A Limited Liability Company (LLC) is a flexible business structure that attracts both large and small businesses.

It’s easy to set up, doesn’t cost as much to maintain as a corporation, and diminishes LLC members’ personal liability and asset exposure.

But how does it protect you or the members of an LLC? Let's take a look.

Limited liability company (LLC) protections: overview

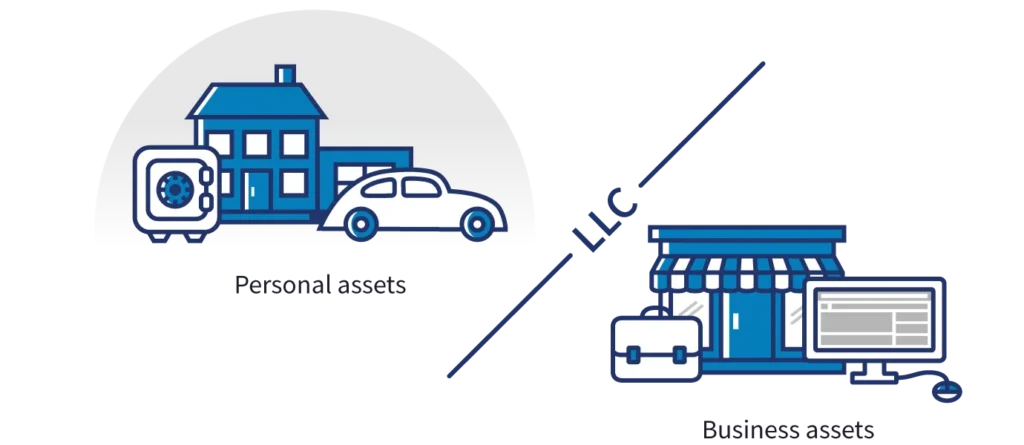

A limited liability company (LLC) is an incorporated legal entity, separate from the business owners (or LLC members).

As such, LLC is independent in its actions, finances, and liabilities from the people behind the company. Even if you’re the only owner operating as a single-member LLC.

So if anything wrong happens in your business — you get sued, get heavily indebted, or bankrupt — no one can go after you as a private person. LLC protections prevent owners’ personal assets from being seized to satisfy the company liabilities. Likewise, you can’t be held personally liable for corporate actions.

Yet, an LLC isn’t a universal screen against all sorts of mishaps. As we’ll further discuss, personal guarantees or wrongdoing by a member can limit LLC protections.

LLC protections include:

- Personal asset protection

- Personal liability protection

1. Personal asset protection

LLCs provide members with personal asset protection. It means your financial exposure is limited to your stake in the business, cash assets in business bank accounts, and any properties owned by an LLC.

Even if this money is not enough to cover the debt, creditors can’t go after your personal accounts, house, or other assets.

However, there are some instances when personal asset protection can be waived. That includes:

- Settling debt, personally guaranteed by a member

- Paying federal or state tax arrears, plus payroll taxes

- Compensation of damages resulting from the members' wrongdoing

Even with these exceptions, LLCs still offer exceptional personal liability protections.

Can personal creditors go after my LLC?

Only under certain circumstances and when they’ve exhausted other means of collecting the debt. Most state laws require personal creditors to first seek a charging order from a court, demanding the LLC to satisfy the debt(s) owed by the member.

They can also seek foreclosure of the LLC’s membership interest (the creditor will then own the member stake in the company). Or obtain a court order for LLC dissolution and collect the debt from LLC’s asset liquidation.

Can my LLC affect my personal credit?

Usually, the activities of an LLC shouldn’t affect personal credit. Because the two of you’re separate. However, if you sign a personal guarantee for a loan your LLC can’t pay back, you’ll be responsible for it. If you miss a payment or don’t pay it in full, then your personal credit score can go down.

2. Personal liability protection

Also, an LLC protects you against liabilities resulting from actions made by another LLC member, a company employee, or an appointed manager, acting on behalf of your business.

But an LLC doesn’t protect you (personally) against any wrongful and tort (bad) actions. Likewise, other LLC managers or members can be liable for criminal acts done by other members or employees if they knew or participated in the violation.

For example, you run a photography business as an LLC. During a wedding, one of your videographers drank a few glasses and then accidentally knocked a guest down the staircase. She ends up having an expensive surgery. The guest sues your LLC for employee negligence.

The ruling is in her favor, and your company now has to pay her medical bills and extra compensation.

Your company doesn’t have enough cash flow. But the creditors can’t go after the owners’ personal funds.

Now, here’s a different scenario — you were that drunk videographer. And your co-owner poured you those glasses and got drunk too. In that case, the court may allow creditors to go after the personal assets of the two of you.

Can the owner of an LLC be sued personally?

It depends. In most states, the owner of an LLC can’t be sued personally for the debts and obligations of the LLC unless they obtained a personal guarantee for the loan or debt of the LLC. LLC owners may also be personally sued if they committed wrongdoing and caused the liability.

When an LLC owner may be sued personally explained

An LLC owner can get personally sued when:

- Their personal actions lead to wrongdoing, negligence, or misconduct.

- They knew but didn’t act upon or participate in wrongdoing made by another member.

- They have provided a personal guarantee on a business loan but failed to meet the obligation.

The LLC operating agreement should lay out what other members should do in these cases.

How to strengthen your LLC protections

You can strengthen your LLC protections using several simple yet powerful practices.

1. Have an operating agreement in place

An LLC operating agreement is highly recommended for multi-member LLCs. It defines each member’s roles, obligations, capital contributions, distributions, and prohibited acts.

A member who commits prohibited actions will be held liable by other members and state laws. By adding clauses about impermissible actions and behaviours, other members can shield themselves from getting tangled in a mess created by a co-owner.

Seek professional legal advice from a corporate law firm to ensure fool-proof protection.

2. Avoid commingling personal and business finances

Unlike a sole proprietorship, an incorporated business entity like an LLC must keep the members’ personal finances separate from business funds and vice versa.

Commingling personal and business funds can lead to a situation called “piercing of the corporate veil”. Piercing of the corporate means that your business isn’t acting as a separate business entity but is rather an extension of the member(s). If a court can prove this, you’ll lose your personal limited liability protection.

An excellent way to keep business assets separate from personal assets is by opening a business bank account for your LLC.

3. Don’t make business claims in a personal capacity

For the same reasons, you should avoid making any business claims personally, i.e., agreeing to do a job as a private person rather than a company.

It means you should sign LLC contracts or other legal documents as a representative of your business or under the LLC name only. If, for some reason, the document doesn’t make it clear that you act as a company, add a disclaimer to clarify that.

4. Purchase business insurance

General liability insurance is common for LLCs. The type of business your company does can lead to unexpected liabilities and lawsuits.

Small Business Administration (SBA) also highlights other business insurance policies available to LLCs:

- Product liability insurance

- Professional liability insurance

- Commercial property insurance

- Home-based business insurance

- Business owner’s policy

If you’re unsure which insurance policy is best for you, speak with an insurance company.

5. Meet all tax obligations on time

LLCs must file taxes on two levels:

- Federal: LLCs can file as a sole proprietorship, partnership, s-corporation, or c-corporation.

- State: sales taxes, franchise taxes, members’ personal income taxes, etc.

Your LLC may also need to pay other local taxes such as business property taxes, state employment taxes, and others, depending on its location.

If your LLC fails to meet its tax obligations timely, there will be late fees, operational penalties, or legal action.

So be sure to pay taxes on time as members are held personally liable for tax arrears for personal tax returns.

6. File the annual report on time

Most states require LLCs to submit an annual report (plus pay any required state filing fees) to keep their company in good standing.

If an LLC fails this obligation, it may be subject to involuntary dissolution. Your LLC will cease to exist until all deficiencies are fixed. During this, the LLC protections are no longer available.

FAQs about LLC protections

Here are some frequently asked questions regarding LLC protections.