A limited liability company (LLC) versus an S-corporation — the choice may not seem immediately obvious for small business owners and budding entrepreneurs. Because the difference between these two types of business entities is subtle but highly important.

So let’s clear up the confusion.

An LLC is a type of legal entity, whereas S-corporation status is a type of tax classification. The proper legal entity name is “corporation” (Inc). An LLC is a matter of state law governing business entities, and an S-corporation is a matter of federal tax law.

Generally, whether or not your business is taxed as an S-corporation for federal taxes has no impact on how your state views your company.

Your company’s underlying legal business structure doesn’t change when you choose to be taxed as an S-corporation.

What is an LLC?

An LLC is a way to structure your business to protect your personal assets while limiting your personal liability. That means if your business falls into legal or financial difficulties, only the business’s assets are at stake. Your personal assets are off-limits.

LLCs can have an unlimited number of owners who are called members. Since LLCs are considered pass-through entities by the Internal Revenue Service (IRS), all company profits are passed along to members and taxed on individual Form 1040. The LLC pays no corporate income tax.

If you don’t make a choice on how your LLC is taxed, and there’s no requirement that you do so, the IRS applies its default tax rules.

|

Default taxation of LLCs |

|

|

Number of owners |

Taxation method |

|

1 |

Sole-proprietor |

| 2+ |

Partnership |

Forming an LLC might make sense if:

- Your new business is currently structured as a sole proprietorship or partnership

- Your business doesn’t plan to seek outside investors in the future

What is an S-corporation?

An S-corporation is a tax classification. It’s not a type of business per se. Any LLC or corporation can choose to be taxed as an S-corporation, or S-corp for short.

The “S” refers to Subchapter S of Chapter 1 of the Internal Revenue Code. The “S” is also commonly referred to as “small,” as in, an S-corporation is a small corporation because an S-corporation is limited to no more than 100 owners — unlike LLCs, which can have unlimited owners.

LLC vs. S-corps: key differences explained

There are two key differences between LLCs and S-corps.

- Taxation

- Ownership structure

These also dictate the costs of maintaining an LLC vs. an S-corp.

|

Entity type |

Ownership | Taxation |

Ongoing costs |

|

LLC |

|

|

|

|

S-corps |

|

|

|

1. Taxation

Tax benefits are the most common reason why companies choose one option over another. There are several taxes to consider.

Business income taxes

Both LLCs and S-corps are types of pass-through entities. That means income tax isn’t paid at the company level. Instead, it’s taxed on the owners’ tax returns.

Most LLCs members are only required to report their company income on personal tax return forms.

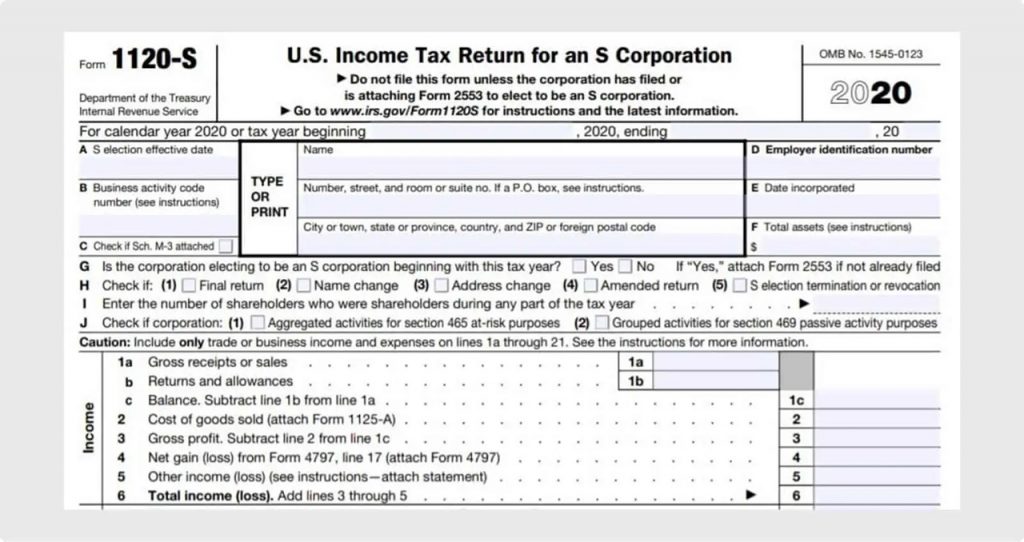

But the S-corp will be required to file a corporate tax return on Form 1120-S, U.S. Income Tax Return for an S Corporation. But no corporate income tax will be due. Think of this as an informational return.

Payroll taxes

LLC members are self-employed for tax purposes. That means they can’t be paid a salary or collect a paycheck.

S-corp shareholders aren’t self-employed for tax purposes. Instead, they are considered employees of the corporation and therefore can be paid a salary. In fact, it’s a requirement that S-corp shareholders collect reasonable compensation.

Reasonable compensation is an IRS term to describe the amount of salary a shareholder must be paid despite the company income. Although there are no specific guidelines, rules, or formulas for calculating reasonable compensation, some factors the IRS considers when determining what’s reasonable are:

- Training and experience

- Duties and responsibilities

- Time and effort put into the business

- Payments to non-shareholders

- What comparable companies pay for similar services

Because S-corp shareholders must be paid wages, the company will incur payroll taxes. These employer-paid payroll taxes include:

- 7.65% for FICA (Medicare tax and Social Security tax)

- Up to 6% for federal unemployment tax

- State unemployment tax, rates vary between states

Self-employment taxes

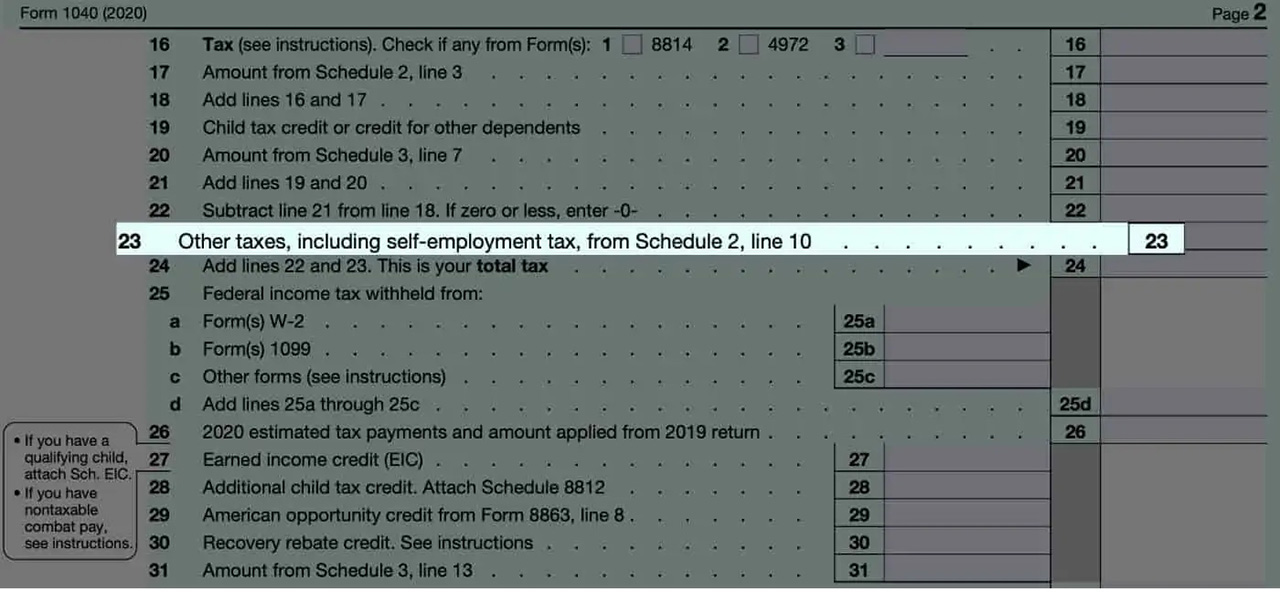

As we mentioned earlier, LLC members are considered self-employed for federal tax purposes, making them responsible for paying the 15.3% self-employment tax on all of the company’s profits. The self-employment tax is paid on line 23 of the member’s Form 1040, U.S. Individual Income Tax Return.

S-corporation shareholders aren’t self-employed and therefore aren’t subject to the self-employment tax.

Personal income taxes

Both LLC members and S-corp shareholders will pay personal income taxes on the company’s profits. And depending on your state, state personal income tax return may be due.

Who pays more taxes LLC or S-corp?

In general, S-corp shareholders will pay less tax than LLC members since they aren’t subject to the 15.3% self-employment tax.

Let’s look at a basic example to illustrate this and assume:

- Each company has $120,000 in taxable income.

- S-corp shareholder is paid a $48,000 annual salary.

- The individual tax rate for federal and state personal income taxes is 20%.

| Example illustrating the difference between LLC vs. S-corp | ||

|

LLC member |

S-corp shareholder |

|

|

Company profit |

$120,000 | $120,000 |

|

Self-employment tax |

15.3% * $120,000 = $18,360 | $0 |

| Personal income tax | 20% * $120,000 = $24,000 |

20% * $120,000 = $24,000 |

|

Payroll taxes |

$0 |

15.3% * $48,000 = $7,344 |

|

Total tax |

$42,360 |

$31,344 |

| Savings |

$11,016 |

|

2. Liability

An LLC provides its member(s) with personal asset protection and limited liability. In essence, an LLC acts as an added “shield” between yourself and your business. If the company has legal or financial difficulties, creditors will only have access to the business assets. Assets belonging to you are off-limits.

Keep in mind that an S-corporation isn’t a legal classification. It’s simply a tax classification. So even if you elect the S-corp tax classification, legally, your business is still an LLC.

3. Formation

Setting up your business as an LLC involves choosing a name, hiring a registered agent, and submitting an application for articles of organization to your Secretary of State (SOS).

Once your LLC is established and registered with your Secretary of State, for federal income taxes, it will be automatically taxed as:

- A sole proprietorship if it’s a single-member LLC

- A partnership if there is more than one member

But if you’ve decided you want the LLC to be taxed as an S-corporation, you’ll need to complete and file Form 2553 with the IRS, which will let the IRS know that you elect to have your LLC taxed as an S-corp. Be aware that if your LLC has more than one member, all members will need to sign Form 2553.

There is no fee to file Form 2553 with the IRS. And you can expect it to take the IRS four to six weeks to process your request, and you’ll receive a notice in the mail letting you know the IRS has accepted your tax classification.

4. Management and Recordkeeping

An LLC is registered in a state where you operate. The company formation process can take between a few days and several weeks to complete, depending on the state backlog and levels of digitalization. LLC formation costs also vary from state to state.

To get your LLC taxed as an S-corp, the only additional document you’ll need to complete for the initial set-up is IRS Form 2553.

With the addition of payroll processing for the S-corp shareholder, the recordkeeping requirements will be the same for an S-corp and an LLC.

How do S-corp owners get paid?

S-corp shareholders are required to be paid a reasonable salary. This is a non-negotiable requirement. The exact dollar number will largely depend on the size of the business, the company’s industry, and the owner’s skills and experience.

How do LLC owners get paid?

LLC members don’t take a salary. Instead, they take distributions when needed. Distributions don’t have to be on a regular schedule like a wage does. The distributions aren’t considered business expenses like an S-corp shareholder’s salary is. Instead, distributions are seen as a return of the capital the member invested into the LLC.

Is an LLC or S-corp better for entrepreneurs?

It depends on what you value: simplicity or tax advantages.

Forming an LLC is an excellent idea for structuring your small business. It provides liability protection and comes with flexibility in how you manage your company. But as your company grows, electing to be taxed as an S-corporation is something to consider.

The S-corp election can reduce your company’s tax bill, but it comes with additional administrative work. Calculating reasonable compensation, processing payroll, and filing payroll tax returns increases regulatory compliance.

If your business doesn’t make enough money to pay its owners a regular salary and generate a profit, choosing the S-corporation tax status doesn’t make sense. Stick with your default tax classification of a sole proprietorship or partnership.

| Pros and cons of LLC vs. S-corp | ||

| Pros |

Cons |

|

|

LLC |

|

|

|

S-Corp |

|

|

FAQs about LLC vs S-corp

Below are some of the most frequently asked questions (FAQs) regarding the differences between an LLC and an S-corp.