Oklahoma offers business-friendly perks, including low filing fees and straightforward requirements for incorporation. Additionally, the state's affordable living costs, favorable tax rates, and manageable employee overhead make it an excellent choice for operating a physical business.

Still, starting an LLC (Limited Liability Company) or expanding your existing business to a new state can feel overwhelming for new entrepreneurs. If you're considering forming an LLC in Oklahoma, this guide will walk you through the process step by step.

Steps to Create an LLC in Oklahoma:

- Step 1: Choose a Name for Your LLC

- Step 2: Appoint a Registered Agent

- Step 3: File Oklahoma LLC Articles of Organization

- Step 4: Obtain an EIN (Employer Identification Number) from the IRS

- Step 5: Create an LLC Operating Agreement

- Step 6: Open a Bank Account for LLC

- Total Costs to Set Up an LLC in Oklahoma

Need to save time? Hire Northwest to form your LLC.

Step 1: Choose a Name for Your LLC

A legal business name is required for every new Oklahoma registered business entity.

The name has to be substantially different from those registered by other companies. It must also meet several additional requirements:

- Include the words Limited Liability Company, Limited Company, or an abbreviation indicating this type of business entity, such as LLC or L.L.C.

- Be distinguishable from the company names of corporations that already exist in Oklahoma.

- Avoid use of restricted words, such as ones pertaining to certain professions and those that may be confused with government agencies.

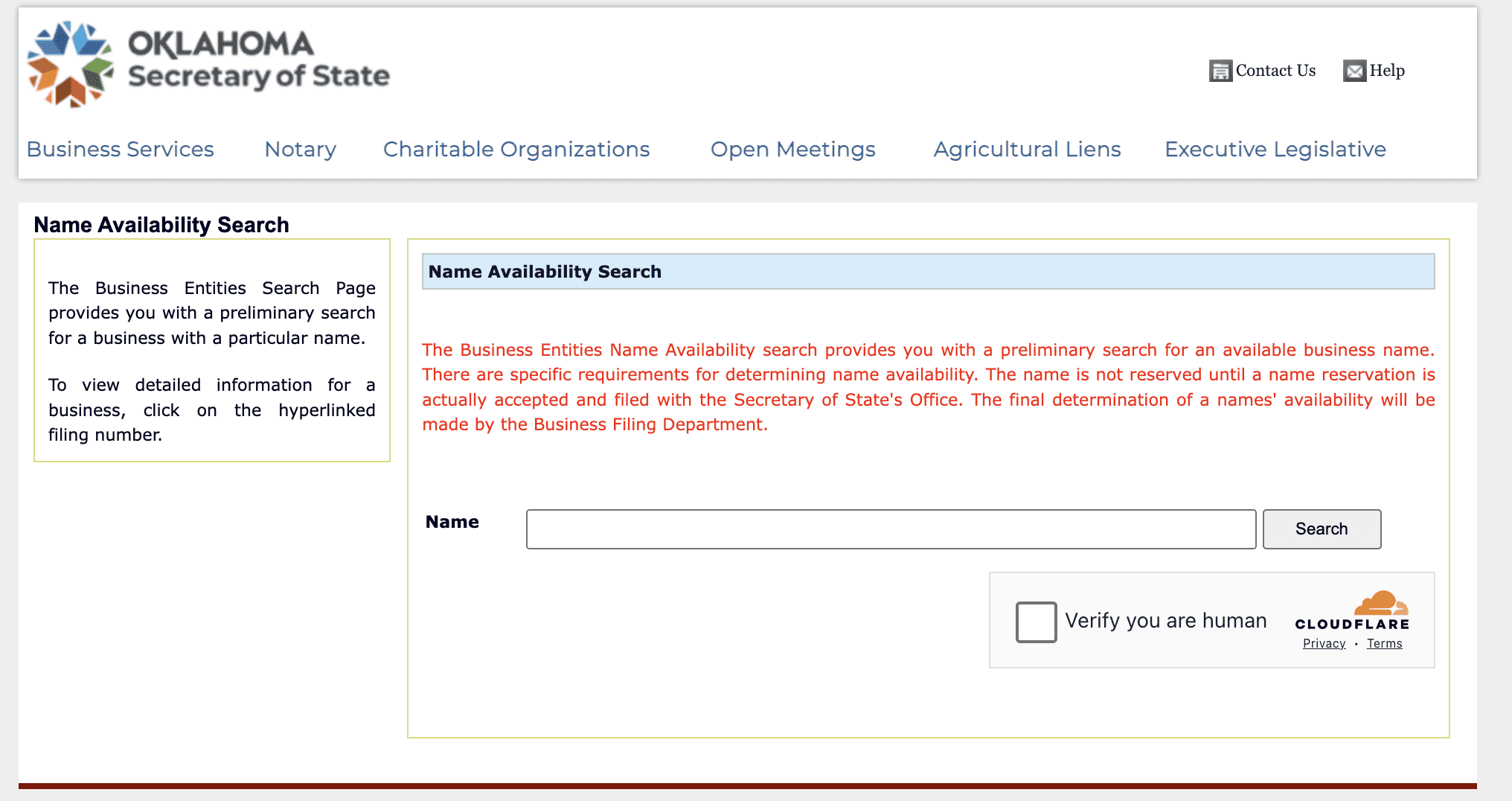

Once you’ve come up with a name, you can find out whether your chosen business name is available by using Oklahoma’s Secretary of State’s business entity name availability search tool:

Alternatively, you can call the Secretary of State's office to ask about name availability by phone at (405) 522-2520. Using this option also allows the office to confirm that your choice is sufficiently different from other registered business entity names.

Name Reservation (optional)

If you’re still preparing your company formation documents and sorting out other operational details, it’s worth reserving your selected LLC name. To get a name reservation in Oklahoma, submit a filing form and a $10 fee.

Filings are accepted online and by mail. Business name reservations are valid for 60 days.

Trade Name (optional)

If you plan to operate your business under a name different from your legal business name, or if have multiple brands under your LLC umbrella, it makes sense to file for a trade name with the state.

A trade name, also known as doing business as (DBA), showcases a connection between your business entity and the selected assumed name. The cost is $25 per name and you must fill in a submit a separate form. Filing for a trade name with Oklahoma serves a dual purpose:

- Prevents another business entity from using your LLC's name similar to a state trademark registration.

- Ensures good standing and compliance with the Secretary of State and prevents trademark issues with other Oklahoma registered businesses.

Step 2: Appoint a Registered Agent

All Oklahoma LLCs must have a registered agent to accept service of process of legal documents, such as in instances when the limited liability company is part of a lawsuit.

- Be an individual resident of OK, 18 years of age or older, or a qualifying business

- Have a street address in Oklahoma. P.O. boxes are not accepted

- Be available at the said physical address during regular business hours

You can be your own registered agent if you meet these requirements.

However, some LLC members choose to hire a registered agent service instead. It makes sense for out-of-state companies without a physical presence in OK. It may also be preferable for single-member LLCs operating from home addresses and keeping that address private from public records.

If you don't want to be your own registered agent, you can hire one for about $90-$249/year in Oklahoma.

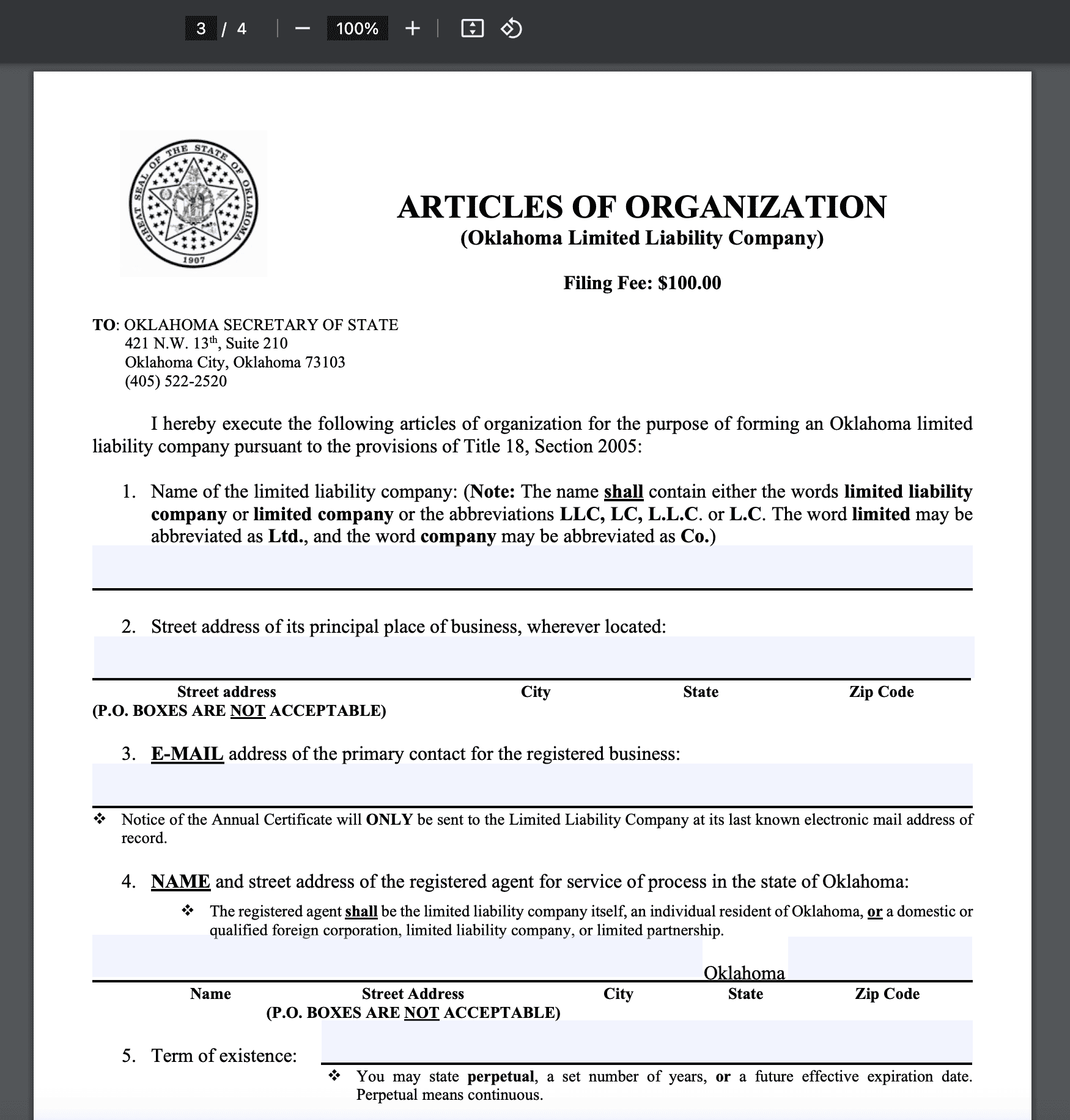

Step 3: File Oklahoma LLC Articles of Organization

To form an LLC in Oklahoma, you must file Articles of Organization for your LLC, either online or by mail, to the Oklahoma Secretary of State’s Oklahoma City office and pay a $100 state fee.

To file your Articles of Organization in Oklahoma by mail, send the completed form along with the $100 filing fee to:

Oklahoma Secretary of State

421 N.W. 13th Street,

Suite 210

Oklahoma City, OK 73103

This filing is the main requirement for company formation.

Oklahoma LLC Articles of Organization must contain certain information:

- Your LLC’s business name

- Street address of your LLC’s principal place of business (note that this cannot be a P.O. Box address)

- An e-mail address for your LLC’s primary person of contact (which is where annual registration documents will be sent)

- Name and street address for the LLC’s registered agent

- Term of existence for your registered business

- Signature of at least one person

For the most efficient processing, online filing is recommended.

Online filings for an Oklahoma LLC are typically processed within 1 to 2 business days, making it the fastest option. Mail filings take 5 to 7 business days, plus additional time for mailing. Be aware that Oklahoma does not offer expedited processing.

Foreign LLC in Oklahoma

If your Limited Liability Company (LLC) is organized in another U.S. state but expects to do business in Oklahoma, it should register with the Secretary of State as a foreign LLC.

There’s a separate registration form for foreign LLCs. The filing fee is $300. The form requirements are similar to domestic LLC formation. However, it also must include a Certificate of Good Standing from the Secretary of State’s office for the state that the LLC is organized. The certificate can’t be older than 60 days.

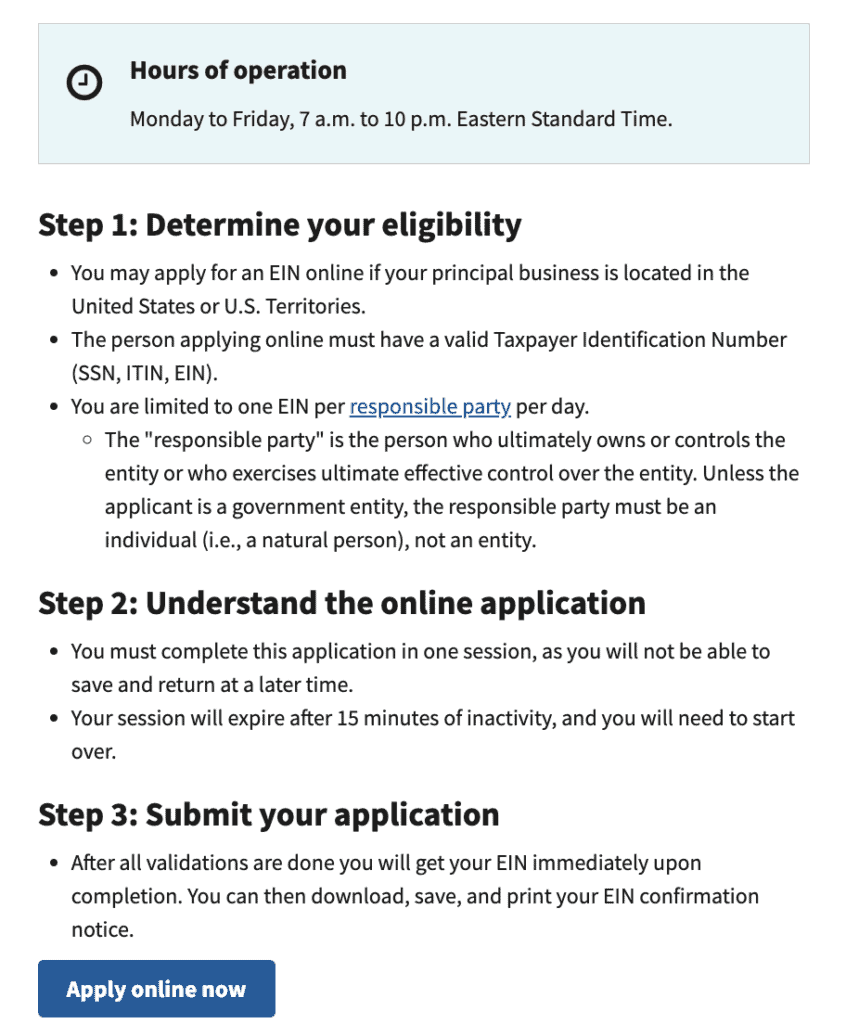

Step 4: Get an EIN (Employer Identification Number) from the IRS

Your Oklahoma LLC may require an employer identification number (EIN).

Even if a single-member LLC is taxed as a sole proprietorship, obtaining an EIN is advisable, especially if the LLC plans to hire employees, open a business bank account, or establish business credit.

EIN is a unique number associated with your business structure. The Internal Revenue Service (IRS) uses it to identify your LLC on federal tax returns and other tax filings.

To obtain your LLC’s EIN, you can apply online.

There is no cost to apply and your LLC will get its EIN immediately upon filing with the IRS once all information is verified. Single-member LLCs, filing federal taxes as a sole proprietorship, can skip this step. In some cases, however, having an EIN is mandatory:

- Any LLC or small business entity with employees must have a federal EIN.

- LLCs filing taxes as a corporation (C-corporation or S-corporation) or partner need an EIN.

- Companies in federally-regulated industries need an EIN.

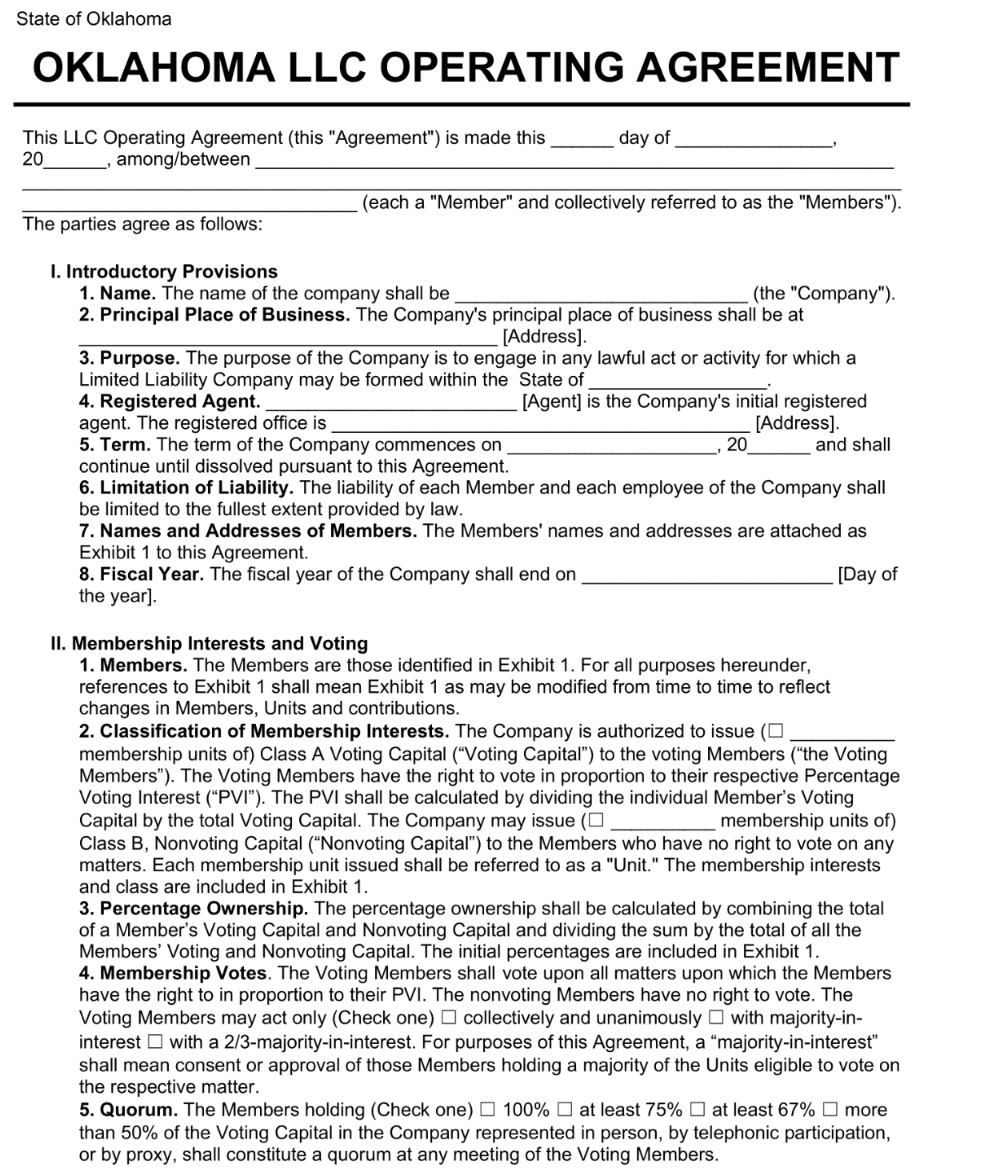

Step 5: Create an LLC Operating Agreement

While not legally required in Oklahoma, having an operating agreement is highly recommended, especially for multi-member LLCs or manager-managed LLCs. An operating agreement outlines the LLC's management structure and operating procedures, helping to prevent future disputes among members.

The Oklahoma Secretary of State does not require filing this document. However, it should be kept with internal records. Without an operating agreement, any possible disputes will be governed only by the Articles of Organization and Oklahoma laws.

Not having an operating agreement can complicate things, whereas having these details all laid out in writing ensures all members are on the same page. Not having an operating agreement may also increase the scope of your personal liability as your business owner.

To make an operating agreement, find an online template or seek help from an attorney or formation service.

Step 6: Open a Bank Account for the LLC

Opening a business bank account for your LLC is highly advised.

A bank account makes it easier to track your business income and expenses and separate them from personal ones. It helps with taxes, allocating profits, payroll, and determining business profitability. Also, it allows you to get business checks and credit cards. Most importantly, a separate business bank account prevents commingling business and personal assets, which can lead to legal issues.

Some banks require that your LLC have an EIN to open a business bank account. Others don’t. On average, monthly fees are $12 – $25, but some banks waive the fees if you keep a minimum balance. Your business bank account doesn’t have to be a local bank. You can choose a national bank but will likely need to set up an account with a local branch.

Total Costs to Set Up an LLC in Oklahoma

The minimum cost to start your Oklahoma LLC is $100 to file your Articles of Organization.

Here’s a summary of the costs of starting an LLC in Oklahoma:

- Filing your LLC Articles of Organization: $100

- Using a professional registered agent: $90 – $249/year (optional)

- Obtaining copies of approved Articles of Organization: $10+ (optional)

- Drafting an operating agreement: $0 – $1,000 (optional)

- Registering a DBA: $25 (optional)

- Reserving a business name: $10 (optional)

These costs can vary depending on your needs and whether you choose to handle everything yourself or seek professional assistance.