Planning to start an LLC in Minnesota? It’s a great place to set up your business.

Minnesota provides strong support for small businesses and offers several financial benefits to help you succeed, including angel investor groups that can provide extra funding beyond regular SBA loans. Plus, investors can enjoy a 25% tax credit. As with any LLC, you’ll also benefit from personal asset protection and straightforward tax rules.

This simple guide will walk you through the steps to start your LLC in Minnesota and get your business up and running:

Steps to Create an LLC in Minnesota:

- Step 1: Name Your LLC

- Step 2: Appoint a Registered Agent

- Step 3: File the Articles of Organization with Minnesota

- Step 4: Get an Employer Identification Number (EIN) from the IRS

- Step 5: Register with the Minnesota Department of Revenue

- Step 6: Create an LLC operating agreement

- Costs to Set Up an LLC in Minnesota

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Name Your LLC

A great starting point is deciding on your LLC’s name. Minnesota's LLC naming requirements are pretty lenient.

Your company name must be different from other businesses, and cannot contain special characters — only letters or numbers.

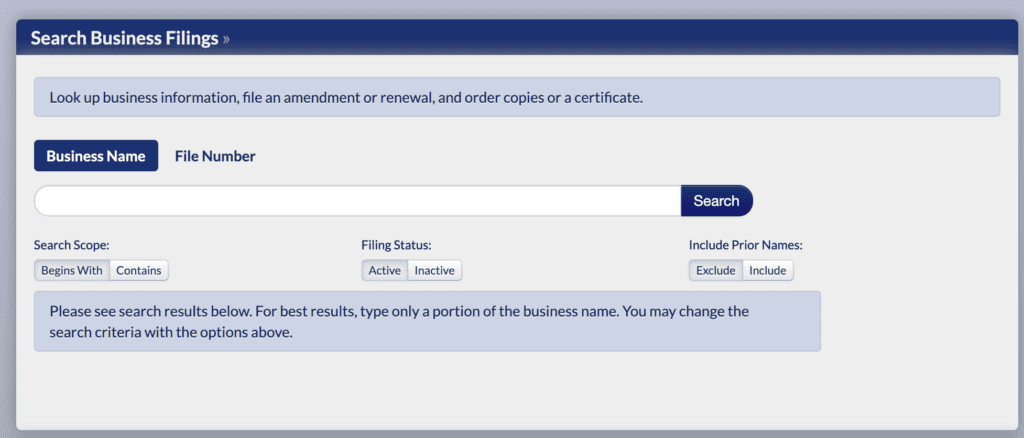

Use the business search tool from the Minnesota Secretary of State to see if the name you want is available:

Reserving your name (optional)

Maybe you aren’t ready to launch your LLC in Minnesota quite yet, but you found an available name that you want. You can reserve the name for up to 12 months. You can file:

- Online or in person for $55 (includes expedited service fee)

- By mail for $35 (longer processing time)

You can extend the reservation for another 12 months if needed.

Assumed name (optional)

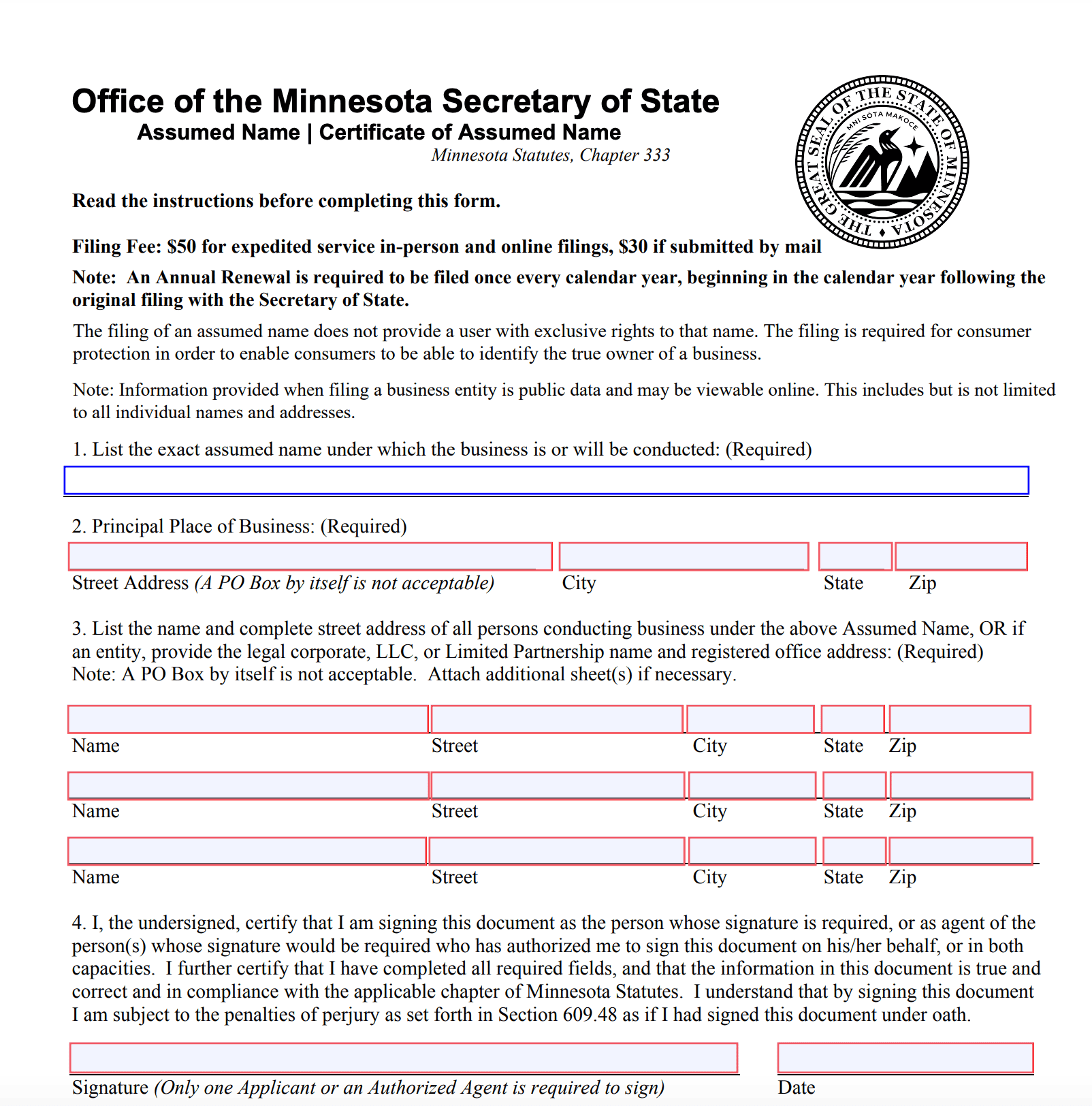

You might want to consider using an assumed name to gain flexibility with branding. This common tool is also called a doing-business-as (DBA) name or trade name. For example, “Bob Enterprises LLC” could use “Bob’s Burgers” as an assumed name to operate under. Customers will know exactly what you’re selling.

You can also operate several branches under different names, all owned by one LLC.

To use an assumed name, file the assumed name form. There’s a $30 fee for mailed-in submissions or $50 for online applications. You must also publish your “Certificate of Assumed Name” in at least 2 local newspapers. You must renew DBAs every calendar year.

There’s no fee as long as your company remains in good standing. If you don’t renew on time, you can reinstate an assumed name by filing the current year's renewal and paying a $45 fee for online or in-person filings. It’s $25 for mailed-in documents.

Step 2: Appoint a Registered Agent

Your Minnesota LLC must have a registered agent.

You need to appoint a registered agent to receive legal documents on behalf of your company. This can include court summons, tax notices, or other essential correspondence.

All Minnesota LLC registered agents must be 18+ years old and have a physical address in Minnesota. P.O. Boxes are not accepted. The agent must be available during standard business hours.

You can act as a registered agent yourself. It can save some money up front, but there are some downsides:

- It lacks privacy and increases junk mail because your address becomes public information

- It’s hard to take time off or travel since you need to be around during business hours

- You could receive a lawsuit notice in front of customers

In case you don't want to be your own registered agent, you can hire one for about $99-$199/year in Minnesota.

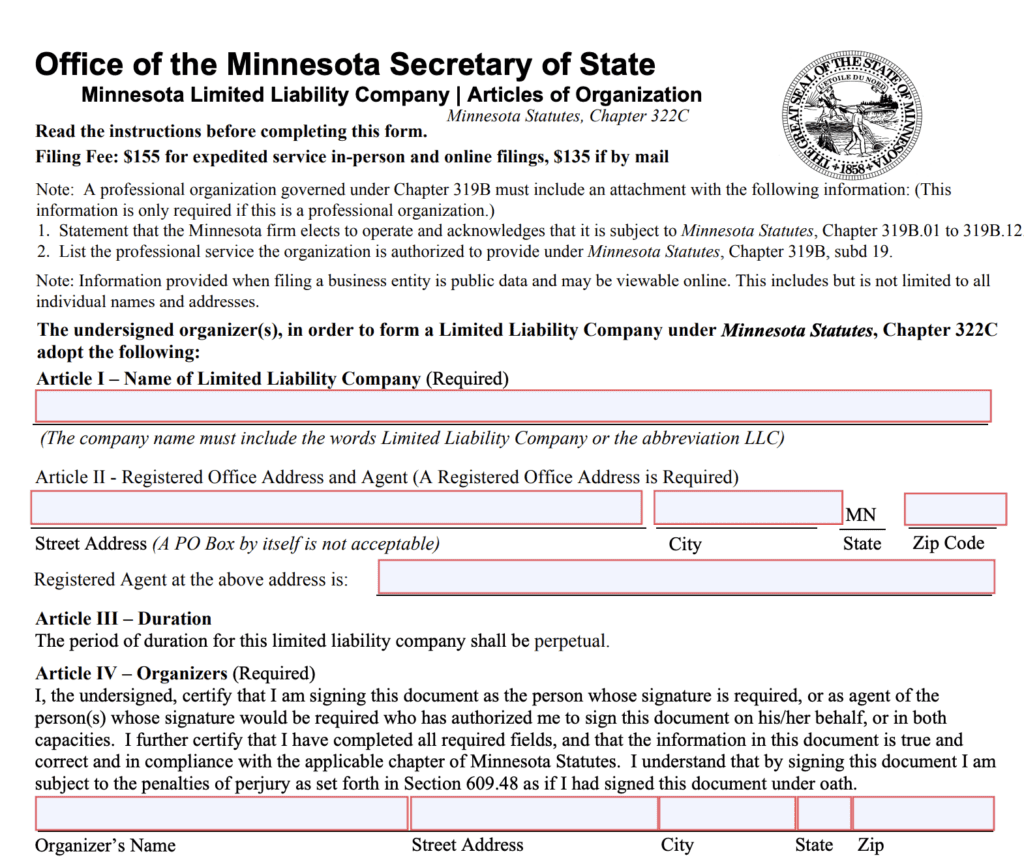

Step 3: File the Articles of Organization with Minnesota

Filing the articles of organization officially creates your Minnesota LLC. Your new business will take its first breath after this form is processed.

On the Minnesota filing form, you provide:

- LLC members' (owners) details

- Registered agent information

- Primary type(s) of business activity

- Number of employees (if any)

- Contact information

The cost of filing Minnesota articles of organization is $155 online (account required) or in-person, or $135 by mail.

Electronic and in-person submissions are usually processed in 1-2 business days. The review process for mailed-in documents can take longer (1-2 weeks).

Registering a foreign LLC in Minnesota

If you have an LLC from another state and want to operate in Minnesota, you can register as a foreign LLC.

The process is similar. Fill in the state form called the Certificate of Authority to Transact Business in MN (LLC).

Filing Fees for Foreign LLCs:

- Online or In-Person: $205

- By Mail: $185

Note: Foreign LLCs must also provide a Certificate of Good Standing from their home state, which may involve additional costs.

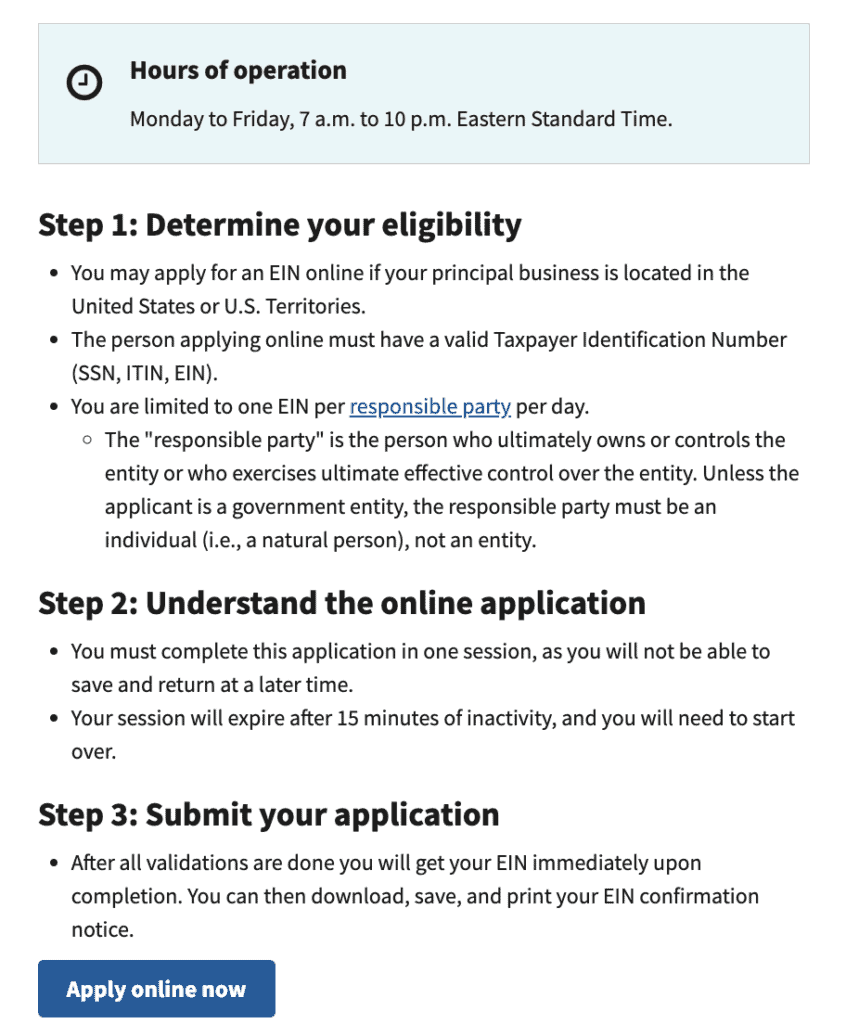

Step 4: Get an Employer Identification Number (EIN)

An Employer Identification Number (EIN) is required for federal tax purposes. The IRS uses them to track your tax information.

All multi-member LLCs must obtain this number from the IRS.

Some single-member LLCs without employees don’t need an EIN. They can use the owner’s Social Security number instead. But many choose to get one anyway as they’re needed for things like a business bank account.

The best way to get an EIN is through the IRS’s online application. This part of the Minnesota LLC formation process is free.

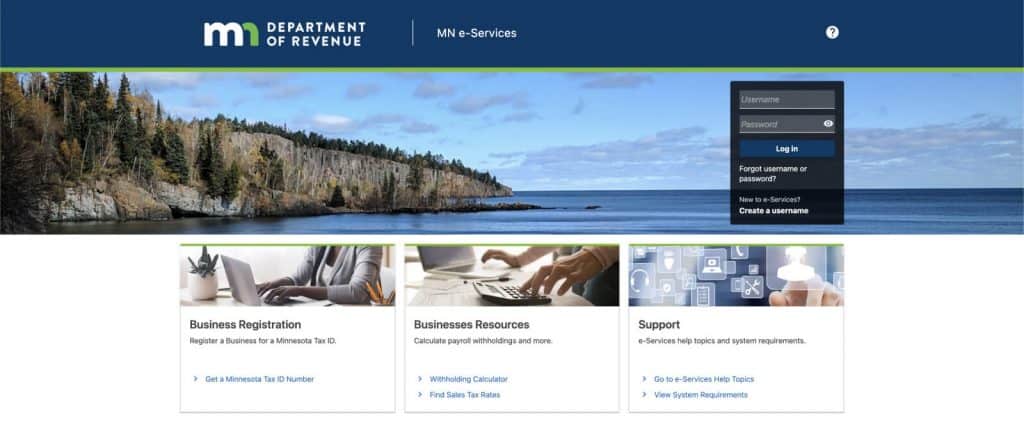

Step 5: Register with the Minnesota Department of Revenue

You also will need to register with the Minnesota Department of Revenue if your Minnesota LLC:

- Sells taxable goods or services

- Files tax returns as an S-corporation or partnership

- Has any in-state employees (so you can pay withholding)

If you fall into any of these categories, you need a Minnesota tax ID. You’ll file your state taxes using this 7-digit number.

The online tax ID application process is simple.

Step 6: Create an LLC operating agreement

Minnesota LLCs aren’t required to have an operating agreement, but it’s best practice to have one. They are very important for any multi-member LLC.

An operating agreement lays out how the business functions and handles many situations. Without one, your LLC will use Minnesota law to resolve disputes.

Experienced entrepreneurs use operating agreements to protect their interests. A well-drafted one covers details like:

- Ownership percentages and contributions

- Rights and duties of members and managers

- Distribution of profits or losses

- Ways to add or remove members

- How to end the LLC

You can create your own operating agreement using free or low-cost online templates. Having one drafted by an attorney can help protect you from issues you may not have considered.

Costs to set up an LLC in Minnesota

- Articles of Organization Form: Online/in-person: $155; Mail-ins: $135

Note: This is the only mandatory cost for starting an LLC in Minnesota.

Optional fees

- Reserving a Business Name: Online/in-person: $55; Mail-ins: $35

- Obtaining a DBA: Online/in-person: $50; Mail-ins: $30

- Registered Agent Fee: Free (act as your own), or hire a registered agent service for $99-$199 per year

- Operating Agreement: Free/low-cost templates or hire an attorney to draft one: $1,000 or more

Further Steps

At this point, you’ve formed a Minnesota LLC and are nearly ready to start operating. There are a few final details to wrap up first.

Open a Business Bank Account

Opening a business bank account helps you keep your business and personal finances separate. Failing to do so risks the personal asset protection LLCs usually provide. Depending on the bank, monthly fees can often be waived if you meet certain deposit minimums. Others charge around $25 or less per month.

Note: Business credit cards may come without any monthly costs, but pay attention to the annual fees.

Personal Income and Sales Tax Rates

Minnesota has a state income tax rate ranging from 5.35% to 9.85%. These are subject to annual adjustments. The state sales tax rate is 6.875%. Additionally, local sales taxes may apply.

Licenses and Permits

Depending on your business activities, you may need to get approval from state, city, or county authorities.

The Minnesota eLicensing portal is a great place to start. Then turn to your local needs. For example, you may need a Minneapolis business license. Saint Paul offers a similar list of licenses and permits.