If you are considering starting a business in the state of Florida, forming a Limited Liability Company (LLC) is a highly popular and beneficial option.

An LLC provides flexibility, limited liability protection, and a favorable tax structure, making it an attractive choice for many entrepreneurs.

However, the formation of an LLC in Florida requires completing a series of registration steps to ensure your business is legally recognized by the state. These steps include choosing a unique business name, appointing a registered agent, filing Articles of Organization with the Florida Division of Corporations, and creating an operating agreement that outlines the management and ownership structure of your LLC.

Additionally, you may need to obtain necessary licenses and permits, as well as comply with any local regulations specific to your industry.

Ready? Let's get started!

Steps to Form an LLC in Florida:

- Step 1: Choose a Name for Your LLC

- Step 2: Appoint a Registered Agent

- Step 3: File Articles of Organization with the Department of State

- Step 4: Create an LLC Operating Agreement

- Step 5: Get an Employer Identification Number (EIN)

- Costs to Set Up an LLC in Florida

- Last Steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Choose a Name for Your Florida LLC

The name of your LLC is important for marketing purposes. But it also has to meet Florida requirements.

Every Florida LLC name must:

- Include L.L.C., LLC, or Limited Liability Company

- Be unique and not cause confusion with an existing business name

- Avoid using terms related to illegal activities or government agencies

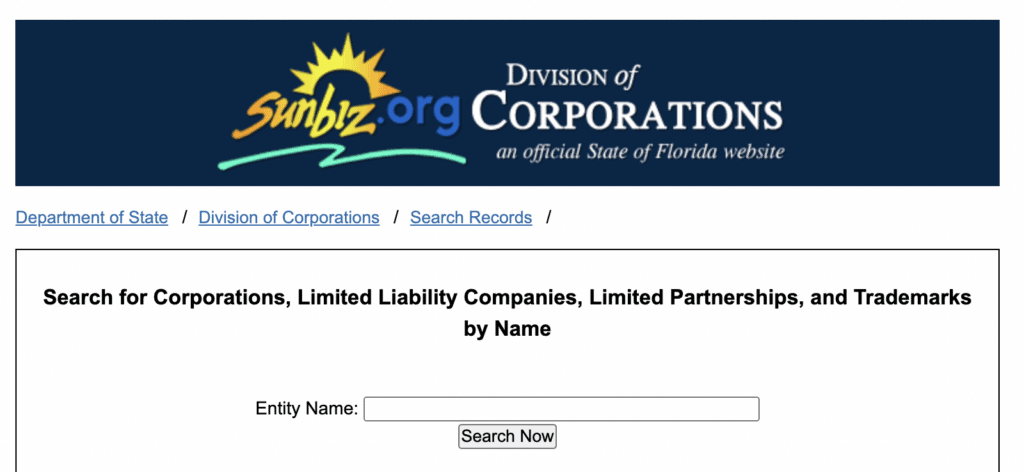

Once you have a name in mind, go to the Division of Corporations Name Search. Make sure that your name is free to use and isn’t too similar to an existing business:

Some business owners like to operate under a name other than the LLC’s legal name. Many places call this a “doing-business-as” (DBA) name. In Florida, this is known as a fictitious name.

Either way, make sure your desired name is available, as you'll need it for the next steps.

Step 2: Appoint a Registered Agent

In Florida, a registered agent is a person (18+ years old) or business entity designated to receive legal documents and official correspondence on behalf of a company.

The requirements for a registered agent in Florida are as follows:

- Residency or Location: The registered agent must be a resident of Florida or a business entity authorized to do business in Florida. The registered agent must have a physical street address in Florida (P.O. Boxes are not acceptable).

- Availability: The registered agent must be available during normal business hours (9 a.m. to 5 p.m., Monday through Friday) to receive service of process, legal documents, and official government communications.

- Consent: The registered agent must consent to the appointment. This means the individual or entity must agree to serve as the registered agent and perform the duties required.

If you don't want to be your own registered agent, you can hire one for about $90-$249/year in Florida.

Step 3: File Articles of Organization with the Department of State

Now it’s time for one of the most exciting steps. The Articles of Organization is the document that creates your Florida LLC. It transforms your idea into a legal entity.

The Articles of Organization include:

- LLC’s principal address

- Registered agent name, address, and signature

- Name and address for all LLC managers if it is member-managed

- Effective date of the LLC, which can be up to five business days before the filing date or 90 days after

- Signature of an authorized representative

LLCs from other states (foreign LLC) need to fill out the Qualification of Foreign LLC form. Then file it with a certificate of good standing from the original filing state.

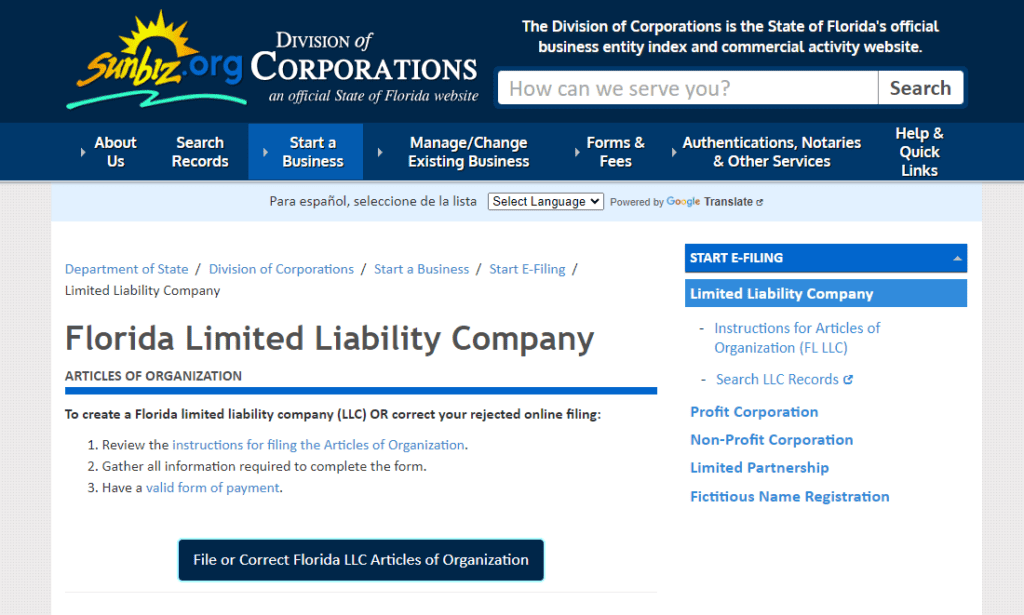

You can file the Articles of Organization online.

Or you can mail them to the Florida Division of Corporations. A $125 fee applies:

Florida Department of State – Division of Corporations

P.O. Box 6327

Tallahassee, FL 32314

The Florida Department of State's Division of Corporations usually processes online LLC filings within 1-2 business days. Mail filings are generally processed within 5–7 business days, plus additional time for postal delivery.

Once processed, Florida will send you an official notification that your business filing has been approved. This is an essential document that you need to keep with the LLC’s records.

It is used for tax purposes to register for an Employer Identification Number (EIN). And it is needed to get LLC business licenses and business bank accounts.

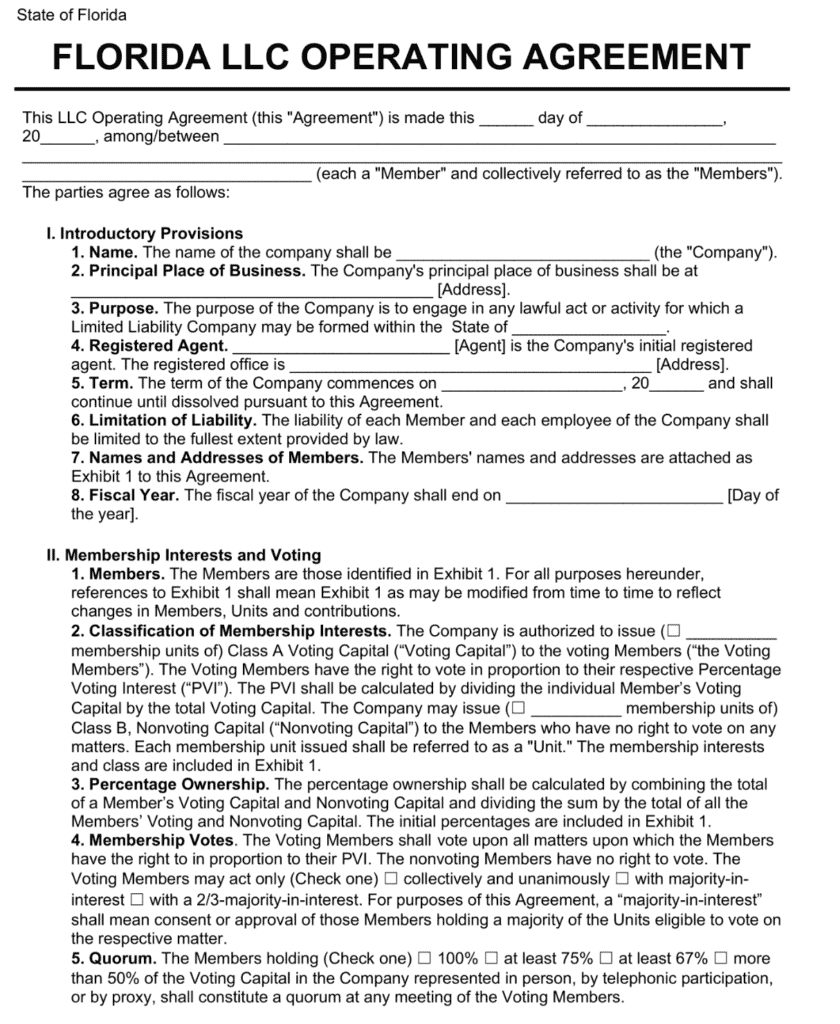

Step 4: Create an LLC Operating Agreement

An operating agreement is central to any LLC’s formation process, especially if there is more than one member. It is an agreement between LLC owners about how to handle many situations.

Without one, the LLC falls back to state law to resolve disputes. Instead of being blindsided by default laws, an operating agreement spells out how to proceed. It also protects your interests.

Operating agreements can cover things like how to:

- Identify the rights and duties of members

- Add or remove members

- Allocate profits and losses

- Resolve various disputes

Although Florida doesn’t require an operating agreement, it is best practice to have one. It is a legally binding contract that ensures your LLC functions as you intend.

You can create an operating agreement with free or low-cost templates. Or you can hire an attorney to customize one for your LLC. Expect to pay upwards of $1,000 or more if you hire an attorney.

Step 5: Get an Employer Identification Number (EIN)

The Internal Revenue Service (IRS) issues Employer Identification Numbers (EINs) to track businesses. It’s a business tax ID, sort of like a Social Security number.

All multi-member LLCs must get an EIN. The IRS also requires single-member LLCs to get one if they hire employees or have other specific situations that apply.

EINs may also be necessary to file annual reports, create vendor contracts, and open business bank accounts. The IRS has an easy online process to get an EIN. It is free and takes about 15 minutes. These filing instructions may help.

Costs to Set Up an LLC in Florida

The cost of forming an LLC in Florida will typically range from $125 to $200 in state filing fees.

Optional costs to starting an LLC in Florida include:

- $50 fictitious name

- $90 to $294 to hire a registered agent

- $1,000 or more for an operating agreement from an attorney

Annual reporting fees are about $138.75 in the state of Florida for LLCs. There are also smaller fees that you might be assessed depending on the kind of business that you operate.

Last Steps

Open Business Bank Account

Opening a business bank account is essential for your new LLC. It simplifies bookkeeping during tax time and is crucial for keeping your personal and business finances separate. Without a dedicated business bank account, your personal asset protection could be at risk if your LLC faces a lawsuit.

To open a business bank account, you'll need to provide proof of your LLC formation. The fees for business accounts vary, ranging from free to about $20 – $50, depending on the bank, the amount of your initial deposit, and the services offered.

Taxes, Licenses, and Permits

Make sure that you secure permits and licensing as required for your business in Florida. These licenses and permits can vary based on where you do business and where you live.

Start with the Florida Department of Revenue. Your LLC may need certain approval or be subject to things like sales tax. See Florida's New Business Start-up Kit to review what your LLC needs.

You also may need to get city and county approval. For example, Miami-Dade County and the City of Miami both have licensing requirements. The City of Fort Lauderdale and others have needs too.

Other Resources

If you're not comfortable filing business taxes on your own, consider hiring a skilled tax professional. While LLC taxes are generally simpler than corporate taxes, they can still be challenging for those without experience. Additionally, it's important to look into insurance coverage. General liability or workers' compensation policies can be extremely valuable if the need arises.

Learning from seasoned business owners can uncover the road to success. Check out your local Chamber of Commerce to connect with knowledgeable peers. The Florida SBDC has a network of mentors that provide no-cost consulting.