Starting an LLC in Pennsylvania might sound like a lot of paperwork, but it’s simpler than you think.

You’ll need to pick a business name, provide a registered office address, and file the Articles of Organization with the Pennsylvania Department of State, along with the required filing fees.

Next, you’ll apply for an EIN with the IRS, open a business bank account, and check if you need any licenses, permits, or industry-specific registrations.

While not mandatory for single-member LLCs, drafting an operating agreement is also a good idea.

It may feel like a long list at first, but don’t worry — you’ll get through it all and have your Pennsylvania LLC up and running in no time.

Ready to form your new LLC in Pennsylvania?

Steps to Create an LLC in Pennsylvania:

- Step 1: Pick a Name for Your Pennsylvania LLC

- Step 2: Choose a Business Address and Registered Agent

- Step 3: File the Pennsylvania Certificate of Organization and Docketing Statement

- Step 4: Get an EIN from the IRS

- Step 5: Draft an LLC Operating Agreement

- Costs to Set Up an LLC in Pennsylvania

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Pick a Name for Your Pennsylvania LLC

The first step in creating an LLC in Pennsylvania is choosing a business name.

When brainstorming a business name for your LLC, make sure that it’s distinct from other businesses registered with the Pennsylvania Department of State (DOS).

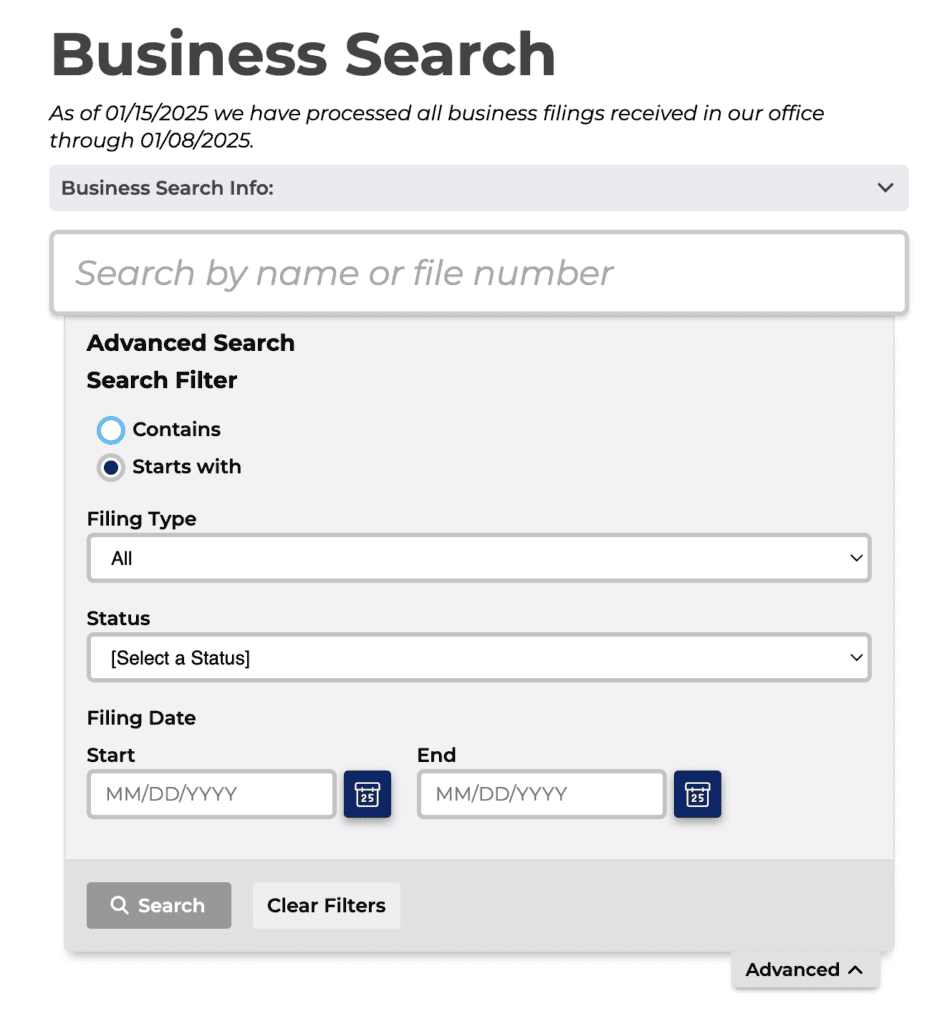

The easiest way to check for names is to run your list of ideas through a name search on the PA DOS website:

Remember that you must add one of the following designators to the end of your LLC business name:

- Limited Liability Company

- Limited

- Company

Or one of these abbreviations:

- LLC

- L.L.C.

- Ltd.

- Co.

Name Reservation (optional)

If you’re not planning to register an LLC immediately, it makes sense to reserve the selected name.

To do so, file a Name Registration form to DOS and secure your name for 120 days. The filing fee is $70.

Step 2: Choose a Business Address and Registered Agent

In Pennsylvania, you must designate a business address as the Registered Address for your LLC. This physical address must be a street address located in Pennsylvania where your company representative (or yourself) can be reached at any time.

All the process of service documents and other correspondence from the authorities will arrive at this address. Options for business owners include the main office of operations, a home address, or a commercial registered office provider.

Pennsylvania also requires a registered agent to be listed by name and physical address. This is where service of process, legal documents, and other business correspondence are sent.

You can appoint yourself as a registered agent.

However, Pennsylvania only requires new businesses to list the physical address of the registered office. It serves the same purpose as a registered agent. The difference is a person’s name is not required.

If you choose to have the registered office be your primary office location or a home office, you may not need to hire anyone.

If you don't want to be your own registered agent, you can hire one for about $49-$125/year in PA.

Step 3: File the Pennsylvania Certificate of Organization and Docketing Statement

Forming a Pennsylvania LLC requires filing two documents and getting approval from the Department of State.

These are the Certificate of Organization and a Docketing Statement. Both must be submitted and approved to officially establish your LLC.

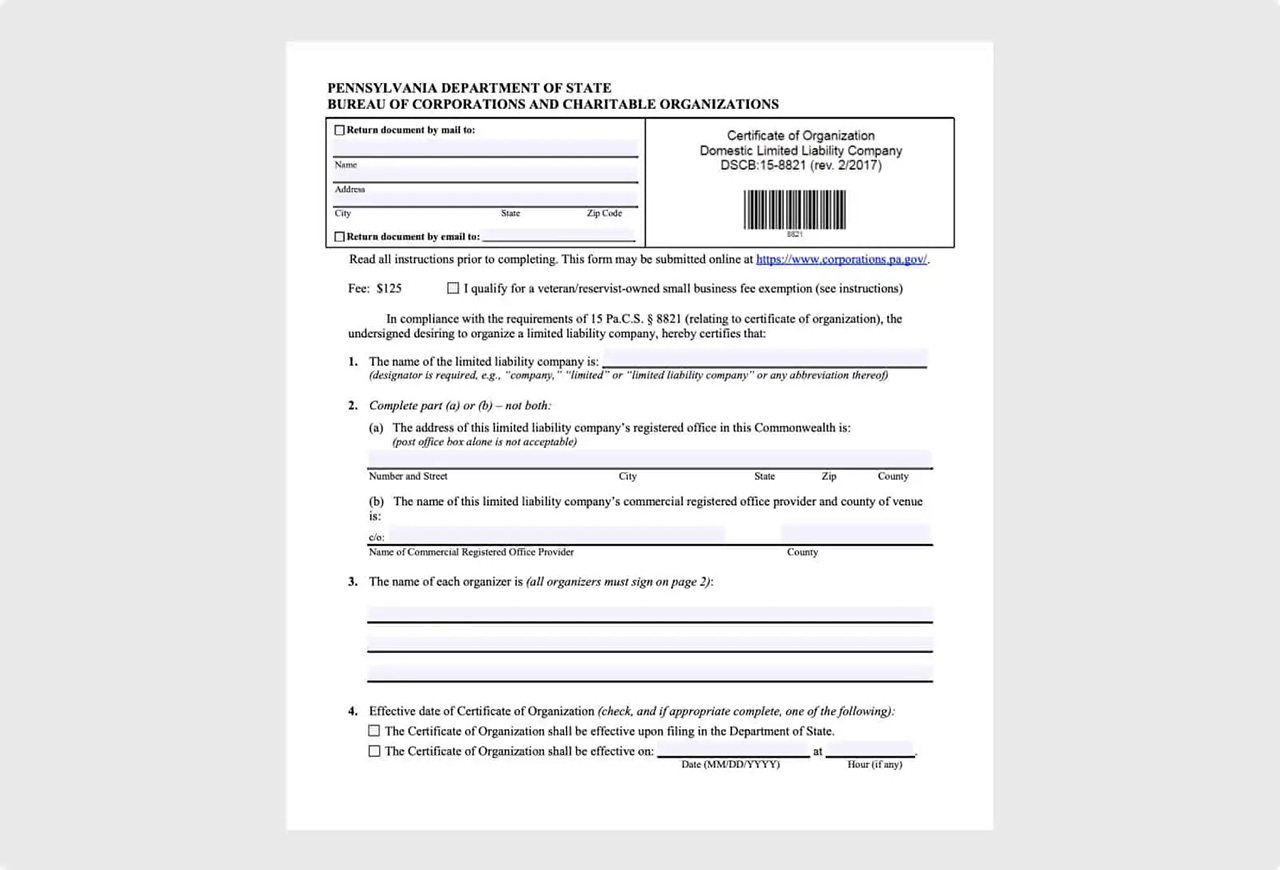

Certificate of Organization

The Certificate of Organization must include the following information:

- Your LLC’s business name

- The Registered Office Address or the name and address of the Commercial Registered Office Provider

- Names of the LLC’s organizers

- The Certificate's effective date

- Any restricted professional services information

- Information for LLCs organized as benefit companies

- Signatures of the members

Docketing Statement

The Docketing Statement must be attached to the Certificate of Organization. It must include:

- Your LLC’s entity name

- The responsible tax party

- A description of LLC’s business activity

- A federal Employer Identification Number (EIN)

- The LLC’s fiscal year

The Certificate of Organization Form and accompanying Docketing Statement can be filed online or sent by mail to the Pennsylvania Department of State. The mailing address is:

Pennsylvania Department of State

Bureau of Corporations and Charitable Organizations

P.O. Box 8722

Harrisburg, PA 17105-8722

The Certificate of Organization and Docketing Statement are processed in about 7-15 business days. The date is upon receipt by the Department of State.

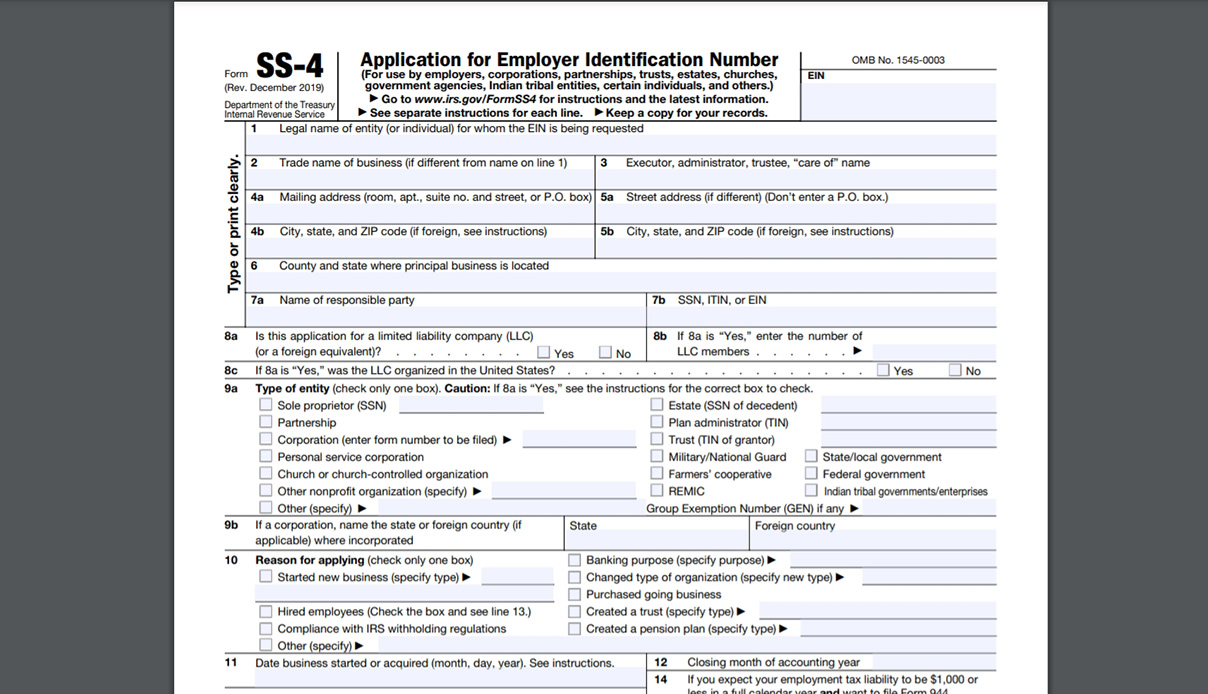

Step 4: Get an Employer Identification Number from the IRS

An Employer Identification Number (EIN) is needed for multi-member LLCs, a single-member LLC with any employees, or an LLC that elects to be treated as a corporation for tax purposes. To obtain an EIN for your LLC, file an application with the Internal Revenue Service (IRS).

Most business entities will need an EIN for identifying the business with federal income tax and state tax filings, employee tax forms, and opening a business bank account.

The IRS website has a questionnaire to help understand if your LLC may need an EIN.

Obtain an EIN

A Limited Liability Company (LLC) must submit a request through the IRS using a Form SS-4 to obtain an EIN.

The IRS offers this as a free service. The application can be made online, through the mail, via fax, or by phone. The telephone option is for international applicants.

Applications for an EIN that are filed online are processed immediately. Applications with a fax number usually receive a response in about four business days. The processing time for mail applications is about four weeks.

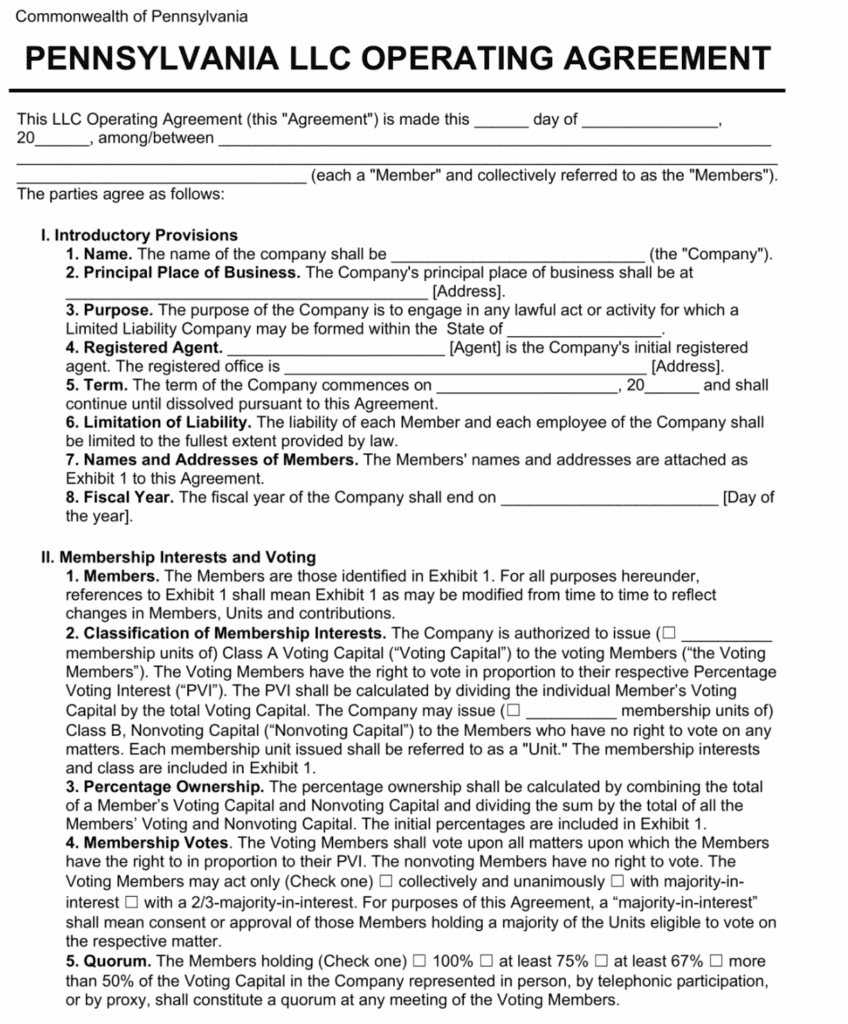

Step 5: Draft an LLC Operating Agreement

Pennsylvania law doesn’t require that a Pennsylvania LLC have an operating agreement.

However, it’s advised to have one. The operating agreement provides liability protection for the LLC and its members. It also defines the roles and obligations of the limited liability company's owners. It’s crucial when personal assets are invested in the business entity.

An operating agreement lays out the members’ roles, capital contributions, salaries, ownership percentage, and profit and loss sharing agreement.

Additionally, LLC operating agreements may include terms on liability, business taxes, and other general business operations.

One or more of your Pennsylvania LLC's members can prepare the LLC operating agreement. Since it’s an internal document, there is no filing fee cost. However, many new businesses may hire legal help to draft their limited liability company operating agreement. The fees for legal service will vary.

Costs to Set Up an LLC in Pennsylvania

Pennsylvania Bureau of Corporations and Charitable Organizations, a local equivalent of the Secretary of State, charges the following fees to form an LLC:

- $125 for a Certificate of Organization (Form DSCB:15-8821) for a domestic LLC.

- $250 for a Foreign Registration Statement (Form DSCB:15-412) for a foreign LLC.

You can file your LLC registration documents online or as a paper copy via mail. Regular processing times can take up to 15 days for paper-based submissions.

However, Pennsylvania offers expedited processing for all company formation documents submitted in person. The fees are as follows:

- $100 for same-day service. Only applicable to documents received before 10 am.

- $300 for 3-hour service. Only applicable to documents received before 2 pm.

- $1,000 for one-hour service. The papers must be submitted before 4 pm.

Cost Charts for LLC in Pennsylvania

| Annual costs for Pennsylvania LLC (1st year) | |

| Description | State fees |

| Certificate of Organization |

$125 or $250 |

|

Registered agent service (if needed) |

$49 – $125 annually |

|

Fictitious name registration (if needed) |

$70 |

| Name reservation (if needed) |

$70 |

|

Trademark registration (if desired) |

$50 |

| Specific permits or licenses (if needed) |

$20+ |

| Certified documents (if desired) |

$40 + $3 per page |

| Annual Costs for a Pennsylvania LLC (2nd year & after) | |

| Description | State fees |

|

Annual report for restricted professionals |

$610+ |

|

Registered agent service (if needed) |

$50 – $200 |

|

Change registered agent (if needed) |

$5 |

|

Specific permits or licenses (if needed) |

$20+ |

| Decennial report (every ten years) |

$70 |

Further Steps

Open a Business Bank Account

A Pennsylvania business bank account helps keep personal funds separate from business funds, which is required under PA law. The fees and timeline for getting a business bank account will depend upon the bank used.

Some banks will provide a fast turnaround time, especially if a member has strong credit or your LLC has raised a lot of capital. But some business owners may need to shop around.

The cost to maintain a bank account is minimal. On average, it may run about $15 a month. If loans or checks are required, then the fees will be more.

Obtain Business Insurance

The type of insurance your LLC may need will depend on the nature of your business. Some common types of business insurance include:

- General liability insurance to protect in lawsuits brought against your LLC

- Workers’ compensation insurance

- Professional liability insurance for LLCs providing professional services

Again, shop around and compare the terms, costs, and coverage among different providers.

Also, some business bank accounts come with discounted insurance plans.