Looking to get an LLC in California? It’s no surprise that California remains a go-to state for LLC formation, especially for innovative startups in the tech world.

To form an LLC in California, you'll need to complete a series of registration steps with the state and address key operational details for your new business.

But why choose an LLC?

This structure offers personal liability protection — meaning your personal assets are shielded if your business is sued. Additionally, operating as an LLC can enhance your credibility with customers compared to running as a sole proprietorship.

This guide offers step-by-step instructions for completing LLC formation in California and ensuring compliance:

Steps to Create an LLC in California

- Step 1: Name Your New California LLC

- Step 2: Appoint a Registered Agent

- Step 3: Draft and Submit the Articles of Organization

- Step 4: File a Statement of Information

- Step 5: Create an Operating Agreement

- Step 6: Get an Employer Identification Number (EIN)

- Costs to Set Up an LLC in California

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Name Your New California LLC

One of the first things you need is a name for your LLC. While marketing concerns are important, California has guidelines you must follow:

- Include Limited Liability Company, L.L.C., or LLC

- Avoid using words like bank, trust, or insurer, unless authorized

- Be unique and distinguishable from other businesses

You can use some abbreviations such as Ltd. for Limited and Co. for Company. LLCs should not include terms related to other business types. Words like incorporated or corporation can’t be used for LLCs.

Make sure that your selected name isn’t taken by another business. It’s important to respect registered trademarks too.

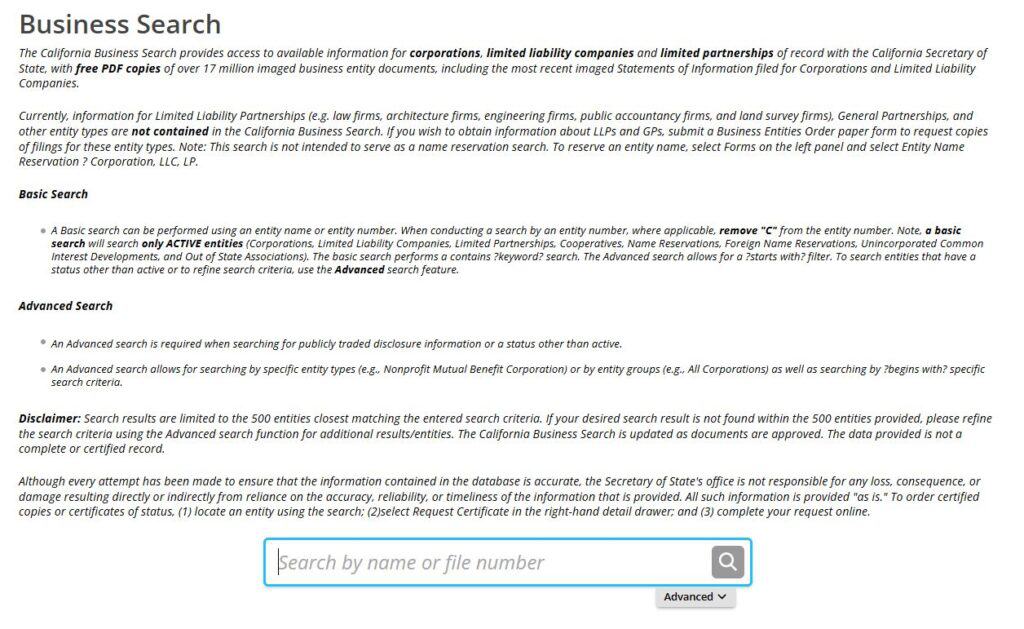

You can search existing business names on the California Secretary of State website:

Also, you can reserve a name to secure your preferred available name while preparing other paperwork. Use the name reservation form and pay a $10 fee to “park it” for 60 days.

This is optional, however.

Step 2: Appoint a Registered Agent

California requires LLCs to appoint a registered agent. This is the legal contact for the business. It receives legal notices and service of process from courts.

You can serve as your own registered agent, appoint an employee, or use a trusted third party.

The registered agent must be at least 18 years old with a physical address, not a P.O. Box. There are no extra fees for designating a registered agent.

Many experienced business owners hire a professional registered agent service. By hiring a service, you can focus on your business. It saves you time and comes with many benefits, such as:

- Your address doesn’t become public information, helping you maintain more privacy

- You don’t have to worry about being available during business hours, something registered agents must do

- You can avoid being served with a lawsuit in front of customers

- The service will sort through junk mail and notify you of important documents

If you don't want to be your own registered agent, you can hire one for about $50-$175/year in California.

Step 3: Draft and Submit the Articles of Organization

The articles of organization is the document that forms a California LLC. It’s a thrilling step that turns your business idea into an actual legal entity.

To get this document, you’ll need to file Form LLC-1 with the California Secretary of State. Many people think an attorney must complete this for them. But the form only includes basic information:

- LLC’s name

- Business address

- Registered agent information

- Management type

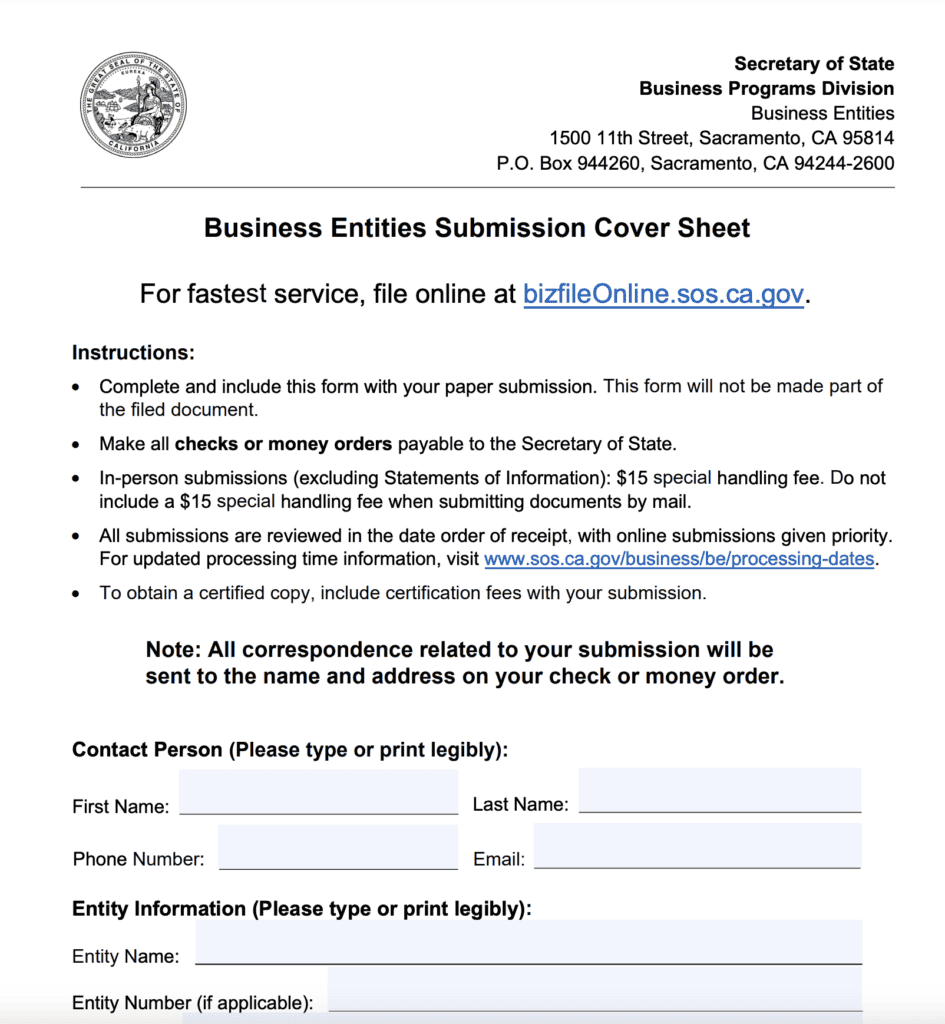

You can file your articles of organization online, by mail, or in person.

The fee is $70 for online and mail filings. In-person submissions have an extra $15 handling fee ($85 total).

Once the Secretary of State (SOS) approves your LLC, you’ll receive a free copy of your articles by mail. Certified copies cost $5 each. If you are tight on time, you can pay for expedited processing through two different systems. One fast method involves getting preclearance verification and then 4-hour processing. The state fees for preclearance are:

- 10 Day Preclearance: $250

- 5 Day Preclearance: $300

- 72 Hour Preclearance: $400

- 24 Hour Preclearance: $500

After that, you then pay $500 to get 4-hour processing on your approved documents. The other method for fast LLC processing is paying for expedited service. No preclearance required. You can choose between:

- $350 for 24-hour service

- $750 for same-day service

You can always check the current processing times on the SOS website. This page separates filings by the submission type. It can help you figure out if you need to pay for faster processing or not.

Step 4: File a Statement of Information

A Statement of Information is a document like an annual report.

In California, you need to file it within 90 days of registering as an LLC, then repeat the filing every two years.

Much of the information is the same as what was included when filing the articles of organization. It makes sure that California has current information about your LLC.

Simply download Form LLC-12 or file online, pay a $20 filing fee, and you’re good to go.

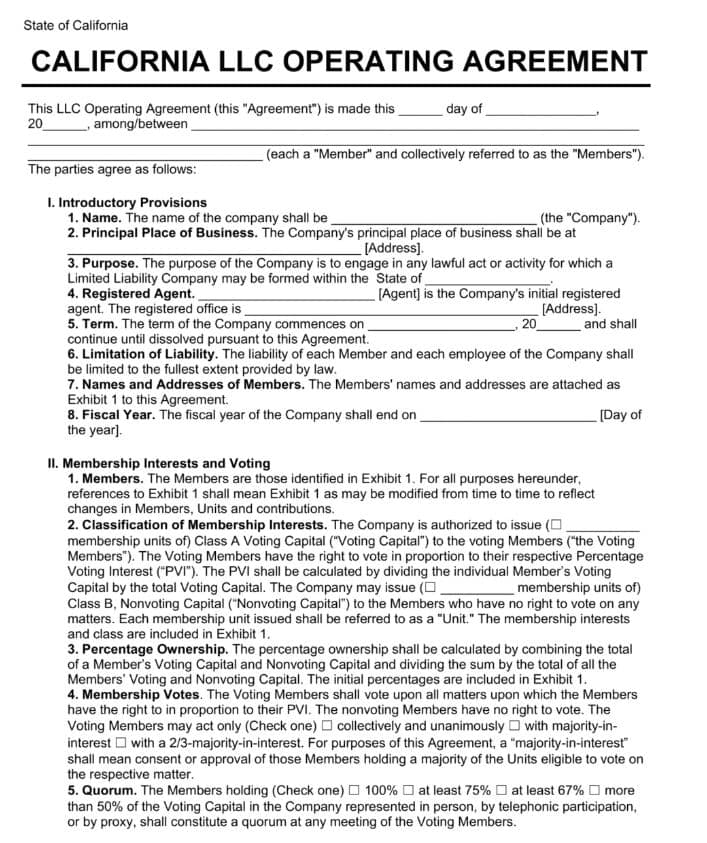

Step 5: Create an Operating Agreement

Operating agreements set forth the rules for a business's internal operations. It’s a formal agreement between you and other LLC members on how the LLC functions and how major decisions are made.

An operating agreement covers how to:

- Distribute profits and losses

- Determine rights and duties

- Add or remove a member

- Dissolve the LLC

- Handle various disputes

All California LLCs (including single-member LLCs) need to have an operating agreement per California Corporation's Code §17050.

You’re not required to file an operating agreement with the California authorities. But you must maintain a written or oral version among your company records. An operating agreement is a binding contract, so it staves off any legal disputes later on. Depending on the size of your business, you can customize a template or consult with an attorney.

Step 6: Get an Employer Identification Number (EIN)

Obtaining an EIN with the IRS is the next step. The IRS uses EINs to track tax information. It’s like a Social Security number for your business.

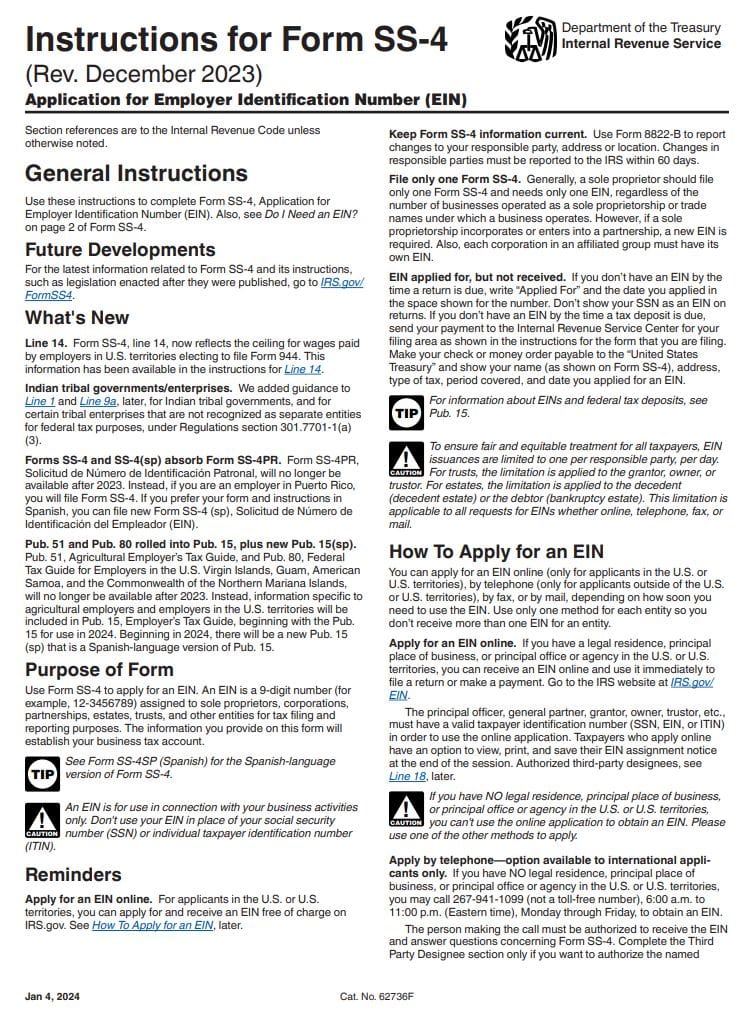

All multi-member LLCs must get an EIN. There are other situations where single-member LLCs must get one too. Visit the IRS website's “Do I need an EIN?” page to see if any of the criteria apply to your situation. After completing the form (SS-4) online, the IRS will issue your EIN immediately. The process takes about 15 minutes and is free.

You can also fax or mail Form SS-4. The IRS provides filing instructions with more details.

Costs to Set Up an LLC in California

The costs to start an LLC in California are minimal. All LLCs must pay a $70 filing fee to register in California. You must pay another $20 to submit a Statement of Information within 90 days.

Other costs that may apply to your California LLC include:

- Name reservation: $10 (optional)

- Expedited processing: $350 to $750 (optional)

- $800 franchise tax applies to all LLCs formed in California, regardless of income or activity.

- Registered agent: $50-$175/year

- Certified copy: $5

- Other license and permit costs: Varies

Further Steps

Open a business bank account

Opening a business bank account is highly recommended, as it helps keep your company’s finances separate from your personal funds.

This separation serves two key purposes:

-

It reinforces your LLC’s status as a distinct legal entity, which helps maintain your personal liability protection.

-

It supports accurate bookkeeping and financial management.

Most banks will require your LLC formation documents when opening the account, so be sure to have those on hand.

Get permits and licensing (if required)

Secure all permits and licensing that you need to do business in California. The location of your business and the activities performed will impact the requirements. These can come from state and local authorities.

Many California cities and counties require a general business license. This is often called a business tax certificate. For example, LLCs in Los Angeles need to get a Business Tax Registration Certificate. Those in the City of San Diego need one too. CalGold is an excellent resource. It helps you determine the license and permits your LLC needs.