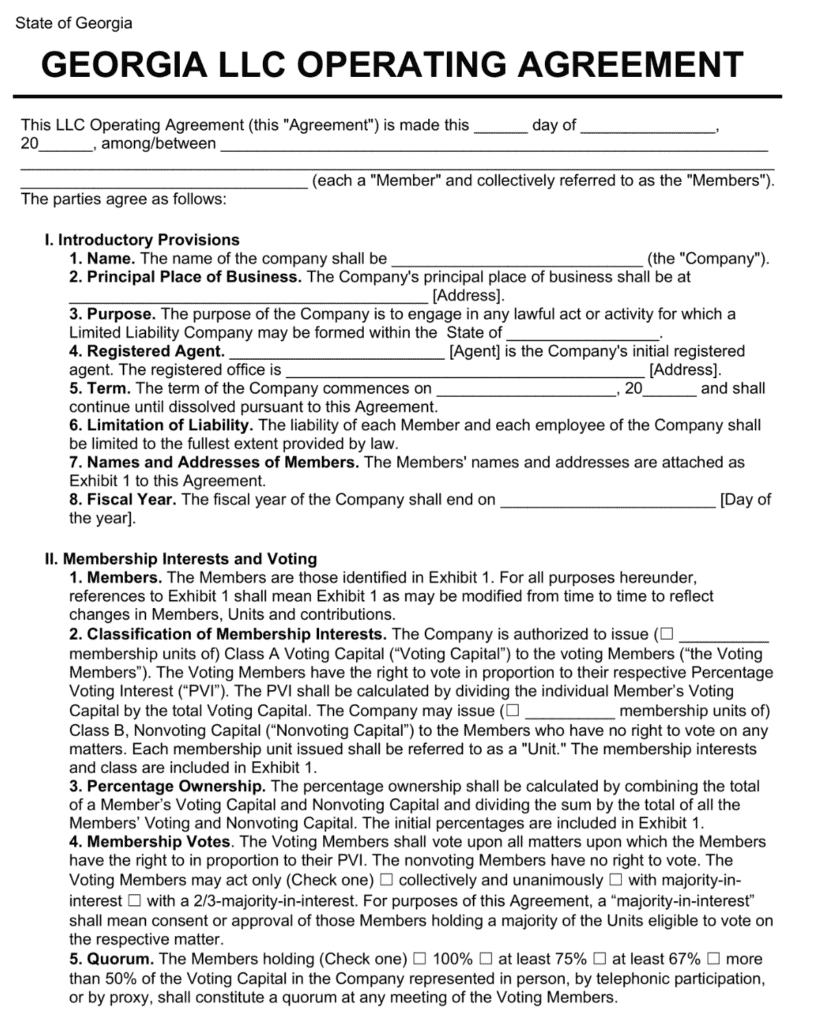

Step 5. Create an LLC Operating Agreement

You’re almost to the finish line. To set your LLC up for success, you should prepare an LLC operating agreement.

An LLC operating agreement is a binding contract that covers operational and financial concerns. It’s an internal agreement between members.

An operating agreement often includes:

- How to add or remove members

- How to distribute profits or losses

- Rights and duties of members and managers

- Method for dissolving the LLC

- Other procedures for handling disputes

To create your operating agreement, you can use an online template. Or you can consult with an attorney to customize one for around $1,000 or more. While the professional costs are higher, protecting your interests can be worth it.

You do not need to file an operating agreement with Georgia officials. Instead, you can keep it with your records and give every member a copy.

Step 6: Obtain an EIN (Employer Identification Number) from the IRS

Depending on your type of operations, business owners may need to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS).

An EIN is a federal tax ID that’s like a Social Security number for businesses.

All LLCs with employees or more than one member must get an EIN. See the IRS rules for more details. You may also need an EIN for banking or state tax purposes.

Total Costs to Start an LLC in Georgia

The minimum cost to start an LLC in Georgia is $100 to file the Articles of Organization. If you choose to file by mail or in person, the fee increases to $110.

Other optional Georgia LLC startup fees may include:

- Name reservation: $25

- Trade name/DBA: varies by county

- Professional registered agent: $50 – $100 / annually

- Certified document copies: $20+

- Drafting operating agreement: $0 – $1,000

Further Steps

At this point, you’ve created your Georgia LLC and are almost ready to start doing business. Before you do, you’ll want to handle a few more details first.

Business bank account

The last step to starting an LLC in Georgia is to open a business bank account. Having a separate bank account for your LLC helps to:

- Establish separation of personal and business assets for legal protection

- Avoid confusion in business recordkeeping

- Create a sense of legitimacy for your business

If your LLC gets sued and you’ve combined personal and business finances, your personal assets may be at risk.

Georgia tax registrations

Many LLCs need to register with the Georgia Department of Revenue. This applies if your business is subject to sales and use tax, needs an alcohol license, or engages in many other activities.

Head over to the Georgia Department of Revenue to see what your business might need.

For unemployment insurance tax, some businesses need to register with the Georgia Department of Labor. If you hire employees, this is a must. You can register quickly online and learn if you’re liable for unemployment insurance tax.

Local licenses and permits

Other needs can come from local authorities, including city and county officials. They may require your LLC to get certain licenses or permits before operating.

For example, all businesses operating within the City of Atlanta must get a Business License. Certain activities require an extra permit, such as alcohol sales and vending.

Fulton County also handles Business Licenses for unincorporated areas in the Fulton Industrial District. Check with your local authorities to get what your LLC needs.