Coming up with a great idea for a new business is just the beginning. Actually getting the business off the ground and seeing it flourish is the hard part. Conventional wisdom tells us that half of new businesses fail within the first two years, but the actual data reveals a slightly different story.

According to the U.S. Bureau of Labor Statistics, over the past two decades, about one in five businesses failed in the first two years. But a similar share — to be exact, 22 percent — are still around 20 years later.

While we don’t know exactly what made certain businesses fail, the reality is geography probably had something to do with it. After all, what’s true in one state isn’t true in another, and all things being equal, some states give entrepreneurs an advantage by making it a bit more affordable to set up shop.

We wanted to understand which states were the least (and most) expensive places to start a businesses, so we analyzed data from a variety of sources (more on that in the methodology section), and here are our key findings:

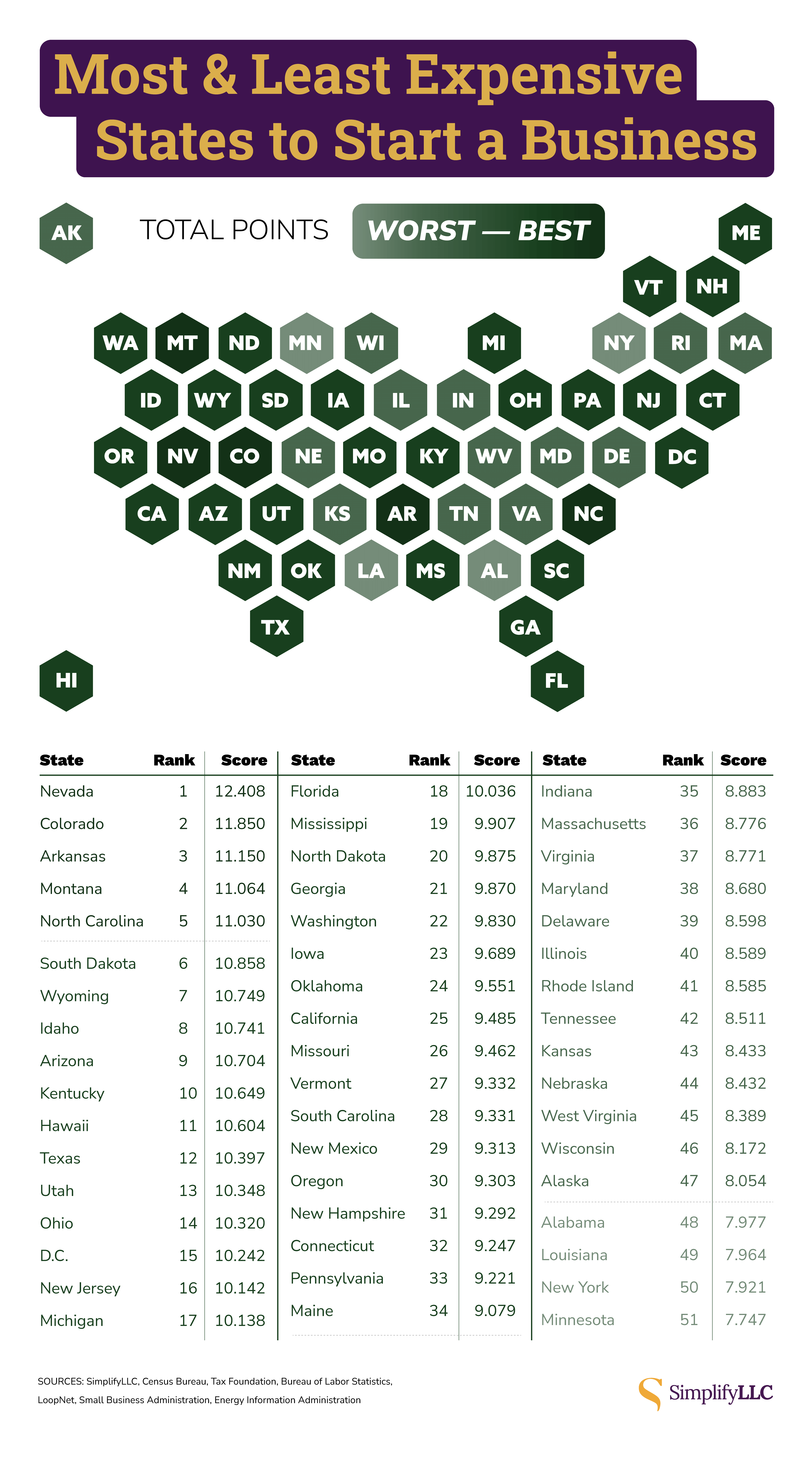

- Nevada is the least expensive state in which to start a business, and Minnesota is the most expensive.

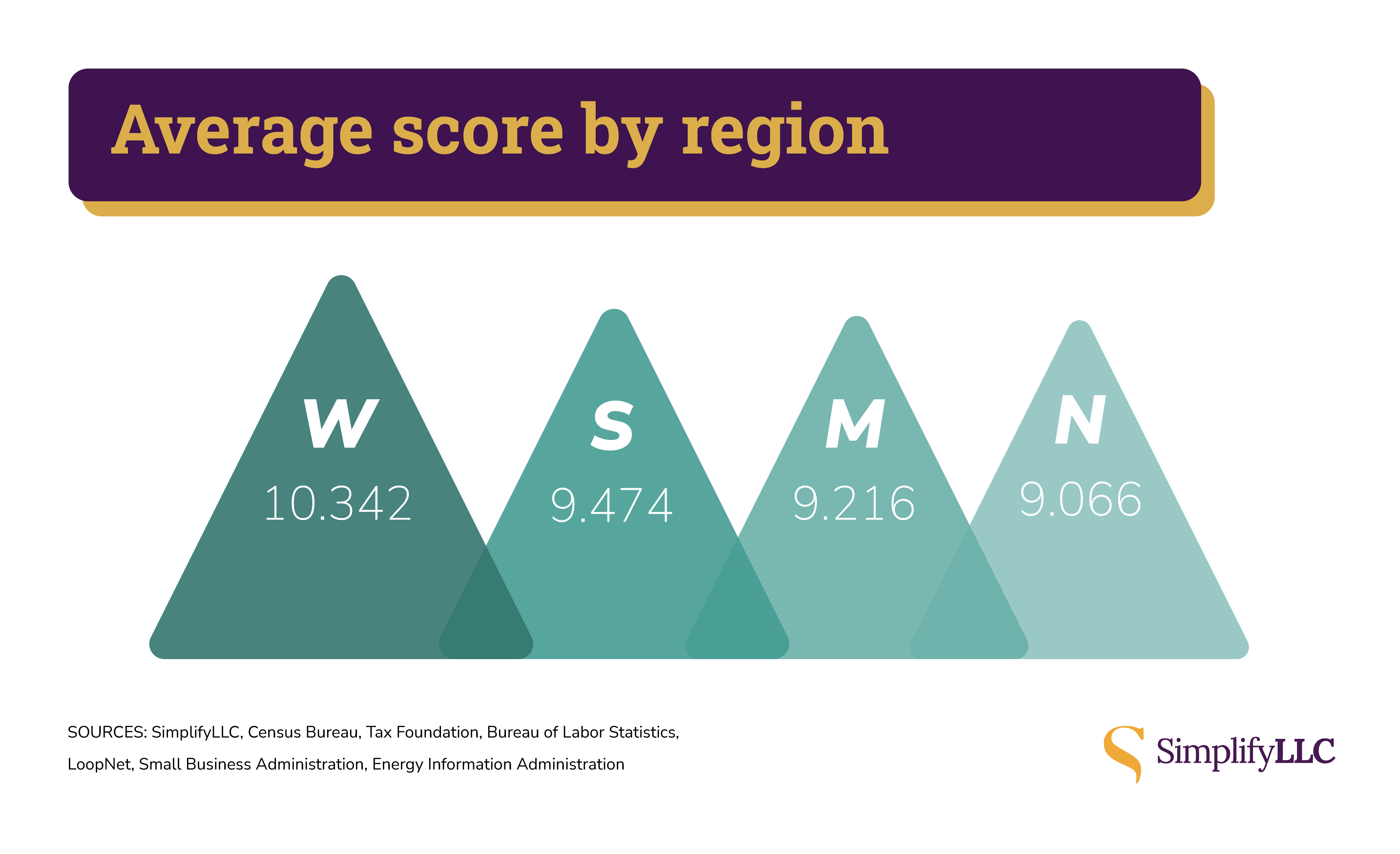

- Six of the top 10 states for saving money when you start a business are in the West, while the Northeast has the worst average score.

Most & Least Expensive States

We compared states across nine business cost-related factors in these categories — basic business costs, labor costs and worker availability, cost of space and utilities, and healthy business environment.

Our analysis found that Nevada, by a margin of just over half a point, is the least expensive state to start a business, followed by Colorado and Arkansas. The most expensive state to start a business in is Minnesota, though New York, Louisiana, and Alabama aren’t much cheaper.

The top of the list is heavy with Western states, which likely speaks to the fact that many states in the region don’t levy a corporate income tax and have relatively low fees for starting an LLC. The West is the only region where the average state’s score is in double digits.

Click on each state in the interactive map below to see their local statistics.

Basic Business Costs

The very wise Ron Swanson once said, “Whatever happened to ‘Hey, I have some apples, would you like to buy them?’ ‘Yes, thank you!’ That’s as complicated as it should be to open a business in this country.”

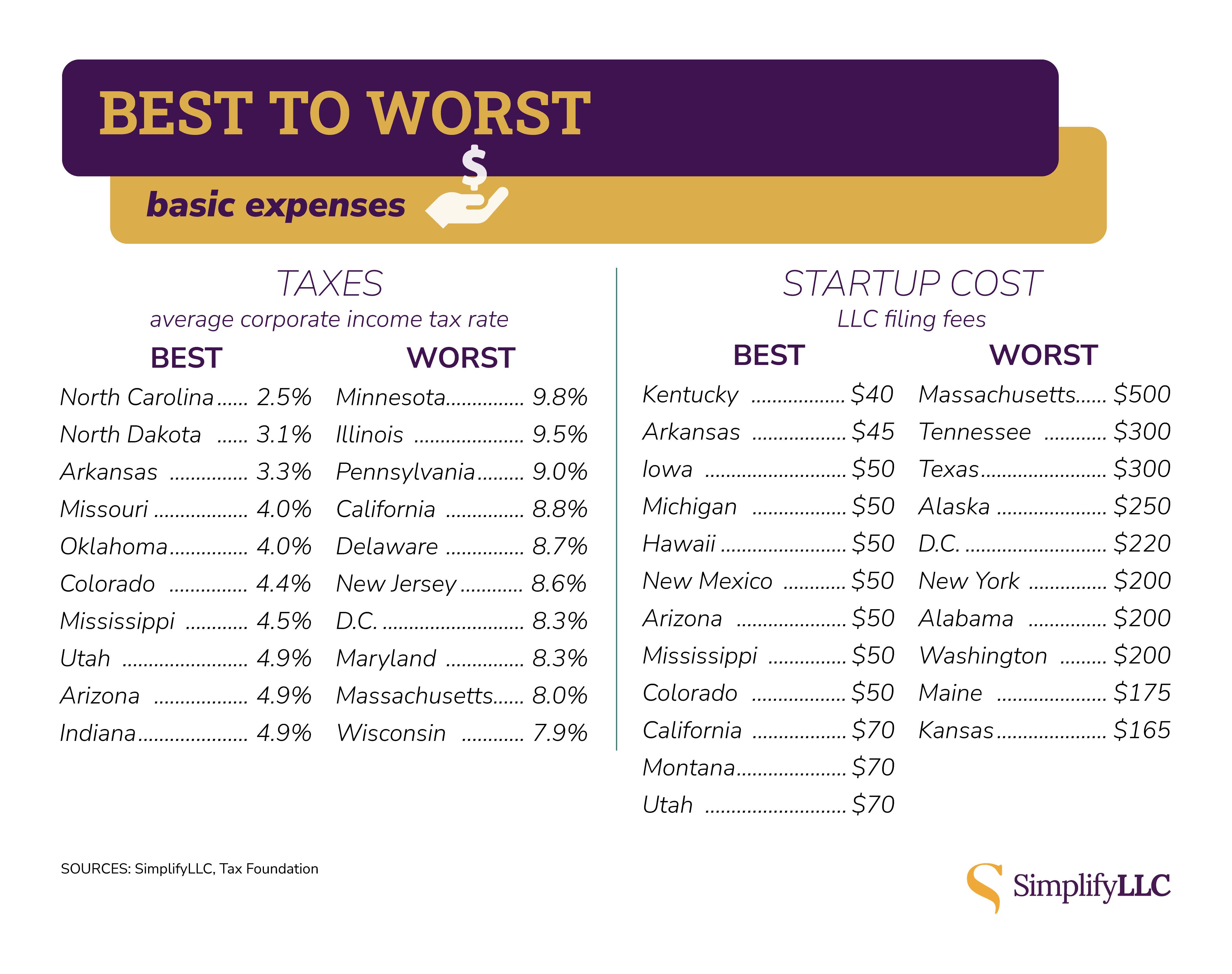

With apologies to Ron, it costs an average of about $125 to file papers opening an LLC, with costs ranging from a low of $40 in Kentucky to a high of $500 in Massachusetts.

And, of course, once a business is up and running, depending on its structure and purpose, it may have to pay income taxes to local, state and federal governments, though many states don’t have a corporate income tax at all, and for certain types of businesses (LLCs, sole proprietorships, and S-corps), taxes are paid on the owner’s income rather than the business itself.

Still, for companies that do expect to pay corporate income taxes, these costs also vary quite a bit depending on the state, which could save thousands of dollars every year. The highest average corporate income tax rate in the U.S. is Minnesota (9.8 percent), followed by Illinois (9.5 percent), and Pennsylvania (8.9 percent). On the flip side, South Dakota and Wyoming have no corporate income tax and no gross receipts tax, while Nevada, Ohio, Texas, and Washington have only a gross receipts tax and no additional corporate income tax.

Labor Costs & Worker Availability

Unless you’re the only person who will ever work for your business, being able to find qualified, affordable labor is paramount. After all, even if you’re a business owner, fatigue is a real problem. A Capital One survey found that almost half of small-business owners said they’d experienced burnout over the past month, with one-quarter saying they currently feel burned out.

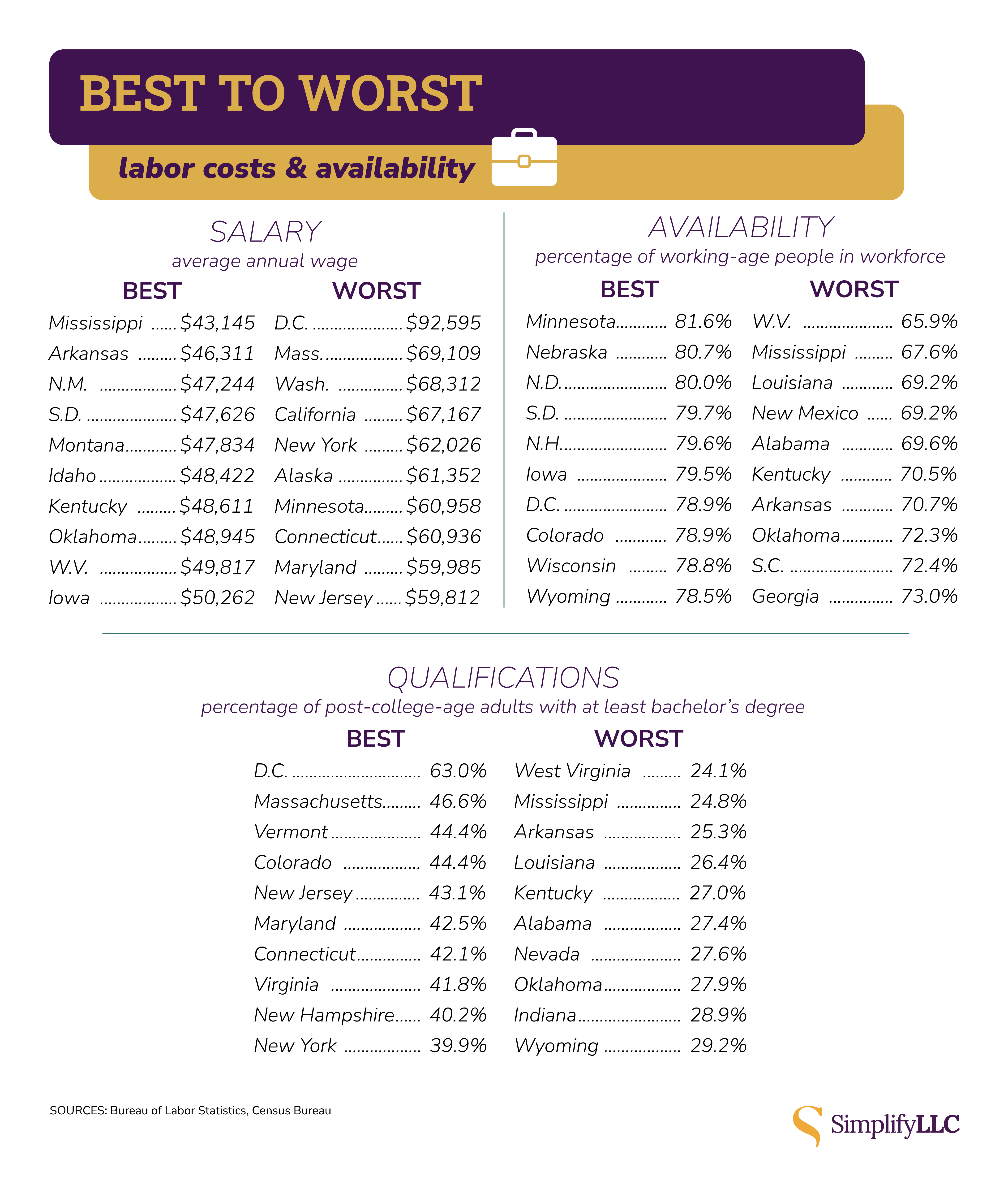

Of course, finding and keeping good people is a balancing act. You want workers who are qualified and experienced, especially for managerial jobs, but with great experience comes great salary demands, which can quickly drain your company’s coffers. And some experts point to labor force participation as a major contributor to the ongoing labor shortage, so staking your claim in a state where fewer people are even looking for work could set your business up for failure.

Across the three metrics we measured here — income, labor force participation, and education — there’s not much consistency, and rates vary dramatically from the best states to the worst states. For example, D.C.’s average annual wage is just south of $100,000, making it the highest in the country, while the lowest is Mississippi’s $43,145. Similarly, the district’s educational attainment rate (63 percent), a measure of post-college-aged adults with at least a bachelor’s degree, is almost 20 points higher than the next-highest (Massachusetts, where about 47 percent of people in this age group have a college degree or better).

Cost of Space & Utilities

While many entrepreneurs start their businesses out of their homes (and Apple’s founders famously started their company in the garage of Steve Jobs’ parents’ house), if your business begins to flourish, chances are you’ll look to expand beyond the bounds of your own home.

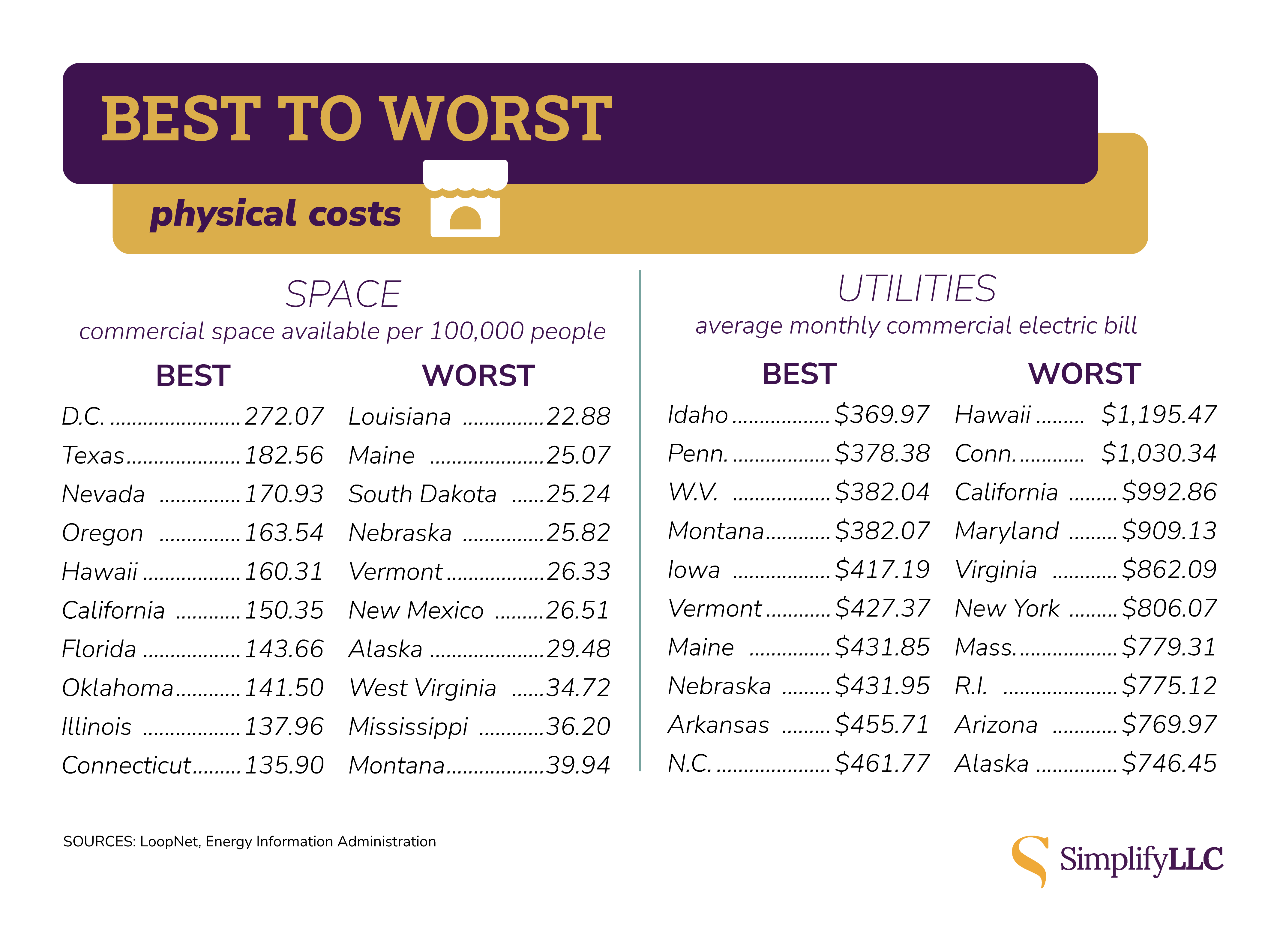

But with expansion comes more headaches and additional costs, including finding space and paying utilities. While those aren’t the extent of the costs, of course, we used commercial space availability and average commercial electric bills to determine the most and least expensive states when it comes to business space.

Aside from D.C., which has the highest population-adjusted rate of available commercial spaces according to LoopNet data, seven of the 10 most space-available states are west of the Mississippi, and four states in the Western U.S. region are in the top 10. And you can expect to get the biggest bang for your utility buck in Idaho, where the average monthly commercial electric bill is just under $400 compared to a high of nearly $1,200 in Hawaii. (D.C.’s average bill is much higher, but this is likely due to population density, so we did not count that against the district in our analysis.)

And before you go assuming this means that cold-weather states are better since you won’t have to run the AC as much, consider that Connecticut, New York, Massachusetts, and Rhode Island all have some of the nation’s highest commercial electricity costs.

Healthy Business Environment

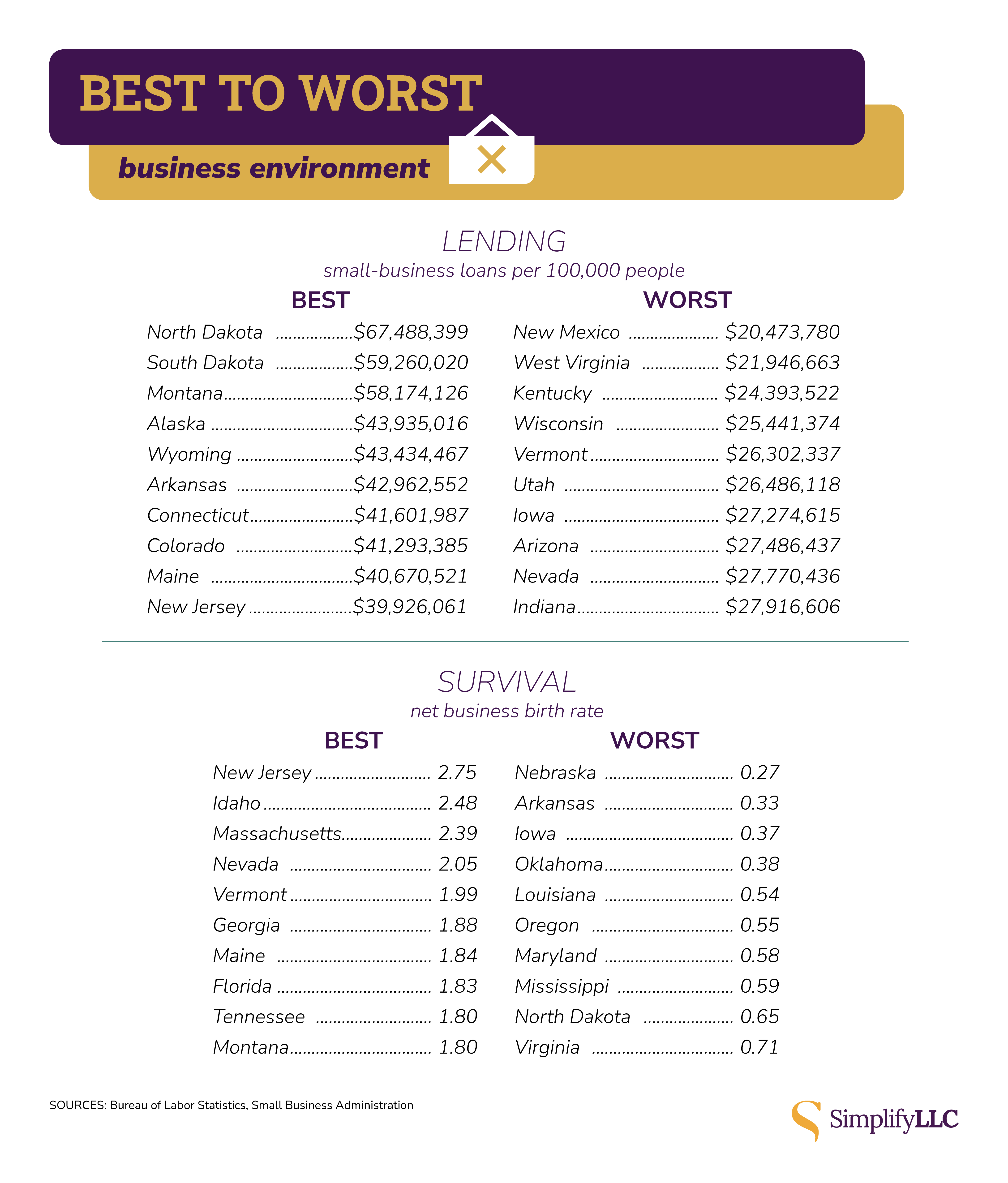

Finally, we looked at the business environment in each state from two perspectives — small-business lending and net business births. Under the Community Reinvestment Act (CRA), which is designed to encourage large financial institutions to issue loans in the communities in which they’re chartered, banks issued more than $354 billion in loans to small businesses in the most recent year with available data, an increase of more than 50 percent over the past five years.

To compare the states fairly in this category, we adjusted each state’s total lending for 2020, the most recent year for which state-level data is available, against population. That means that while California had the highest overall total, after adjusting for its large population, it fell closer to the middle.

Nationally and in every state, the rate of business births was higher than the rate of business deaths in the most recent available year (2021), with the national business birth rate just over a point higher than the death rate, though Nebraska, Arkansas, Iowa, and Oklahoma had a business death rate that nearly matched the birth rate, a result that doesn’t bode well for a young organization.

Conclusion

For entrepreneurs who have the ability to pick and choose where they want to start their business, it’s clear that certain states will allow you to save money in various business-related areas, which could help propel your business to the next level.

Methodology

We calculated each state’s rate across nine business-related categories compared to the national rate or an average of the states to determine which state gives entrepreneurs the best chance of success. States were awarded point values based on how better or worse their metrics were compared to the national rate; points in all categories were then totaled to arrive at overall scores for each state.

For example, top-ranked Nevada scored a total of about 12.4 points across the nine categories, ranging from a high of 2.52 points in the corporate tax category to a low of 0.78 points in the educational attainment category. Here are the data categories and sources:

Basic business costs:

- Corporate income tax rates: This 2023 information came from the Tax Foundation. Many states have bracketed corporate income tax rates, and for those states, we calculated a rate average. Additionally, several states do not levy corporate income taxes, so for those states, we imputed the equivalent of the best-scoring state in the category, North Carolina, with an average corporate income tax rate of 2.5%.

- Business filing fees: This SimplifyLLC data was most recently updated in 2023 and does include some variables that were not factored into our ranking. For example, Nebraska’s $100 LLC filing fee also includes a publication fee, which varies by community.

Labor costs & availability:

- Average annual income: This U.S. Bureau of Labor Statistics data is from 2022.

- Labor force participation rate: This U.S. Census Bureau is from 2021.

- Percentage of adults 25+ with at least bachelor’s degree: This U.S. Census Bureau data is from 2021.

Cost of space & utilities:

- Average monthly commercial electric bill: This Energy Information Administration data is from 2021. Given the unique aspects of D.C. being a city, it’s got by far the highest average commercial electric bill. To avoid unfairly weighing down the district’s score, we substituted the next-highest average bill, Hawaii, for our overall ranking.

- Available commercial real estate: This LoopNet data is from a search conducted March 24. Data was unavailable for Ohio and Oregon, so we substituted the state average. Additionally, to account for size differences, we calculated a rate of the total number of available commercial units per 100,000 residents.

Healthy business environment:

- Small business lending under Community Reinvestment Act: This Small Business Administration data covers Community Reinvestment Act loans for new small businesses, and it’s from 2020. Additionally, to account for size differences, we calculated a rate of total lending amount per 100,000 residents.

- Net change in business establishments: This BLS data is from 2021 and consists of the average quarterly rate of business births minus the average quarterly rate of business deaths. Q4 data for 2021 was not available for business deaths.