Thinking about starting an LLC in Massachusetts? Great decision!

Massachusetts is a fantastic place to launch your business, offering a strong foundation with excellent legal protections. Forming an LLC may seem complicated at first, but it doesn’t have to be. This guide simplifies the process, breaking it down into clear and easy-to-follow steps so you can get started with confidence.

Ready to learn how to form your LLC in Massachusetts?

Here’s a straightforward, five-step plan to help you set up your business and stay focused on what really matters—your success.

Steps to Get an LLC in Massachusetts:

- Step 1: Pick a name for your Massachusetts LLC

- Step 2: Designate a registered agent

- Step 3: File the Massachusetts LLC Certificate of Organization

- Step 4: Prepare an LLC operating agreement

- Step 5: Obtain an EIN (Employer Identification Number) from the IRS

- Costs to set up an LLC in Massachusetts

- Further steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Pick a name for your Massachusetts LLC

To get started on this journey, you’ll need to come up with a name for your new business.

Be sure to pick something marketable and identifiable. It also must meet Massachusetts LLC naming laws. The state requires all company names to be different.

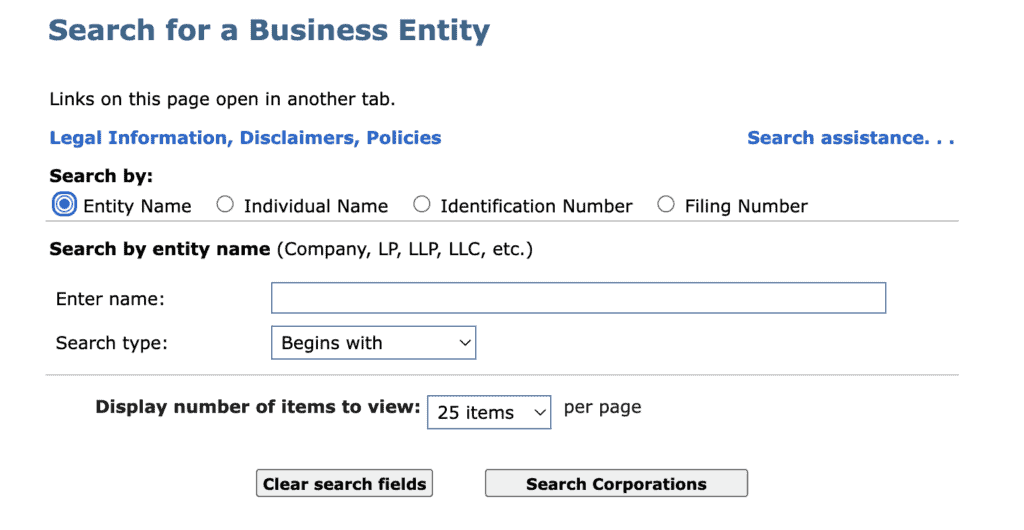

You can search the Secretary of State’s database to see if your LLC name idea is available:

Quick fact: Massachusetts also requires the term “limited liability company” or “limited company” (or their abbreviations) in all LLC names.

As a bonus tip, you may want to consider available website domain names when choosing your LLC's name. Securing the domain name is a great idea. It stops others from using it.

Name reservation (optional)

Reserving a business name isn’t required to form an LLC in Massachusetts. But it can take the pressure off while gathering the rest of your LLC formation documents.

It costs $30 to file a name reservation. This holds your LLC name for up to 60 days. You can extend for another 60 days for $30.

Trade name (optional)

You can use a trade name to operate under a name other than the LLC’s legal name. This is also known as using a:

- DBA (doing business as)

- Fictitious names

- Assumed names

Trade names are ideal for offering many products or services. You can use different brand names but still keep them owned by one Massachusetts LLC.

For example, if you’re starting a lawn care business that handles irrigation and landscaping, your LLC could look like this:

- Dave’s Complete Lawn Care, LLC (LLC's legal name)

- Complete Irrigation by Dave (trade name)

- Total Landscaping by Dave (trade name)

In Massachusetts, trade names are not filed with the Secretary of State, but rather with the city or town where your company operates. Filing requirements and fees vary. In Cambridge, for example, LLCs can use a business certificate that costs $50, must be notarized, then renewed every four years.

Check with your local authorities to confirm the details in your Massachusetts community.

Step 2: Designate a registered agent

A critical task every LLC has is deciding on a registered agent based in Massachusetts. A registered agent receives important legal and tax documents for the LLC.

Massachusetts registered agents can be:

- At least 18 years old and a resident of the state

- A domestic corporation

- A foreign corporation authorized to do business in Massachusetts

Although you can be your own registered agent, you should consider using a professional service too. The benefits of hiring a registered agent service include:

- Keeping your address out of the public record

- Letting you leave during business hours without worrying about your required registered agent duties

If you don't want to be your own registered agent, you can hire one for about $89-$175/year in Massachusetts.

Step 3: File the Massachusetts LLC Certificate of Organization

Are you ready to officially form your LLC? Pay close attention as this is the step that transforms your business idea into a Massachusetts LLC.

To form your Massachusetts LLC, file the Certificate of Organization. Other states call this the Articles of Organization.

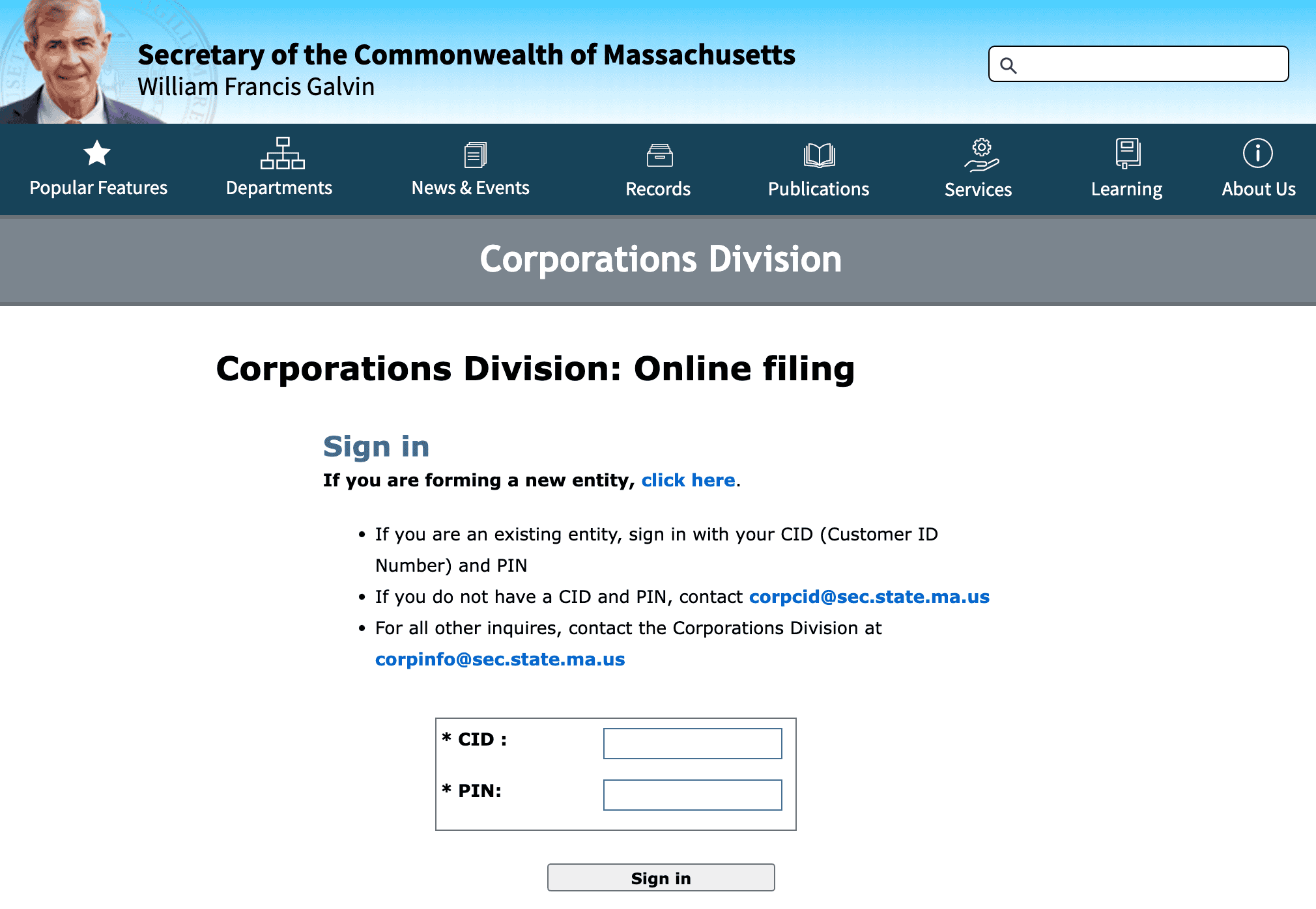

Massachusetts encourages electronic filing using the Corporations Division Online Filing System. Paper filings are also accepted. The state filing fee is $500 no matter which route you select.

Your LLC application will ask for:

- Complete company name, address, and nature of your business

- Contact information for all LLC members

- Name and address of your registered agent

- Your federal employer identification number (EIN), which we’ll cover in step 5

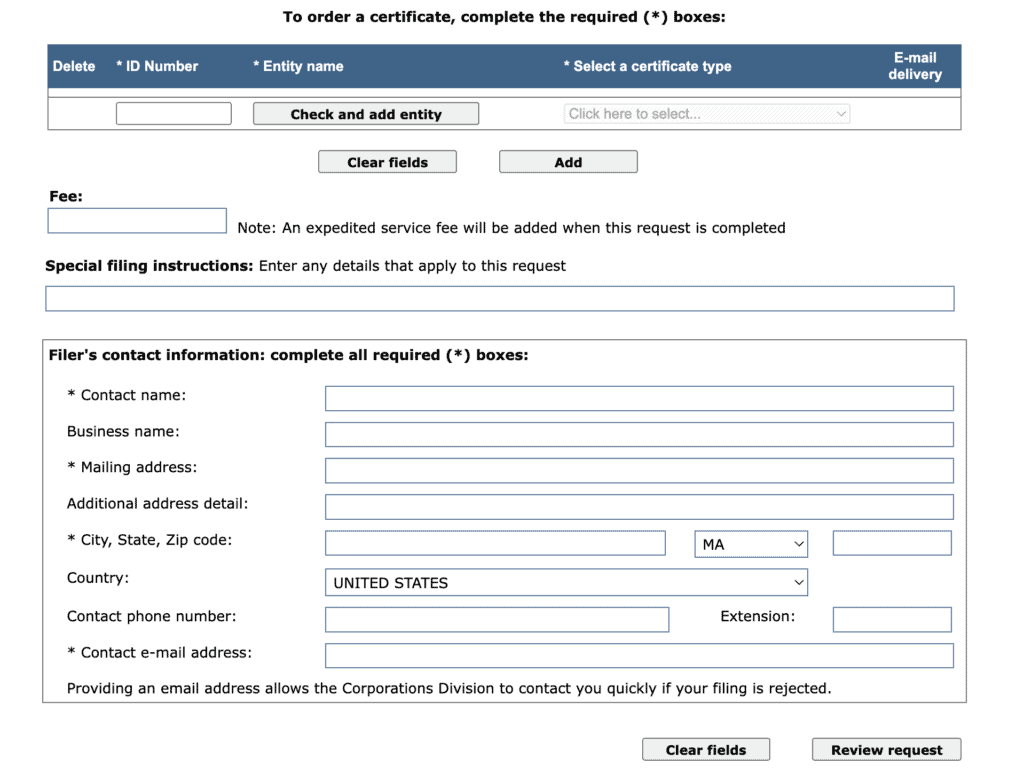

Once approved, get a certified copy of Legal Existence from Massachusetts.

This is important to keep with company records. You may need it to open a bank account, apply for loans, or other transactions. It’s proof that you formed your Massachusetts LLC properly.

To get a this important document, request a certificate from the Massachusetts Corporations Division.

Step 4: Create an LLC Operating Agreement

Your next critical step in starting a Massachusetts LLC is the operating agreement. This document outlines how your company will operate.

Massachusetts doesn’t require you to file your operating agreement, but that doesn’t mean you should skip this step. When an LLC doesn’t have an operating agreement, any dispute relies on default LLC laws in Massachusetts. These may not be in your favor.

Instead, you can protect your LLC with a well-drafted operating agreement. It will be utilized during disputes and help avoid problems in the first place.

An operating agreement is an internal contract between LLC owners. It should cover things like:

- Profits and losses allocation among LLC members

- Process for adding or removing members

- Who will manage the day-to-day operations

- Company dissolution process

- Other rights, duties, and methods for dealing with disputes

You can find operating agreement templates online, or work with an attorney to draft a customized document.

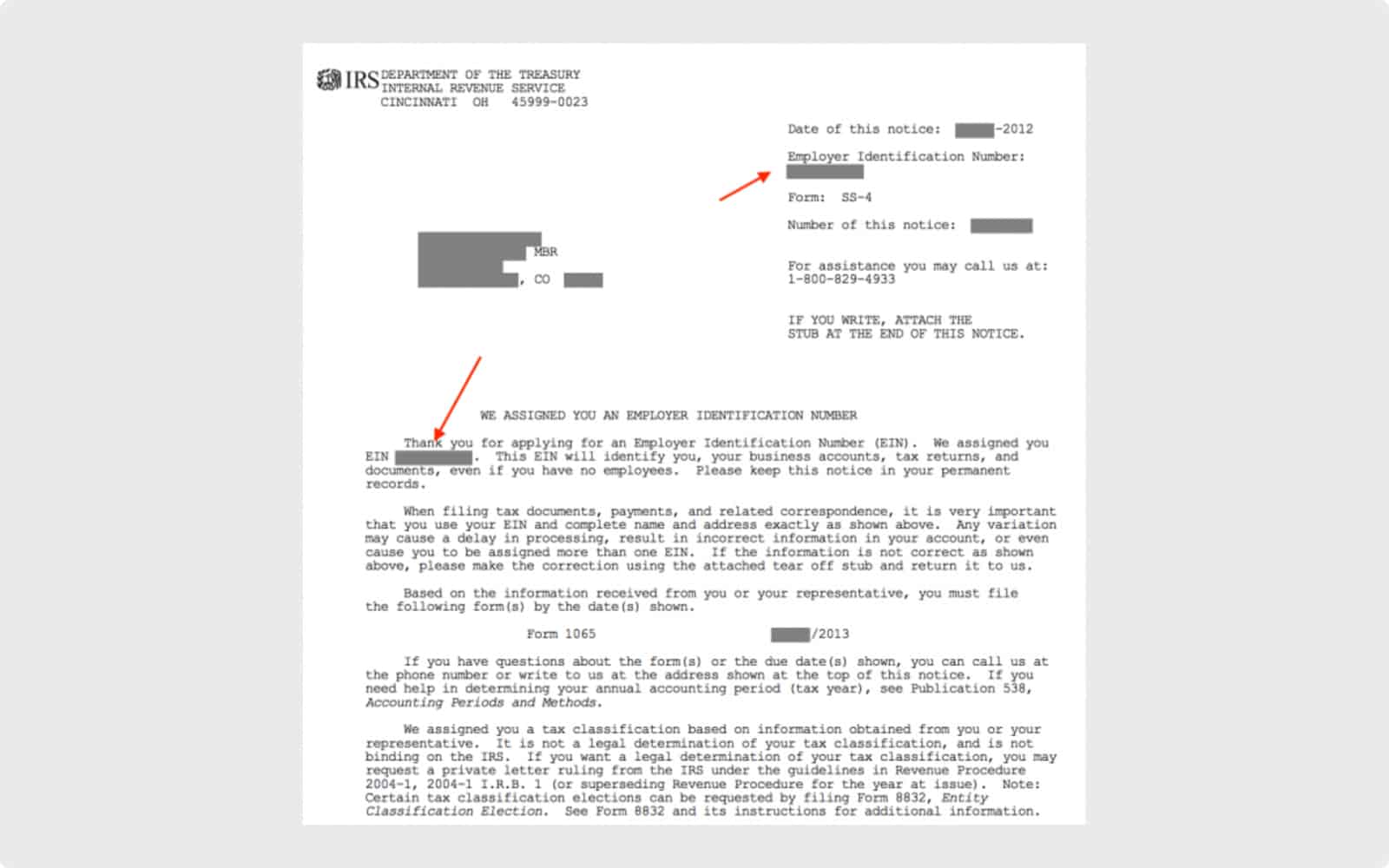

Step 5: Obtain an EIN (Employer Identification Number) from the IRS

For federal tax purposes, the IRS assigns business entities an EIN. It’s like a Social Security number for your LLC.

You must get an EIN if:

- You are a multi-member LLC, reporting taxes as a partnership, S-corporation, or C-corporation

- Your company plans to hire employees (not contractors)

- You withhold wages or make other distributions to a non-resident alien

- You use certain retirement plans

Some single-member LLCs reporting as a sole proprietorship can use a Social Security number, but many get an EIN anyway.

Costs to set up an LLC in Massachusetts

Starting an LLC in Massachusetts is not cheap compared to many of its peers. At a minimum, the required cost to start an LLC in Massachusetts is $500. This is the fee to file the Certificate of Organization, a mandatory document.

Optional costs to form a Massachusetts LLC include:

- Name registration fee ($30)

- Trade name fees (varies by city/county)

- Registered agent service ($89 to $175 year)

- Operating agreement ($0 to $1,000 or more)

Every Massachusetts LLC will also have to file an annual report. This costs $500 each year.

Additionally, LLC owners might have to pay for business or professional licenses, depending on the type of business.

Further steps

Open business bank account

It can be tempting to use a personal bank account for business purposes. But that’s a disaster you want to stay clear of.

Legally, you can’t combine personal and business funds as an LLC owner. If you do, you may lose many of the LLC benefits, including personal asset protection. Your belongings could be at risk if your LLC gets sued. A business bank account also helps with taxes and bookkeeping.

Be aware of taxes

There’s a good chance you need to register with the Department of Revenue (DOR) to collect and pay taxes. Common taxes for Massachusetts LLCs include:

- Sales tax (currently 6.25%)

- Unemployment insurance

- Family and medical leave

- Withholding

Getting your company registered with the DOR is quick and easy through MassTaxConnect. There’s no fee to register. Once you’re registered, you’ll be able to file your state tax returns and pay taxes online.

Local licenses and permits

Depending on your location and activities, you may need to jump through a few more hoops. These can come from state, city, and county officials.

Many industries–like construction, healthcare, and real estate–need to get a professional license or permit. City and county needs vary. It is important to check with your local authorities to get what your LLC needs before starting up.

For example, every Boston business must get a Business Certificate which lasts four years.