Starting an LLC in Indiana is a simple and cost-effective process, making it a popular choice for entrepreneurs.

Indiana's business-friendly environment offers straightforward filing requirements and reasonable fees that cater to small business owners. The state also provides helpful tools and resources to guide you through every step — from choosing a unique business name to filing necessary documents with the Indiana Secretary of State.

Whether you're launching a new venture or expanding your operations, forming an LLC in Indiana ensures personal liability protection and a flexible management structure.

In this guide, we’ll walk you through the step-by-step process.

Steps to Create an LLC in Indiana:

- Step 1: Choose a Name for Your LLC

- Step 2: Appoint a Registered Agent

- Step 3: File Indiana LLC Articles of Organization

- Step 4: Create an LLC Operating Agreement

- Step 5: Get an EIN (Employer Identification Number) from the IRS

- Costs to Set Up an LLC in Indiana

- Further steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Choose a Name for Your Indiana LLC

Selecting a name for your new business is where you should start. In addition to marketing concerns, you’ll need to ensure that the name meets Indiana’s rules and requirements.

Every Indiana LLC name must:

- Be unique and different from existing businesses

- Include Limited Liability Company or an abbreviation such as LLC

- Avoid using terms related to regulated fields — such as law, medicine, or non-profit status — unless authorized

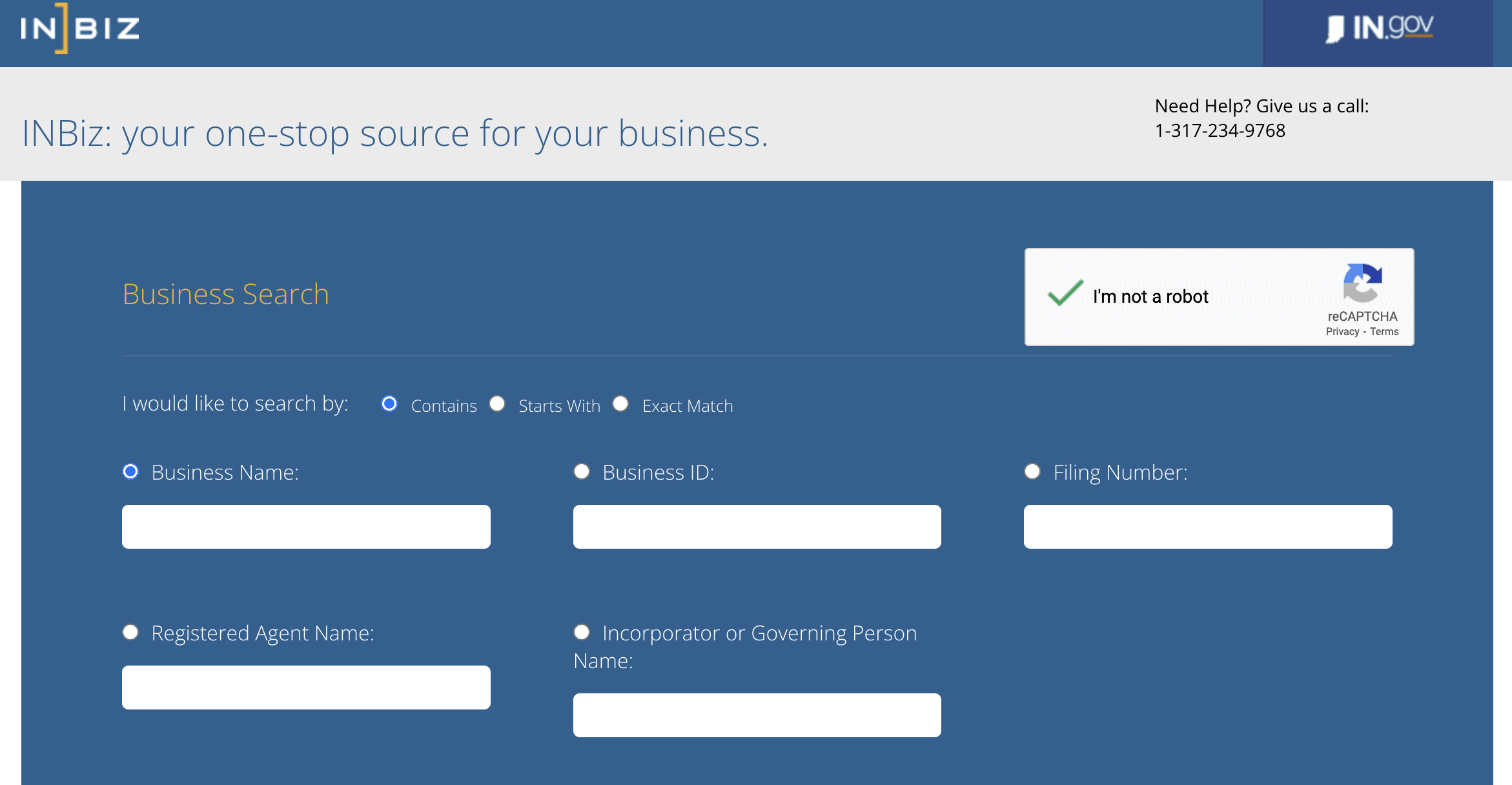

Use the Indiana Public Business Search Database to see which names are already taken and which are still available. Run multiple searches to ensure that you select a unique name that won’t cause confusion with existing businesses.

Name Reservation (optional)

If you want to reserve a name, create an account with the state of Indiana. Next, go to the “Start a New Business Section” to begin the name registration process. You can also use a paper form.

Reserving a name ensures its availability while you complete formation documents, but this step is optional.

The cost to reserve a corporate name in Indiana is $10. It is valid for 120 days.

Assumed Name (optional)

Many business owners like to use a doing-business-as (DBA) name. This can also be called a trade name or a fictitious name. Indiana calls it an assumed name.

A DBA or assumed name provides a lot of flexibility by letting you operate under a name different from the LLC’s legal name. For example, an LLC named “Indiana Farm Supply LLC” might operate under an assumed name like “Hoosier Hog Hub.”

To use an assumed name, you need to file it with the State of Indiana. The assumed name registration cost in Indiana is $20 per name.

Step 2: Appoint a Registered Agent

All Indiana LLCs must have a registered agent listed in the company’s application. A registered agent is the main point of contact for state notices, letters, and other legal documents. It’s an important role.

All Indiana registered agents must be:

- Physically located in Indiana with a street address (not a P.O. Box)

- At least 18 years old

You can serve as your own registered agent. Or you can appoint a trusted party like an employee, accountant, or friend to perform the role for you.

If you don't want to be your own registered agent, you can hire one for about $49-$200/year in Indiana.

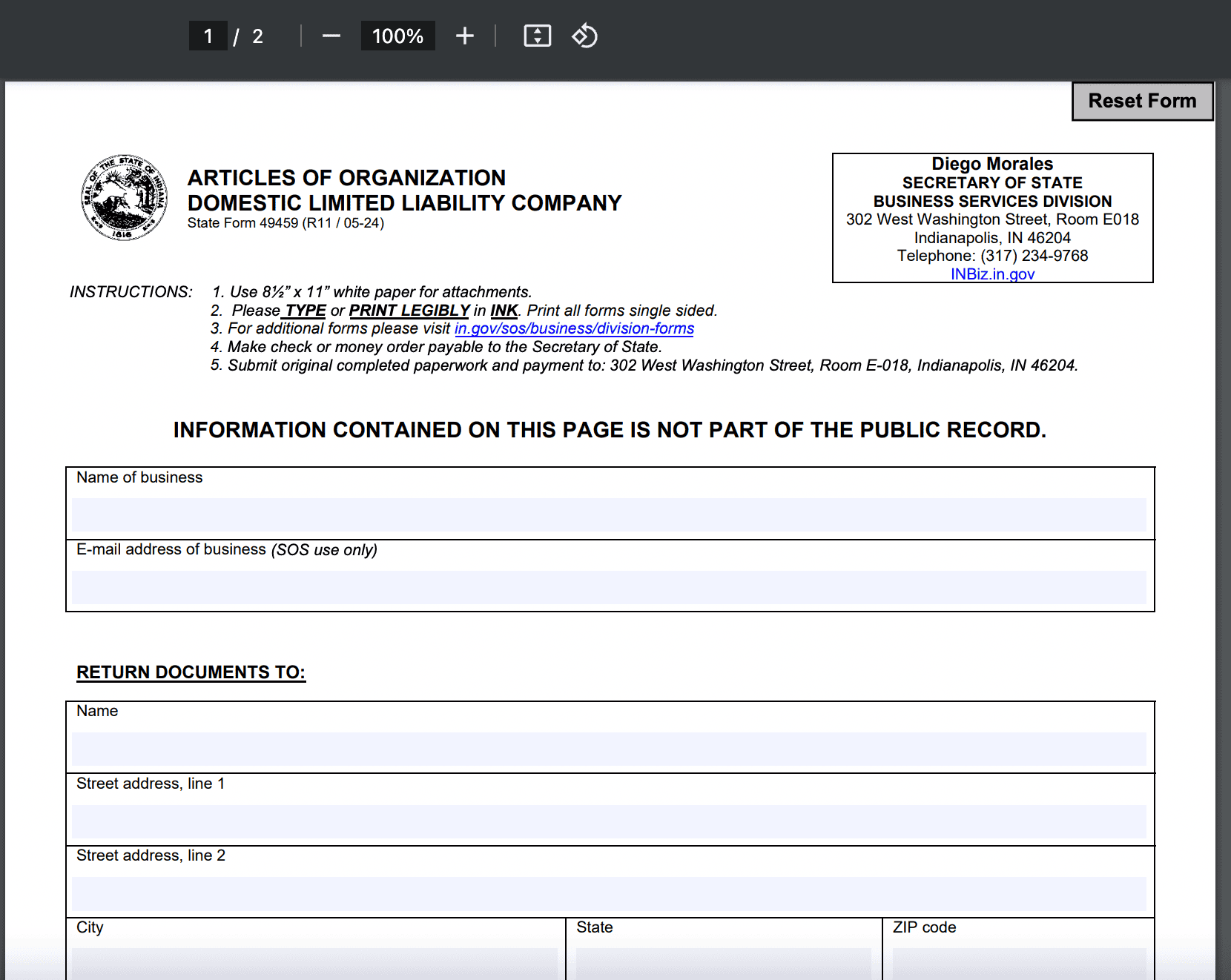

Step 3: File Indiana LLC Articles of Organization

Filing your articles of organization with the Indiana Secretary of State is the key step. It’s what brings your business vision to life by creating the legal entity.

Indiana Articles of Organization require:

- LLC’s name and duration

- Registered agent contact information

- Management structure

- Signature of at least one manager, member, or organizer

You can submit them online, in person, or via mail. Be prepared to pay a filing fee of $95 (online) or $100 (mail) to submit the Articles of Organization.

Processing time varies depending on the submission method:

- 1-2 days for online submissions

- 5-7 days for mail or in-person submissions

At present, Indiana doesn’t offer any expedited services.

Once your LLC has been approved, obtain a Certificate of Existence from the state of Indiana. This costs $26 and can be requested from the state’s online portal.

Keep a copy of this document with your business records. While it is not mandatory at this stage, you may need it later for purposes such as opening a business bank account, securing financing, or conducting business in another state.

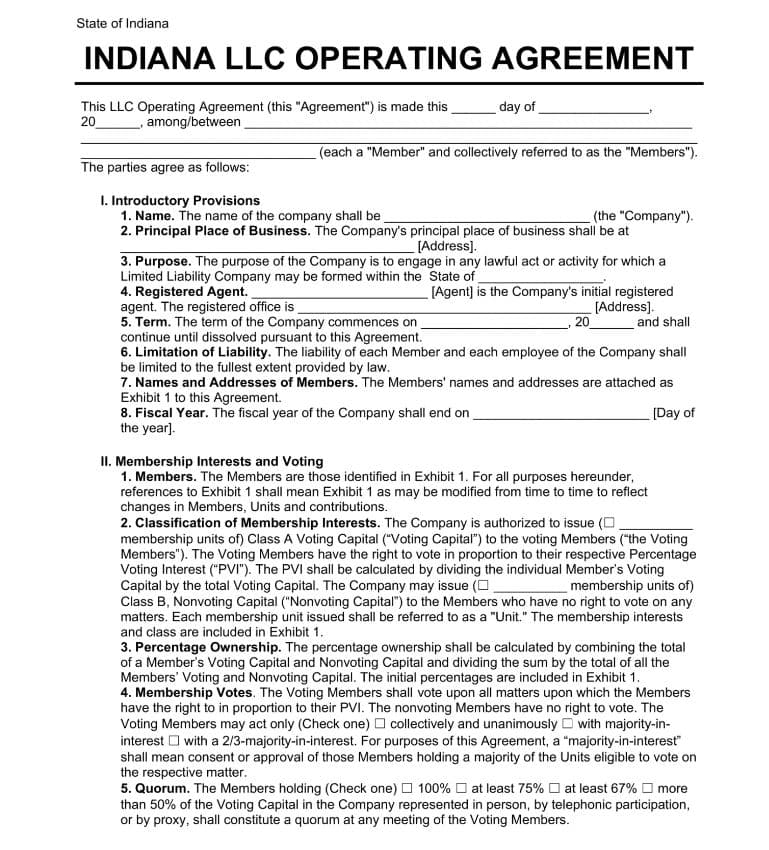

Step 4: Create an LLC Operating Agreement

An operating agreement outlines how the business will function. It is an internal agreement between owners and managers that lays out how to handle many situations.

Without an operating agreement, state law will step in. This may lead to unexpected and undesirable results.

Experienced entrepreneurs protect their interests with well-drafted operating agreements. They include things like:

- Rights and duties of LLC members and managers

- Ownership percentages and contribution amounts

- Allocation of profits and losses

- How to add or remove a member

- Ways to resolve certain disputes

- Method for dissolving the LLC

Business owners are strongly encouraged to draft an operating agreement for their LLC. Indiana doesn’t require one and you don’t file it with the SOS. But it’s still good to have one. They are critical for all multi-member LLCs.

Many online providers sell customizable operating agreement templates. You can also hire an attorney to draft one for you but expect to pay $1,000 or more.

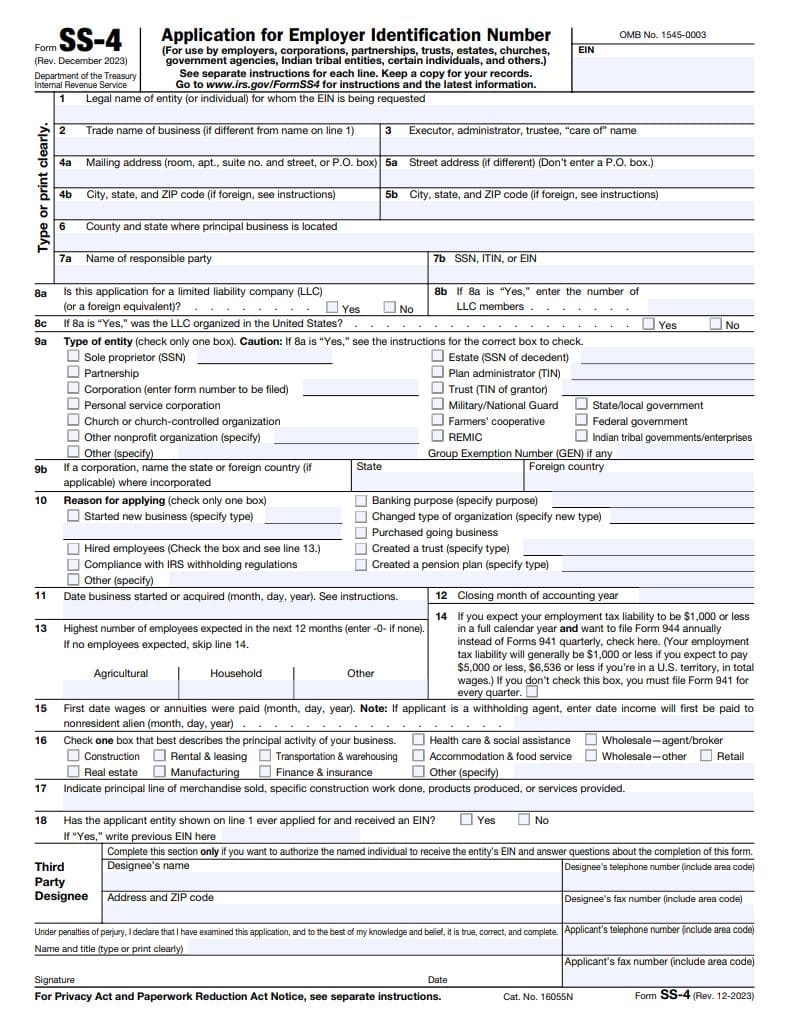

Step 5: Get an EIN (Employer Identification Number) from the IRS

After filing your Articles of Organization and drafting your operating agreement, taxes are the next step to tackle. Business owners should submit a request to the Internal Revenue Service (IRS) for an Employer Identification Number (EIN).

An EIN is like a Social Security number for a business. The IRS uses them to track tax information.

The IRS requires an EIN if your LLC:

- Has more than one member

- Hires any employees

- Falls under a handful of other situations

If you use the sole proprietorship tax classification, you may be able to use your personal Social Security number instead. But it’s best practice to get an EIN anyway. Banks and local tax authorities might require one.

Getting an EIN is quick, easy, and free. Apply online via the IRS website to get your EIN in minutes. Or submit a paper application on Form SS-4.

Costs to Set Up an LLC in Indiana

The minimum cost to start an LLC in Indiana is $95, the fee for filing the Articles of Organization.

Optional charges include:

- $10 to reserve a business name

- $20 to apply for a fictitious (DBA) name

- $99-$149/year to hire a registered agent service

- $0-$1,000 Operating agreement (free template or attorney)

Without hiring an attorney for the operating agreement, most people can start an Indiana LLC for $200 or less.

Further steps

Open a Business Bank Account

Opening a business bank account is highly recommended as it plays a crucial role in maintaining accurate records and accounting. However, there's an even more important reason to have one.

Mixing personal and business finances can jeopardize the legal protections of your LLC. In the event of a lawsuit, your personal assets might be at risk. To avoid this, use a business bank account to demonstrate that your LLC operates as a separate entity.

Many banks offer business accounts at no cost or for a fee of up to $25 per month, depending on your deposit amount and the services provided. Typically, you'll need a photo ID, the articles of organization, and your EIN to open an account.

Local Taxes, Licenses, and Permits

Part of LLC ownership is navigating the state and local needs. Start with the state authorities. The INBiz online portal helps streamline the process.

Many Indiana LLCs need to register with the Indiana Department of Revenue. If you hire employees, you’ll need to register with the Department of Workforce Development.

LLCs selling products or offering taxable services in Indiana must register for a sales tax permit through the Indiana Department of Revenue (DOR).

Other Resources

Leveraging the knowledge of local leaders can help you blast through challenges.

You can get advising services from organizations like SCORE and the Indiana SBDC. Or get your fingers on the pulse of the business community by joining the Chamber of Commerce.