Are you about starting a new LLC (limited liability company) in Oregon?

Whether you’re starting fresh or converting an existing business, forming an Oregon LLC is a smart move.

An LLC is a good choice for small businesses, offering both tax benefits and legal protections that aren’t available to sole proprietorships or corporations. This business structure protects your personal assets, keeping them separate from your business liabilities, and avoids double taxation thanks to pass-through taxation.

Follow this guide for a straightforward, step-by-step process to get your Oregon LLC up and running.

LLC in Oregon: Step-by-Step

- Step 1: Name Your New LLC

- Step 2: Appoint a Registered Agent

- Step 3: File Articles of Organization

- Step 4: Get an EIN (Employer Identification Number) from the IRS

- Step 5: Create an LLC Operating Agreement

- Step 6: Open a Bank Account

Need to save time? Hire Northwest to form your LLC.

Step 1: Name Your New LLC

The first step in forming your Oregon LLC is to select a name for it. But you’ll need to be aware of the state’s naming requirements.

To register your LLC in Oregon, the name you choose must meet the following requirements:

- Must be distinguishable from other business names

- Must include the term “limited liability company” or the abbreviation “LLC” or “L.L.C.”

Once you settle on the right name, you’ll want to check that another business hasn’t taken it. Like most states, Oregon doesn’t allow multiple companies to operate under the same name.

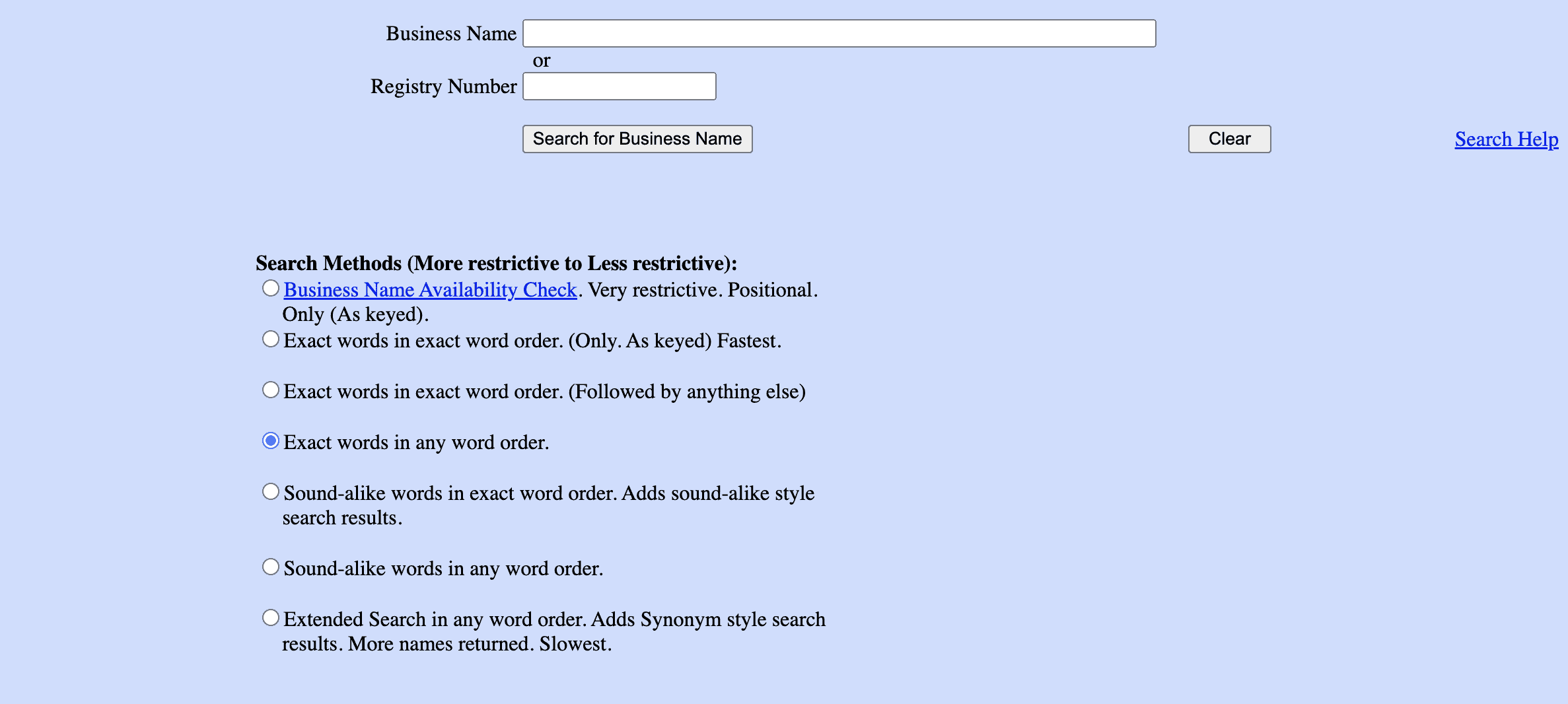

You can use the business name search on the Oregon Secretary of State’s website to look up the business registry of used names and verify availability:

Name reservation (optional)

If your name is available but you’re not quite ready to file your formation application, you can reserve the LLC name for 120 days. The service requires a $100 fee by completing the Oregon name reservation form.

Note: A name reservation doesn’t give you the right to conduct business under this name until you complete the company formation process.

DBA or assumed business name (optional)

If you plan to use an assumed business name, also known as a fictitious name or a DBA “doing business as” name, you’ll need to register it with the Secretary of State and pay a $50 fee.

Using an assumed name allows you to use a different name than your registered name. For example, if your LLC is named “West Coast Enterprises” and you’re operating a Mexican cuisine food truck, you may want to register the name of your food truck as your assumed business name. It lets you market your business using the name your customers know, not your formal business name.

Oregon assumed business name registrations are valid for two years. After that, you’ll need to renew it every two years if you want to continue using it for your business.

Step 2: Appoint a Registered Agent

All Oregon LLCs need to appoint a statutory agent (registered agent) as part of the company registration process. And you’ll need to provide their information to the state.

Oregon requires a registered agent for all LLCs; failure to maintain one can lead to dissolution.

Your registered agent is the person or company that will accept service of process (e.g., legal and other official documents) on behalf of your LLC. Registered agents can be a:

- Business owner

- Trusted employee or manager

- Corporate attorney or accountant

- Professional registered agent service

Remember that registered agents must have a physical street address in Oregon (not a P.O. box) and be available during regular business hours. If your company doesn’t have a physical location in Oregon, you’ll need to hire a local registered agent service. Companies with a presence in Oregon can also benefit from a registered agent service. Additionally, if your business operates out of your home, it can prevent receiving unsolicited mail or having your private address listed in public records.

In case you don't want to be your own registered agent, you can hire one for about $70-$199/year in Oregon.

| Registered agent: DIY vs. hire a registered agent company | ||

| Pros | Cons | |

| DIY |

|

|

| Hiring company |

|

|

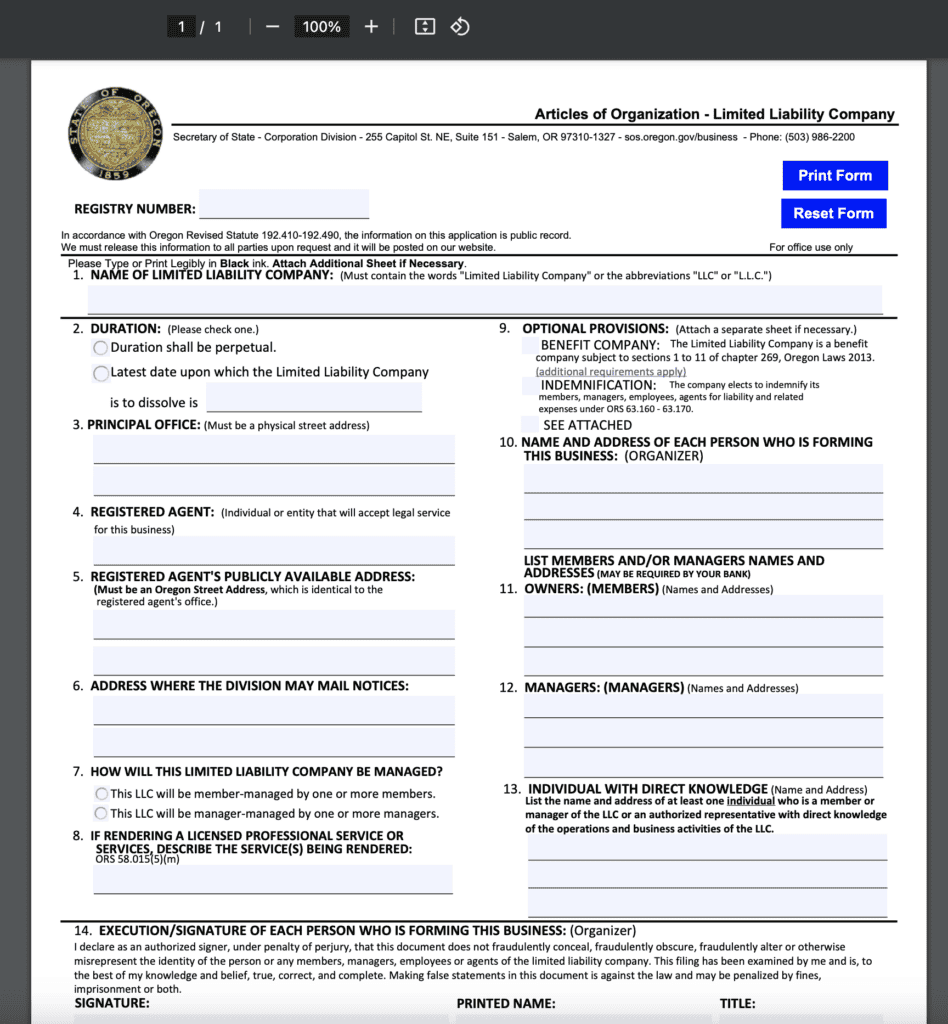

Step 3: File Articles of Organization with the Oregon Secretary of State

Your next step in the formation process is to complete the Articles of Organization. You can do this online or by submitting a paper application.

These Articles are the official document that forms your LLC and allows your company to do business in Oregon when approved by the Secretary of State. The state filing fee is $100.

Per Oregon Statute Sec. 63.004, when preparing your Articles of Organization, you’ll need to include the following:

- Name of the LLC.

- Physical address and mailing address of the company.

- Registered agent name and address.

- Management structure.

- Names and addresses of all members of the LLC.

When you submit your LLC registration in Oregon online, it typically gets processed within 1 business day. If you choose to file by mail, it generally takes 5-7 business days for processing, plus additional time for mailing.

Oregon does not offer expedited processing—all filings follow standard timelines.

If you prefer to submit your Articles of Organization via the mail:

Oregon Secretary of State – Corporation Division

255 Capitol St. NE, Suite 151

Salem, OR 97310-1327

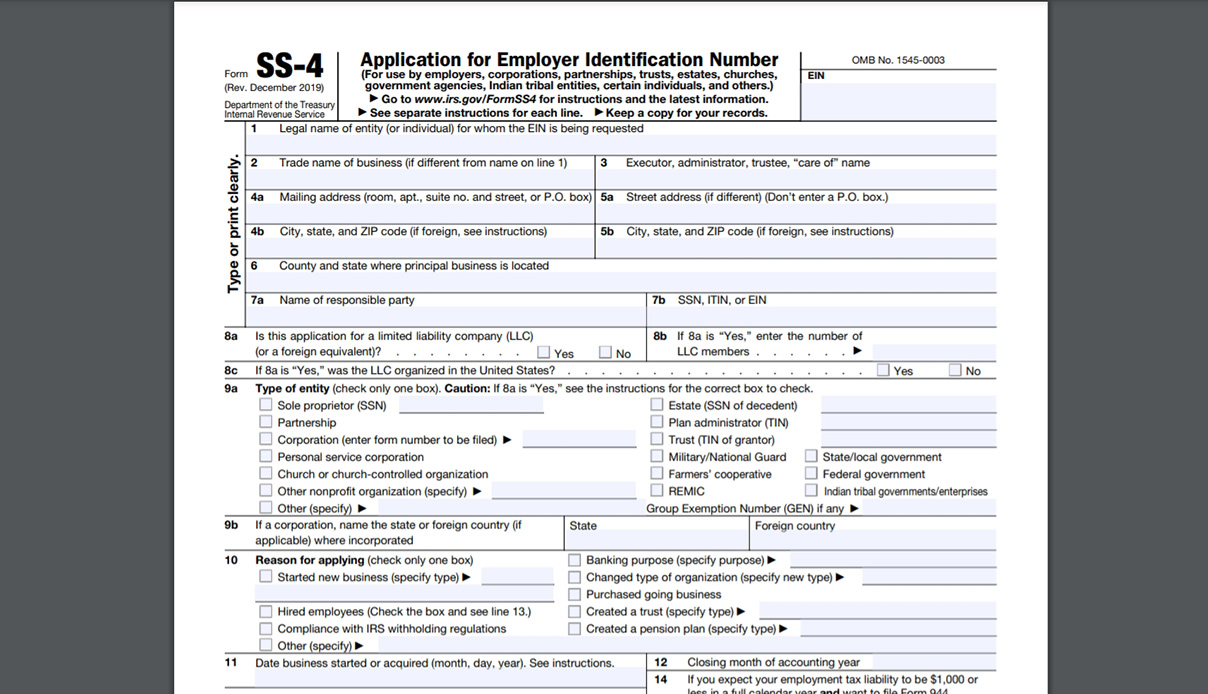

Step 4: Get an EIN (Employer Identification Number) from the IRS

After you’ve successfully filed your Articles of Organization, you’ll need to secure a federal employer identification number (EIN) from the Internal Revenue Service to file your federal income taxes.

The EIN acts like a social security number for your company. It’s an identification number unique to your business, and you’ll use it on all correspondence with the IRS. There’s no fee for getting an EIN, and you can do it quickly online by answering just a few questions. And after you complete the application, your EIN will be generated immediately.

You can also submit a paper application using Form SS-4, Application for Employer Identification Number. However, applying this way can take several weeks before you get a response from the IRS.

The EIN is necessary not only for federal taxes. But you’ll need it to open a business bank account, which we’ll discuss more a little later.

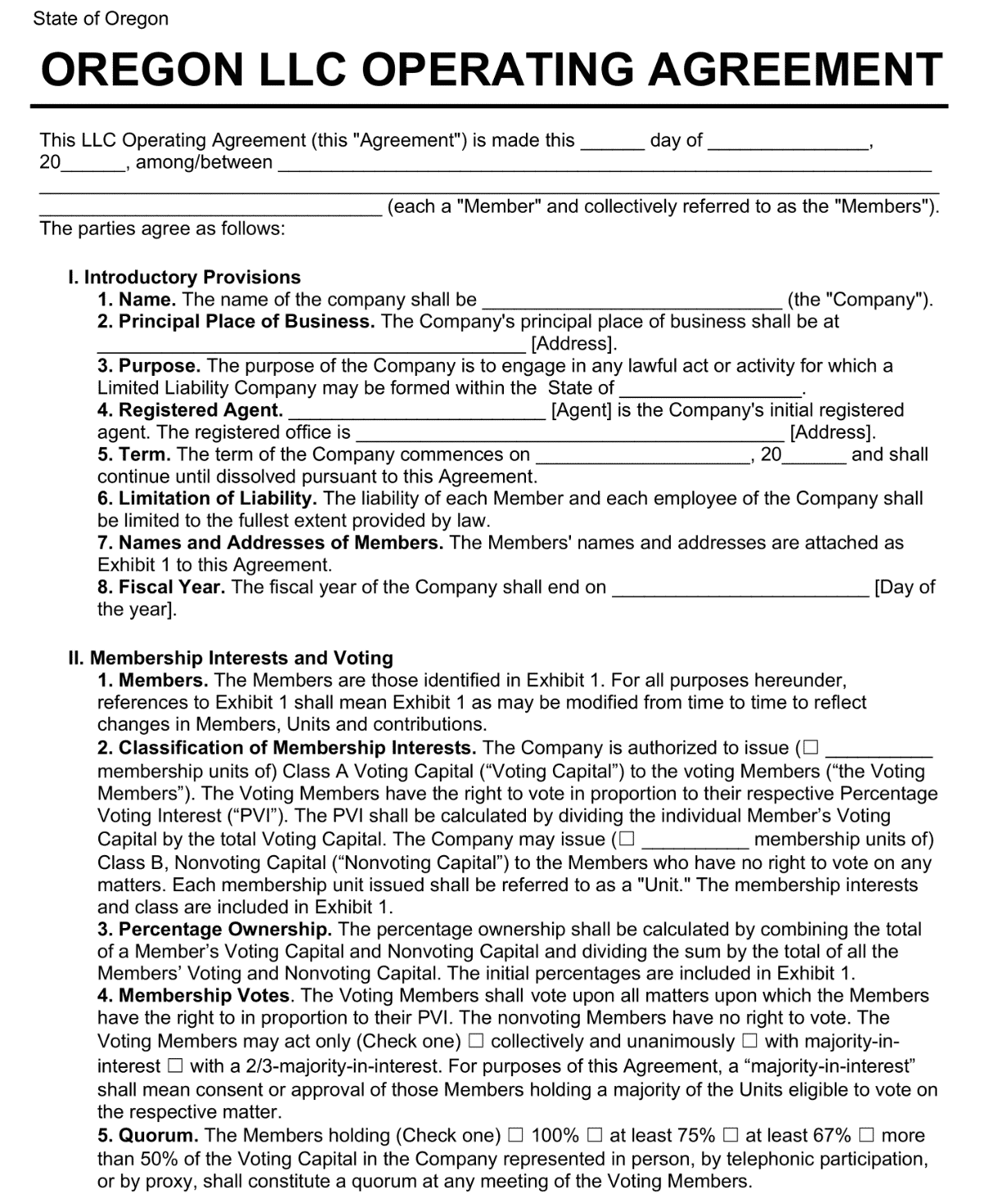

Step 5: Create an LLC Operating Agreement

Oregon doesn’t require your LLC to include an operating agreement as part of the company formation process. But it’s still essential to have one for everyone but single-member LLCs.

An LLC uses an operating agreement to spell out the rules and procedures for operating and managing the company. It includes details on financial and operational decision-making.

Operational agreements serve as a roadmap for preventing and resolving business issues. It should cover grounds in regards to the following:

- Who has decision-making power? What happens if there’s a disagreement?

- What happens if one member wants to leave the business? What happens to his stake? How can the member leave?

- What if the LLC wants to bring on another member? How will the new member’s powers differ from the original members?

- What happens when the members want to end the LLC?

Online services offer customizable forms that can cost a few hundred dollars. Hiring a corporate attorney can cost $500 or more.

Step 6: Open a Bank Account

Once you have your EIN, you can open a business bank account. Keeping your business finances separate from your personal is critical for LLC members. Since banks have different requirements for opening and maintaining accounts, it’s wise to call around to see who offers the best option for your company.

Things to consider include:

- Monthly service fees.

- Miscellaneous fees (e.g., wire transfer fees, overdraft fees).

- Minimum required balances.

- Minimum initial deposits.

- Interest rates.

You’ll also want to know what documents you’ll need to bring with you when you open an account. Most often, at a minimum, you’ll need:

- A file-stamped copy of your LLC’s Articles of Organization.

- Your EIN.

- Your driver’s license or other photo identification ID.

Confirm with your bank what documents you’ll need to open your business bank account.