Forming an LLC in Michigan is a straightforward way to establish a legal business structure with limited liability protection.

This guide outlines the steps, costs, and requirements for setting up an LLC in the state. Michigan provides a relatively simple registration process, reasonable filing fees, and ongoing compliance that's manageable for small business owners.

Whether you're starting a new venture or formalizing an existing one, this guide will help you navigate the process of starting your Michigan LLC.

LLC in Michigan: Step-by-Step

- Step 1: Choose a name for your LLC

- Step 2: Select a registered agent

- Step 3: File the Michigan LLC Articles of Organization

- Step 4: Create an LLC Operating Agreement

- Step 5: Acquire an EIN from the IRS

- Costs to set up an LLC in Michigan

- Further steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Choose a name for your LLC

First things first, your newly minted business needs a legal name.

Before you start printing business cards or advertisements, make sure the LLC name meets Michigan LLC name requirements.

Michigan authorities ask that your LLC’s name be different from existing businesses. It can’t sound too similar either.You want to choose something that avoids confusion. Otherwise, they may deny your registration.

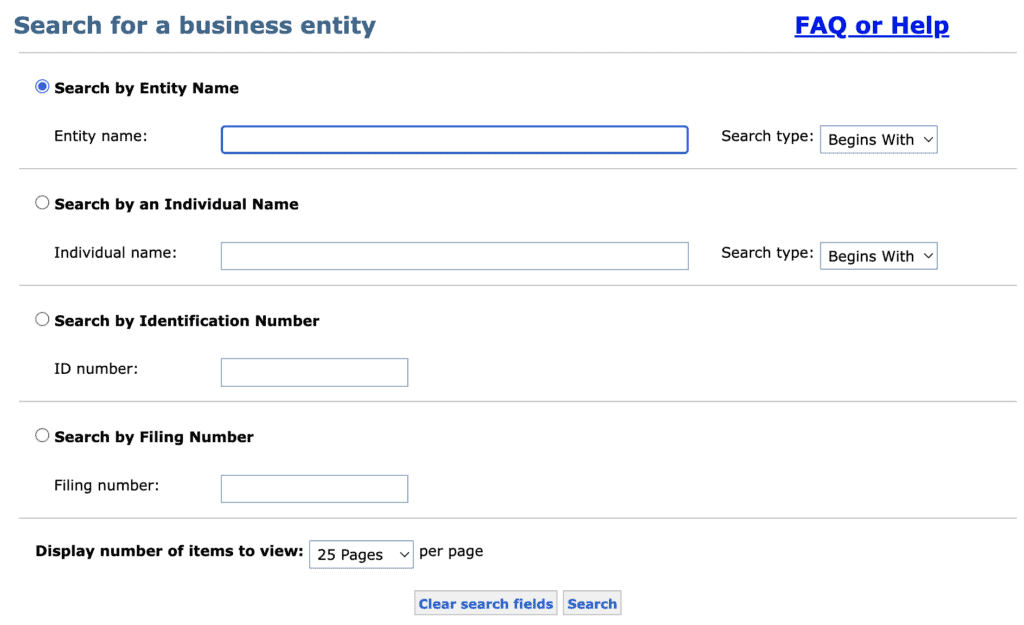

To see what’s already taken, use Michigan’s Business Entity Search feature:

Your MI LLC’s business name must also include one of the following:

- Limited Liability Company

- LLC

- L.C.

- LC

- L.L.C.

Reserve your LLC business name (optional)

If your preferred LLC name is available, you can file for a name reservation to claim it. Doing so holds it for six months.

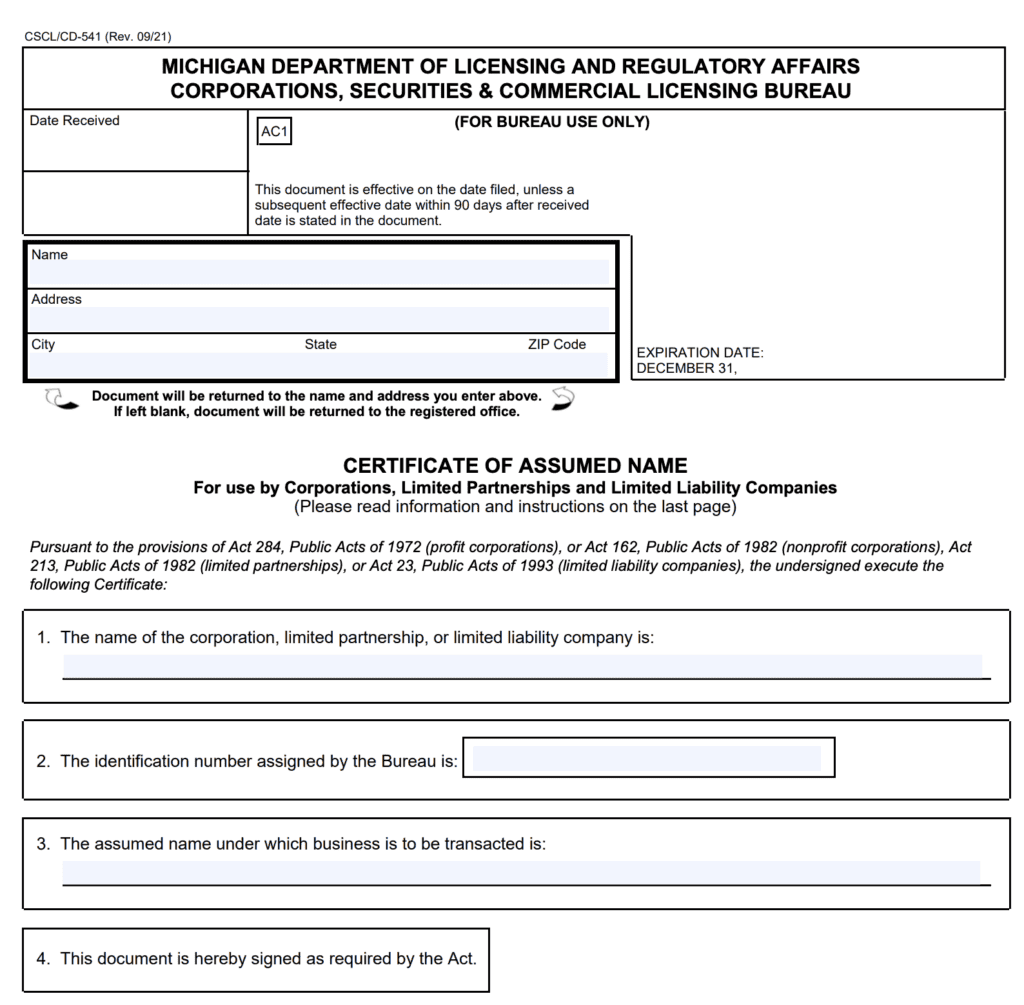

Assumed name (optional)

Some business owners choose a different name to operate under. Your Michigan LLC can have a legal name that’s different from the name used to sell products or services. You can even use multiple names for different product lines.

This is known as using an assumed name. Some places call it a fictitious name, doing-business-as (DBA) name, or trade name. They’re all the same thing.

To use one, register the assumed name with the Michigan Commercial Licensing Bureau with this form. You can file online or by mail. A $25 fee applies.

Step 2: Appoint a registered (resident) agent

All Michigan LLCs must have a registered agent (also known as resident agent in Michigan). This is the public contact for the LLC, with an office location listed in the Michigan business database.

The registered agent requirements are straightforward:

- A company or person 18 years of age or older

- Located in the state of Michigan

- At a physical street address (not a P.O. Box)

- Are available during regular business hours

Some LLC owners choose to act as their own registered agents. It's allowed as long as they are available at a physical street address in Michigan during business hours (9 AM to 5 PM). If you don’t want to serve as your own registered agent, you can hire one for approximately $49 to $299 per year in Michigan.

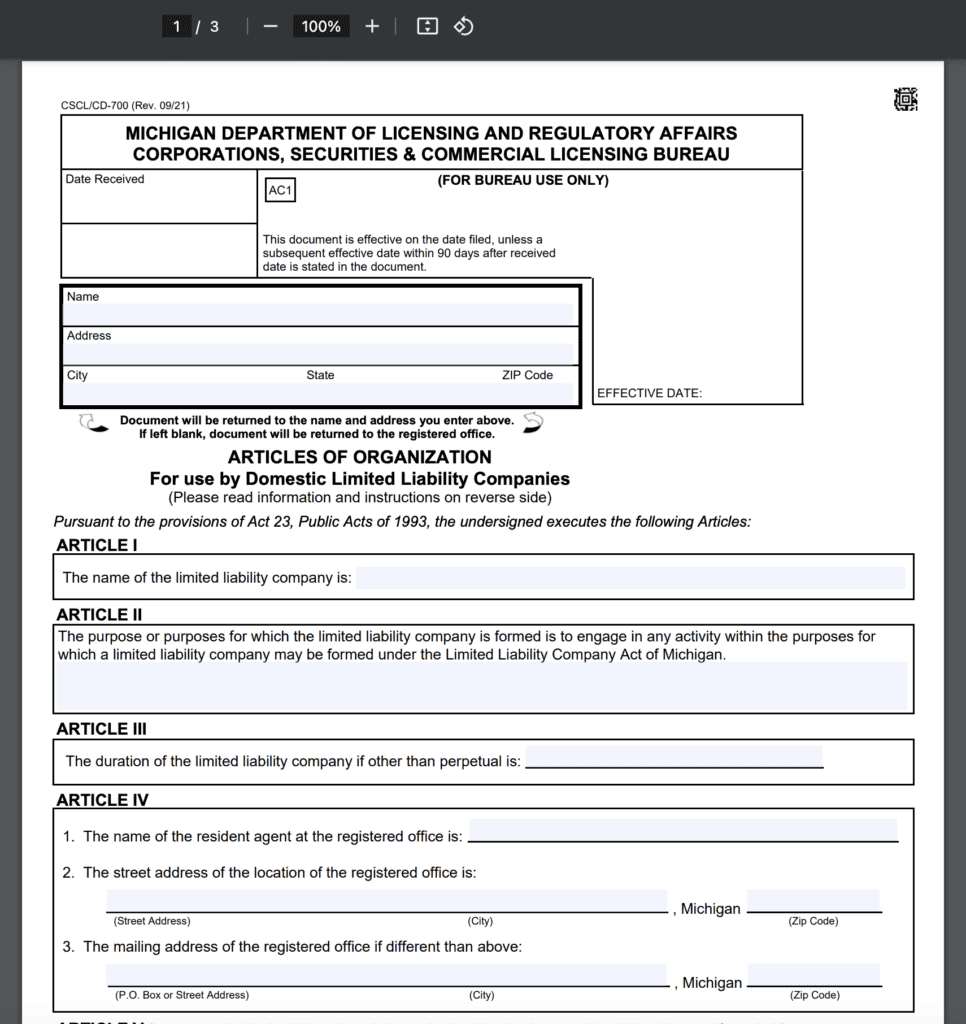

Step 3: File the Michigan LLC Articles of Organization

All of the steps in this guide to forming an LLC in Michigan are important. But this one is above all the rest. The Michigan LLC Articles of Organization filing is the cornerstone of your LLC. It takes your dreams and turns them into a legal entity.

You can submit an online form or mail it in. The standard filing fee is $50.

To complete the Articles of Organization for your Michigan LLC, you’ll need:

- The LLC name, purpose, and duration (if not perpetual)

- The professional services your LLC will provide (if applicable)

- Registered agent’s name and address

- Signature(s) and name(s) of the LLC’s organizers

Special considerations

Certain highly regulated industries have special rules. These mostly apply to LLCs that fall under Michigan Professional Licensing requirements.

If you are forming a professional LLC in Michigan, the following must be included in the Articles of Organization:

For all other LLCs that are not professional LLCs, Michigan clarifies: A limited liability company may be formed for any purpose for which a corporation can be formed under the Business Corporation Act or for which a partnership may be formed. An “all-purpose clause” is permitted.

Processing time

Once the Articles of Organization form is received, the processing time is about 5-10 business days. This can change depending on the current backlog and if any questions come up. Filing online is usually the fastest method.

If time is of the essence, Michigan offers expedited service:

- $100 — same-day processing (must be received by 1 pm)

- $500 — two-hour processing (file by 3 pm)

- $1,000 — one-hour processing (file by 4 pm)

Once your LLC is approved, obtaining a Certificate of Good Standing may be necessary for certain business activities, such as opening a business bank account or securing financing.

The fee for obtaining this certificate is $10 if ordered online, by mail, or over the phone, and $12 for in-person orders.

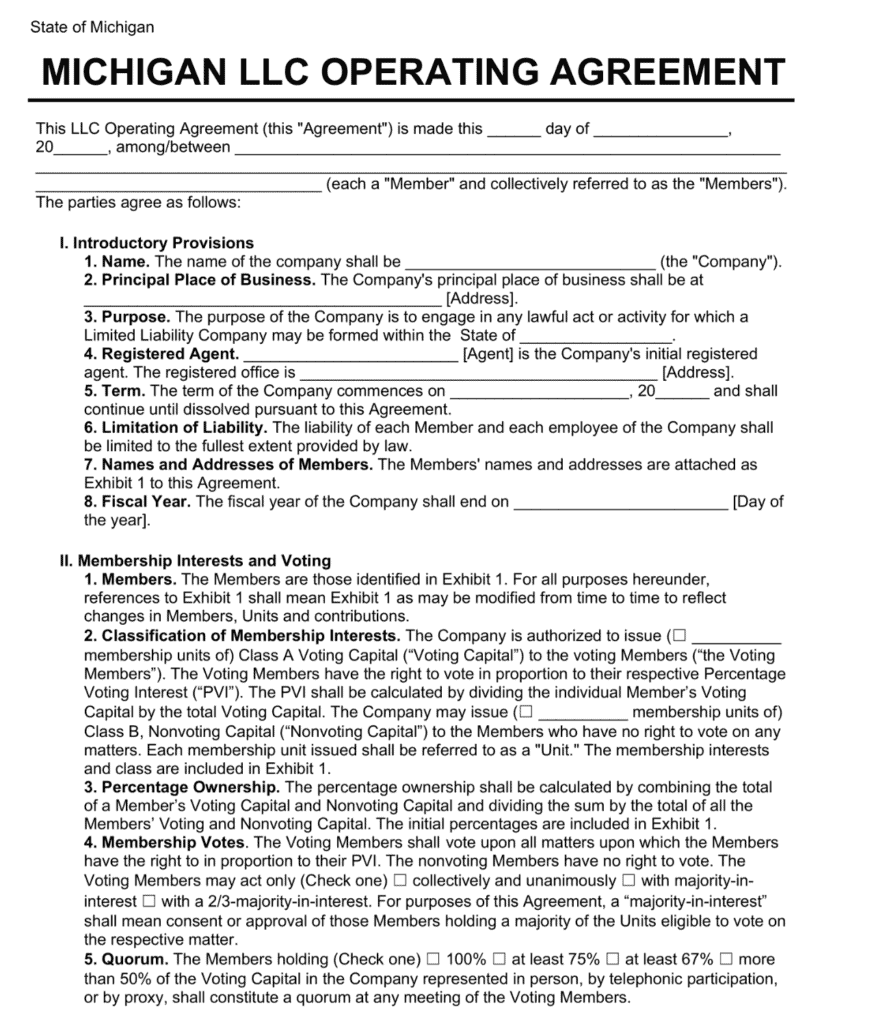

Step 4: Create an LLC operating agreement

Michigan law doesn’t require new LLCs to have or file an operating agreement. Yet, it still makes sense to draft one. And they are essential if your Michigan LLC has more than one member (owner).

An operating agreement lays out how your LLC handles many situations. Savvy business owners use them to protect their interests and ensure that everything runs as expected. It can also prevent conflicts by laying out clear expectations.

Operating agreements cover things like:

- Ownership share and contributions

- LLC’s standard operating procedures

- Member rights and roles

- Provisions on personal liability and personal assets

- LLC management practices

Plus, any other provisions as deemed necessary for your type of business and by the LLC’s members.

If an LLC doesn’t have an operating agreement, then Michigan state law will step in. This can result in surprising results that don’t align with your interests.

How to prepare an operating agreement?

There are many operating agreement templates available online. Grab one and customize it for your LLC’s needs.

If your LLC ownership is complicated, seek professional legal help for your operating agreement.

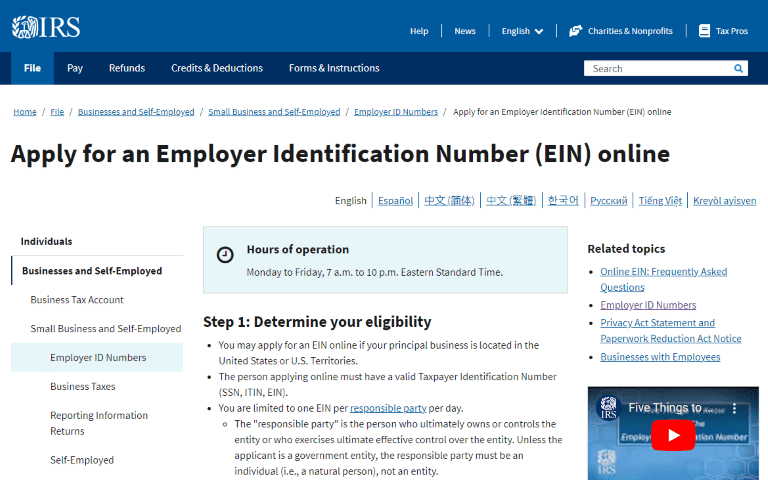

Step 5: Acquire an EIN from the IRS

The next step is to obtain an Employer Identification Number (EIN) from the IRS for your LLC. It is a unique 9-digit number used to identify your LLC on tax filings.

Your LLC must have an EIN if it:

- Has more than one owner

- Hires any employees

It’s also required to open a business bank account and pay state or local taxes.

Some single-member LLCs without any employees may use the owner's Social Security number. But many choose to get an EIN anyway. It’s also required if you use certain retirement plans.

Getting an EIN is simple and free. Use the IRS's free filing service to get your EIN in minutes.

Costs to set up an LLC in Michigan

Starting an LLC in Michigan is affordable compared to other states. The primary cost is the $50 fee for filing your articles of organization.

Optional costs to start an LLC in Michigan include:

- Reserving an LLC name ($25)

- Assumed name registration ($25)

- Third-party registered agent service (approximately $100/year)

Each Michigan LLC must submit an annual report. Costs range from $25 to $75, depending on the business's nature.

Further steps

Open a bank account

Setting up a business bank account for your LLC isn’t a Michigan requirement. But it’s a must-do to prevent any legal mishaps.

Your LLC assets must be separate from personal assets.

Why? Because combining these finances can result in a “piercing the corporate veil.” This means your personal assets can be at risk if your LLC gets sued.

Business permits and licenses

Business permits and licenses are required for LLCs based on the type of business. You need to comply with federal, state, county, and city requirements.

The U.S. Small Business Administration website lists useful information for different types of businesses. Agriculture, finance, healthcare, and law are common examples. Michigan has a list of business permits and licenses to help you navigate this need at the state level. LLC owners should also check with the local clerk’s office. They can help point you in the right direction.

Local resources and insurance

It’s normal for new LLCs to encounter all sorts of challenges. The difference between success and failure is how you handle these situations.

Rather than try to scratch your way through everything alone, learn from others. Connect with experienced entrepreneurs through the Michigan SBDC. There are many Michigan programs aimed at helping new businesses. One final consideration is getting insurance for your LLC. Workers’ compensation is essential if you hire employees. A general liability policy can help avoid many headaches.