Foreign-owned LLCs, non-resident aliens, and others without a Social Security Number may need to obtain an EIN without first having an SSN. First, let's explore what an EIN and SSN are and why they're important for your business.

A Social Security Number (SSN) is a nine-digit number created in 1936 solely to track U.S. workers' earnings. Most citizens are assigned a Social Security Number during their first year of life so that the parents can take advantage of the tax breaks afforded based on dependents.

An Employer Identification Number (EIN) is sometimes referred to as a Federal Tax Identification Number, and its purpose is to identify business entities for taxation. While sole proprietorships can operate under the owner's Social Security Number, doing business and filing taxes is easier if the individual is kept separate from the company for tax purposes. So, it's not strictly necessary for a sole proprietorship to have an EIN, but it is a recommended best practice.

There are times when applying for an EIN is required. Some instances include:

- Corporations

- LLCs

- Partnerships

- Trusts created by estate funds and estates that operate as a business after the death of the owner

- Sole proprietorships who hire employees

- Operates as a non-profit or in conjunction with a non-profit

- Files taxes for employment, alcohol, tobacco, or firearms

- Sole proprietorships who need to file for bankruptcy

Let's dive into the process of applying for an EIN without an SSN.

Who is Eligible to Apply for an EIN Without an SSN

All businesses operating in the U.S. need an EIN to open a bank account, apply for licenses, and file tax returns. First, you must determine if you are eligible for an EIN without an SSN. The EIN entities listed below are eligible for an EIN without providing an SSN.

- Non-resident aliens may not have a social security number but still have a tax obligation to the U.S.

- Foreign citizens not residing in the U.S. who want to open a business in the U.S. will need an EIN.

- Foreign entities without a physical presence in the U.S., such as those with only an online presence, will still have tax obligations in the U.S. Such businesses will need an EIN.

- Grantors or trusts created under a Will may not always be U.S. citizens with a social security number. Those trusts will need an EIN to operate effectively.

- Foreign-owned LLCs that hold an interest in the U.S. will need an EIN.

If you fall into any of the above categories, you're likely eligible to receive an EIN without an SSN. It's relatively easy to apply for an EIN without an SSN, so be wary of the numerous websites offering to do this for you for an exorbitant fee. Instead, review the information below and find out how simple obtaining an EIN for your business can be.

How to Apply for an EIN without an SSN

If you are a foreign entity or a non-resident seeking to open or expand a business in the United States, don't let the lack of a social security number discourage you. Another option is to apply for an EIN with an Individual Taxpayer Identification Number (ITIN). An ITIN is a number issued by the Internal Revenue Service (IRS) for individuals who need to report income but are not eligible for an SSN.

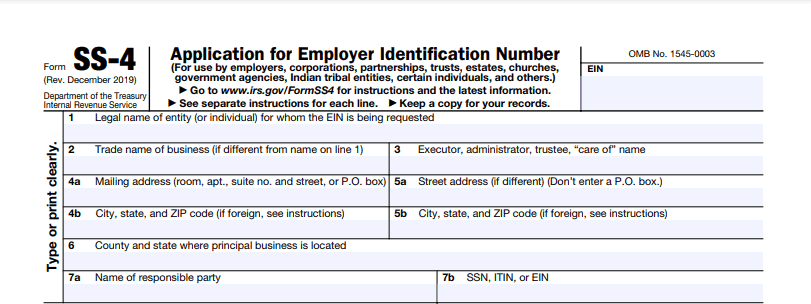

If you don't have either of these numbers, it is still possible to file for an EIN. You will use IRS Form SS-4. Follow the instructions carefully. When you reach line 7(b), it will ask for your SSN or ITIN. The IRS instructions clearly state to write “Foreign” or “N/A” in that space if the responsible party doesn't have an SSN or an ITIN.

International EIN applicants are limited in the ways that they can file for an EIN. Who is considered an international applicant?

- No principal place of business in the U.S. or its territories

- No legal residence in the U.S. or its territories

- You do not have an SSN or ITIN

Download Form SS-4 before you start the application process. If you meet the criteria of an international applicant, you must apply for an EIN using the following methods.

- Call the IRS at 267-941-1099 from 6:00 am to 11:00 pm EST. Note this is not a toll-free number. If you are applying by phone, have Form SS-4 completed before you call. An IRS agent will use the information you provide to assign an EIN.

- Fax the completed Form SS-4 if you are within the U.S. to 855-215-1627. If you are outside the U.S., fax it to 304-707-9471.

- If filing by mail, you should send the completed Form SS-4 at least 4 to 5 weeks before you need your EIN. According to the IRS, receiving your EIN in the mail may take four to five weeks.

- If you have a place of business in one of the 50 states or D.C., mail to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 4599

- If you don't have a legal residence or principal place of business within the U.S. or its territories, mail to:

Internal Revenue Service

Attn: EIN International Operation

Cincinnati, OH 45999

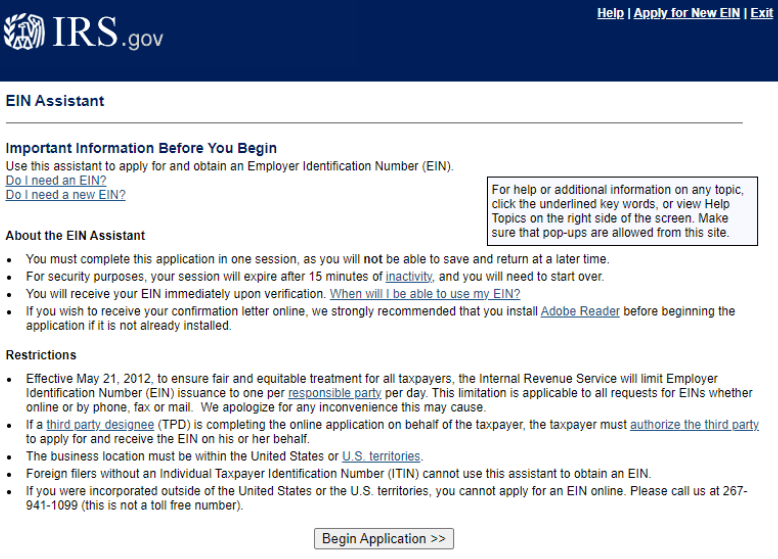

Those with a social security number or ITIN can apply for an EIN online by visiting the IRS EIN Assistance site. You are unable to save progress and return to the site, so make sure you have all the required information available before starting your session.

Should I Get an ITIN?

If applying for an EIN online is important to you and you will incorporate your business inside the U.S., you may want to consider first getting an ITIN. However, according to the IRS, the responsible party must reside inside the U.S. or one of its territories. If you are incorporated outside the U.S., it's unlikely you should bother with getting an ITIN. Instead, you would follow the process above to obtain an EIN.

Frequently Asked Questions

How long does it take to get an EIN without a SSN?

If you are eligible to apply online because you have an SSN, EIN, or ITIN and plan to incorporate your business in the United States—you can get an EIN immediately by applying online. If you apply by phone or fax and include a return fax number, you can expect your EIN in about one week. If you are applying by mail, allow at least four to five weeks to receive your EIN.

If a return is due before you receive your EIN, write “applied for” and the date you applied in the space where the IRS requests the EIN. If a deposit is due, send your payment to the correct service center for your state. Make sure your name is as shown on the SS-4, and include the address, type of tax, the period covered, and the date you applied for the EIN.

Can you start a business with an ITIN number?

If you plan to work as a contract worker or open a sole proprietorship, you can do so with an ITIN number. To apply for an Individual Tax Identification Number, fill out form W-7 with the IRS. After you submit your application, you should receive your number in approximately seven weeks.

What is the difference between an EIN and an ITIN?

The Employer Identification Number (EIN) and the Individual Tax Identification Number (ITIN) are 9-digit numbers the IRS assigns for two distinct purposes. The EIN identifies business entities, and the ITIN is assigned to individuals who are required to file tax returns but don't have an SSN because they are not U.S. citizens with a Social Security Number (SSN). Simply put, the EIN is for business entities, while an ITIN is for individuals who need to file taxes.

Why should a sole proprietorship have an EIN?

Sole proprietorships are not legally required to have an EIN until they hire employees, but it's still a smart business decision. An EIN can also help establish your legitimacy as a professional business, helping you attract both customers and partners. Some lending institutions require an EIN to give business loans.

An EIN makes it easier to keep track of your business expenses and keep them separate from personal expenses. This simplifies tax time and allows you to take full advantage of tax deductions for personal and business expenses.

It is also crucial to note that an EIN can serve as a powerful deterrent to identity theft. Without an EIN, you are left providing your social security number to numerous businesses, leaving you vulnerable to identity theft. An EIN serves as a unique identifier of your business while allowing you to keep your social security number private.