Thinking of starting an LLC in Montana?

Montana is known for its breathtaking landscapes, from Glacier National Park to its rich mining history, but it’s also a promising place to start a business. With low operating costs and less competition than many other states, Montana provides a strong foundation for entrepreneurs. Forming an LLC in the state can boost your business's credibility while offering essential legal protections and a business-friendly tax setup.

Ready to get started?

This guide will take you through the process step by step, including all the costs involved.

Steps to Create an LLC in Montana:

- Step 1: Choose a Name for Your Montana LLC

- Step 2: Appoint a Registered Agent

- Step 3: File the Montana LLC Articles of Organization

- Step 4: Create an LLC Operating Agreement

- Step 5: Get an Employer Identification Number from the IRS

- Costs to Set Up an LLC in Montana

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Choose a Name for Your Montana LLC

Every business needs a brand name. It should be short, memorable, and indicative of what you do. LLCs also need to meet several Montana naming requirements.

The legal name you choose must:

- Contain Limited Liability Company, Limited Company, or a similar abbreviation like LLC

- Be different from the names used by other businesses

- Avoid implying that the LLC is another type of business structure

- Avoid using words like attorney, bank, or university, unless authorized

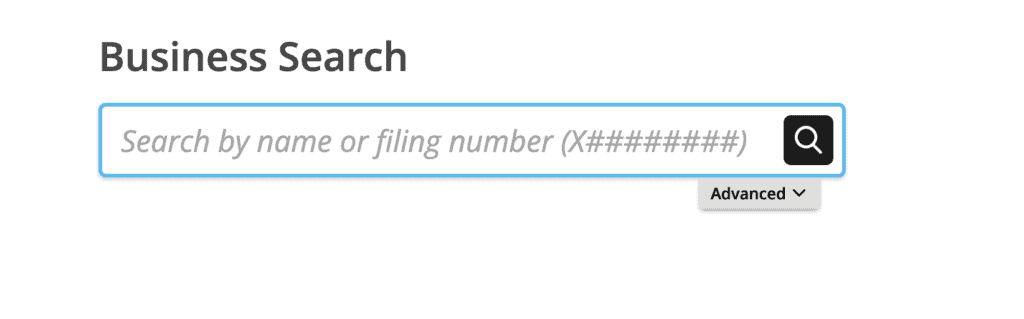

Once you have some LLC name ideas, you’ll need to check for name availability. Use the business name database from the Montana Secretary of State (SOS):

Name reservation (optional)

If you’re not ready to file all the LLC documents yet, you can still reserve your business name. This stops other companies from scooping it up.

In Montana, you can file a name reservation form online. The filing fee is $10 and the reservation is good for 120 days.

Trade name (optional)

You might struggle to come up with the an LLC name that provides the branding you want. Don’t worry. You can always file to operate under an alternative name. This is called a trade name or a doing-business-as (DBA) name.

A DBA establishes an association between your official business's LLC registration and the new brand name. You can use multiple trade names under one LLC.

An example would be if you launched a pet service business and named it “Pat’s Pet Sitting LLC.” Later, you decide to expand your operations and offer grooming services or sell pet supplies. You could add a DBA to your LLC to operate as Pat’s Pet Grooming or Pat’s Pets. You can register a DBA with the Montana SOS online. There is a $20 fee.

Step 2: Appoint a Registered Agent

Like with many other states, you must list a registered agent for your Montana LLC. A registered agent acts as a point of contact for your business. They receive service of process, important legal documents, and official correspondence. An individual or business entity can act as a registered agent if they:

- Are over 18 years old and reside in Montana

- Have a physical street address (not a P.O. Box)

A registered agent must be an individual and must be available during regular business hours. You can serve as your own Montana registered agent, but your business cannot serve as a registered agent.

If you don't want to be your own registered agent, you can hire one for about $90-$249/year in Montana.

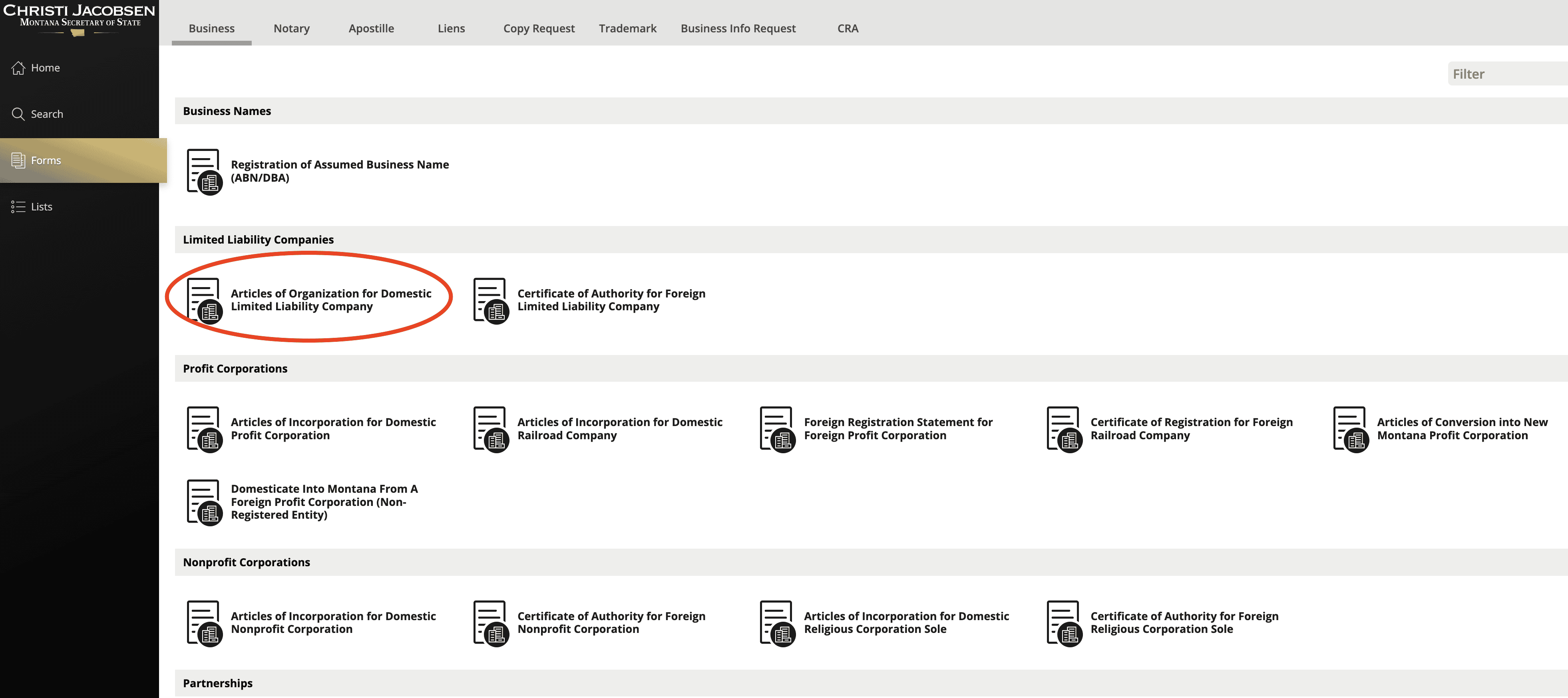

Step 3: File the Montana LLC Articles of Organization

The next step is to register your Montana LLC with the state. This will create a legal entity.

To officially form an LLC in Montana, file an Articles of Organization form with the following details:

- LLC name and mailing address

- Registered agent’s name and address

- Management structure

- Names and addresses of all members or managers

- Date and signature of the person filling out the paperwork

If you have a business in another state and want to also do business in Montana, you must register as a foreign LLC. Foreign LLCs must file a “Certificate of Authority of Foreign Limited Liability Corporation” online with the Montana SOS. They also need a current certificate of good standing/existence from the origin state.

The filing fee is $35. Montana's average LLC registration processing time is 7-10 business days. If you need your LLC formed faster, expedited processing is available at an extra cost:

- 24-hour priority handling: $20

- 1-hour expedited handling: $100

Once Montana approves your LLC, request a Certificate of Existence. This will cost $5 but is important to have on file. You’ll likely need it to open a business bank account or get financing for projects.

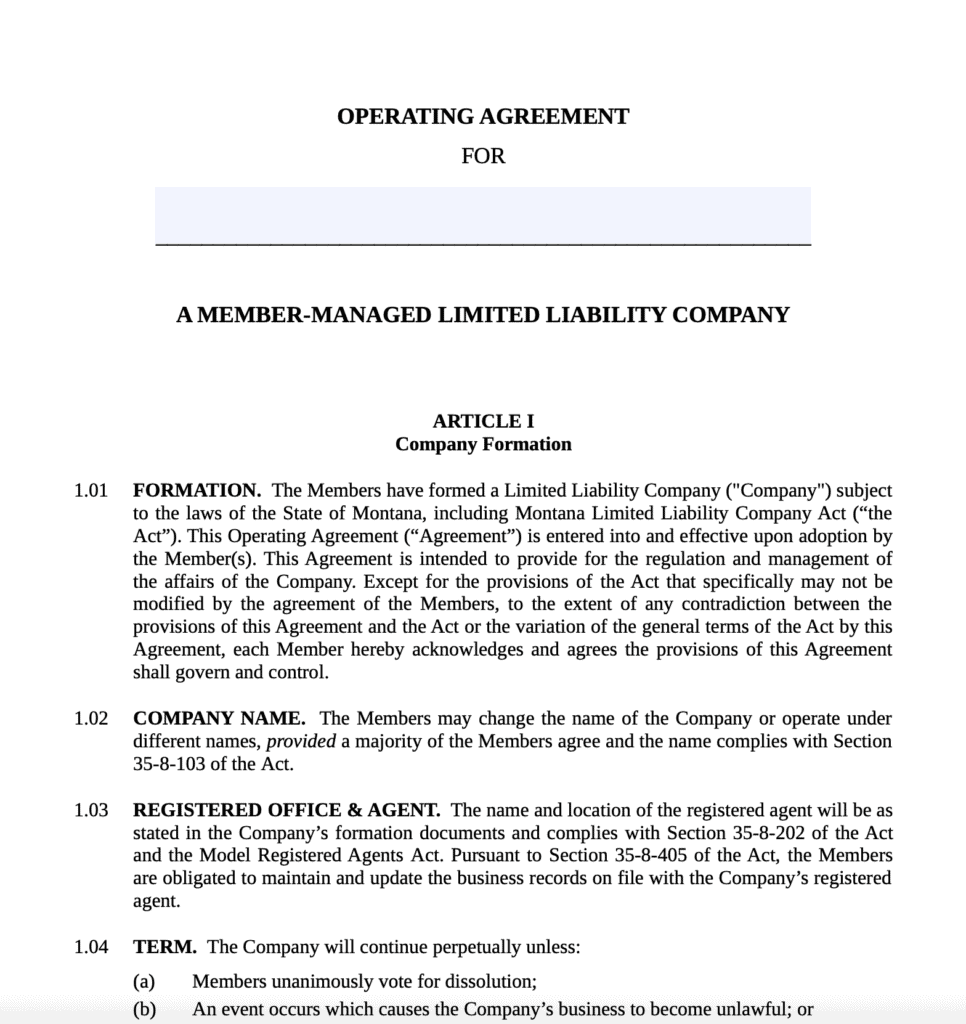

Step 4: Create an LLC Operating Agreement

Although not legally required in Montana, having an operating agreement is highly recommended to outline the management structure and operating procedures of the LLC.

Operating agreements are like a guidebook for running the company. They lay out details for managing operations, making decisions, and distributing profit.

Montana state law doesn’t require LLCs to have an operating agreement, but it's highly recommended. Without one, Montana law steps in to resolve conflicts. This may not align with your interests.

Business owners can use operating agreements to make sure everything functions as they intend. Operations agreements are essential for every multi-member LLC.

The operating agreement:

- Shows that members’ assets and debts are separate from the LLC’s

- Prevents and resolves conflicts without relying on Montana law

- Provides a clear picture of business operations to owners

- Tracks ownership interests and lays out distribution methods

- Includes procedures for adding and removing members or dissolving the LLC

You can draft your operating agreement using an online template, or hire an attorney to help create a customized one.

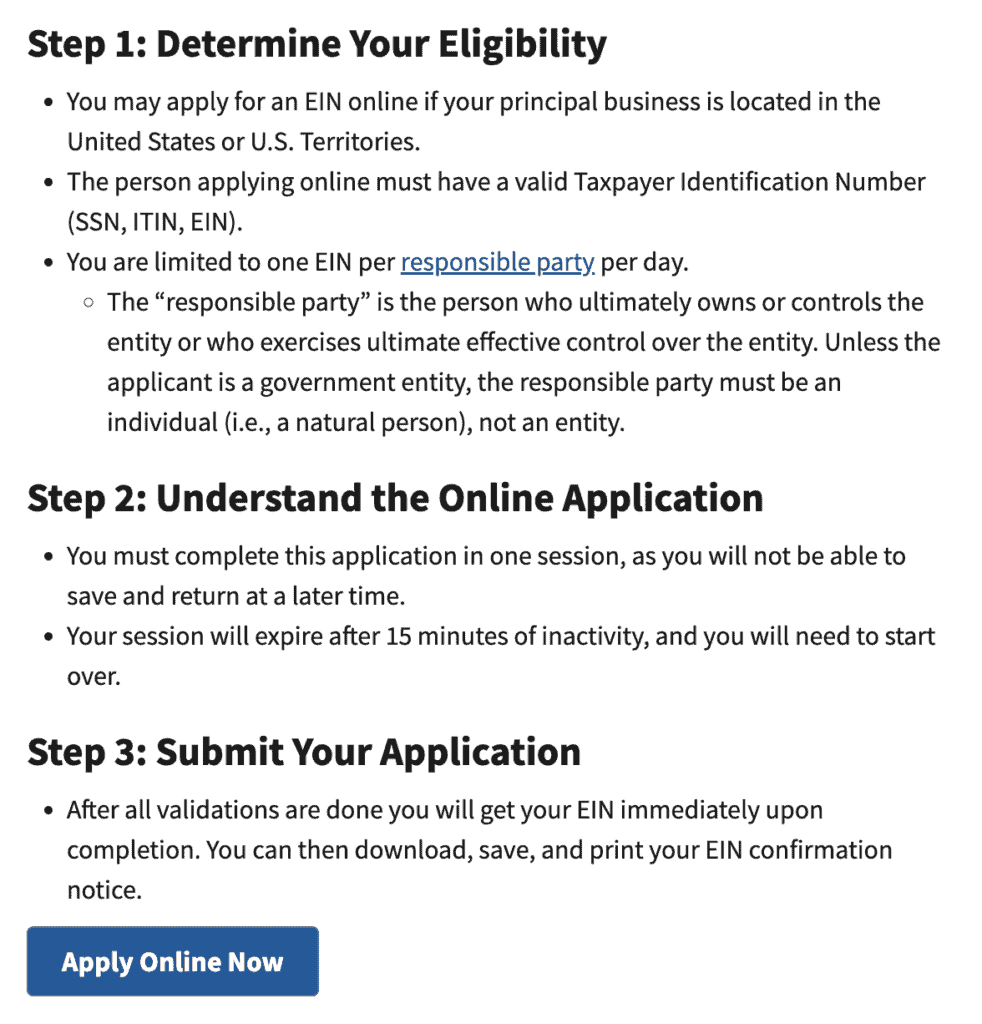

Step 5: Get an EIN (Employer Identification Number) from the IRS

Now it’s time to switch over to tax concerns.

An Employer Identification Number (EIN) is like a Social Security number (SSN) for the business. The IRS uses it to identify the LLC and file taxes.

All multi-member LLCs must get an EIN. Some single-member LLCs without employees don’t need to apply for EIN immediately, but it’s best practice to get one anyway as they can be needed to open a bank account.

The IRS online application is the fastest way to get an EIN. But you can also request one by mail or fax. It’s free.

Total Costs to Set Up an LLC in Montana

Starting an LLC in Montana is reasonably priced compared to other states. The minimum expense to establish a Montana LLC is just $35 to file your articles of organization.

This fee is paid to the state upon registering your LLC in Montana. However, if you are a foreign LLC, the minimum fee increases to $70.

There is a possibility of incurring extra optional expenses. These include a registered agent service (approximately $100/year) or registering a trade name ($20).

Here’s a breakdown of the costs involved:

Mandatory Fees

- Articles of Organization Filing Fee: $35 (paid to the Montana Secretary of State)

- Annual Report Fee: $20 (due between January 1 and April 15 each year)

Optional Fees

- Name Reservation (if needed): $10 (reserves a business name for 120 days)

- Trade Name (DBA) Registration: $20 (if you plan to operate under a different name)

- Certified Copy of Business Registration: $5 (useful for business banking or financing)

- Registered Agent Service: $90 – $249 per year (if you choose a professional service instead of being your own agent)

Final Steps

Open a business bank account

LLCs are not allowed to use a personal account for business finances. Doing so risks losing your personal liability protection.

Open a business bank account once all your formation documents are approved. Monthly fees can often be waived if you meet certain requirements. They’re usually no more than $25 per month.

Local tax and licenses

Many businesses need to register with local authorities. This includes state, city, and county organizations. From taxes to activity-based licenses, check what your LLC needs before operating.

Start with the Montana Department of Revenue to see if you have any state tax needs. Then go to the Department of Labor and Industry to fulfill any employer needs. Business licenses are needed for things like alcohol sales and gambling. The Small Business Licensing Information page has a lot of information to get you started.

Additional Montana Requirements and Recommendations

Montana requires LLCs to file an annual report between January 1 and April 15. The filing fee is $20 if submitted on time; late filings incur additional penalties.

Getting insurance coverage can make a huge difference when things turn south. A general liability policy puts a lot of resources at your fingertips so you can continue forward even if major lawsuits arise.

You’ll also go far by connecting with the local business community. You’re going to face many new challenges as an owner. Use organizations like the Montana SBDC to learn from the best. This Montana Business Help list has many useful resources for advice and funding.