Taxes are one of the biggest concerns for small business owners.

You may be worried about doing your IRS paperwork correctly and claiming all proper tax deductions.

A simple way to stave off the stress is to know when various business taxes are due. Then prepare your books in advance.

Here’s a list of important dates you need to know when filing and paying taxes for your small business.

Table of contents

- Federal tax deadlines for 2023: Essential due dates

- 2023 tax filing deadlines for sole proprietors

- How do I file a tax extension for 2023?

- 2023 tax filing deadlines for partnerships

- 2023 tax filing deadlines for S-corporations

- 2023 tax deadlines for employers

- Conclusion

- FAQs about tax deadlines and reporting

Federal tax deadlines for 2023: Essential due dates

Most taxpayers first think about the federal income tax return and Form 1040.

You must file your federal return with the IRS by the annual tax deadline (April 18, 2023). Or file Form 4868 for a 6-month extension of time to file your return.

In addition to filing your federal tax return, the IRS expects you to file and pay other estimated tax payments throughout the year.

The IRS runs an online tax calendar — a reporting schedule that divides a calendar year into quarters — indicating when various filings and payments are due.

Here are the main tax deadlines for 2023 for small business owners:

- January 17th, 2023: Estimated tax payment due for the previous year.

- January 31st, 2023: Businesses must issue Form 1099 to qualifying recipients.

- February 15th, 2023: Businesses must issue annual information statements (Forms 1099-B, 1099-S, and 1099-MISC) to recipients of certain payments.

- March 15th, 2023: Partnerships and S-corporations tax returns are due.

- April 18th, 2023: Tax day to file personal tax returns and pay any tax due.

- April 19th, 2023: Filing day for residents of Maine and Massachusetts.

- April 18th, 2023: Corporate income tax due date for corporations and payment of the first estimated tax installment.

- June 15th, 2023: Tax day to file personal tax returns for people based outside of the US.

- June 15th, 2023: Individual estimated tax payment installment for 2023.

- June 15th, 2023: Corporations must make the second installment of estimated income tax for 2023.

- September 15th, 2023: Estimated tax payment installment for 2023.

- September 15th, 2023: Due date for extended tax returns for partnerships and S-corps.

- September 15th, 2023: Corporations must make the third installment of estimated income tax for 2023.

- October 16th, 2023: Deadline for extended personal income tax return filing.

- October 16th, 2023: Deadline for extended corporation income tax return filing.

- December 15th, 2023: Corporations must make the fourth installment of estimated income tax for 2023.

2023 tax filing deadlines for sole proprietors

The following dates apply to single-member LLCs and unincorporated businesses that operate as sole proprietors.

Mark these dates to stay atop the filing deadlines throughout the calendar year.

January 17th, 2023: The last installment of estimated tax payments for 2022 is due on January 17th, 2023. If you made money in 2022 but didn’t make any payments throughout the year, you can make an estimated payment by this date without a penalty.

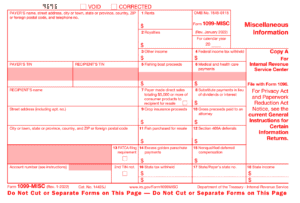

January 31st, 2023, and February 15th, 2023: Businesses have until January 31st to issue Form 1099s. These tax forms provide information about payments made to third parties throughout the tax year.

For example, independent contractors, freelancers, and self-employed individuals will receive Form 1099s from companies they worked for.

Taxpayers will also receive Form 1099s (Forms 1099-B, 1099-S, and 1099-MISC) for contests, prizes, or gambling winnings, royalties, interest, dividends, retirement plan distributions, and debt that was settled.

April 18th, 2023: Most people think of April 15th as the official tax filing deadline, but that date varies depending on holidays and weekends.

The tax filing deadline is also the day that your prior year's tax liability must be paid in full. Even if you file Form 4868 for an automatic extension to file your return for 6 months, you must still pay any tax due by April 18th to avoid a penalty for filing late.

The payment deadline for the first installment of the estimated taxes due for 2023 is April 18th.

April 19th, 2023: Residents of Washington DC, Maine, and Massachusetts have until April 19th, 2023, to file individual tax returns. These states recognize Emancipation Day on April 15th and Patriots’ Day on April 18, 2023.

June 15th, 2023: If you’re a U.S. citizen working abroad or enrolled in the military, your federal income tax return is due on June 15th. You can also file Form 4868 for an automatic extension, but you’ll get an extra four months to file instead of six.

June 15th, 2023, and September 15th, 2023: The second installment of estimated tax payments for 2023 is due on June 15th and September 15th for individual taxpayers.

October 16th, 2023: All individual taxpayers who filed automatic extensions have until today to file their tax return. This is also the last day to e-file your return with most tax software programs. Any tax returns filed after today must be mailed to the IRS until e-file reopens for the next tax filing season.

How do I file a tax extension for 2023?

Taxpayers who need additional time to file their tax returns can request an extension with the IRS.

To do so, you must file Form 4868 (Application for Automatic Extension of Time To File U.S. Individual Income Tax Return) by the tax filing deadline of April 18th.

Note that filing Form 4868 gives you an extension to file your return, not an extension to pay.

If you think you have a tax liability when filing for an extension, you must also pay the estimated tax due to avoid a late filing penalty.

2023 tax filing deadlines for partnerships

By default, the tax classification for multi-member LLCs is a partnership.

This means the partners must file Form 1065 for the legal entity in addition to Form 1040 for partners for their individual tax returns.

Like individuals, partnerships must make estimated tax payments, issue 1099s, plus consider a few other tax deadlines.

March 15th, 2023: Partnership income tax returns are due. The partnership must have a 2022 calendar year return on Form 1065, U.S. Return of Partnership Income. Each partner will get a Schedule K-1 detailing their share of the partnership’s profits, losses, and distributions.

September 15th, 2023: It’s common for partnerships to request extensions to file as they wait to get documents needed to fully report all business transactions.

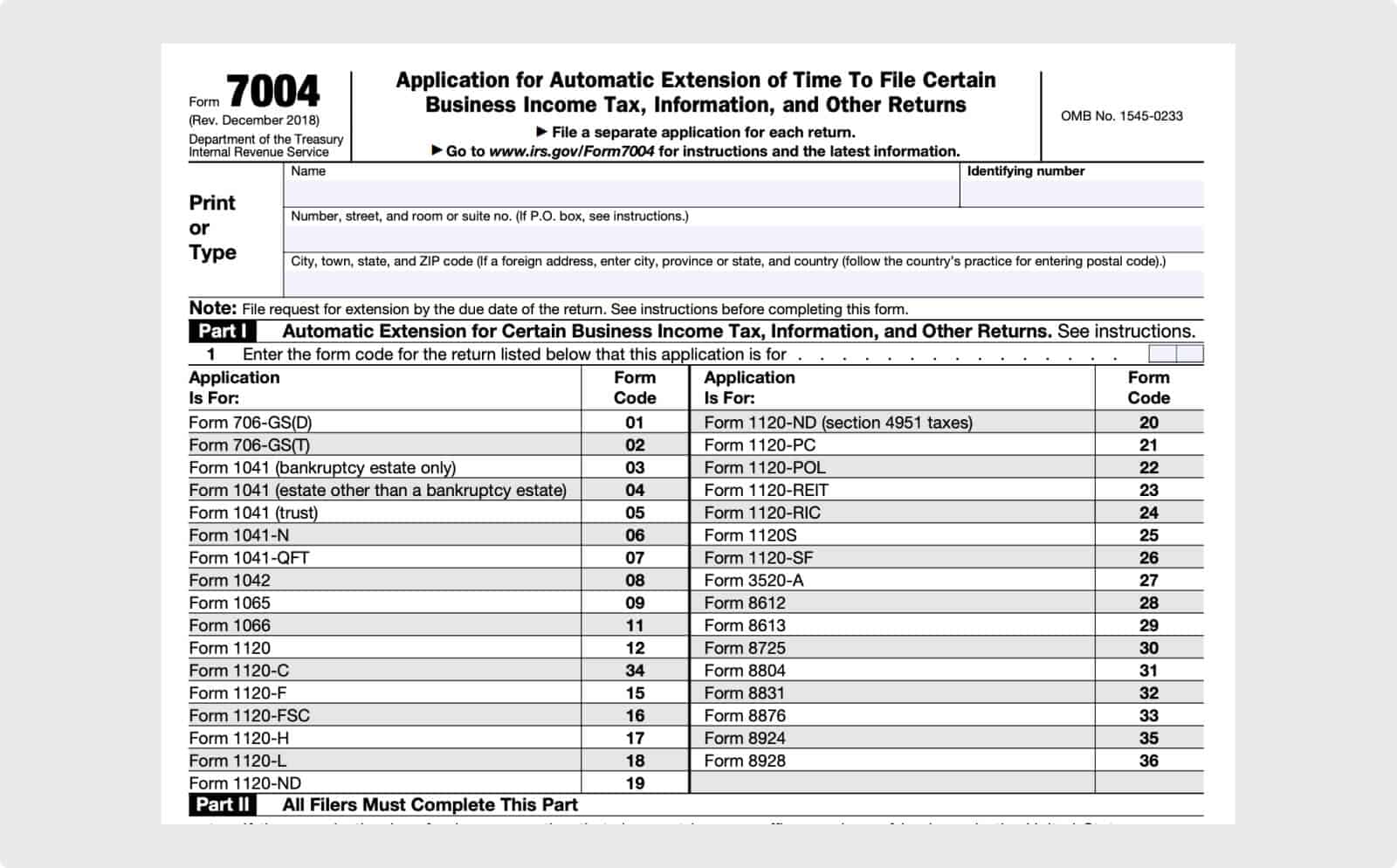

In this case, the partnership can file Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns with the IRS for a 6-month extension.

Partnership tax extensions impact partners as they’ll have to wait to receive their Schedule K-1s and may have to file an extension to file their individual tax returns.

2023 tax filing deadlines for S-corporations

S-corporations (S-corp) are domestic legal entities that elect to pass income, losses, deductions, and credits to shareholders.

LLC members often elect S-corporation status to save on self-employment taxes and avoid double taxation while still having personal liability protection.

The IRS must first accept your S-corp election before operating as such. You must submit Form 2553 to the IRS, and it must be a business decision that all shareholders agree on.

Then keep the following deadlines in mind:

January, 31st, 2023: Tax deadline to report all non-employee compensation to third parties that you paid more than $600 to in the current tax year.

March 15th, 2023: S-corporations must file income tax returns by March 15th and pay any tax due. Once filed, the entity must provide each shareholder with a copy of their Schedule K-1, Shareholder's Share of Income, Deductions, Credits, etc., so they can file their individual income tax returns.

Business owners have until March 15th to elect S-corporation status for 2023. If your Form 2553 is filed after this date, your S-corp status will be effective for the calendar year 2024 (if accepted by the IRS).

September 15th, 2023: Extended deadline for S-corp income tax returns.

S-corporations can request a 6-month extension to file the income tax return (Form 7004) with the IRS for a 6-month extension. Partnership tax extensions impact partners as they’ll have to wait to receive their Schedule K-1s and may have to file an extension to file their individual tax returns.

2023 tax deadlines for employers

If your small business has employees, you’ll have to pay taxes to both the IRS and state tax agencies.

These include payroll taxes withheld from employees' paychecks, your employer's share of Medicare and Social Security (or FICA) taxes, and Federal Unemployment (FUTA) tax.

January 3rd, 2023: Payment of deferred social security taxes from 2020. If you deferred paying your employer share of social security tax, 50% of the deferred amount is due, and the remaining 50% is due one year from this date on January 3rd, 2024.

January 31, 2023: You must process and send your employees their W-2s by January 31st – either via mail or electronically. Employers must also report the value of health insurance coverage in box 12 on the W-2.

January 31, 2023: As an employer, you'll have to file Form W-3, Transmittal of Wage and Tax Statements, which summarizes all of the W-2s you've issued for the year.

January 31st is a busy day for taxes!

Other forms and reports due by January 31st include:

- Form 945 to report taxes withheld on-payroll taxes

- Non-employee compensation on Form 1099-NEC

- Form W-2G for lottery & gambling winners

- Form 941 to report a fourth-quarter of 2022 for Social Security, Medicare, and income tax withheld

- Form 940 to report annual federal unemployment tax

Conclusion

The first step in complying with federal, state, and local tax laws is to know what’s due and when.

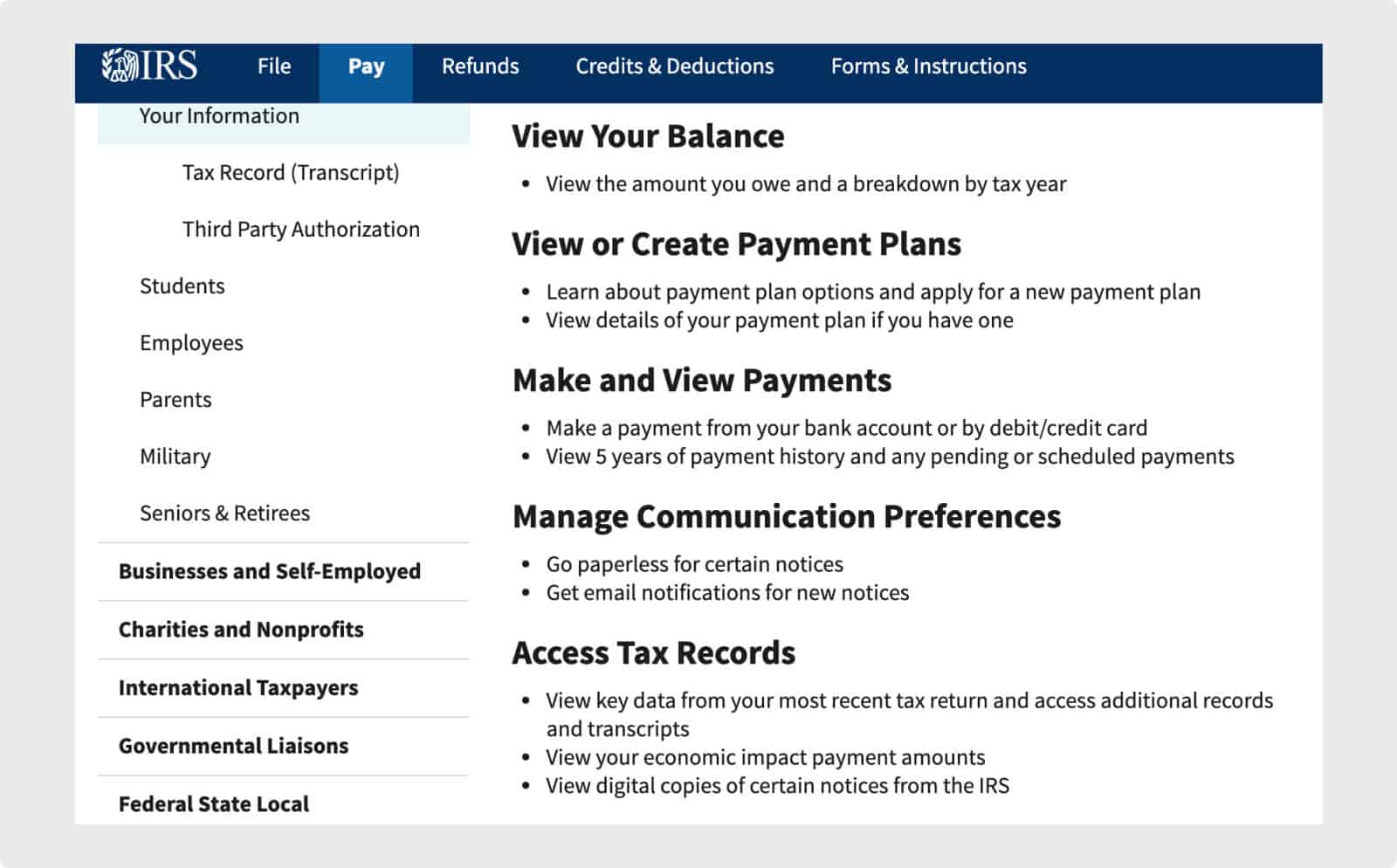

IRS.gov website provides ample taxpayer resources. You can also log in to your account to view notifications and reminders. Make sure you have up-to-date bank account details registered so that you are billed correctly.

Also, popular accounting apps for small businesses will remind you about compliance. You can configure a mobile app to send you reminders in advance.

If keeping up with all of the tax deadlines is overwhelming for you as a business owner, consult with an accountant or tax professional to help you navigate your tax situation to avoid extra fines and penalties.

FAQs about tax deadlines and reporting

Here are answers to several frequently asked questions about federal tax deadlines.