Looking to start an LLC in Louisiana?

Fortunately, Louisiana is quite an affordable place to live and run a business. Furthermore, Louisiana's top-notch universities — such as Louisiana State and Tulane — provide a steady stream of entrepreneurial talent, along with a unique culture and heritage. All of this makes Louisiana a great place to start a business.

Forming a limited liability company (LLC) is the most common option among small business owners. This type of business entity provides personal asset and liability protection for its owners, plus it’s easy to manage.

So how do you incorporate an LLC in Louisiana? This step-by-step guide provides all the instructions.

Steps to Create an LLC in Louisiana:

- Step 1: Choose a Name for Your New Louisiana LLC

- Step 2: Designate (or become) a Registered Agent

- Step 3: File Louisiana LLC Articles of Organization

- Step 4: Create an LLC operating agreement

- Step 5: Get an EIN (Employer Identification Number) from the IRS

- Costs to Set Up an LLC in Louisiana

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Choose a Name for Your New Louisiana LLC

If you're thinking of starting an LLC, you probably have a few names in mind. Before you register your top option, make sure it meets Louisiana’s requirements.

Louisiana LLC names must:

- Include Limited Liability Company, Limited Company, or a similar abbreviation

- Be unique and distinguishable from existing business names

- Avoid implying it’s a part of a government agency

- Avoid containing immoral, deceptive, or scandalous words

- Refrain from regulated industry terms like insurance or bank, unless authorized

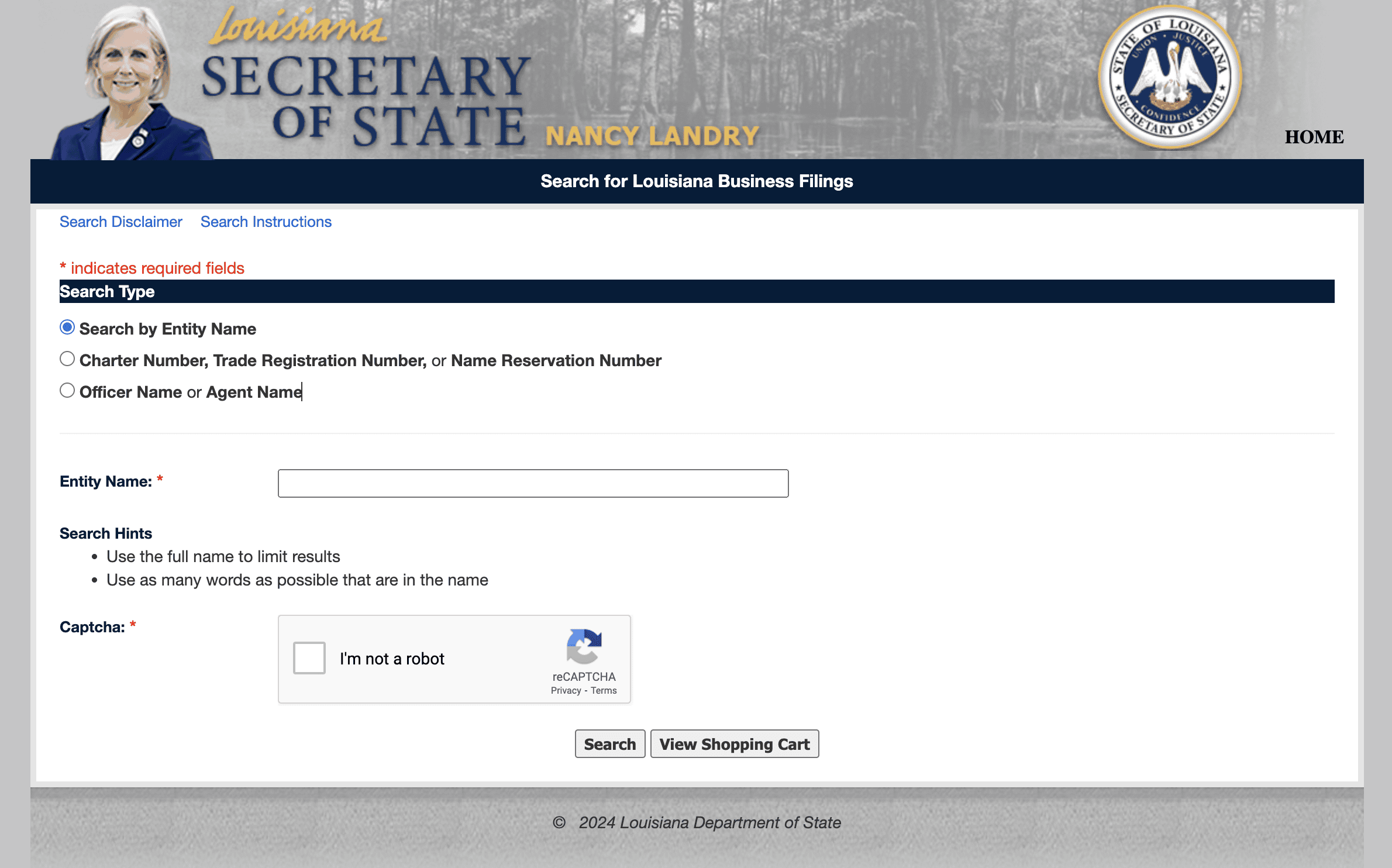

Once you find a name that meets these requirements, make sure it is available. Head over to the business name search on the Louisiana Secretary of State’s (SOS) website:

Along with a business name, you should also check if a domain name is available. This is optional, but a smart move. Even if you don’t want to create a website right away, it’s best to secure the domain name.

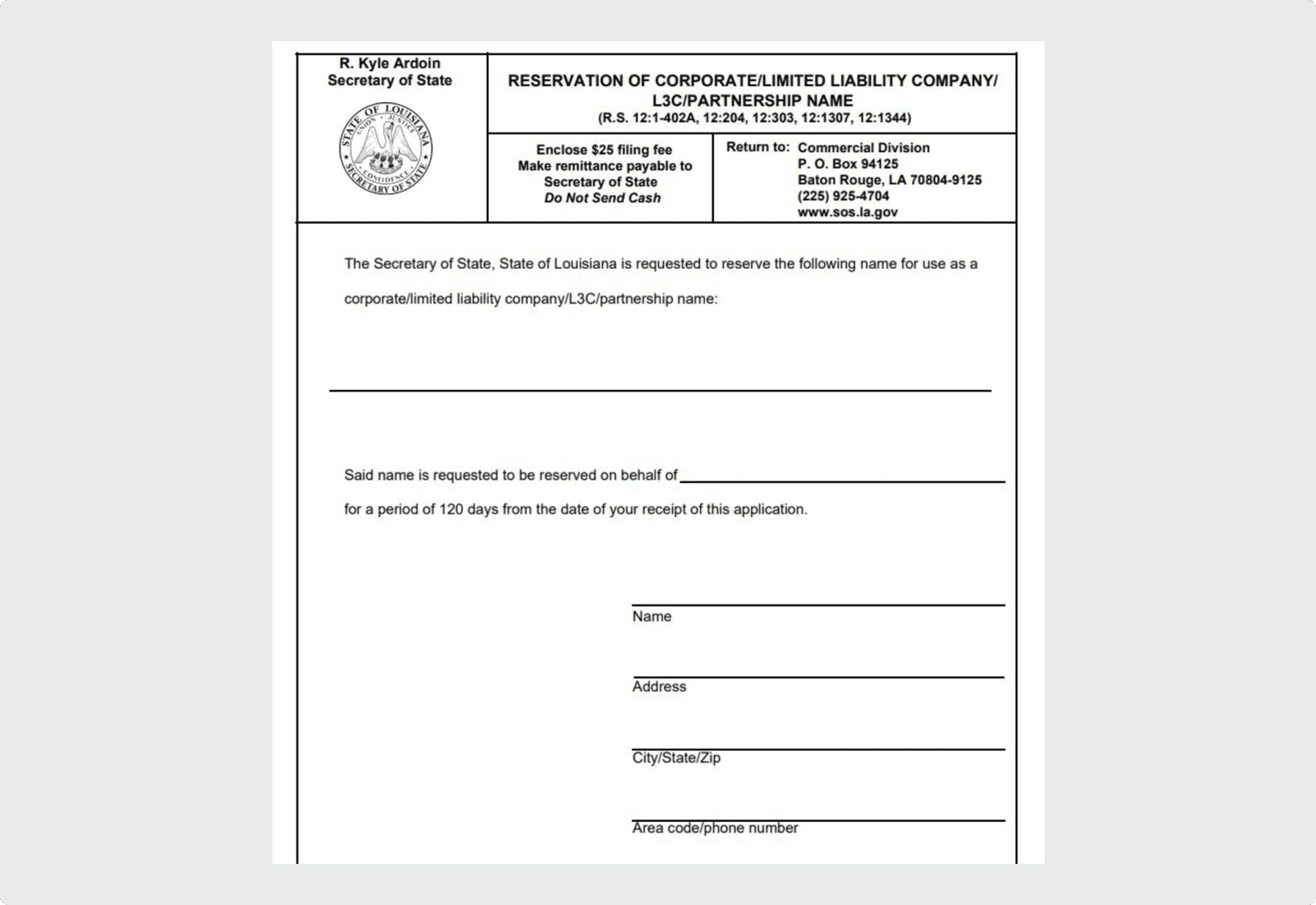

Name Reservation (optional)

If you’re not quite ready to form the LLC but know the name you want, you can reserve it. This is an optional step. It gives you time to prepare other documents without worrying if someone will take it.

Filing a name reservation costs $25. The reservation lasts for 120 days.

Trade Name (optional)

Many business owners choose to operate under a name that’s different from the LLC’s legal name. This is known as using a trade name, doing-business-as (DBA), or assumed name.

Not every business needs a trade name. But it can help in many situations:

- For sole proprietors to avoid using their legal first and last name

- To keep a generic LLC name with a more descriptive operating name (e.g., New Orleans First Enterprises LLC using Cajun Crawfish Craziness)

- To offer different services or products under multiple trade names

To register one in Louisiana, complete the Application to Register a Trade Name. A $75 filing fee applies.

Step 2: Designate (or become) a Registered Agent

Choosing a reliable registered agent is the next important step. This is a contact responsible for accepting legal documents and other administrative notices.

You’ll need to list the registered agent details on your company formation documents. This includes the full name and address, which become part of the public record.

All registered agents must meet the following requirements:

- At least 18 years old

- A legal resident of Louisiana

- Has a physical address in Louisiana (not a P.O. Box)

- Will be available during regular business hours

You or any other person can act as a registered agent. This includes people like a trusted employee, corporate attorney, or accountant.

If you don't want to be your own registered agent, you can hire one for about $99-$249/year in Louisiana.

Step 3: File Louisiana LLC Articles of Organization

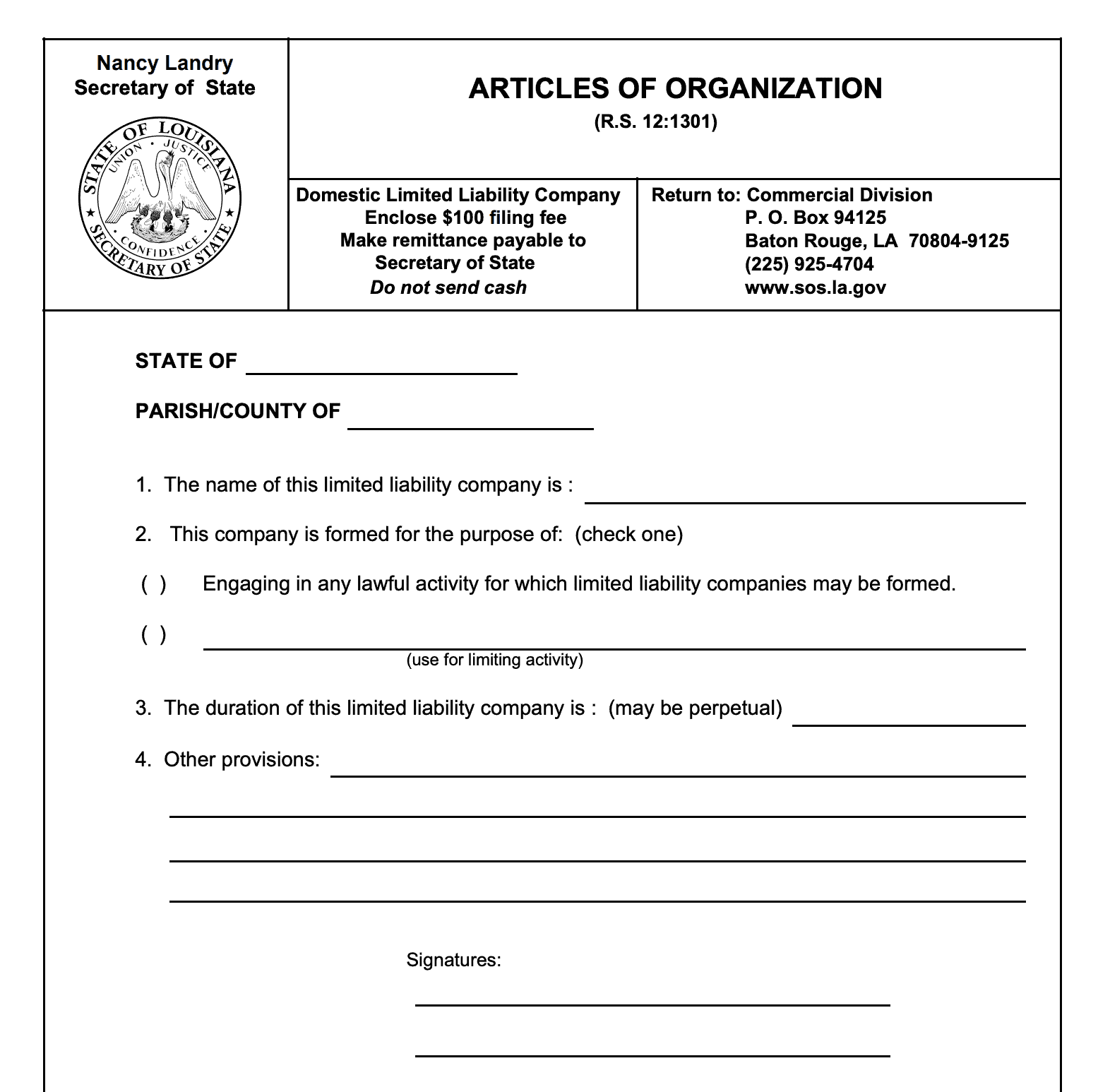

After you’ve settled on your company name and registered agent, you’re ready for a very important step. The Articles of Organization is the document that creates your business.

The Articles of Organization form is a short two-page application. You’ll list important information about your company, such as:

- Company name and address

- Registered agent contact information

- Names and contact details for members

The filing fee is $100 for domestic LLC formation and $150 for foreign LLCs.

You can file your Articles online through geauxbiz.sos.la.gov:

Or hand-deliver or mail a paper application to the Secretary of State at the following address:

- Mailing Address: Louisiana Secretary of State Commercial Division, P.O. Box 94125, Baton Rouge, LA 70804-9125

- Physical Address (for in-person submission): Louisiana Secretary of State, 8585 Archives Ave, Baton Rouge, LA 70809

Registering your business online has the fastest response, usually within a few business days. You can also receive your state tax ID and apply for an unemployment insurance account.

In a rush? No problem. Louisiana SOS offers two tiers of expedited processing for an extra fee:

- $30 for 24-hour processing

- $50 for immediate walk-in processing

Once your LLC is approved, request a certificate of organization. Keep this with your records. It may be needed for financing, banking, and other needs. Louisiana charges $15 for this document.

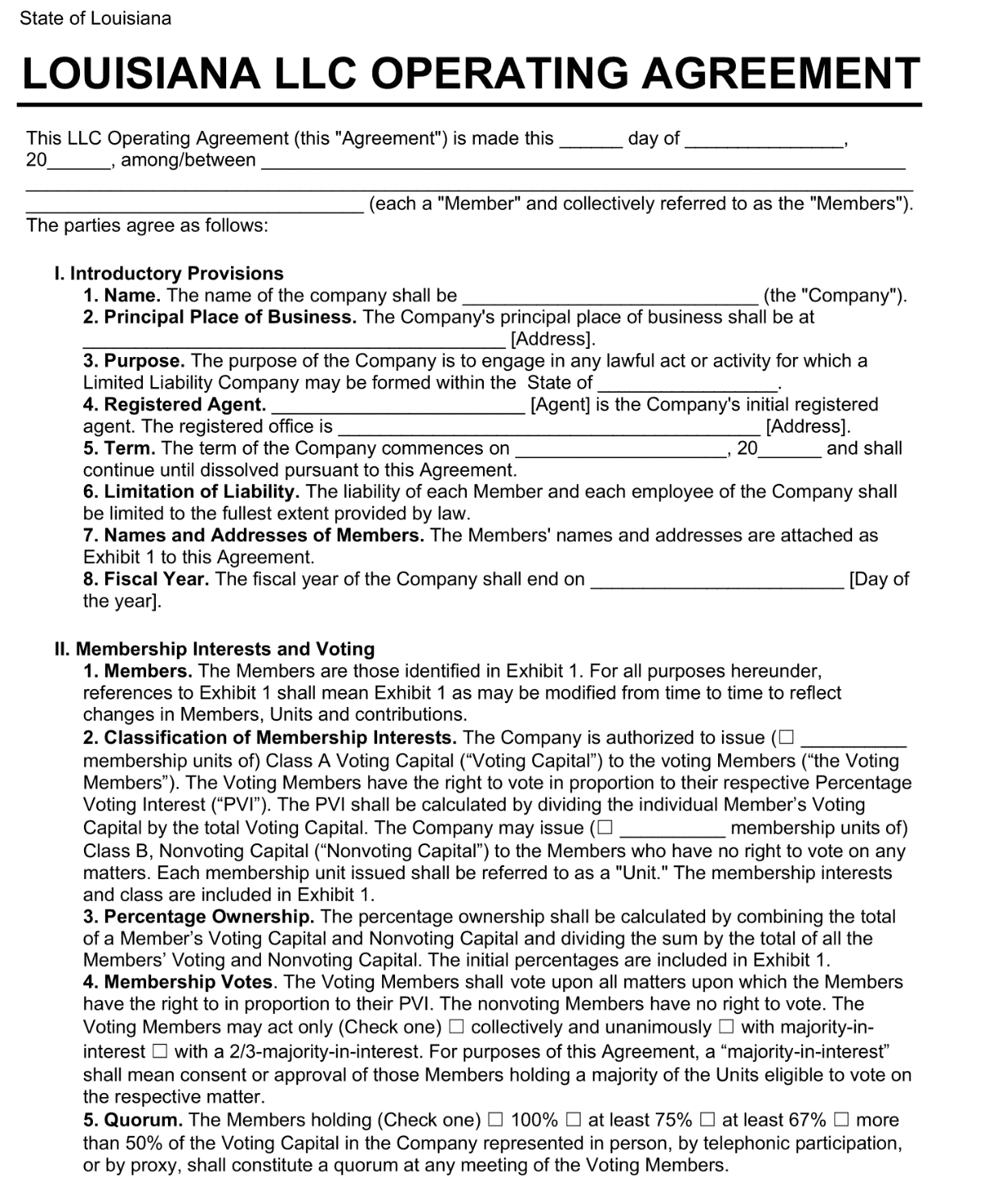

Step 4: Create an LLC operating agreement

The next step is to draft an operating agreement. Louisiana doesn’t require your LLC to have an operating agreement, but it’s a sound idea to have one, especially as a multi-member company.

An operating agreement spells out how your company will function. Without one, Louisiana law will determine the outcome of disputes. This may not align with your interests.

Protect your business by creating a well-drafted operating agreement. It will help to prevent problems and ensure everyone is on the same page.

An operating agreement should cover things like:

- Member names and contact information

- Ownership percentages and contributions

- Method for allocating profits and losses

- Process for adding or removing members

- Voting process for major company decisions

- Procedures to close the company

You can find standard operating agreement templates online to customize. Or you can hire an attorney to prepare one for you to make sure your LLC is covered.

Step 5: Get an EIN (Employer Identification Number) from the IRS

After forming your LLC, you’ll want to get an EIN from the Internal Revenue Service. It’s like a Social Security number for businesses. The IRS uses them to track tax information.

All multi-member LLCs must get an EIN. They’re also needed to:

- Hire and pay full-time employees

- Report federal income tax

- Pay for any type of federal license or permits

Some single-member LLCs can use their personal Social Security number instead of an EIN. But if the LLC hires any employees or falls under other special situations, it must get an EIN.

Costs to Set Up an LLC in Louisiana

The only required cost to start an LLC in Louisiana is the filing fee to submit your Articles of Organization. This is $100 for domestic LLCs and $150 for foreign LLCs.

Other optional costs include:

- Name reservation ($25)

- Fictional name filing ($75)

- Registered agent service ($199 to $249 per year)

- Operating agreement ($0 – $1,000)

Additionally, LLCs must pay a $30 fee each year to file the Annual Report to the State of Louisiana.

Further Steps

At this point, take a moment to celebrate.

You’ve registered your Louisiana LLC and are almost ready to start your business. There are a few final items to take care of first.

Open a business bank account

Setting up a business bank account is great for accounting and tax purposes. It’s also a crucial element of the LLC’s legal protections. If you combine your personal and business finances, you could lose the LLC’s asset separation. This means your personal assets could be on the table if your LLC gets sued.

To open a business account, most banks will want to see the Articles of Organization, EIN, and a photo ID.

Taxes, licenses, and permits

Another critical step is to register and get any approval your business needs. These can come from state, city, and parish authorities.

Start with agencies like the Louisiana Department of Revenue (DOR). It manages sales tax for businesses that sell taxable goods or services. Local authorities may issue licenses and permits. For example, Baton Rouge has a new business registration process. And New Orleans requires an occupational license.

Other helpful resources

Getting adequate insurance coverage is always worthwhile. Workers’ compensation is vital if you hire employees. But all businesses can get a lot of value from a general liability policy.

Experienced entrepreneurs understand the value of learning from others. You can uncover proven ways to find success. Connect with the local business community through groups like:

- Louisiana Small Business Development Center

- Louisiana Economic Development

- Central Louisiana Regional Chamber of Commerce