Ready to start an LLC in Virginia? The process is quick, affordable, and simple, making it an excellent choice for new small business owners.

To form a Limited Liability Company (LLC) in Virginia, you’ll begin by selecting a unique business name and appointing a registered agent.

Next, you’ll file the Articles of Organization with the State Corporation Commission. Depending on your business location or industry, you might also need to secure a business license. If you plan to hire employees, it’s also a smart move to apply for an Employer Identification Number (EIN).

That covers the essentials. Let’s break down each step of starting an LLC in Virginia in detail:

Steps to Create an LLC in Virginia:

- Step 1: Choose a Name for Your New LLC

- Step 2: Appoint a Registered Agent (Agent for Service of Process)

- Step 3: File the Articles of Organization

- Step 4: Obtain an EIN (Employer Identification Number) from the IRS

- Step 5: Prepare an LLC Operating Agreement

- Step 6: Open a Business Bank Account

Need to save time? Hire Northwest to form your LLC.

Step 1. Choose a Name for Your New LLC

Choosing a name for your LLC is an exciting new step for forming a business entity. It can also be frustrating if the name you want to use isn't available.

The Virginia State Corporation Commission (SCC) requires business entity names to be different from existing businesses.

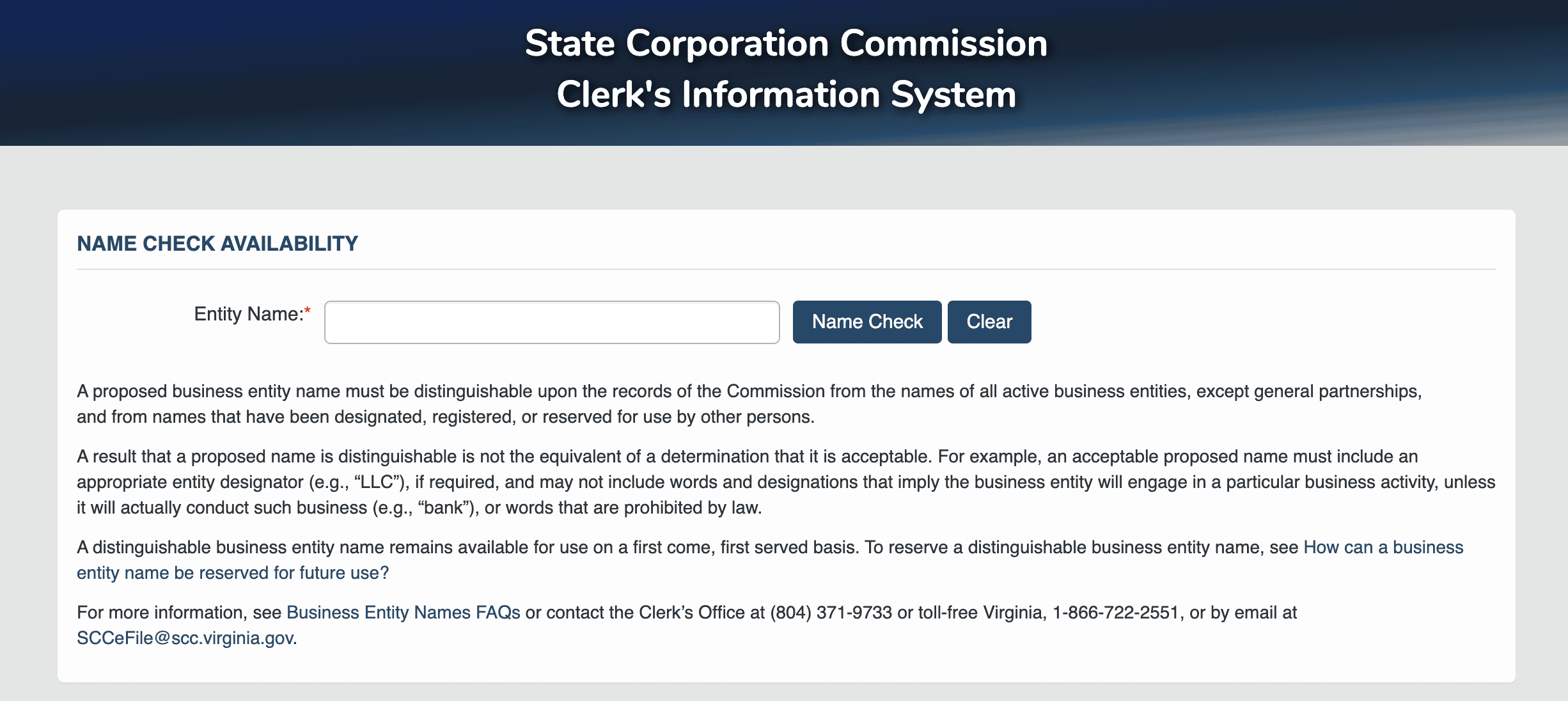

You can check if the name you want to use is available using the SCC's name search tool:

Beyond being unique from other registered companies, your business entity name must include:

- “Limited Liability Company”

- “Limited Company”

- or some variation of the “LLC” or “L.L.C.” abbreviation.

The LLC name must also not be misleading, like including “CPA” in the business name if a CPA doesn’t own the business. Words like “federal” or “reserve” or “United States” may not be used in businesses that operate in banking or insurance.

If your intended LLC name is available, you can reserve it (optional) for 120 days with the Virginia State Corporation Commission. The name reservation fee in Virginia is $10 — very affordable.

Some business owners like to form their LLC under one name and operate under another. For example, a lawn care company may register with the Virginia SCC as “Lawncare Unlimited LLC.” That same company can advertise the business as “Ace Lawn Care.” It’s allowed so long as the owner files a fictitious name (DBA certificate) with the SCC. Again, the state fee is just $10. You won't break the bank if you need to register several brand names for your LLC.

You can renew your name reservation for another 120 days as long as you do so within 45 days of the first reservation's expiration date.

Step 2. Appoint a Registered Agent (Agent for Service of Process)

Any LLC formed in Virginia must select a registered agent for service of process.

The purpose of a registered agent is to receive legal documents for your company. For example, your registered agent will receive annual report reminders for your company. The designated point of contact must have a valid street address in Virginia as P.O. boxes are not accepted.

Some LLC owners opt to serve as their own registered agents. While a registered agent service involves a fee, it offers benefits such as privacy, flexibility, and guaranteed availability—advantages that can be crucial for new business owners.

If you don't want to be your own registered agent, you can hire one for about $100-$250/year in Virginia.

It's not necessary to designate your registered agent immediately; this requirement only comes into play when you proceed to the next step: filing the Articles of Organization.

Step 3. File the Articles of Organization

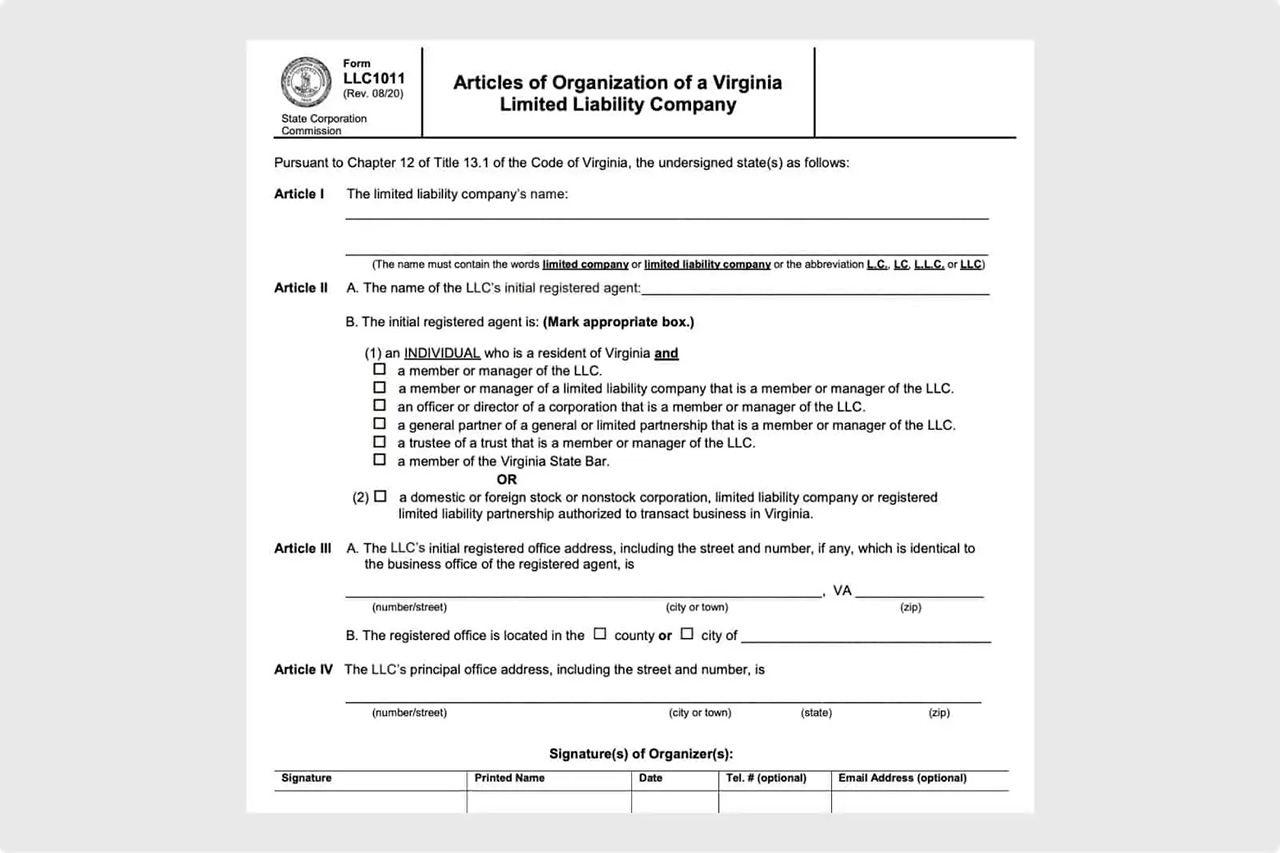

Articles of Organization filing is the core step of forming an LLC. This document signals new company creation to the state.

The Articles of Organization can be filed online (where you first need to create an account) or in person at the State Corporation Commission in Richmond, VA.

The filing fee is $100.

When filling out the form, be prepared to provide the following information:

- The limited liability company's name

- The name and address of the registered agent

- The principal office address

- Signature of all owners

It usually takes up to four weeks to process your LLC filing documents, or sooner for expedited service. Expedited service fees in Virginia are as follows:

- Next-day processing: $100 (if submitted by 2:00 PM EST)

- Same-day processing: $200 (if submitted by 10:00 AM EST)

Steps to Filing

Online Filing:

- Visit the Virginia State Corporation Commission's (SCC) Clerk's Information System (CIS) at https://cis.scc.virginia.gov.

- Create an account or log in if you already have one.

- Follow the prompts to submit your Articles of Organization online.

Mail Filing:

- Download the Articles of Organization form (Form LLC1011) from the SCC's website.

- Complete the form with the required information.

- Prepare a check or money order for $100, payable to the “State Corporation Commission.”

- Mail the completed form and payment to:

State Corporation Commission

Clerk’s Office

P.O. Box 1197

Richmond, VA 23218-1197

Foreign LLC in Virginia

LLCs formed in other states that wish to transact business in Virginia are considered foreign LLCs. Foreign LLCs must also provide formation documents, obtain a certificate of authority, and pay a $100 filing fee to the SCC clerk's office.

Step 4. Obtain an EIN (Employer Identification Number) from the IRS

An Employer Identification Number or EIN is a 9-digit number issued by the IRS that uniquely identifies your business – similar to a social security number. You can use your EIN when providing Form W-9s to clients, when opening a business checking account, or when you apply for a business loan or credit card.

LLCs that have more than two members are required to have an EIN for federal tax reporting purposes. Also, if you plan to have employees, an EIN is required for tracking and reporting on your hiring and payroll activities. EINs are required for every business type. It’s essential for companies with employees because an EIN is required to withhold taxes on employee wages and file employment or excise taxes.

Business owners of domestic firms can apply only for their EINs. They are available to use immediately after submitting the application. When applying for your EIN, you must select a tax classification such as sole proprietorship, S-corp, or C-corp. In this way, you tell the IRS how you want your LLC to be taxed.

Tax classifications for LLCs

A single-member LLC is not recognized as a taxable entity by the Internal Revenue Service. This business structure will be taxed similarly to a sole proprietor, where the profits and losses are included on the business owner's personal tax return.

Thus, you don’t need to file any additional tax forms. Gains and losses from the business are included in the business owner's personal tax return. If you choose to have your LLC taxed as an S-corporation, you must do so in advance. The intended S-corp must apply for this status by completing IRS Form 2553 within 2 months and 15 days of the start of the tax year. Owners will complete a tax return on Form 1120S, and each owner will receive a Schedule K-1 form.

The K-1 reports each business owner's share of income, credits, and deductions, which will be included on each owner's personal tax return. S-corporation election reduces the amount of self-employment tax that owners would pay if they choose the default tax classification set by the IRS.

Some business owners don’t favor a C-corporation because of double taxation – business profits are taxed at corporate rates and again as distributions when at individual shareholders’ rates. Choosing a business structure involves many factors like tax strategy, personal asset protection, and the number of owners.

An LLC is an entity separate from its owner. This arrangement implies that your LLC isn’t truly a separate entity. Commingling can cause you to lose the personal asset protection that entices many people to form an LLC. If your business is sued and you’re found to be commingling, your personal assets could be in jeopardy.

Another best practice is to file your business taxes using your EIN instead of your social security number. It helps ensure that you don’t violate the rules that LLC members must follow.

Note: Every Virginia LLC must pay an annual registration fee of $50, which is due by the last day of the LLC's anniversary month each year. If the payment is late, a $25 penalty applies.

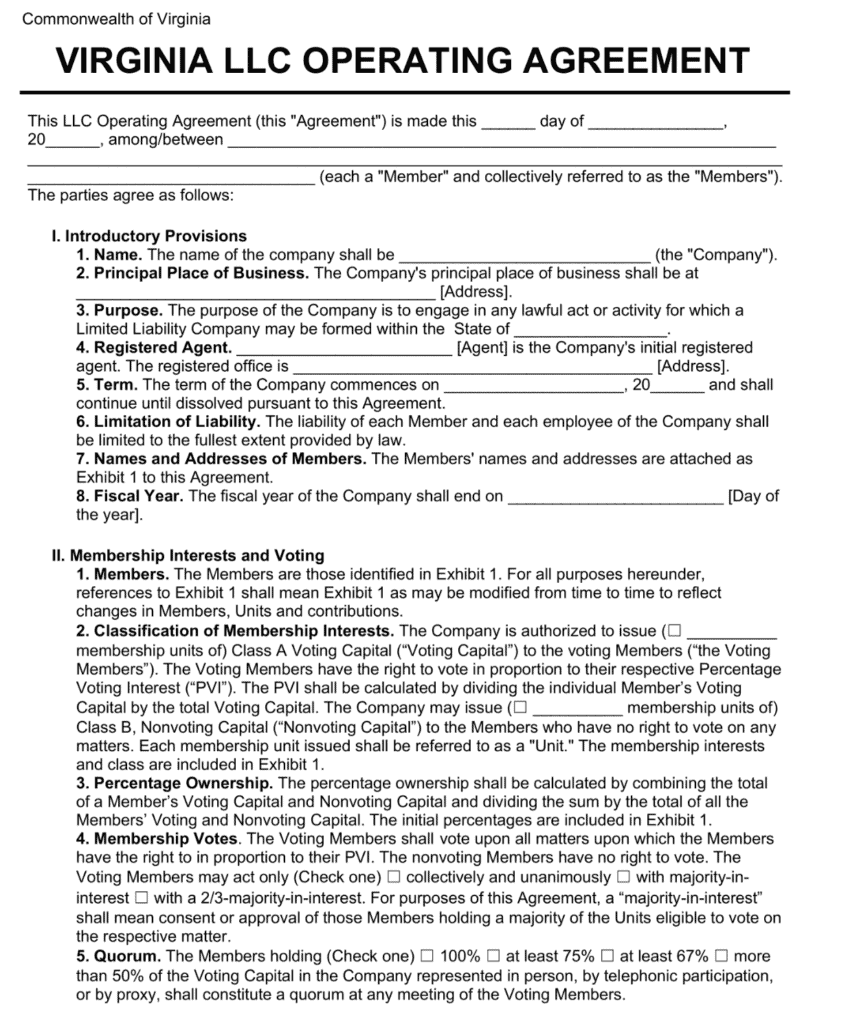

Step 5. Prepare an LLC Operating Agreement

It's important not to confuse the Articles of Organization and Operating Agreement. Filing the Articles of Organization with the State Corporation Commission (SCC) officially creates your LLC.

The Operating Agreement doesn't have to be filed with the SCC but is still recommended to prepare one.

This document indicates who the business owners are, how the company will be operated, and how the profit distribution will happen. The operating agreement should be signed by all members and updated as the business evolves.

There are many templates online for members to use as a starting point for creating an operating agreement. You can also hire an attorney to prepare an operating agreement on behalf of your LLC.

Step 6: Open a Business Bank Account

While not required by Virginia law, it’s recommended for your LLC to have a separate business bank account. The purpose of this is so that you can:

- Track your business spending.

- Ensure you don't mix business and personal transactions.

One of the limited liability company law requirements is not to commingle or mix your business and personal transactions. Doing so can create personal liability for violating the rules of an LLC.

For example, you should not pay for business items out of your personal checking account or vice versa. That implies that your LLC isn’t truly a separate entity. If you’re commingling funds and you get sued, you could lose the added asset protection that an LLC provides, and your personal assets could be at risk of loss in a lawsuit.

Using your EIN to file your business tax returns ensures that your business finances are separated from your personal finances and that you don’t violate the rules that LLC members must follow.