If you're considering starting a business in Illinois, forming an LLC is a smart choice.

Starting an LLC in Illinois provides robust protection for your personal assets, shielding them from potential business liabilities. If your Illinois LLC faces a lawsuit, only its assets—not your personal ones—are at risk.

Additionally, an Illinois LLC provides flexibility for tax reporting, often making it a more efficient option for business owners. And that's not all—an LLC sets the stage for future growth and scalability.

Ready to create your own LLC? Here's a step-by-step guide to registering your LLC in Illinois.

Steps to Get an LLC in Illinois:

- Step 1: Choose a name for your Illinois LLC

- Step 2: Appoint a registered agent

- Step 3: File the Illinois LLC Articles of Organization

- Step 4: Prepare an LLC operating agreement

- Step 5: Get an Employer Identification Number (EIN)

- Costs to set up an LLC in Illinois

- Other

Need to save time? Hire Northwest to form your LLC.

Step 1: Choose a name for your Illinois LLC

Thought of the perfect name for your soon-to-be LLC? Great! But first you’ll need to make sure it meets Illinois legal requirements too.

According to Illinois naming guidelines, every LLC name must:

- Be unique and distinguishable from existing businesses

- Include Limited Liability Company, L.L.C., or LLC

- Avoid words related to other business structures, like Corporation or Limited Partnership

- Only use terms related to regulated fields like banking or insurance if authorized

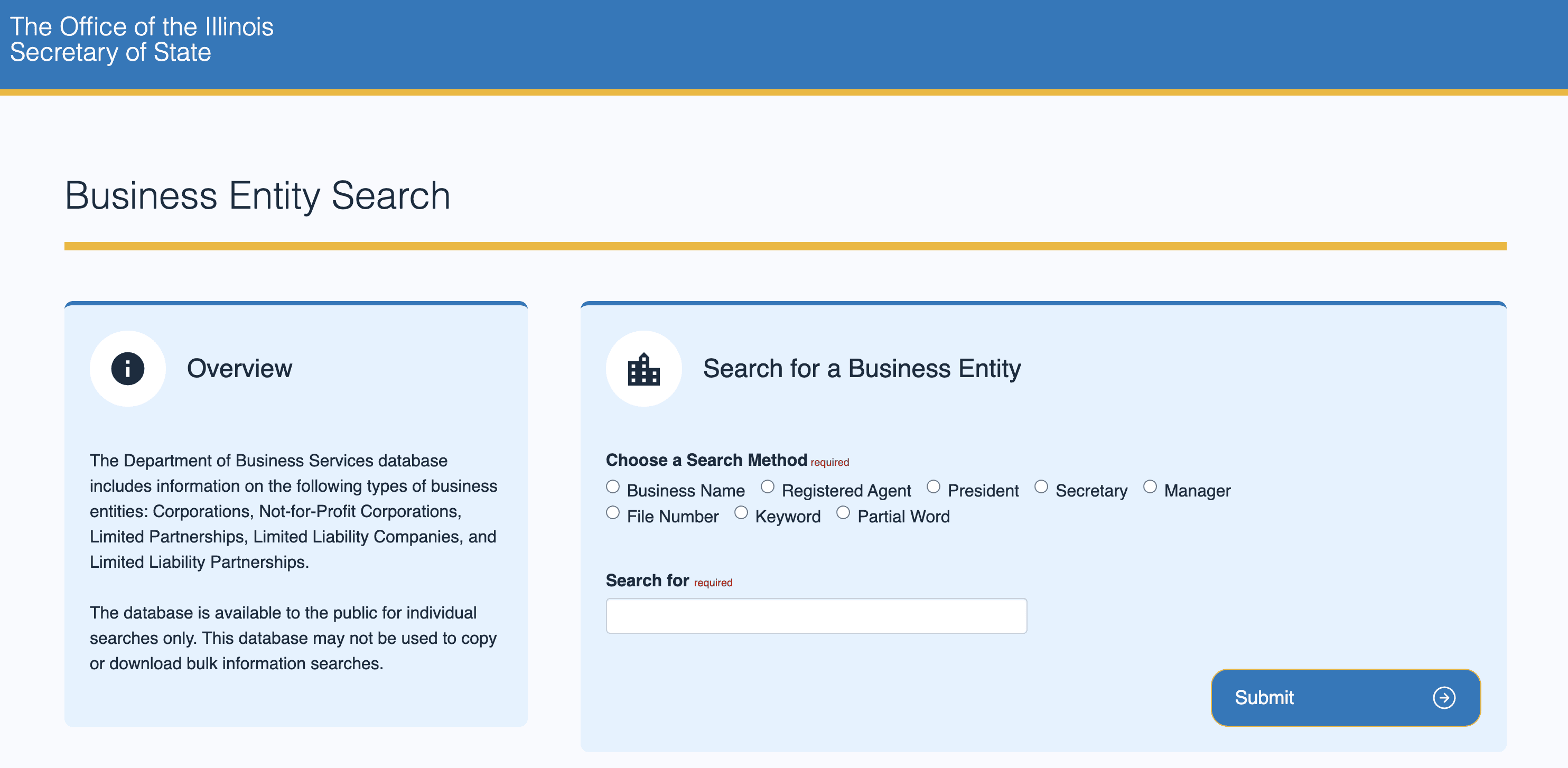

Once you find a name you think works, go to the Illinois Secretary of State (SOS) website to see what’s already in use:

It’s best to avoid anything that would cause confusion with existing businesses.

For $25, you can file an Application to Reserve a Name to hold it for 90 days (optional). This stops anyone from taking your reserved name while you prepare the rest of your formation documents. It’s also wise to avoid interfering with registered brand names and trademarks. Review the U.S. Patent and Trademark Office database or consult with an attorney to avoid lawsuits.

You can always apply for a doing business as (DBA) name later on (optional). This lets you operate under a name different from the LLC’s legal name.

Step 2: Appoint a registered agent

Every LLC needs a registered agent. It serves as the main contact and receives important documents such as legal notices and tax information.

Any Illinois registered agent must:

- Have a physical street address (not a P.O. Box) in Illinois

- Be available during business hours all working days of the year

- Sort through junk mail without missing critical notices

A registered agent handles legal documents for your LLC, forwards them to you, and keeps your personal address off public records.

They also remind you about state filing deadlines to help keep your business compliant.

If you don't want to be your own registered agent, you can hire one for about $99-$175/year in Illinois.

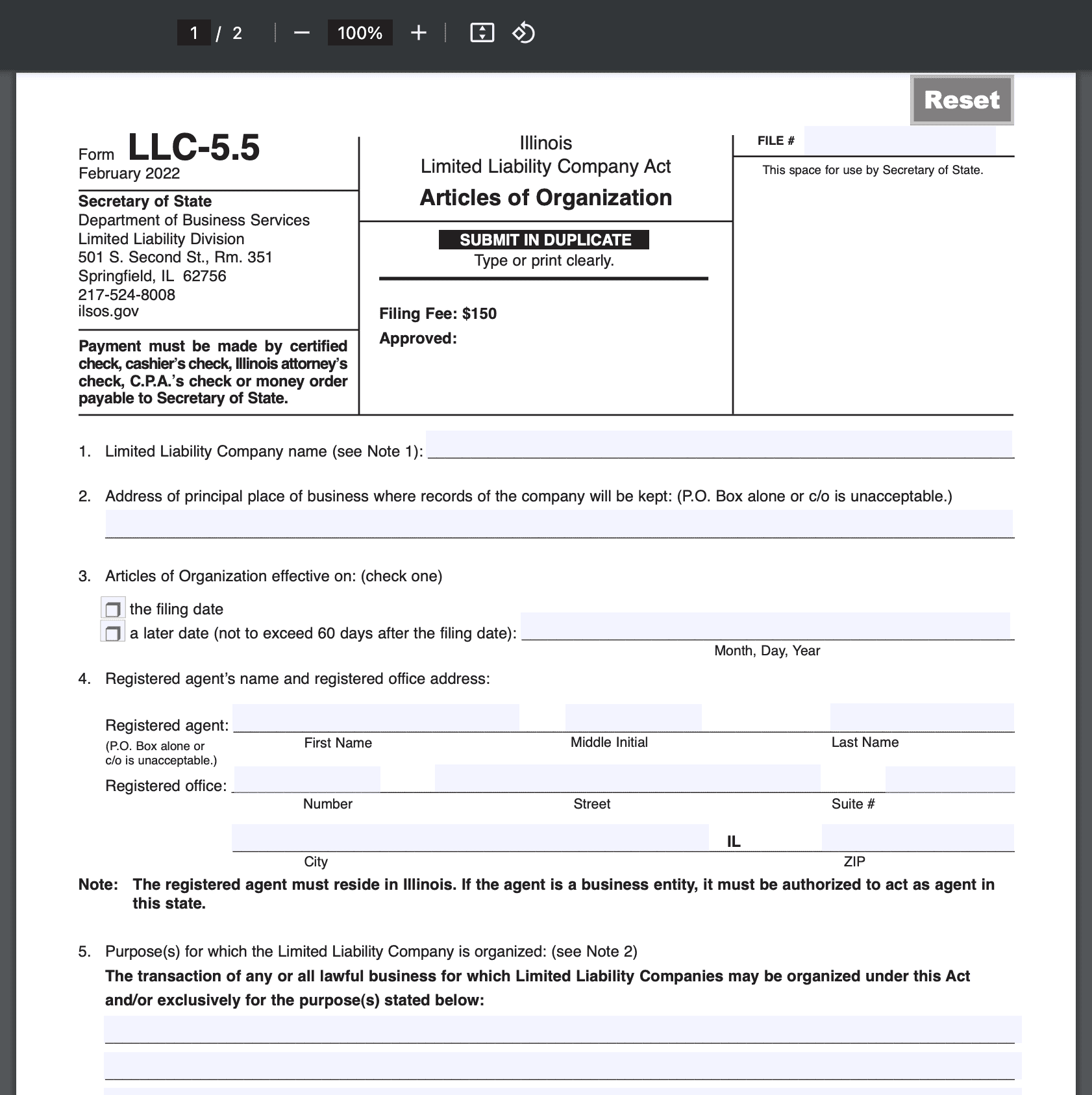

Step 3: File the Illinois LLC Articles of Organization

It’s time for one of the most exciting parts of forming an LLC.

Filing the Articles of Organization with the the Illinois Secretary of State will transform your idea into a legal entity (LLC)

The application requires:

- The LLC’s name, address, and purpose

- The registered agent’s contact information

- Manager contact information

- Organizer signature and contact information

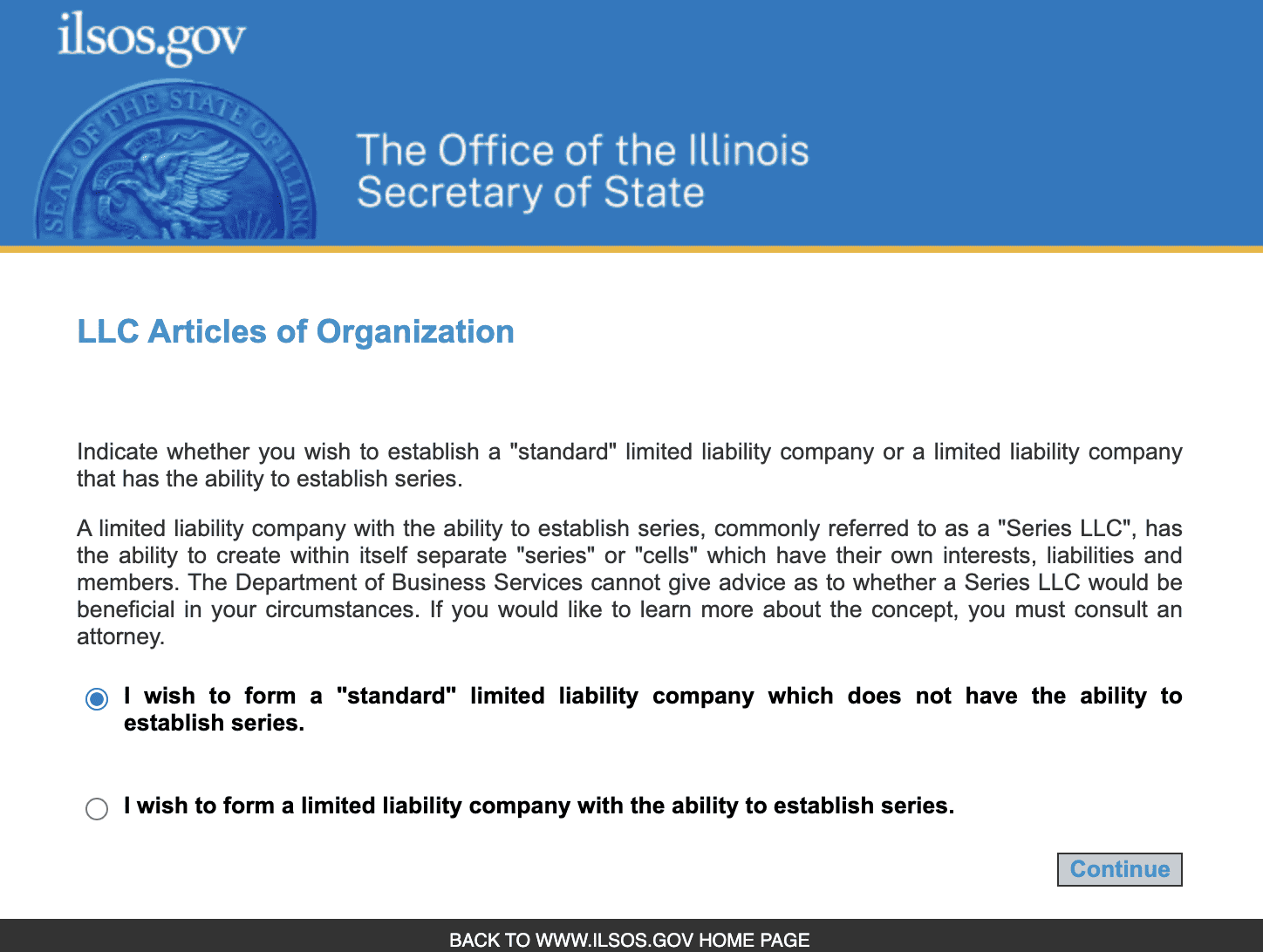

You can handle the process through the SOS’s online services. Or you can use a paper application to file the documents in person or by mail.

The online process asks if you want to establish a standard LLC or a series LLC. It’s recommended you consult with an attorney if you’re planning to establish a series LLC.

The basic filing fee for your LLC articles of organization is $150. If you want a series LLC, the filing fee is $400. Each additional series within the LLC requires an extra $50 per series. The standard online filing has a 10-day processing time. There’s no official timeline for mail-in filings. You can buy expedited service for an extra $100 fee.

Once processed, get a Certificate of Good Standing from the State of Illinois. It costs $25, and you can immediately print the Certificate of Good Standing after purchasing.

Keep these documents with your company records. You may also need them to open a bank account or receive certain financing offers.

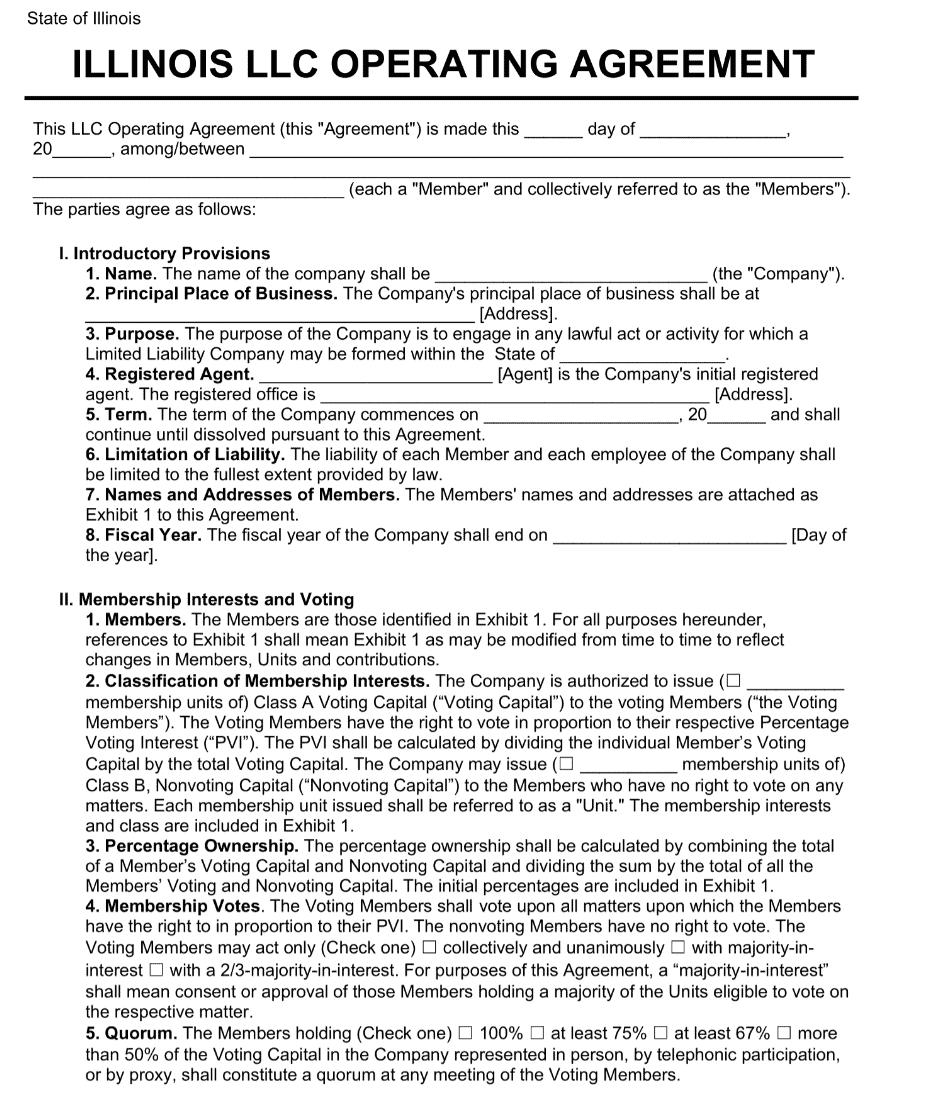

Step 4: Prepare an LLC operating agreement

An operating agreement is a contract between LLC members. It lays out how the business functions and handles many situations.

Even though Illinois doesn’t require one, it’s still a good idea to create one. Operating agreements are critical for multi-member LLCs. It is the first document an attorney will request if a dispute arises.

An LLC operating agreement should include:

- List of LLC members with ownership interests and contributions

- Rights and duties of members and managers

- Allocation of profits and loss

- Procedures for adding and removing members

- How to dissolve the LLC

- Methods for resolving certain disputes

You can create or change the operating agreement at any time over the life of the business. Use a free or low-cost online template to keep it simple. Or consult with an attorney to create a customized agreement but expect to spend $1,000 or more.

Step 5: Get an Employer Identification Number (EIN) and Register with the Illinois Department Of Revenue

Now it’s time to think about tax needs. There are two tax authorities to register with when forming your LLC — the Internal Revenue Service (IRS) for federal needs, and the Illinois Department of Revenue (IDOR) for state ones.

The IRS uses Employer Identification Numbers (EINs) to track business tax information — it's free. Your LLC must get an EIN if it:

- Has more than one member

- Hires any employees

- Has other specific situations that apply

Even if your LLC isn’t required to have an EIN, it’s still best practice to get one.

You can get an EIN online in about 15 minutes with a simple application. The IRS will issue your EIN right after submission.

Furthermore, all businesses operating in Illinois must register with the Illinois Department of Revenue (IDOR). You can complete this application online or file Form Reg-1 via mail or in person. There is no registration fee.

Certain businesses will need to include other schedules or get an IDOR license. This applies to things like alcohol sales and gaming.

Costs to set up an LLC in Illinois

The minimum total cost to create an LLC in Illinois is $150 to file the Articles of Organization.

You will also want a certified Copy of LLC Registration for another $25.

Other optional costs that may be part of forming an LLC in Illinois include:

- $25 to reserve a name

- $99 to $175 per year to hire a registered agent

- $400 to file the Articles of Organization for a series LLC

- $100 for expediting processing

- $0 to $199 or more to create an operating agreement

Further steps

At this point, you can pat yourself on the back and celebrate forming an LLC in Illinois. Before you start operating, there are a few more tasks to knock out.

Open a Business Bank Account

Opening a business bank account is not only helpful for bookkeeping and tax purposes. It’s also an essential tool that maintains your LLC’s legal protections.

A business bank account will keep your personal finances separate from your business. This shows that your LLC is a separate entity. If you don’t do this, you could lose the LLC’s personal liability protection. Your personal assets could be at risk if you get sued.

Many banking institutions offer business checking accounts. Fees range from free to about $25 per month.

Obtain local licenses and permits

Local authorities may also issue business licenses and permits. Many of these depend on the activities your business engages in.

For example, the City of Chicago and City of Aurora offer a range of business licenses. Cook County requires businesses in unincorporated areas to get a business license. Before you start serving customers, make sure your Illinois LLC gets what it needs.

Other

LLCs must file an annual report each year before the first day of their anniversary month. The filing fee is $75.

LLCs taxed as partnerships or corporations must pay a 1.5% PPRT tax on net income.

Insurance is also worth investigating. A workers’ compensation policy is vital if you hire any employees. But most businesses can benefit from a general liability policy. Leveraging the knowledge of seasoned business owners can help catapult your business ahead. Connect with local leaders by joining the Chamber of Commerce.