Sole proprietorships are the simplest and most common form of business.

A sole proprietorship is easy to set up. Still, there are certain compliance and tax procedures you need to follow.

After reading this guide, you’ll know how to register yourself as a sole proprietorship.

Ready to get started?

What is a sole proprietorship?

A sole proprietorship is an unincorporated type of business owned and operated by one individual.

There’s no distinction between you and your business, meaning you have a shared identity. A sole proprietorship isn’t a separate legal entity — it’s an unincorporated form of business. As a sole proprietor, you have complete control over the business and get to keep all the profits. But also assume all the business’s financial troubles — liabilities, debts, and losses — and other legal responsibilities.

Registering your business as a sole proprietorship comes with several benefits:

- Simplicity and affordability: Whether you start as a freelance service provider or run a food truck, you don’t need to file much state paperwork to set up shop.

- Flexibility: Sole proprietorship can be easily turned into an alternative legal entity type — general partnership, LLC, or even a corporation (INC).

- Simple banking: You can make and accept payments straight from your personal bank account without opening a business checking account.

- Easy tax reporting: You won’t have to file extra tax returns as a sole proprietor — your business income is reported on personal tax returns.

How to become a sole proprietorship step by step

You don’t need to formally incorporate or submit any paperwork to state officials to start a sole proprietorship. If your business has a single owner, the IRS considers you a sole proprietor by default. You will only need to report your business profits and losses on a personal tax return (Schedule C form).

You’ll still need to complete several administrative, financial, and tax formalities for compliance.

1. Select a business name

Aside from coming up with a new business idea or finding a product to sell, you’ll need to choose your business name.

By default, sole proprietors operate under their personal legal name.

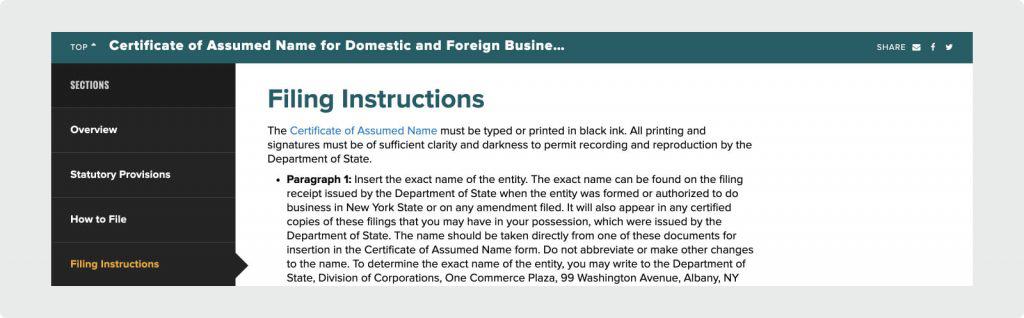

But if you want to use a more brandable business name, you can file for a Doing Business As (DBA) name, aka a fictitious business name.

DBA for sole proprietors (optional)

DBA registration allows you to legally do business under a different name. This filing informs the Secretary of State (SOS) that you publicly operate under a certain name and grants you the right to do so.

The DBA acts as the company’s operating name and promotes your business while symbolizing what you offer the public. A DBA is neither a legal structure nor provides limited liability protection for your business. Instead, it’s a way for you to have a brandable business name without forming an LLC or corporation. Registering a DBA is a straightforward process. Depending on your state, you’ll have to apply either with:

- The local Secretary of State Office

- City/County Clerk at your location

Most states allow you to file your DBA registration online. You generally get your new trade name approved within four-seven business days.

DBA filing fees vary by state but usually fall between $10 and $100.

2. Obtain necessary business licenses

Sole proprietors don’t need to get a general state-wide business license in most states.

However, most cities and counties pose individual regulations to different professional licenses and permits and sales permits.

Professional (occupational) licenses

Professional licenses are based on your industry or profession and ensure you can legally provide a particular service.

For instance, tattoo shops, dietitians, massage therapists, and childcare centers, among other businesses, need occupational licenses.You can apply for the license through your local city, county, or state office. We recommend checking the relevant government website to see if your business requires a license or permit to be allowed to operate legally.

Your business license or permit costs between $20 to $250+, plus renewal fees. The amount you’ll pay depends on your location and license type.

Sales licenses

Most states require retailers to hold a valid sales license, aka a sales tax permit, if they sell taxable goods or services.

In most states, you won’t pay anything to register for a sales license. In other states, the annual costs range from $5 to $100. What’s taxable varies from state to state. Be sure to check with your local revenue office.Without the appropriate business licenses or permits, you risk incurring hefty fines.

3. Understand your tax obligations

Like any other business entity, a sole proprietor must pay federal and state taxes on profits from their business.

Federal taxes

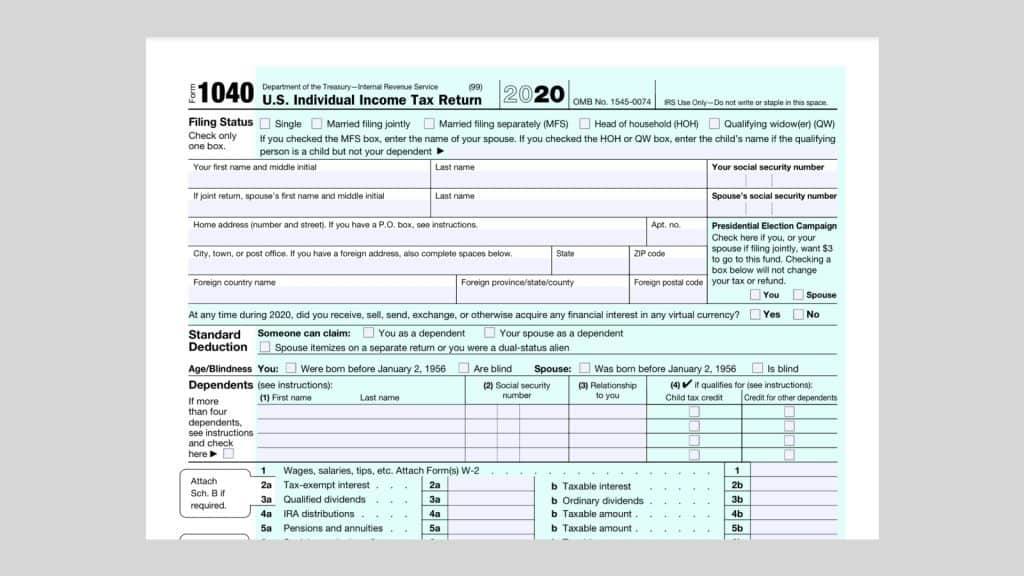

You’ll report your business income and expenses on Schedule C attached to your Form 1040 and pay self-employment taxes such as Medicare and social security.

The federal government treats a sole proprietor as the same entity as their business for tax purposes. That means you’re taxed at the individual tax rate, just like you were before you started your business.

State taxes

Apart from state personal income taxes, a sole proprietor may need to pay:

- Sales taxes: On taxable products and services sold by their business.

- Employment taxes: If you hire employees, you’ll pay employment taxes.

How much should I set aside for taxes as a sole proprietor? Tax obligations vary by business and location. A solid rule of thumb is to save 25%-30% of your business income to cover federal and state taxes each quarter. You’ll need to send estimated tax payments to the IRS and your state’s revenue office each quarter to avoid costly fines.

4. Get insurance

Unlike LLCs, sole proprietors have unlimited personal liability. It means you’re personally liable for the business actions and debts. If your business gets sued, you risk losing your personal assets. Such high degrees of risk leave you exposed.

Business insurance protects against lost wages, damaged property, or lawsuits.

At the very least, you can consider property and liability coverage, medical coverage, and disability coverage. And when you hire employees, add workers’ compensation insurance to your insurance policy needs.

5. Get prepared to hire employees

As a sole proprietor, when the time comes to hire help, you have several options.

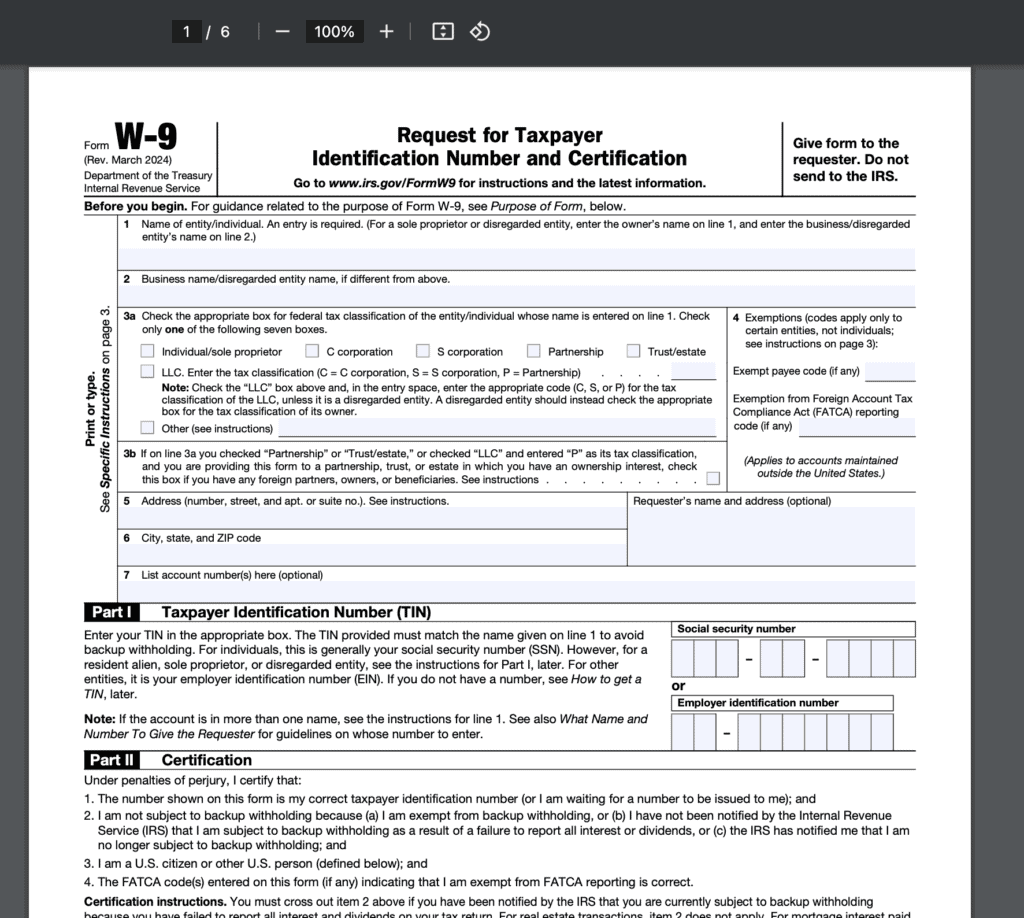

You can hire independent contractors or employees to help you keep up with all the tasks. If you decide to hire contractors, be sure to:

- Have a signed contract that includes details about what services they will provide and how payment will be made.

- Collect a Form W-9 before you pay them so you can send a Form 1099 in January if required.

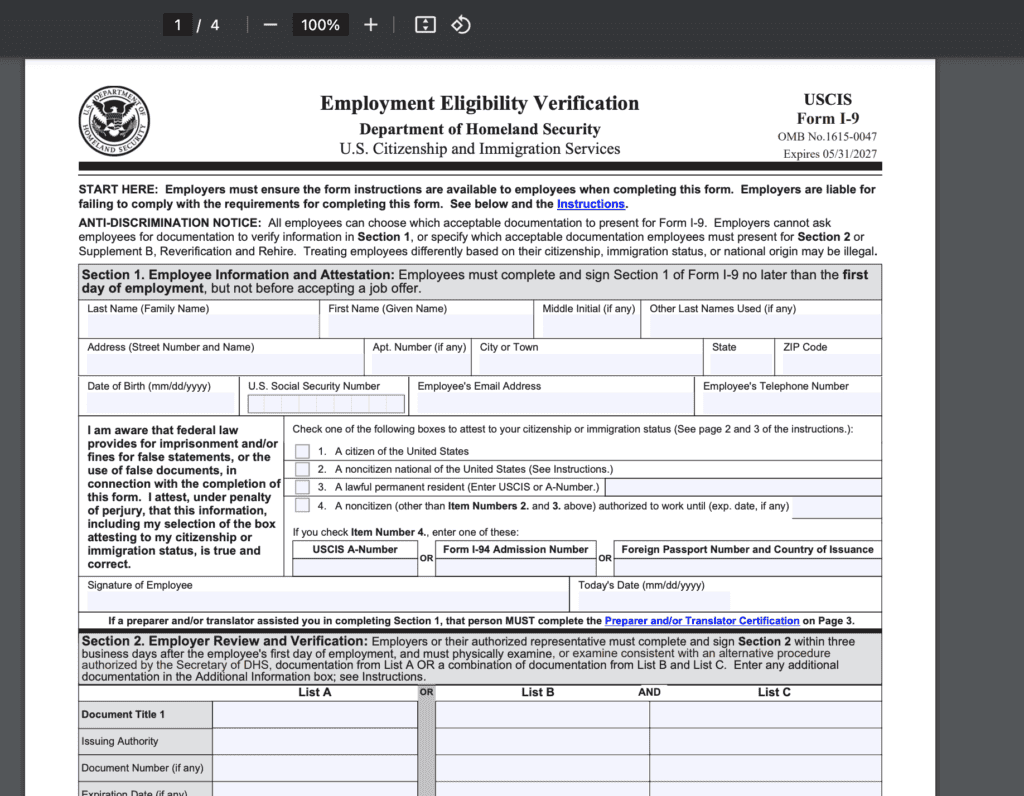

Before hiring employees, you need to:

- Get a federal employer identification number (FEIN) from the IRS. You can apply for it and get it instantly on the IRS website or apply by mail or fax.

- Register with your state’s unemployment office to pay state unemployment tax and with your state’s revenue department to send tax withholdings.

- Have the employees fill out Form W-4 and Form I-9 and all other necessary employment forms.

Once your employees start working, withhold employment taxes from their wages, contribute your employer taxes, and file payroll reports.

Sole proprietorship as a federal tax classification

Apart from being a business structure, the sole proprietorship is also a tax classification used by the IRS for federal tax purposes.

If there’s only one owner, the IRS presumes your business to be a sole proprietorship — unless you form a limited liability company (LLC). A single-member LLC can elect an alternative tax classification and report federal taxes as a corporation — under S-corporation or C-corporation status.

Is self-employed and sole proprietorship the same?

Yes, a sole proprietor is another term for a “self-employed” person. Self-employment means that you aren’t legally employed by another company. Instead, clients request your services on a contract-based or freelance basis. Or you sell products to the general public.

What type of business is best for a sole proprietorship?

A sole proprietorship is an excellent choice for people who want to pursue independent work — run a side-business, do gig work, offer consulting services, or launch a full-scale business. Sole proprietors may operate as a:

- Freelancer: You do contract-based projects for multiple clients part-time or full-time.

- Business owner: In this case, you have more autonomy in completing client work.

- Franchisee: You benefit from the brand, business model, and guidance of a franchisor and pay them royalties in exchange.

FAQs about becoming a sole proprietor

Here are the most frequently asked questions about forming and operating a sole proprietorship.