Are you thinking about forming an LLC in Alabama? Great choice!

The LLC (Limited Liability Company) structure is one of the most popular options for small business owners, and for good reason.

An LLC is a cost-effective way to protect your personal assets while avoiding the complex tax obligations associated with corporations. It offers a balance of simplicity and security, making it an excellent choice for entrepreneurs. Additionally, the process of forming an LLC is straightforward and manageable for any business owner, even those just starting out.

Ready to take the next step? Let’s get started on building your Alabama-based business today!

Steps to Create an LLC in Alabama:

- Step 1: Name Your Alabama LLC

- Step 2: Select a Registered Agent

- Step 3: Draft and Submit the Certificate of Formation

- Step 4: Obtain a Certificate of LLC Registration from the State

- Step 5: Create an LLC Operating Agreement

- Step 6: Get an Employer Identification Number (EIN)

- Total Costs to Set Up an LLC in Alabama

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Name Your Alabama LLC

To start an LLC in Alabama, the first step is to come up with a unique business (LLC) name.

You’ll want a brandable name that reflects what your business offers, and one that meets legal requirements. Your Alabama LLC name must:

- Include “Limited Liability Company” or the abbreviation “LLC” or “L.L.C.”

- Not interfere with any other registered business name or trademark

Your LLC’s name must not be the same as an existing business. It needs to be unique and distinguishable from any established business entity name.

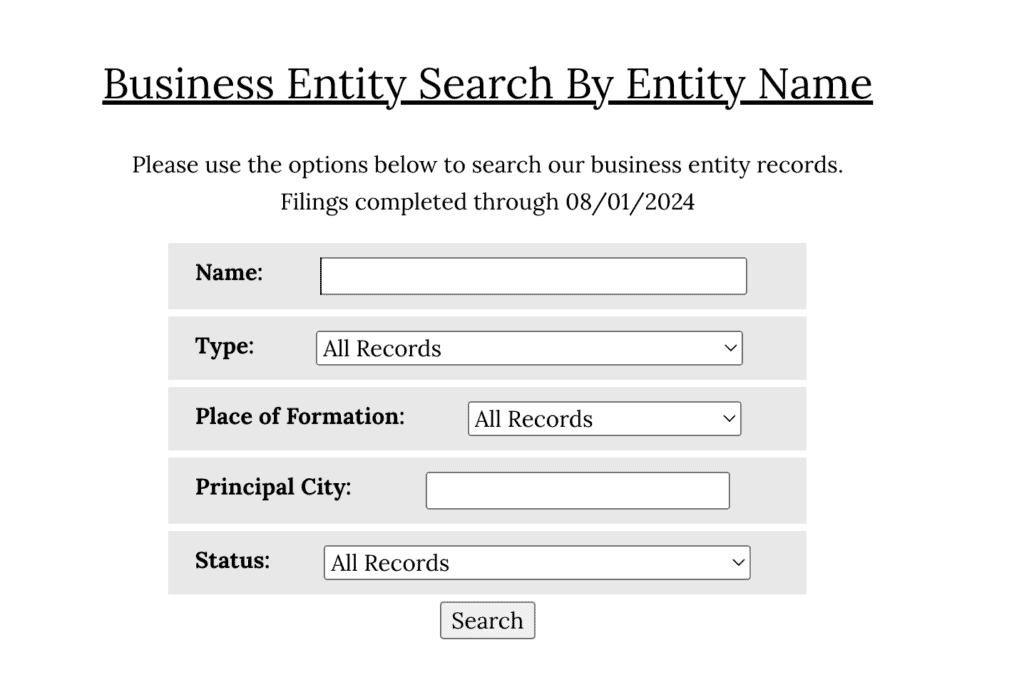

Use the Business Entity Search on the Alabama Secretary of State (SOS) website:

If you plan to sell goods or services in another state, it’s worth searching those business listings too. Your business may be considered a foreign LLC in states outside of Alabama.

Online filers complete the name search as part of the filing process.

Name Reservation

Once you have a name, you should reserve it by filing a Name Reservation Request with the Alabama Secretary of State (SOS). There is a $25 fee for mail submissions or $28 for online reservations.

Unlike other states, this is a required step before you can file the formation documents. It also stops others from taking the name while you prepare the documents to form your Alabama LLC.

The online reservation is immediate. You can print the Certificate of Name Reservation right away.

The reserved name is valid for one year from the date the application is accepted.

Trade Name (optional)

Trade names provide flexibility with your Alabama LLC’s name. It allows you to operate under names other than the LLC’s legal name. This popular technique is also called “DBA” (short for doing business as), assumed name, or fictitious business name. You can run multiple businesses under one entity. Or use a name that’s closely related to your goods or services.

You can file an Application to Register Trade Name form in Alabama. There is a $30 fee, with an additional $1.20 processing fee if filed online. Registration is not mandatory and does not come with legal protections. But it alerts others that the name is in use in Alabama.

Step 2: Select a Registered Agent

Once you’ve chosen a name for your LLC, the next step is to select a registered agent.

Your registered agent is a person or professional service who agrees to be your point of contact. They maintain compliance with local regulations and laws. Registered agents receive legal and tax notices on behalf of your business. If your business is sued, your registered agent will accept the court papers. You can’t use a P.O. Box as your registered office address.

Your Alabama registered agent must be either:

- Someone who lives in Alabama and is at least 18 years old; or

- A business with a principal office in the state

Some LLC owners elect to serve as their own registered agents, but some also use registered agent service.

If you don't want to be your own registered agent, you can hire one for about $49-$299/year in Alabama.

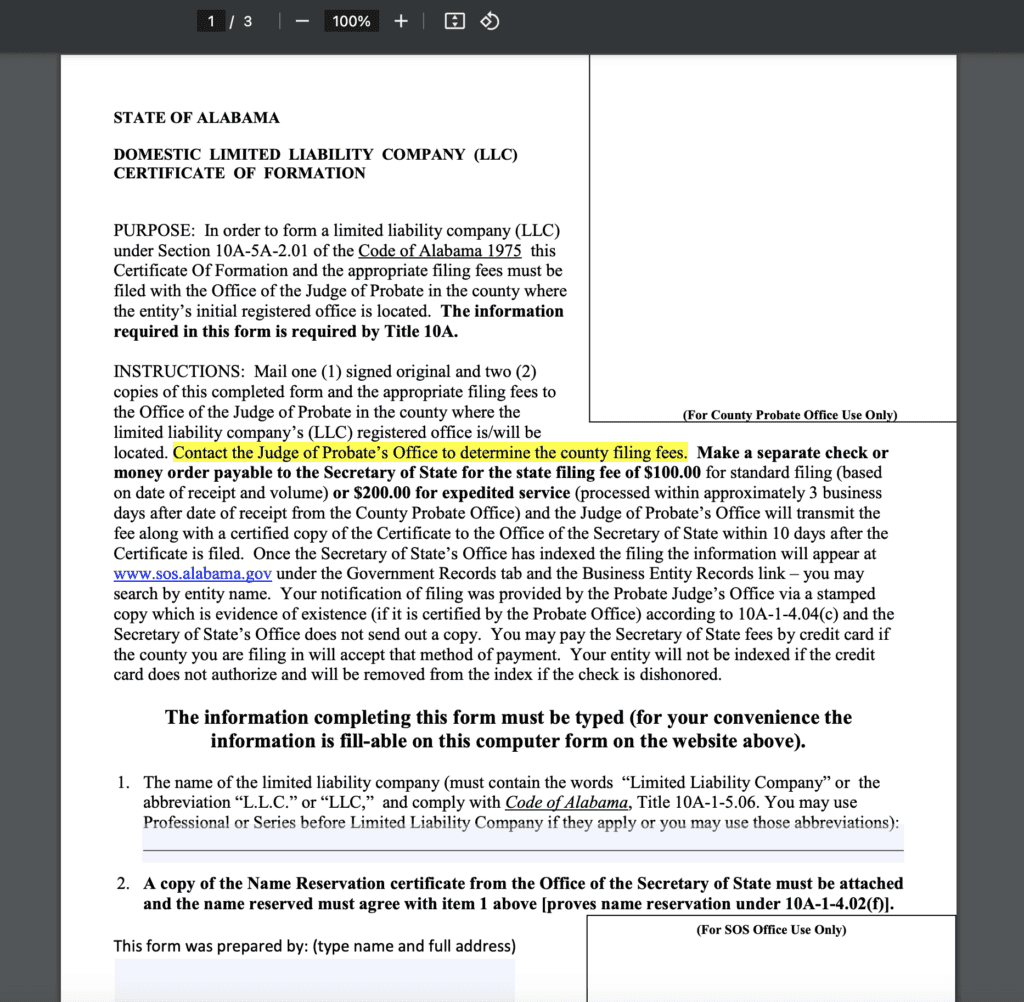

Step 3: Draft and Submit the Certificate of Formation

Now it’s time for the most exciting step to forming an LLC in Alabama. The Certificate of Formation is the document that brings your business into existence.

To file your formation documents, you’ll need:

- LLC’s name

- Certificate of Name Reservation

- Registered agent’s information

You can submit an online application on the Alabama Secretary of State’s website. Or you can mail in a paper application to the probate court where the registered agent is located.

The LLC filing fees in Alabama are:

- Domestic Filing: $200 ($208 online)

- Foreign Filing: $150 ($156 online)

Document processing times can take up to 14 days. If you’re tight on time, expedited service is available for an extra $100. Your filing will be processed within 3 business days after receipt.

Step 4: Obtain a Certificate of LLC Registration from the State

Once the Judge of Probate processes your Certificate of Formation, your LLC formation becomes effective. The Alabama Secretary of State will then register your LLC, and your business will appear on their website.

Congratulations!

That means you’ve officially formed your Alabama LLC.

Note: The process of registration by the Secretary of State may take a few days after the Judge of Probate’s approval. Be sure to check the status online to confirm your LLC is officially listed.

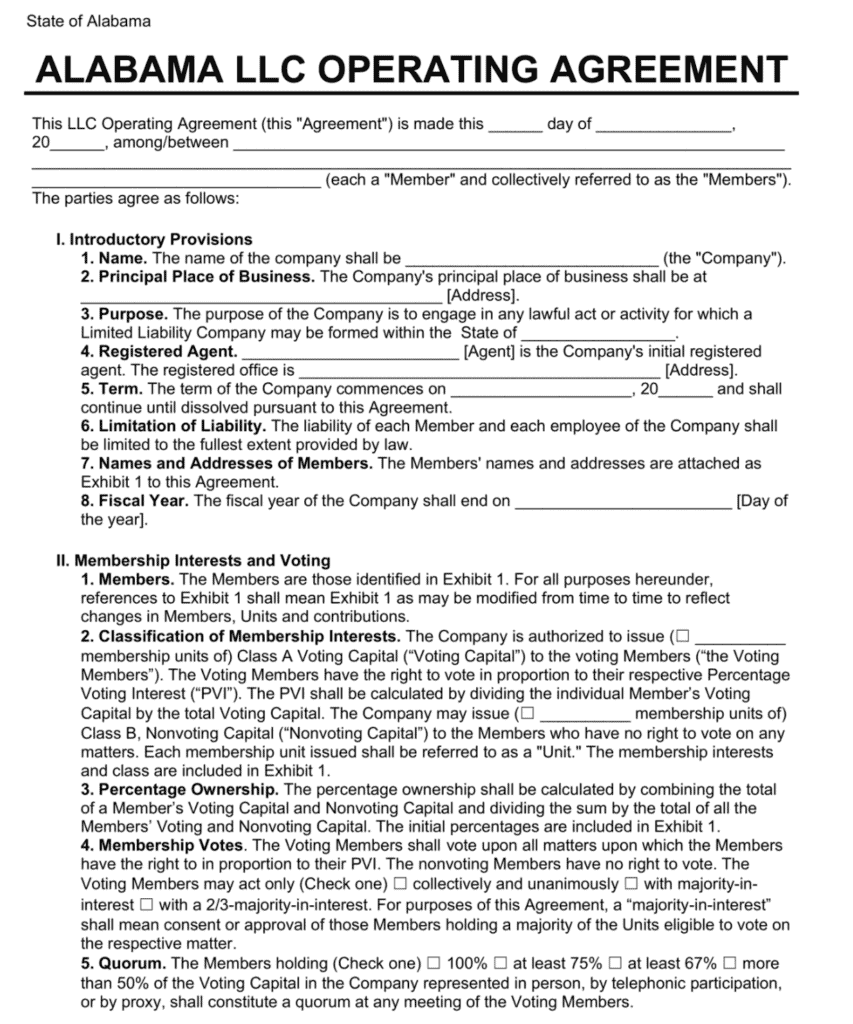

Step 5: Create an LLC Operating Agreement

In Alabama, an operating agreement is not legally required for forming an LLC. However, it is highly recommended. This legal document specifies:

- Who the LLC members are

- The rights and duties of members and managers

- How the business operates

- How to distribute profit and losses

Without an operating agreement, the LLC defaults to the state law. This may not align with your interests. And if disputes arise, it can result in unexpected outcomes.

An operating agreement is internal to the LLC. You don’t have to file one with the Secretary of State. For single-member LLCs, an operating agreement is not needed since you probably agree with yourself, though some transactions may require one.

The importance of operating agreements grows for multi-member LLCs. It helps establish clear boundaries and responsibilities. The operating agreement should be signed by all LLC members. It should be updated for registered agent changes or ownership modifications. Lenders, accountants, and attorneys may request your operating agreement to provide services.

You can find an online template for creating an operating agreement. Or hire an attorney to draft the operating agreement on behalf of the LLC.

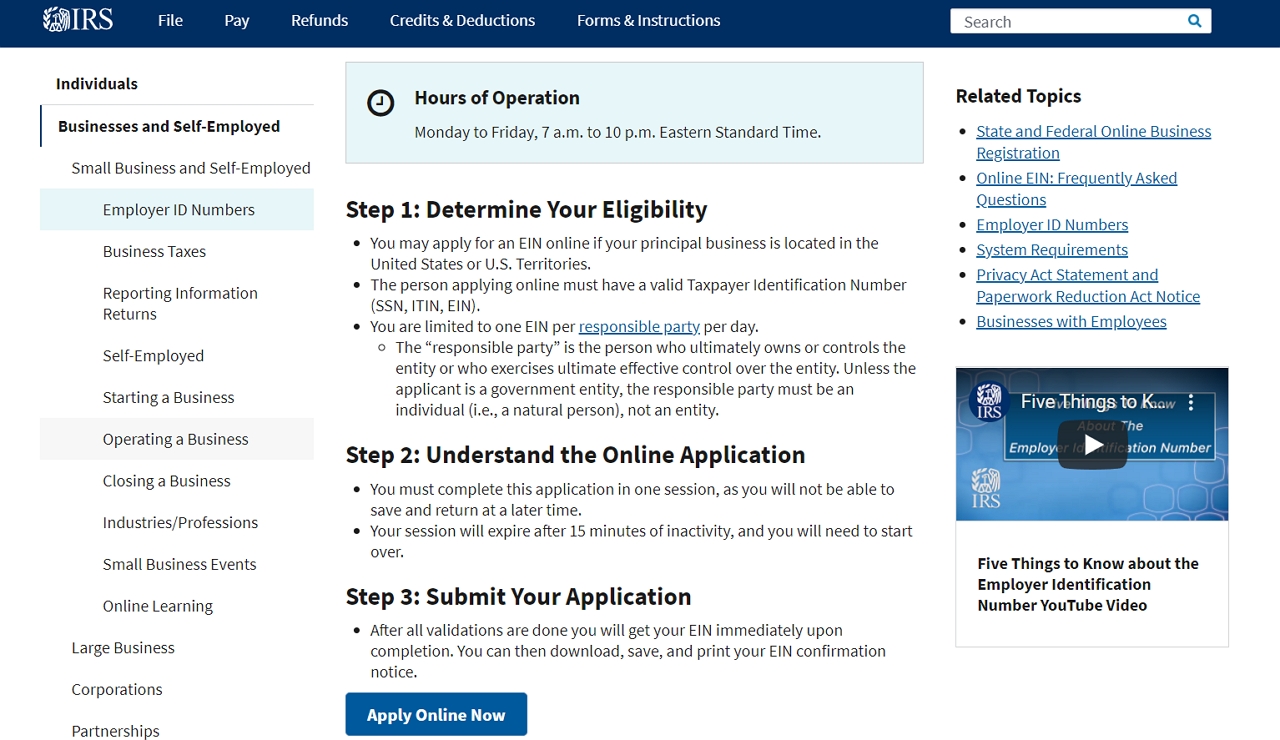

Step 6: Get an Employer Identification Number (EIN)

The IRS issues unique identifiers to help track businesses. These are Employer Identification Numbers (EINs). These are like Social Security numbers for businesses.

You can apply for an EIN on the IRS website. It’s easy and free. Your EIN is available immediately.

The most challenging part of the EIN application is selecting the business structure. This classifies the tax treatment for your entity. The options include:

- Single-member LLC: The IRS treats these as “disregarded entities.” They are taxed like a sole proprietorship with the income reported on the owner’s tax return.

- Multi-owner LLC: By default, the IRS considers these partnerships. The partnership files a tax form, but it does not pay taxes directly. Instead, the income flows over to the personal income tax return of each partner on a K-1.

Multi-member LLCs can also elect S-corporation or C-corporation taxation. Both come with more reporting duties and different tax treatments.

S-corps can be attractive. They may lower the self-employment tax that the LLC members have to pay.

Most LLC owners avoid C-corp elections because it results in double taxation. The company must pay taxes on income. Then shareholders are taxed again on any distributions they receive.

Total Costs to Set Up an LLC in Alabama

Starting an LLC in Alabama will cost at least $225 in the first year. This includes mandatory costs, such as:

- Certificate of Name Reservation – $25 (Valid for one year, required before filing LLC formation)

- Certificate of Formation Filing Fee – $200 ($208 online)

Optional costs:

- Trade Name (DBA) Registration – $30 ($31.20 online)

- Registered Agent Service – $49 to $299 per year

- Operating Agreement Drafting – $0 to $500+ (Depends on using a template or an attorney)

- EIN (Employer Identification Number) – Free (Obtained directly from IRS)

Alabama imposes a Business Privilege Tax based on your LLC’s net worth. The rates range from $0.25 to $1.75 for each $1,000 of net worth in Alabama. For taxable years beginning after December 31, 2023, there is a full exemption from the business privilege tax on tax due of $100 or less.

Further Steps

Open a Bank Account

Alabama has no state requirements for opening a business bank account. But it’s important to keep the protections the LLC provides.

A business bank account helps separate your business and personal funds. This maintains the idea that your business is a separate entity. If you commingle your business and personal funds, it implies that your LLC isn’t truly a separate entity. This is a problem that happens if you pay business expenses from a personal account or vice versa.

If you fail to separate funds and you get sued, the LLC’s protection may disappear. Your personal assets could be in jeopardy.

Permits and Licenses

You may need to get business licenses and permits from the State. These apply to professional services and specific activities. Things like restaurants and nail salons often need these. Local licenses and permits can also be necessary. For example, all operations in Huntsville need a business license. And there’s a list of activities that need a local permit too.

Costs vary by profession and most licenses must be renewed – something to factor into your LLC costs.

Annual Report and Tax Filing

All LLCs must file the Alabama Business Privilege Tax Return and Annual Report. The purpose of this filing is for the state to have current information about your business. This includes your principal office address, registered agent information, and ownership information.