Thinking about starting a limited liability company (LLC) in Ohio?

Then you’re likely wondering what steps are needed to set up this business structure.

Forming an LLC involves submitting formation documents to the Ohio Secretary of State (SOS), along with securing the necessary business licenses and permits, which vary depending on your business type. You’ll also need to designate a registered agent and handle essential tax registrations with the IRS and state authorities.

If that feels like a lot to manage, don’t worry—we’ll walk you through the entire process step by step.

Steps to Create an LLC in Ohio:

- Step 1: Choose a Name for Your Ohio LLC

- Step 2: Appoint a Registered (Statutory) Agent

- Step 3: File for Articles of Organization with Ohio Secretary of State

- Step 4: Get an Employer Identification Number from the IRS

- Step 5: Register with Ohio State Tax Authorities

- Step 6: Create an LLC Operating Agreement

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Choose a Name for Your Ohio LLC

Selecting a business name for your Ohio LLC is the first step towards forming the entity.

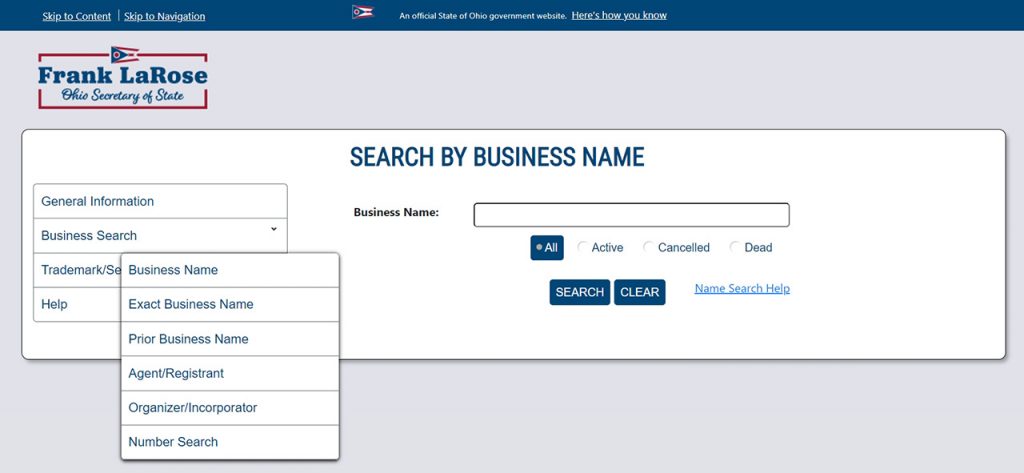

Brainstorm for a unique, brandable name. Once you have several combinations, run a business name search on the Ohio Secretary of State website to verify that no other registered business uses a similar name:

Legal LLC names in Ohio must be unique and distinguishable from other registered business names with the state.

Also, don’t forget about adding a designation. For example, LLCs need the designation LLC, Limited Liability Company, or some other acceptable variation at the end of the business name. In addition, the names of legal companies must not:

- Use slurs

- Include or suggest profanity

- Appear similar to a government entity’s name

Once you have found a name you like that's available for your LLC, you might want to reserve it while completing other company formation documents. However, this is entirely optional, as you can simply register your LLC name in Step 3.

If you still choose to reserve the name, the cost is $39 and the name will be reserved for 180 days.

Step 2: Appoint a Registered (Statutory) Agent

Before filing the Articles of Organization with the Ohio Secretary of State, you need to designate a registered agent in Ohio (referred to as a statutory agent in the state).

You statutory agent's name and address must be included when you file your Articles of Operation.

All business entities in Ohio must have a statutory agent to receive service of process or other hand-delivered legal documents on behalf of your business entity.

Here’s who can act as a statutory agent in Ohio:

- A natural person with permanent residence in the state and a registered street address, not a P.O. Box.

- A domestic or foreign corporation, nonprofit corporation, limited liability company, partnership, limited partnership, limited liability partnership, limited partnership association, professional association, business trust, or unincorporated nonprofit association with a business address in this state.

- If the agent is a business entity, then the agent must meet the requirements of Title XVII of the Revised Code to transact business or exercise privileges in Ohio.

In other words, you have three options — act as a statutory agent yourself, designate an employee, or hire a professional registered agent service for about $100 to $350 year in Ohio.

You don’t have to make the above decision immediately. You can list yourself as a statutory agent at first, then “upgrade” to a professional service (if needed).

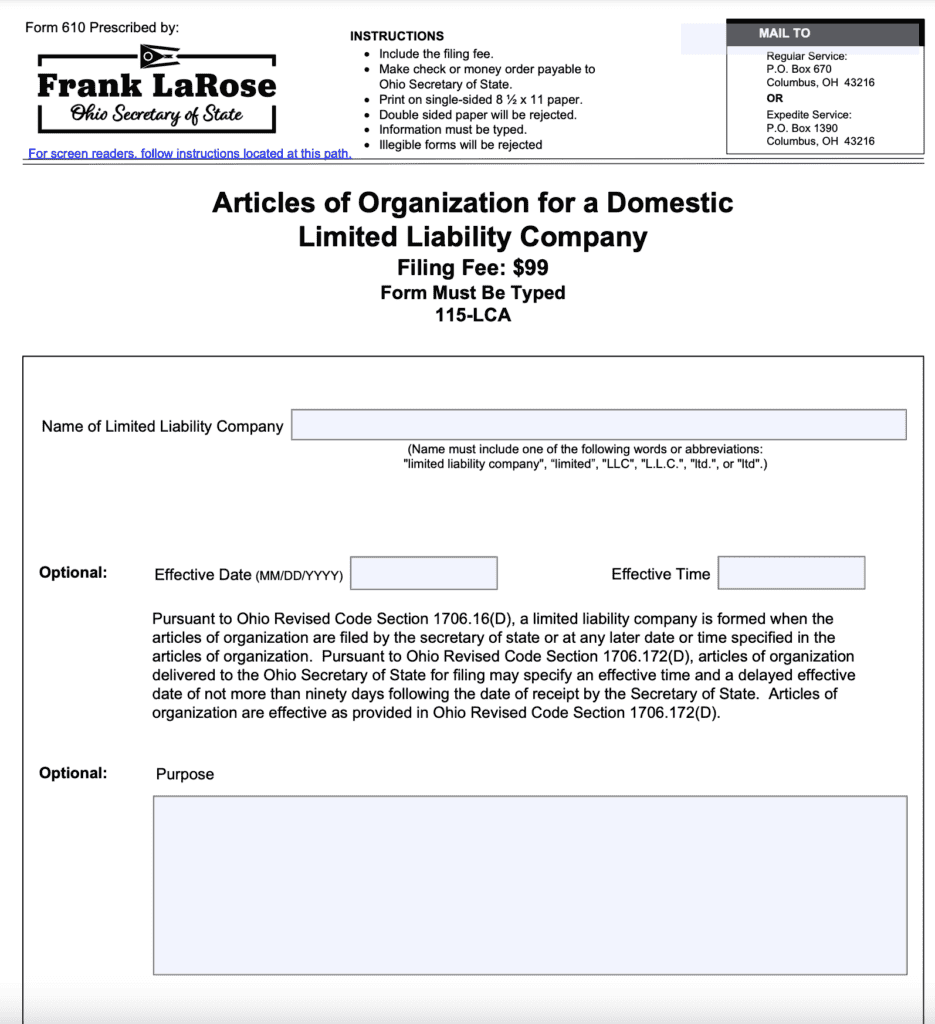

Step 3: File Articles of Organization with the Ohio Secretary of State

Articles of organization signal company formation to the state.

It’s the main document you need to form an LLC in Ohio.

Per Ohio Revised Limited Liability Company Act Section 1706.16, you’ll need to provide the following information to the SOS:

- The business name of the LLC

- Statutory agent name and address

- Period of duration (with some exceptions)

- Provisions of the operating agreement, if needed (such as when they differ from the articles of organization)

To file for articles of organization, download and fill in the state form 610 to mail it or hand it in personally during an appointment. Or use the online portal (the Ohio business gateway) to register an LLC online.

However, you can speed up Ohio LLC registration by paying expedited fees:

- $100 for 2-day processing

- $200 for 1-day processing

- $300 for 4-hour processing (if delivered by 1:00 p.m.)

Both foreign limited liability companies and domestic limited liability companies can find the applicable forms for submitting their formation documents, along with the filing fees, via the Ohio Secretary of State's webpage on Filing Forms and Fee Schedule.

Step 4: Get an EIN (Employer Identification Number) from the IRS

Ohio LLCs need an Employer Identification Number (EIN) for identification on tax filings. Additionally, you need an EIN to pay employment taxes and open a business bank account.

Your LLC can get an EIN by submitting an application at IRS. Applying for an EIN with the IRS is a free service.

Step 5: Register with Ohio State Tax Authorities

Your Ohio LLC will also need to register with the Ohio Department of Taxation to pay state taxes when applicable.

In particular, your company may be subject to the following type of taxation:

- Employee taxes for Ohio LLCs with at least one employee, which includes FICA and unemployment taxes

- Sales taxes if your LLC sells goods in Ohio

- A commercial activity tax (CAT) if your LLC has taxable income of $150,000 or more in a calendar year

Business owners can find information regarding Ohio taxes, including registration and filing requirements and filing due dates, on Ohio’s Department of Taxation website.

Step 6: Create an LLC Operating Agreement

Ohio LLCs are not required to file an LLC operating agreement with the state of Ohio. However, it’s recommended to have one for multi-member LLCs.

An operating agreement outlines your LLC’s managerial policies and procedures and sets forth the responsibilities of each LLC member.

This document creates a “checks and balances” system within your company and helps ensure that each member knows their position and decision-making capacity.

Further Steps

Maintaining a separate business bank account for your LLC is an excellent legal and accounting practice.

First of all, comingling personal spending with business assets can result in the loss of personal liability protection your LLC extends to you. Secondly, comingled finances are an accounting nightmare and can result in misreporting.

Be sure to register a business bank account for your LLC early on. As a small business, you may prefer to go with a local Ohio bank. Also, you may want to open an account with your current bank to negotiate lower account fees.

In Ohio, domestic limited liability companies (LLCs) are not required to file annual reports with the Secretary of State. This is a notable advantage for LLCs operating in Ohio, as it reduces ongoing administrative obligations and associated costs.

Ohio Income and Sales Tax Rates:

Ohio's highest personal income tax rate is 3.99%. Ohio also has a sales tax rate of 5.75% with a maximum combined state and county sales tax of 7.5%.