With its vibrant economy and entrepreneur-friendly environment, Colorado offers a beautiful, thriving locale for your new business. Starting your LLC in Colorado is an exciting step toward turning your business ambitions into reality.

Establishing an LLC safeguards your personal assets while enhancing your credibility , setting you up for long-term business success. While the process might initially seem overwhelming , our straightforward, step-by-step guide breaks it down into simple, manageable actions.

With the right approach and resources, you’ll have your Colorado LLC up and running in no time.

Steps to Create an LLC in Colorado:

- Step 1: Choose a Name for Your Colorado LLC

- Step 2: Appoint a Registered Agent

- Step 3: File the Colorado LLC Articles of Organization

- Step 4: Draft an LLC Operating Agreement

- Step 5: Obtain an EIN (Employer Identification Number) from the IRS

- Costs to Set Up an LLC in Colorado

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1. Choose a Name for Your Colorado LLC

When choosing your LLC’s name, marketing considerations may be a priority, but you also must comply with Colorado laws.

In Colorado, LLC names must:

- Include the term “limited liability company” or the abbreviation “LLC” or “L.L.C.”

- Be distinctive to avoid duplication or confusion with other established businesses

- Avoid using regulated terms unless authorized, such as lawyer, doctor, or bank

You can review the Business FAQs for more details.

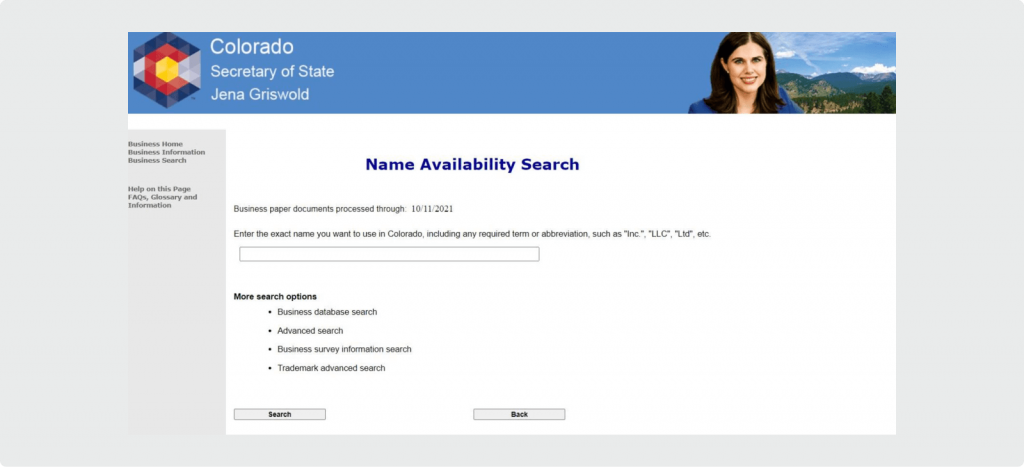

Name availability search

Colorado requires names to be distinguishable from existing entities per the Colorado Secretary of State's (SOS) database. After brainstorming several ideas, you will need to verify that no other Colorado-based company is already using the name you’ve selected.

You have two options to complete a name search online, both through the Colorado SOS website:

- Confirms whether a specific name is available

- Does not provide similar name suggestions

- Lists names similar to your search

- Does not indicate whether a specific name is available

When searching for name availability, run multiple searches with different variants using both of these tools. Search without the LLC terms as well.

Reserving Your Colorado LLC's Name (optional)

After you’ve settled on a name that meets Colorado’s naming requirements, you can reserve it by submitting an application and paying a $25 fee (online). This is optional. Choosing to submit the application and pay the fee allows you to reserve the name you’ve selected for 120 days. If you need more time to form your LLC, you can extend the reservation for an additional $25.

A reserved name is held for your future use. It doesn’t start a business.

Name reservations aren’t a required part of starting an LLC. But they are useful when you need time before filing the documents to form the Colorado LLC.

Choosing a Trade Name in Colorado (optional)

Trade names are a common tool used by many businesses. They allow you to operate your business under a name that’s different from the LLC’s name. These are also called “doing business as,” DBA, or assumed names.

In Colorado, you must register a trade name if you intend to use one.

Sole proprietorships use trade names when they don’t want to use their personal name to do business.

In some cases, LLCs may also want to use a trade name. Examples include:

- The LLC’s legal name doesn’t identify what the company does (e.g., Rocky Mountain Enterprises, LLC)

- The LLC offers multiple product lines (e.g., a real estate company with vacation rentals and commercial offices)

In Colorado, trade names don’t have to be unique, allowing multiple people to register the same name.

Step 2. Appoint a Registered Agent

A Colorado LLC must appoint a registered agent to serve as the official point of contact for your business.

The registered agent is responsible for receiving vital notices, such as legal documents and tax communications. It is not something to take lightly.

You must list the registered agent and provide their contact information on your LLC formation documents. This will be publicly available information.

While the small business owner can be the registered agent, there are other options. In Colorado, a registered agent can be anyone that meets the state’s requirements:

- Over age 18

- Primary residence and physical address in Colorado (not P.O. box)

- Available during regular business hours

You can also use a professional service, but it must be registered to do business in Colorado. You cannot use a P.O. box.

If you don't want to be your own registered agent, you can hire one for about $59-$209 per year in Colorado

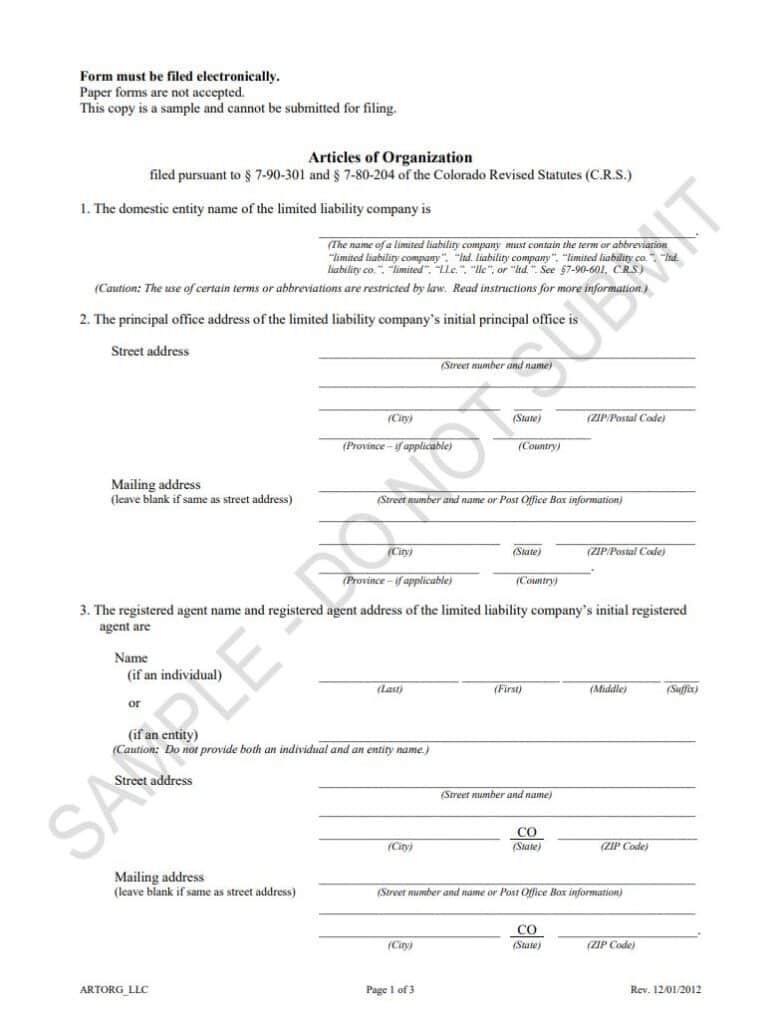

Step 3. File the Colorado LLC Articles of Organization

The next step is to file your Articles of Organization online with the Secretary of State. This is the legal document that creates your company.

The cost of filing a domestic Colorado LLC’s Articles of Incorporation is $50. Foreign LLCs need to file a Statement of Foreign Entity Authority and pay a $100 fee.

All new LLCs must file online since Colorado no longer accepts paper applications. Payments are accepted by debit/credit cards.

Colorado also provides a helpful online checklist outlining everything you need to file your Articles of Organization, such as:

- LLC name

- Principal office address

- Mailing address

- Registered agent contact information

- Managers of the LLC

- Founders of the LLC with contact details

Once an LLC has been approved, business owners should obtain a Certificate of Good Standing from the state of Colorado. This document will support your business as it grows, helping you navigate future financing, banking, and accounting needs.

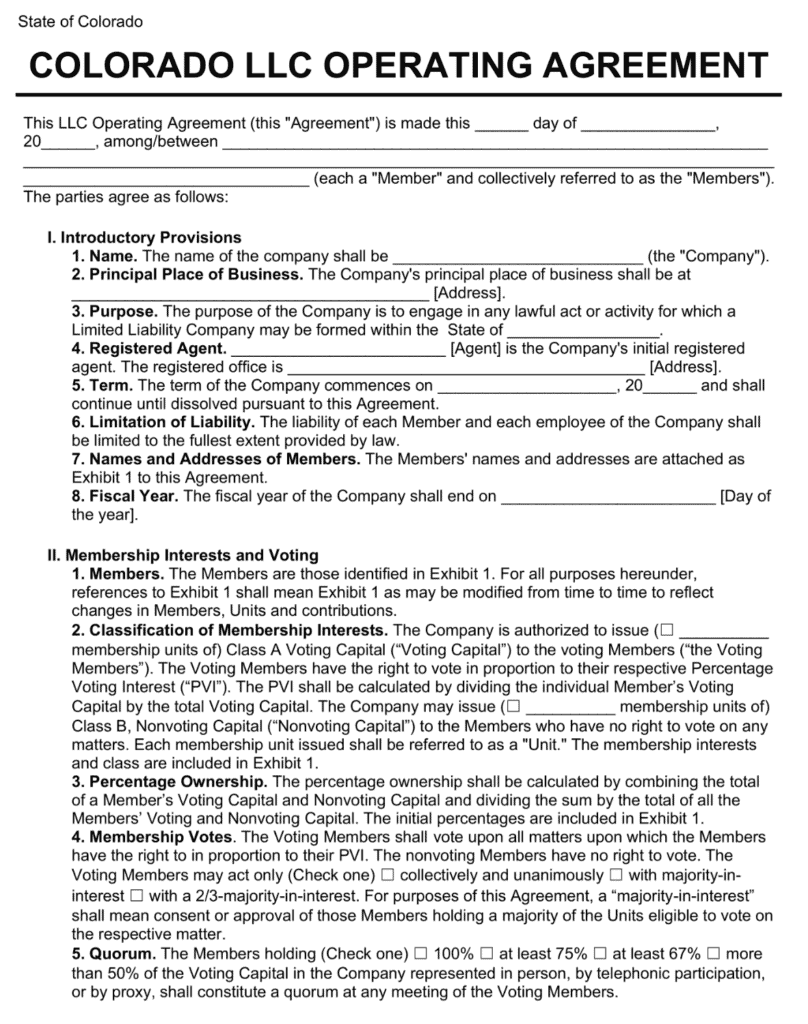

Step 4. Draft an LLC Operating Agreement

While not required in Colorado’s formation process, every LLC should create an operating agreement. This legal document lays out how your company will operate and be managed.

An operating agreement is essential for multi-member LLCs. Without it, the entity must use the default Colorado LLC laws, which may not fit your desires and can lead to surprising outcomes. By creating an agreement, you can choose how your LLC handles many situations.

Operating agreements can be as in-depth as you like. At a minimum, they should include:

- The LLC’s name and business address

- The LLC’s purpose

- Members’ names, contributions, and ownership percentages

- Procedures for adding new members and the steps for member departures

- Profit and loss allocations among members

- Management structure

- Plans on how to dissolve the LLC

You can find free or low-cost templates online. If you decide to have an attorney prepare a customized agreement, expect to spend $1,000 or more.

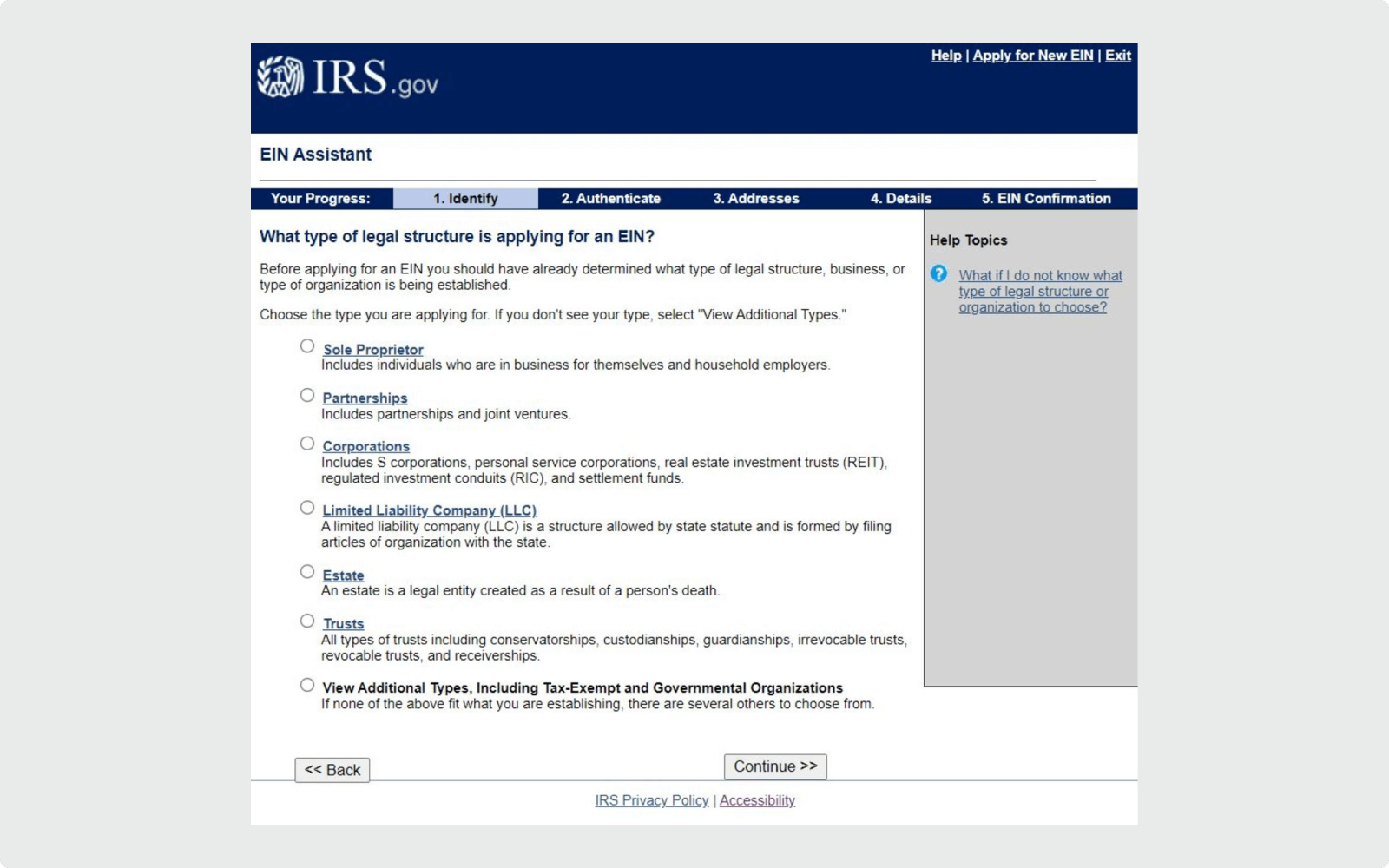

Step 5. Obtain an Employer Identification Number from the IRS

The Employer Identification Number (EIN) is like a Social Security number for your business. It is a unique ID that the Internal Revenue Service (IRS) assigns to track your business. An EIN is also known as a tax ID number or a Federal Employer Identification Number (FEIN).

Local and state tax authorities may also use the federal EIN for filings, such as state income or employment taxes.

The fastest and easiest way to apply for an EIN is to use the IRS website. It generates your EIN immediately – and it's free.

Costs to Set Up an LLC in Colorado

There is only one required cost to start an LLC in Colorado: the fee to file your articles of organization.

This is only $50 in Colorado, which is less than many other states. ($100 for foreign LLCs.)

Other optional costs include name reservation ($25), trade name registration ($20), and professional registered agent service (around $90-$200 per year).

Colorado also requires business owners to file an annual Periodic Report and pay a $10 fee. The brief filing verifies contact information and shows the business is still active.

Further Steps

Although you’re very close to launching your business, there are a few other steps you should take care of right away.

1. Open a business bank account. This is a crucial part of tracking your company’s finances. A business bank account is essential to:

- Separate company funds from personal

- Prove the legitimacy of your business

- Make tax preparation easier

To open an account, you’ll need a copy of your approved Articles of Organization and an EIN if you have employees. You may also need to provide a copy of your personal identification (e.g., driver’s license).

2. Obtain a sales tax license. If you are selling goods, you’ll need a sales tax license from the Colorado Department of Revenue (DOR). Colorado businesses are responsible for collecting sales tax on goods sold to customers. Most services are not taxable.

You can quickly apply through My Biz Colorado. You’ll have to pay a $16 application fee and put down a $50 deposit.

Most Colorado sales tax licenses are valid for two years, expiring at the end of each odd-year period, at which time they must be renewed to keep your company in good standing.

3. Obtain Additional Required Licenses and Authorizations

Many professional services require a state license.

Some businesses may also need authorization from local authorities. For example, Denver requires licenses for short-term rentals, tattoo artists, and many other business-related activities.

Finally, it's worth considering insurance coverage, such as general liability or workers’ compensation. Savvy business owners use these to protect their assets and avoid future headaches.

Other considerations

You should also identify if you need any other business licenses or permits. Many professional services require a state license.

Some businesses need authorization from local authorities too. For example, Denver requires licenses for short-term rentals, tattoo artists, and many other activities.

Finally, it's worth considering insurance coverage, such as general liability or workers’ compensation. Savvy business owners use these to protect their assets and avoid future headaches.