Thinking of starting an LLC in Utah?

Utah offers a variety of advantages for small business owners looking to form a Limited Liability Company (LLC).

With low tax rates, no annual franchise tax, and minimal state filing fees, the state provides a cost-effective environment for launching a new business.

These financial benefits make Utah an especially appealing choice for entrepreneurs–event those starting out with limited capital.

Here’s a full guide with step-by-step instructions on how to form an LLC in Utah.

Steps to Create an LLC in Utah:

- Step 1: Choose a name for your Utah LLC

- Step 2: Appoint a registered agent

- Step 3: File the Utah LLC Certificate of Organization

- Step 4: Create an LLC Operating Agreement

- Step 5: Obtain an EIN (Employer Identification Number) from the IRS

- Costs to set up an LLC in Utah

- Final steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Choose a name for your Utah LLC

Starting a new Utah-based LLC begins with choosing a legal name for your business.

The name of your Utah LLC must be distinguishable from other business names registered in the state. According to the Division of Corporations and Commercial Code, a name is considered “distinguishable” if it:

-

Contains one or more different keywords than existing business names

-

Uses similar words arranged in a different order

-

Features creative or unique spellings of certain words

For example, “Chick Filet” is distinguishable from “Chick-fil-A” because of the variation in how the names are spelled.

The name must also include “Limited Liability Company” or “Limited Company” or an abbreviation like LLC or L.L.C. Certain words like bank or insurance require additional permits to use while words like “treasury” or “government” are prohibited entirely from being a part of an LLC’s name.

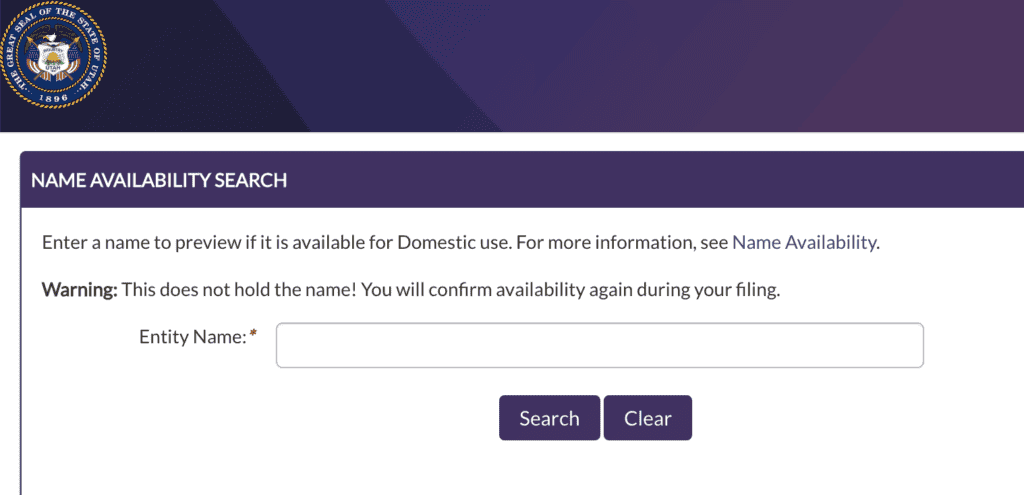

A name availability search tool will tell you if the name you want to use is available:

You may also contact the Utah Secretary of State’s office by phone to receive confirmation.

Note: Even if a business name appears to be available, the official decision on granting the name usage to your company will come from the state.

Name reservation (optional)

If you're not ready to start your business but like a particular name, you can reserve it for up to 120 days.

To do so, complete the Application for Reservation of Business Name form and pay the $22 fee if filing online. If reserving a name by mail, send the form along with a check to:

Utah State Tax Commission

PO Box 141700

Salt Lake City, UT 84114-1700

Note: If you end up using the name before the 120 days expire, you must cancel the name reservation. This ensures that the reserved name is no longer held separately and can be officially registered as your LLC's legal name.

Doing business as (optional)

Businesses that want to operate under a brand name different from their legal name must file a DBA with Utah’s Division of Corporations and Commerce Code.

A DBA or “Doing Business As” is ideal for companies with legal names that aren’t marketing-friendly, or for LLCs planning to run multiple brands under the same corporate umbrella.

Let’s say you’ve registered your LLC under a generic name such as “Debbie and Co LLC.” But your customers know you as “Debbie’s Dresses.” Filing for a DBA legally links these two names.

The LLC members or an organizer would need to file the DBA paperwork and pay a state fee of $22 for a three-year registration. Filings can be done by mail or online.

Step 2: Appoint a Registered Agent

A registered agent is a person (at least 18 years old) or business entity designated to receive official correspondence and legal documents, such as service of process, on behalf of your company.

The state also sends documents like annual reports to your designated registered agent. Thus, your LLC must have a registered agent with a street address in Utah (not a P.O. Box).

For foreign LLCs without a local office — and for domestic LLCs run from home — meeting the registered agent requirement can be a challenge.

In case you don't want to be your own registered agent, you can hire one for about $45-$185/year in Utah.

Step 3: File the Utah LLC Certificate of Organization

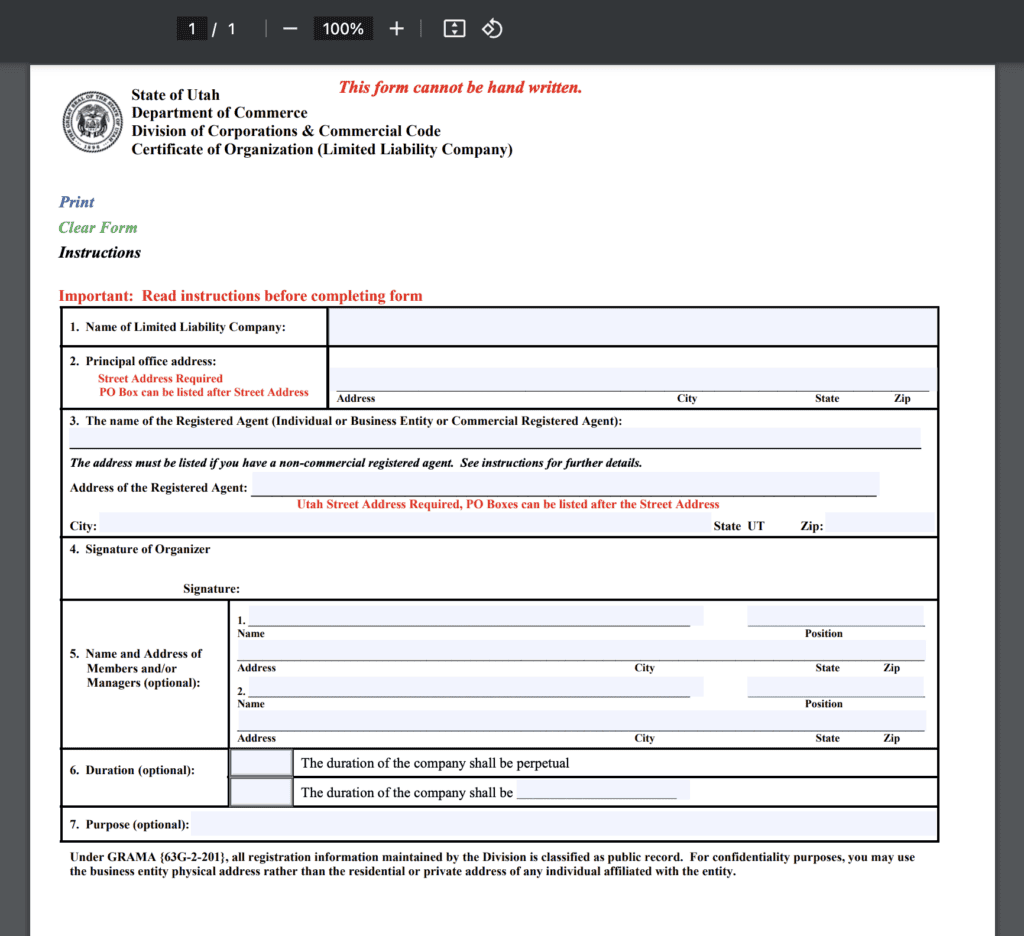

Once you've chosen a name and designated a registered agent, the next step is to file a Certificate of Organization (Articles of Organization) with the state.

You can register a Domestic Limited Liability Company (LLC) online, in person, by mail, or by fax. The online process is quick and straightforward, with the business entity registration processed within 7-10 days.

You can file online or by mail, and the $59 processing fee must be paid to the state of Utah by both domestic and foreign LLCs. Expedited processing is available for an additional $75, with approval typically within 1–2 business days.

If you prefer to register by form, you can use the Application for Registration, and for additional help, refer to the instructions provided for the application

The LLC certificate of organization includes:

- The LLC’s name and mailing address

- Registered agent’s contact information

- Additional statements for specialized LLCs (like low-profit or professional services companies)

A limited liability company is formed when the LLCs certificate of organization is marked as “effective” by the state.

Upon approval, business owners should request a certificate of existence and good standing from the state of Utah. This will cost you $12 and will be of assistance when applying for a business credit card, loan, insurance, and bank account.

Step 4: Create an LLC Operating Agreement

An operating agreement is a legal contract between the owners (LLC members) regarding the members’ rights and responsibilities. It’s similar to corporation bylaws but not legally required to be filed with the state. Single-member LLCs can skip this step.

However multi-member LLCs should prepare this document as having it in place prevents managerial issues and conflicts around profit distribution.

Utah doesn’t have a required format for an operating agreement. You can use any template you find online or have an attorney draft a custom document for you.

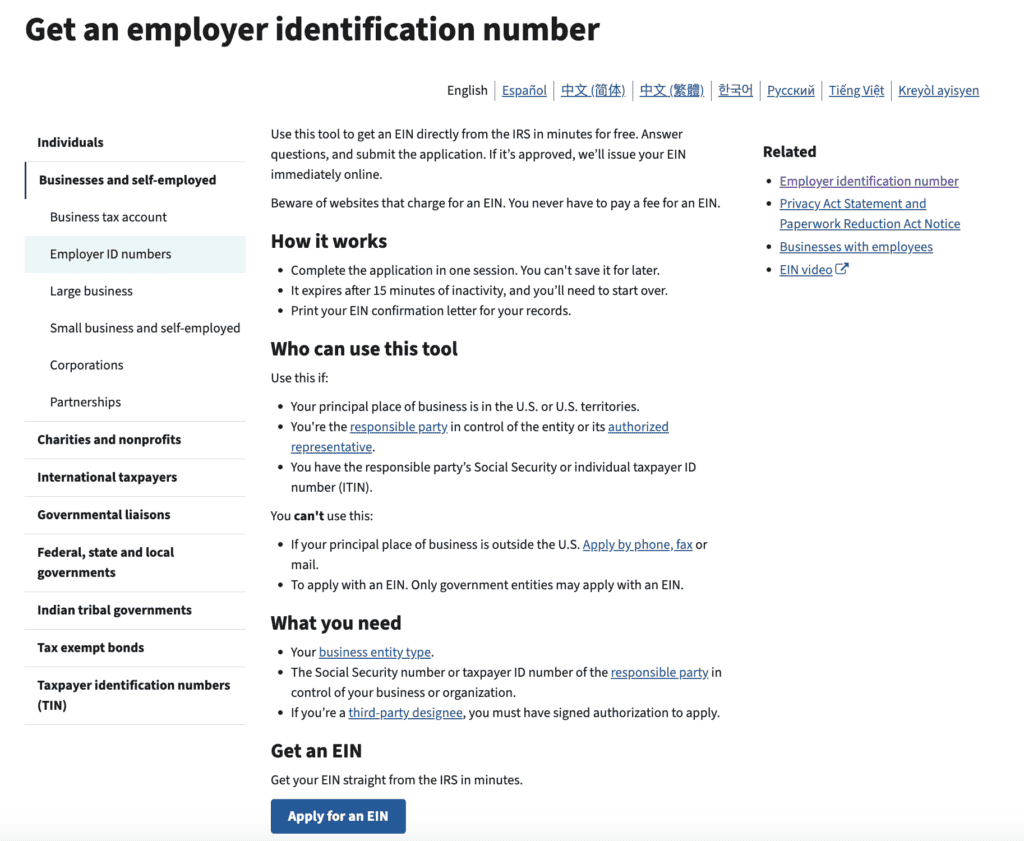

Step 5: Get an EIN (Employer Identification Number) from the IRS

A Federal Tax ID number, also known as an EIN or Employer Identification Number, is required for many businesses for tax purposes.

Specifically, you will need an EIN if you:

-

Plan to hire employees

-

Operate as a partnership

-

Withhold taxes on income (such as for non-resident aliens)

-

Are required to pay certain federal taxes

You can get an EIN online through the IRS website after answering some basic questions about your business.

Total costs to set up an LLC in Utah

Forming an LLC in Utah is fairly cost-effective. The only required fee is filing a Certificate of Organization for $59.

Other optional costs include:

- Name reservation: $22

- Registering a “doing business as” (DBA) trade name: $22. The fee to file the Certificate of Organization is $54.

- Annual report filing: $18/year

- Registered agent: $150-$200/year

- Certificate of existence: $12

- Operating agreement: $0 – $1,000+

Final steps

Open a business bank account

Unlike a sole proprietorship, an LLC needs a separate business bank account to prevent the commingling of personal and business transactions.

Commingling personal and business transactions implies that your LLC is not a separate business structure from you.

Most banks will ask for your EIN, Certificate of Organization, and an opening deposit averaging $100. Most business accounts also pay interest, offer merchant services and provide debit/credit cards.

Obtain permits and licenses (if required)

If you plan on hiring employees or work in a regulated industry such as real estate, cosmetology, or construction, you might need to get some additional permits and licenses. Businesses that sell taxable goods from the state or have an economic nexus in Utah must register for a sales tax license. A business creates economic nexus (a local presence) with Utah when they meet one of several criteria:

- Have a warehouse or fulfillment center

- Have employees working locally

- Sell products at local trade shows

- Sell physical products (online or physical retail store) to Utah residents (conditions apply)

Be aware of taxes

Utah's base state sales tax rate is 4.85%. However, local jurisdictions may apply additional sales taxes, resulting in total combined rates that typically range from 6.1% to 9.5%, depending on the specific location. Registering for a sales tax license is a simple and free process. You can request a Utah sales tax number in two ways:

- Via Taxpayer Access Point (TAP)

- At OneStop Business Registration (OSBR) portal during company formation

Many small business owners don’t realize they need to collect or pay sales tax until it’s too late – when they’ve already gotten a bill from the Utah State Tax Commission. Thus, it’s important to consult with a CPA to understand all of the scenarios which could create an economic nexus (and more taxes to pay) for your business.

Good luck with your new LLC!