Starting a business in Tennessee?

Forming a limited liability company (LLC) is a popular choice for entrepreneurs due to its flexibility and liability protection.

An LLC safeguards your personal assets from business debts and lawsuits while giving your business a professional edge over a sole proprietorship.

In Tennessee, the process to set up an LLC is straightforward but requires completing a few key steps with the state.

This guide will walk you through everything you need to know to start your Tennessee LLC with confidence.

Steps to Create an LLC in Tennessee:

- Step 1: Choose a Name for Your LLC

- Step 2: Appoint a Registered Agent

- Step 3: File the Tennessee LLC Articles of Organization

- Step 4: Prepare an LLC Operating Agreement

- Step 5: Get an Employer Identification Number (EIN)

- Total Costs to Set Up an LLC in Tennessee

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Choose a Name for Your LLC

The Tennessee Secretary of State requires LLC business names to:

- Include the words ‘Limited Liability Company' or ‘LLC' (or their abbreviations, L.C. or LLC.) at the end of its name.

- Not contain any words prohibited by Tennessee law.

- Not be deceptively similar to an existing Tennessee business entity's name.

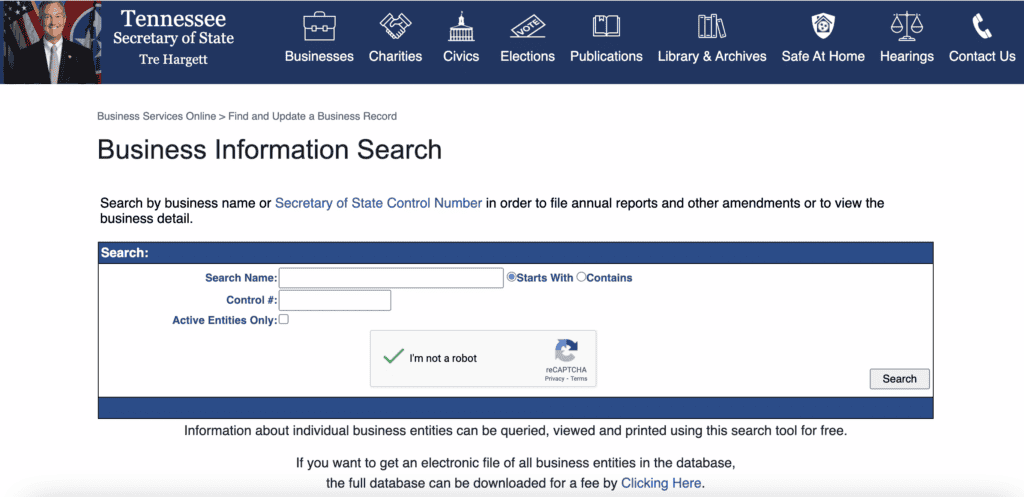

Business owners can use the Tennessee business name search database to check if their intended name is available:

If you find an available name you'd like to claim but aren't yet ready to form your business, you can opt in to reserve the business name for 120 days. The cost is $20 to do so and is completely optional. The Tennessee name reservation form must be returned by mail or in person at the Tennessee Secretary of State's office in Nashville. Mail-in applications must be paid for by check or money order. In-person applications must be paid for in cash.

To return by mail, send to:

Tennessee Secretary of State

ATTN: Corporate Filing

312 Rosa L. Parks Ave FL 6

Nashville TN 37243

The cost of DBA (doing business as) in Tennessee is $20 per name and is valid for five years.

Step 2: Appoint a Registered agent

The good news is that you can pick anyone to serve as your registered agent (even yourself), and it doesn't necessarily have to be someone affiliated with your LLC.

Whether you name a corporation or an individual as your registered agent, you’ll need to list their physical street address (not a P.O. box) on the company formation documents.

If you don't want to be your own registered agent, you can hire one for about $99-$299/year in Tennessee.

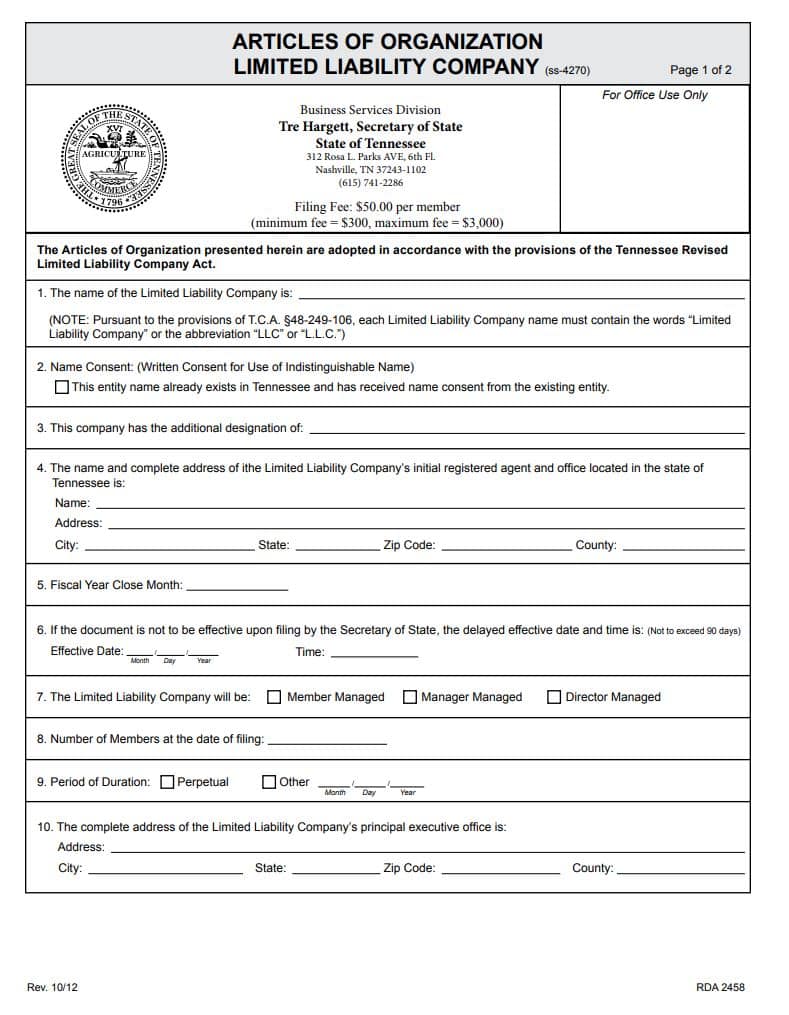

Step 3: File Tennessee LLC Articles of Organization

The next official step to forming an LLC is to file the Articles of Organization for a Limited Liability Company with the Tennessee Secretary of State (SOS).

To officially file your LLC in Tennessee, you need to file the Articles of Organization.

Here's how you can do it:

- E-file: The fastest way to file is online. Head over to tnbear.tn.gov/NewBiz and use the online tool to complete your application. You can pay the filing fee with a credit or debit card. Be aware, there's a small convenience fee for card payments to cover transaction costs. If you'd rather avoid this fee, choose the “print and mail” option.

- Print and Mail: If you prefer handling things by mail, visit tnbear.tn.gov/NewBiz and fill out your application online. Then, print it out and send it, along with the filing fee, to: Secretary of State’s Office, 6th FL – Snodgrass Tower, ATTN: Corporate Filing, 312 Rosa L. Parks Ave., Nashville, TN 37243.

- Paper Submission: For those who like to do things the traditional way, you can get a blank application here, by emailing the Secretary of State at [email protected], or by calling (615) 741-2286. Fill it out by hand or on your computer, and mail it with the required fee to the address mentioned above.

- Walk-in: If you prefer in-person assistance, you can visit the Secretary of State Business Services office to pick up a blank application.

Tennessee has an unusual fee structure compared to other states. In Tennessee, Articles of Organization cost has a base fee of $300 plus an extra $50 for each LLC member:

- Minimum fee is $300 for single-member LLC and up to 6 members.

- Maximum fee is up to $3,000 (58 members or more)

This cost structure applies to both domestic and foreign LLCs.

Each method ensures your LLC is properly registered, so choose the one that best fits your needs.

After registering your LLC, request a certification of LLC registration from the state of Tennessee. Submit Form SS-4232 and $20 to the state in order to receive the Certificate of Existence.

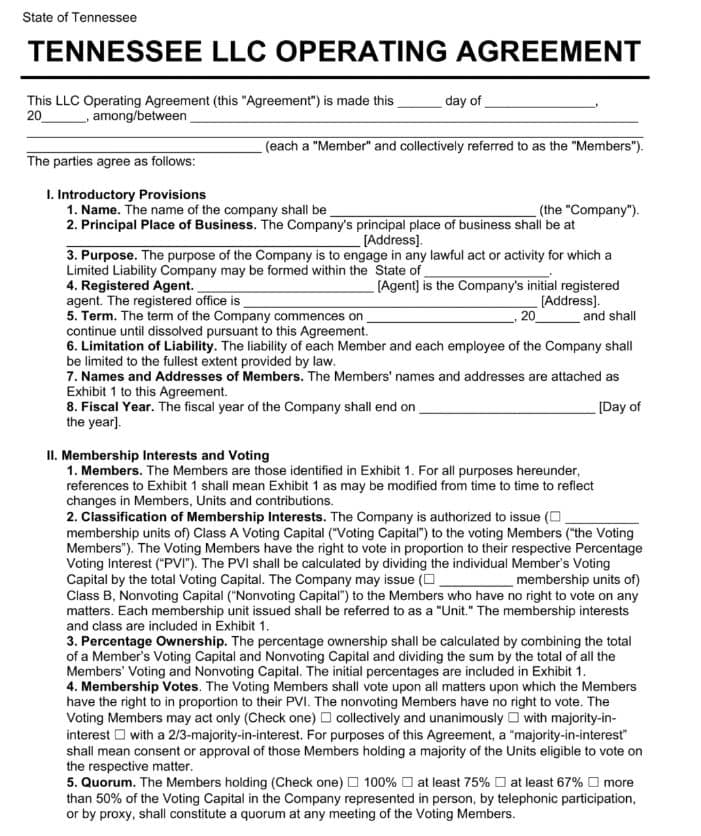

Step 4: Prepare an LLC Operating Agreement

An operating agreement legally specifies your LLC’s management structure, members’ duties and responsibilities, capital investment and profit distribution provisions, and any other operational tidbits you may want to include. Having an operating agreement can protect you from future disagreements among members.

Multi-member LLCs benefit the most from having an operating agreement. Single-member LLCs need not worry about an operating agreement until you decide to scale your business and bring in another member on board.

Step 5: Get an EIN (Employer Identification Number) from the IRS

LLC members can apply for an Employer Identification Number (EIN) on the IRS website. The EIN is a 9-digit number that uniquely identifies your business structure for federal tax purposes. It’s similar to an individual’s social security number.

An EIN is primarily required for multi-member LLCs or single-member LLCs with payroll-based employees.

You can skip on this step as a solo small business owner.

Once the application is complete, you can immediately use the EIN to register with state tax authorities, apply for business credit, or add employees to your payroll.

Total Costs to Set Up an LLC in Tennessee

Starting an LLC in Tennessee involves several costs:

- Articles of Organization Filing Fee: $300 base, plus $50 per member beyond six, capped at $3,000.

- Name Reservation Fee: $20 for a 120-day reservation (optional).

- DBA Registration Fee: $20 to operate under a different name (optional).

- Annual Report Fee: $50 per member, with a minimum of $300 and a maximum of $3,000.

- Registered Agent Services: $100 to $300 per year (optional).

While Tennessee has higher start-up costs compared to some other states, it offers benefits such as no state income tax on wages and a growing economy.

Further Steps

After successfully registering your LLC, there are a few important steps to consider:

Open a Business Bank Account: It's crucial to separate your business transactions from your personal finances. Mixing the two can lead to legal issues and could affect your LLC’s good standing with the state.

Understand Your Tax Obligations: Doing business in Tennessee means you’ll need to pay various local and state taxes, such as:

- Business tax

- Gross receipts tax: The gross receipts tax is a component of the business tax and is calculated based on the total revenue your business earns within Tennessee. Unlike income tax, gross receipts tax is assessed on the business’s total sales or receipts, not just profit.

- Franchise tax- 0.25% of the greater of your LLC’s net worth or the value of its real and tangible property in Tennessee, with a minimum tax of $100.

- Excise tax – Based on net earnings or income of the LLC (6.5%).

- Sales tax – LLCs selling tangible goods or taxable services must register for a sales tax permit through the TNTAP portal.

If your LLC earns over $3,000 annually in Tennessee, you must register for and pay the business tax. This tax is managed by the state and is due annually, on the 15th day of the fourth month after your fiscal year ends. For more detailed information, you can refer to the manuals published by the Tennessee Department of Revenue.