Starting an LLC in Missouri is an excellent step for new business owners. Deciding to start a business in Missouri sets you up in a business-friendly location. There’s low operating expenses, a central location, and a skilled workforce — everything needed to help emerging entrepreneurs thrive. Plus, it's one of the least expensive states to start your business.

Are you ready to take your business to a new level? Follow the steps to form an LLC in Missouri.

Steps Needed to Get an LLC in Missouri

- Step 1: Pick a name for your Missouri LLC

- Step 2: Choose a registered agent

- Step 3: File for articles of organization with Missouri Secretary of State

- Step 4: Create an Operating Agreement

- Step 5: Secure an EIN (Employer Identification Number) from the IRS

- Total Cost to Set up an LLC in Missouri

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Pick a name for your new LLC

Deciding on your LLC name is the first step. You’ll need to check if the Missouri LLC name you want is available. And your LLC name has to:

- Be different from existing business names

- Include Limited Liability Company or an abbreviation like LLC

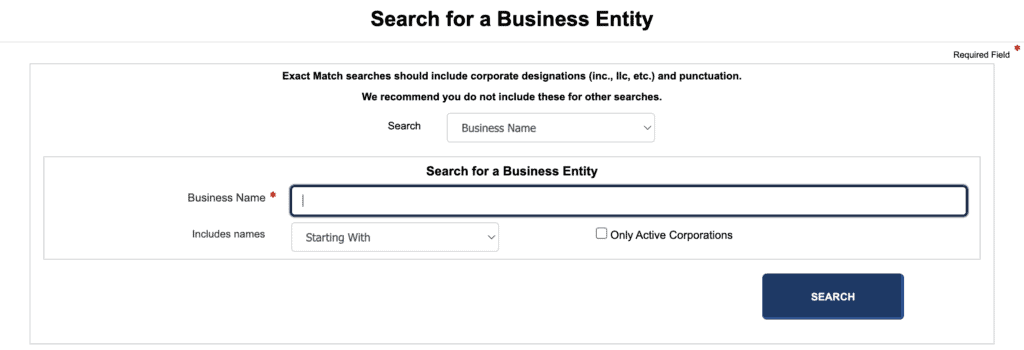

Use the Missouri State of Secretary (SOS) name search tool to see what’s already taken. With some creativity and a dash of luck, you can find an available name to use for your Missouri LLC.

An assumed name doesn’t have to be a fictitious name, “provided that the foreign corporation’s actual name shall be used together with its assumed name on documents filed with the Secretary of State. See Section 351.584, RSMo.”

Fictitious name (optional)

Domestic LLCs can run a Missouri business under a name other than its LLC name. This opens up a world of possibilities with different brands. But it keeps ownership under one LLC.

Some places call this a doing-business-as (DBA) or trade name. Missouri calls it a fictitious name. To use one, submit a filing and pay a $7 fee (valid for five years).

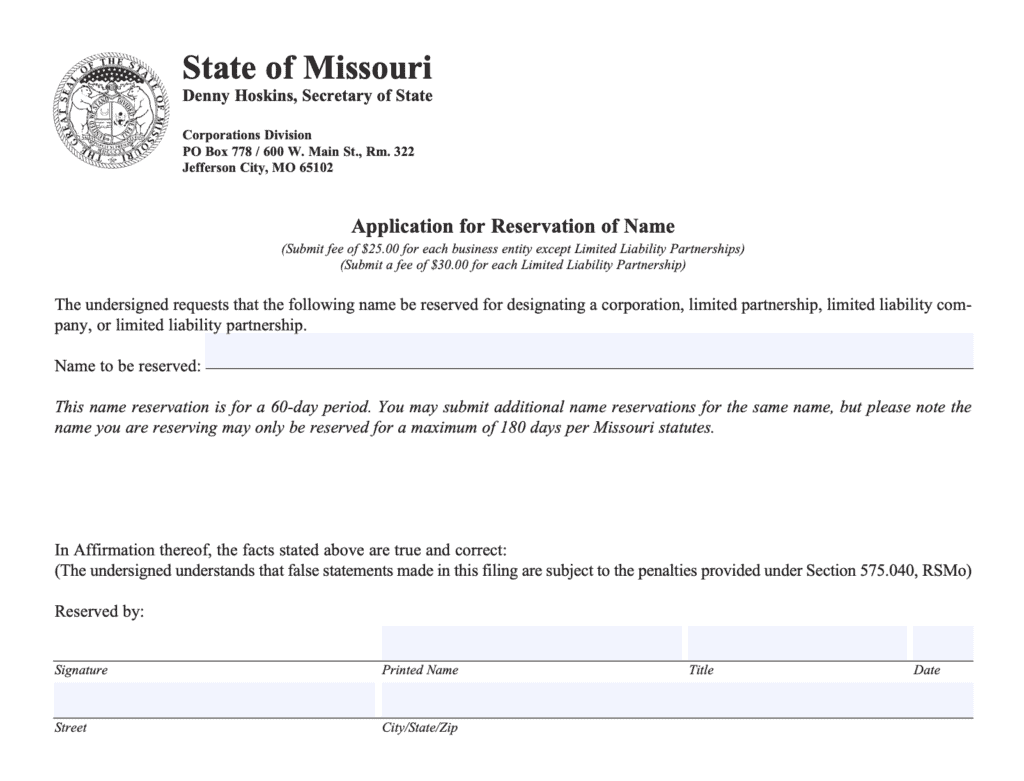

Reserve your LLC name (optional)

Filing a name reservation form holds the business name you want for 60 days. You can file online or through the mail. The filing fee is $25 for LLCs.

This lets potential owners reserve the LLC name while completing other documents.

You can reserve the business name for two extra 60-day periods, for 180 days total. If the reservation runs out, your LLC can still use that name if someone else doesn’t take it.

Step 2: Choose a registered agent

All Missouri LLCs must appoint a registered agent. The job of a registered agent is to receive official documents on behalf of the LLC. This includes legal notices related to lawsuits and other critical information.

All Missouri registered agents must:

- Be available during regular business hours

- Be a resident of Missouri or authorized to conduct business in Missouri

- Have a physical street address in the state

- Be capable of handling legal documents

Business entities can be Missouri registered agents if they meet the registered agent requirements. You can also be your own registered agent if you meet these requirements, or appoint a trusted friend or family member.

If you don't want to be your own registered agent, you can hire one for about $40-$125/year in Missouri. It’s helpful for foreign LLCs and LLC owners who don’t meet the state requirements.

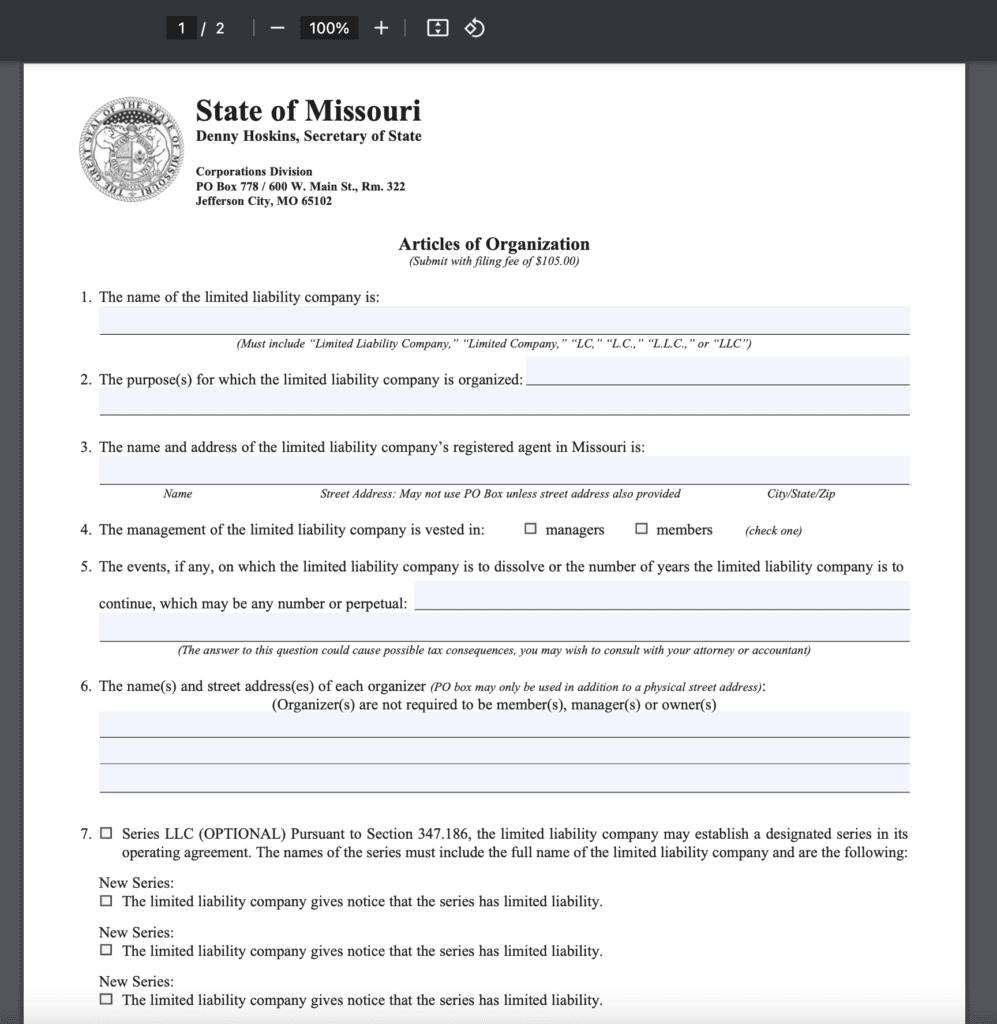

Step 3: File Articles of Organization with the State of Missouri

Filing the Articles of Organization is a major step in forming your Missouri LLC. This document converts your entrepreneurial vision into a legal business.

Once the Missouri SOS processes the articles of organization, you own an LLC. Foreign LLCs must also register to operate in the state.

Articles of organization costs are as follows:

- $105 if filed by paper (domestic/foreign)

- $50 if filed online (domestic)

Missouri doesn’t provide an official processing time, but online filings receive the fastest processing. Reports show that Missouri processes some LLCs in a matter of days (usually within 24 hours), others might take longer.

Submitting the filing

To register your LLC online in Missouri, use the Business Registration Online Portal. Mail paper filings to:

State of Missouri, Secretary of State

Corporations Division, P.O. Box 778

600 W. Main Street, Room 322

Jefferson City, MO 65102

Information to include

The articles of organization should include the following details:

- LLC’s business name, any assumed name, and principal address

- LLC’s purpose and duration

- Registered agent name and address

- Whether the LLC is member-managed or manager-managed

- Name(s) and address(es) of each LLC organizer

The foreign LLC application includes similar information, with a few extra items. It must list the principal address and jurisdiction where the LLC is organized. You’ll also need a certificate of good standing from that jurisdiction no more than 60 days old.

Once Missouri approves your LLC application, request a Certificate of LLC Registration. This only costs $10 (plus and is an important document that shows your business is real and in good standing.

Keep a copy with your business records. You may need it for things like opening a bank account or receiving loans.

Step 4: Create an Operating Agreement

Missouri statute requires all LLCs to have an operating agreement. However, it’s not filed with the Missouri SOS. It’s an internal contract between LLC members and managers.

- Roles and responsibilities of anyone participating in the LLC

- Tax treatment elections

- Membership interests and transferability

- Profit and loss allocations

- Rules for the conduct and operations of the LLC

- Voting rules and procedures

- Other operational matters

Savvy business owners use operating agreements to protect their interests.

They also help avoid disputes by specifying many details and procedures. It’s the first document a legal expert will turn to if things go south. You can find many free templates using a Google search.

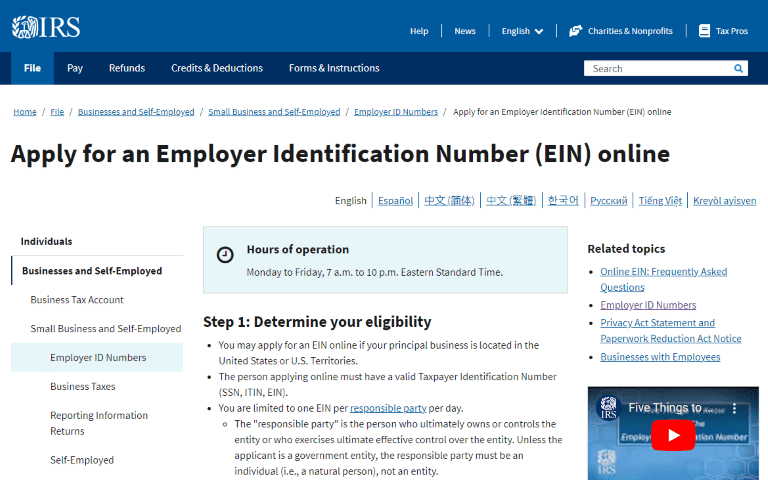

Step 5: Secure an EIN (Employer Identification Number) from the IRS

An Employer Identification Number (EIN) is a unique tax ID for a business. The Internal Revenue Service (IRS) uses EINs to track tax filings and information. Missouri may use it for certain state tax forms too.

Every multi-member LLC must get an EIN. But some single-member LLC owners can use their Social Security numbers.

If your LLC has any employees, you must have an EIN. Also, your LLC needs an EIN for sales/excise tax and certain retirement plans.

You can apply for an EIN online for free. Upon verification of submitted information, the IRS issues your LLC’s EIN right away.

Total Cost to Set Up an LLC in Missouri

Forming an LLC in Missouri is cost-effective.

The $50 fee to file the Articles of Organization online is the only mandatory cost. It jumps up to $105 for paper filings.

Other optional costs to starting an LLC in Missouri include

- Name reservaton: $25

- Fictitious name: $7

- Registered agent fees: $99 to $199/year

- Certified Copy: $10+

- Operating agreement: $0-$1,000+

The real cost savings come in the form of no annual filing fee, which adds up over time. This can cost up to $500 per year elsewhere.

Further Steps

It’s a good business practice to open a business bank account. It simplifies accounting and taxes. Also, business bank accounts usually provide extra protections beyond personal bank accounts.

Plus, mixing personal and business finances can put your LLC protections at risk. If your business gets sued, you might be personally liable.

Don’t forget to apply for any local business licenses or professional licenses your LLC needs. Many requirements occur at the city or county level. For example, all businesses in the city of St. Louis must get a business license.

Connecting with startup organizations can go a long way. The Missouri Small Business Development Center has specialists who can provide valuable advice. Joining the Missouri Chamber of Commerce and Industry gets you in front of local leaders.

It’s time to let your excitement fuel your ambitions. Take a decisive step forward by checking to see if your Missouri LLC name is available. Then keep up the momentum through each step on this guide to starting an LLC in Missouri.