Starting an LLC in Rhode Island is the first step toward owning a thriving business.

This straightforward guide walks you through the LLC formation process. After you finish these simple steps, you’ll have a solid business entity to serve as your foundation. LLCs combine an excellent tax structure with crucial legal protections.

Rhode Island is small but mighty. And it’s a great place to start a business. Between the fast processing times for legal documents and a streamlined online portal, you can kickstart your business venture in no time.

Are you ready to navigate into the waters of business ownership? Let’s go through the steps to form an LLC in Rhode Island.

Steps to Get an LLC in Rhode Island

- Step 1: Choose a Name for Your LLC

- Step 2: Appoint a Registered Agent

- Step 3: File the Articles of Organization

- Step 4: Create an Operating Agreement

- Step 5: Get an Employer Identification Number (EIN)

- Costs to Set Up an LLC in Rhode Island

- Last steps

Step 1: Choose a Name for Your LLC

The first step to starting an LLC is picking a name for your new company. Make sure that it meets Rhode Island LLC naming requirements.

Review Rhode Island LLC law to see what the state requires. The short version is that your LLC name must:

- Include Limited Liability Company, L.L.C., or LLC

- Be unique from existing businesses

Avoid using obscenities and anything misleading. And don’t include words related to regulated industries like medicine and law, unless you have authorization.

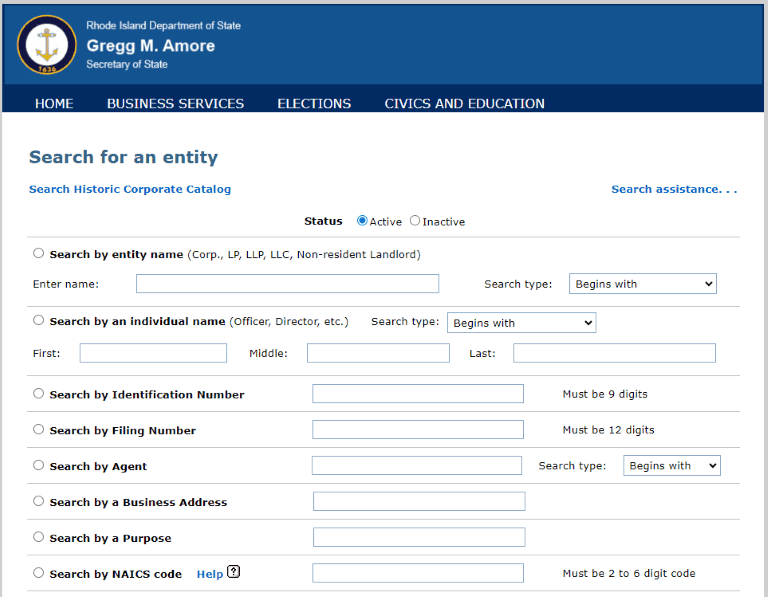

Rhode Island provides name availability guidelines to help you identify what is different and what isn’t when it comes to business names. Use the Rhode Island Secretary of State (SOS) Entity Search to see what’s taken.

LLC name reservation (optional)

Once you find the name you want, you can secure it for 120 days. This gives you more time to prepare the rest of your LLC formation documents knowing your LLC name will still be available.

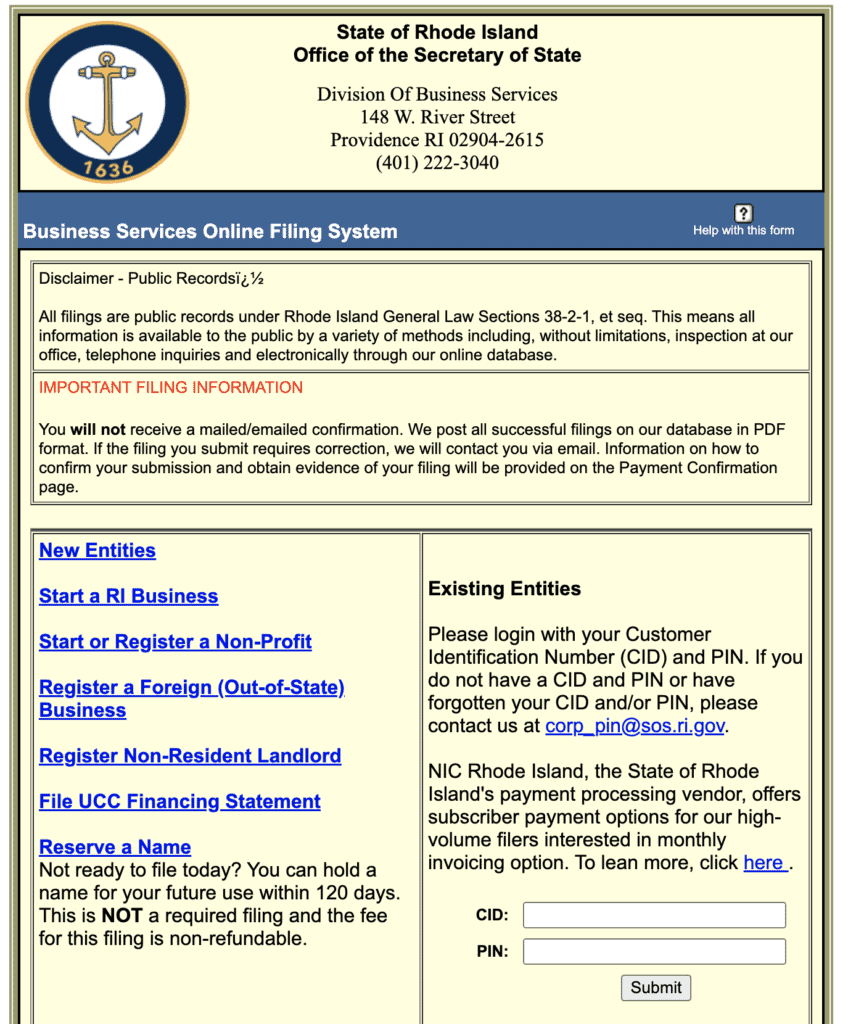

To do so, file the Application for Reservation of Entity Name. The easiest way is through the Business Services Online Filing System. You’ll probably want to bookmark that link as it is useful for many steps to forming a Rhode Island LLC.

There’s a $50 fee to reserve an LLC name in Rhode Island.

Register a fictitious name (optional)

Did you know that you can operate under a name that’s different from the LLC’s legal name? This is commonly called using a doing-business-as (DBA) or trade name. In Rhode Island, this is called using a fictitious name.

Fictitious names let you sell products or services with descriptive brand names. Or you can operate several businesses owned by one LLC.

The only catch is that you need to register your LLC fictitious name with Rhode Island. Use the online filing system or the Fictitious Business Name Statement form to handle this. There’s a $50 fee to register a fictitious name in Rhode Island.

Step 2: Appoint a Registered Agent

Your next task is identifying the registered agent for your LLC. Rhode Island calls this a resident agent. This is an official contact that receives important documents and notices. It can include legal service of process, tax documents, and other vital items.

Every Rhode Island LLC resident agent must:

- Be a Rhode Island resident or a company authorized to do business in the state

- Have a Rhode Island street address (not a P.O. Box)

- Be available during normal business hours

Many business owners serve as their own resident agent because it’s free. But it means that your address goes in the public record and you don’t have anyone to help fulfill your duties. Taking time off or traveling becomes challenging.

A popular alternative is to hire a resident agent or registered agent service. This maintains your privacy. And more important, it makes sure someone is around to receive your notices.

If you don't want to be your own registered agent, you can hire one for about $99-$199/year in Rhode Island.

If you form an LLC with Northwest, they'll give you a free registered agent for the first year. After that, it's $125 per year.

Step 3: File the Articles of Organization

The Articles of Organization is the document that outlines the basic information about your business. It’s what forms a Rhode Island LLC.

There are a few items that can be tricky to figure out. You should already have a name and resident agent. Once you figure out your federal tax situation and management structure, you’re ready to go.

The LLC Articles of Organization includes this information:

- LLC’s name and principal address

- Resident agent’s name and address

- Federal tax classification

- Whether the LLC is member-managed or manager-managed

- Manager name(s) and address(es), if any

- Effective date (up to 90 days from filing)

- Signature of an authorized person

- Contact information for the person filing

You can file your Articles of Organization online:

Or you can use this application to mail it in. Rhode Island is quick with standard processing and there’s no expedited service. You can plan on one to three business days turnaround time.

The fee to file your Rhode Island Articles of Organization is $150.

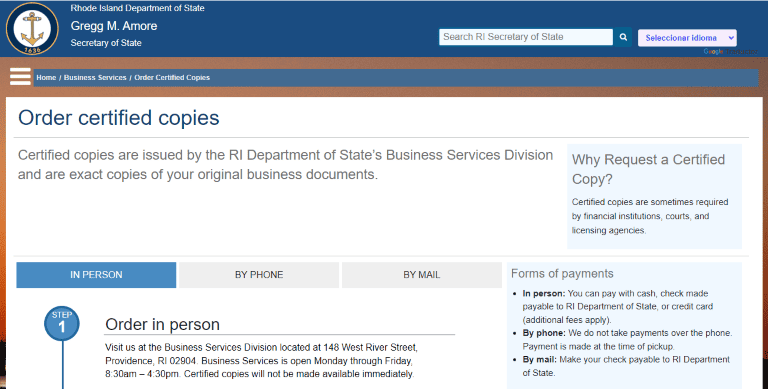

Once processed, request a certified copy of your Articles of Organization. This is important to keep with your LLC records. It’s proof that your entity exists and can be needed to open a bank account or work with certain parties, like investors.

There’s no official form, but the Secretary of State provides these instructions to order certified copies. The fee is $10 plus $0.15 per page for Rhode Island certified document orders.

Step 4: Create an Operating Agreement

An operating agreement for an LLC is like the backbone of the business structure. It’s a document tailored to outline the roles, responsibilities, and general blueprint of the LLC.

Rhode Island law does not require LLCs to have an operating agreement. You should still have one, especially if you have a multi-member LLC. It’s an internal contract between members that serves as a binding promise about how the business will run.

An LLC operating agreement lays out things like:

- Rights and duties of members and managers

- Ownership structure, percentages, and contributions

- Distribution of profits and losses

- Ways to add or remove members

- Other crucial details to running and managing an LLC

If you don’t have an operating agreement, Rhode Island LLC law steps in to resolve disputes. Instead of dealing with this uncertainty, use an operating agreement to customize how issues are resolved. It also helps to avoid conflict in the first place by making sure everything is clear.

Use a free or low-cost template to create your LLC operating agreement. Or hire an attorney to draft one for you.

Step 5: Get an Employer Identification Number (EIN)

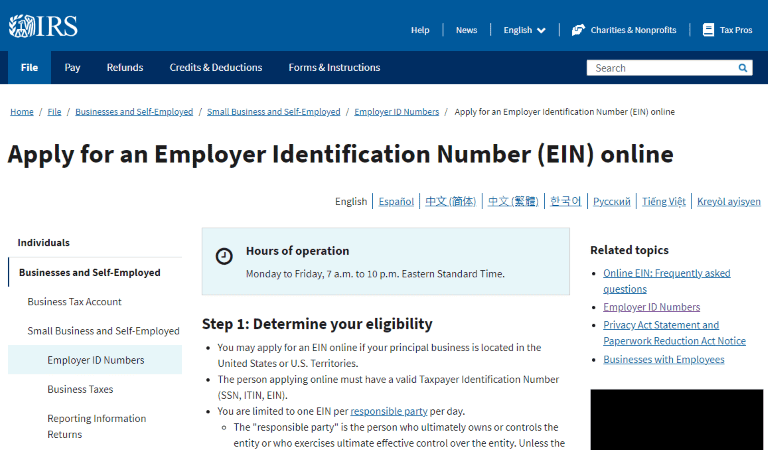

Up next is setting your LLC up for federal taxes by getting an Employer Identification Number (EIN). The Internal Revenue Service (IRS) uses EINs to track tax information. It’s like a Social Security number for businesses.

Any LLC with more than one member must get an EIN. It’s also mandatory if you hire employees, use certain retirement plans, or file particular tax returns.

Some single-member LLCs without employees don’t have to get an EIN. They can use the owner’s Social Security number instead. But you might need it for banking needs anyway.

Getting an EIN is free and quick. The IRS online application is the easiest way. Answer a few questions and the IRS issues your EIN in minutes.

Costs to Set Up an LLC in Rhode Island

At a minimum, it costs $150 to start an LLC in Rhode Island. That is the filing fee for the LLC Articles of Organization.

Other costs that may be part of your Rhode Island LLC formation include:

- $50 to reserve a name

- $50 to register a fictitious name

- $50 to $200 per year to hire a registered agent

- $10 plus $0.15 per page for certified documents

- $1,000 or more for an attorney-drafted operating agreement

Your Rhode Island LLC will also need to file an annual report. There is a $50 fee to do so. Make sure to check the filing period or you’ll face another $25 late fee.

Last Steps

Once you reach this point, you’re nearly ready to launch your business. Before you do, tackle these items to make sure you’re on solid footing.

Business bank account

Your LLC needs to have a business bank account. It’s critical to maintaining the LLC’s legal liability protection. If your LLC gets sued and you’ve mixed personal and business finances, your personal assets could be at risk. Having a dedicated bank account also helps with accounting and taxes.

Monthly fees can be waived if you meet certain minimums, but are usually no more than $25 per month otherwise. You’ll likely need proof your LLC exists, your EIN, and a photo ID.

Rhode Island taxes

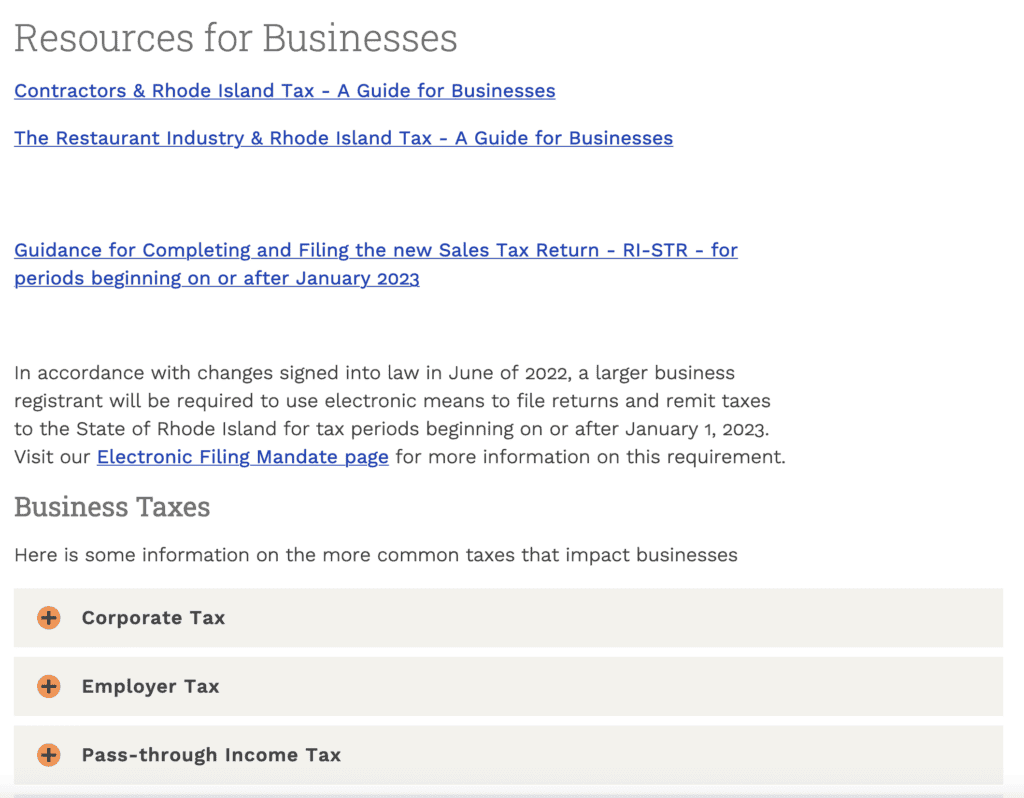

Besides your federal taxes, you’ll also need to take care of Rhode Island LLC tax needs. The RI Division of Taxation (DOT) Combined Online Registration Service is the place to go. You can handle most of your needs with one application.

For more information on what your LLC must get, check out the DOT’s Business Taxes page.

Licenses and permits

Many LLCs also need to cover their license and permit needs. These can come from state, city, and county authorities.

A good starting point is the Rhode Island Department of Business Regulation. They don’t force everyone to get a business license, but they do cover things like short-term rentals, food service, and insurance sales.

Next, turn to your city and county officials. For example, the City of Providence requires approval for liquor, food, or auto sales. Cranston has a list of city business licenses too. Check with your local municipality to see if your LLC needs any licenses or permits.

Building connections

Successful business owners have seen many of the hurdles you’ll encounter. You can discover valuable insight by connecting with local leaders through organizations like:

- Rhode Island Small Business Development Center

- Rhode Island Coalition of Entrepreneurs

- Entrepreneurship for All Rhode Island

- Greater Providence Chamber of Commerce