Thinking of starting an LLC in New Mexico?

New Mexico’s low LLC formation costs and simple compliance requirements make it an attractive location. Startups, small businesses, and mid-market companies can get up and running right away.

Forming an LLC also means that people will take your business seriously, which can help you attract investors much easier too. And LLCs offer important personal liability protection.

In this guide, we break down the main steps to creating an LLC in New Mexico.

Steps to Create an LLC in New Mexico:

- Step 1: Pick a Name for Your New LLC

- Step 2: Appoint a Registered Agent

- Step 3: File the Articles of Organization

- Step 4: Create an LLC Operating Agreement

- Step 5: Get an EIN (Employer Identification Number) from the IRS

- Costs to Set Up an LLC in New Mexico

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Pick a Name for Your New LLC

Choosing your business name is the first, and arguably the most important step in forming your New Mexico LLC.

New Mexico has specific LLC business name requirements. Each LLC name needs to:

- Include Limited Liability Company, Limited Company, or a similar abbreviation (LLC, L.L.C)

- Be unique and different from other New Mexico businesses

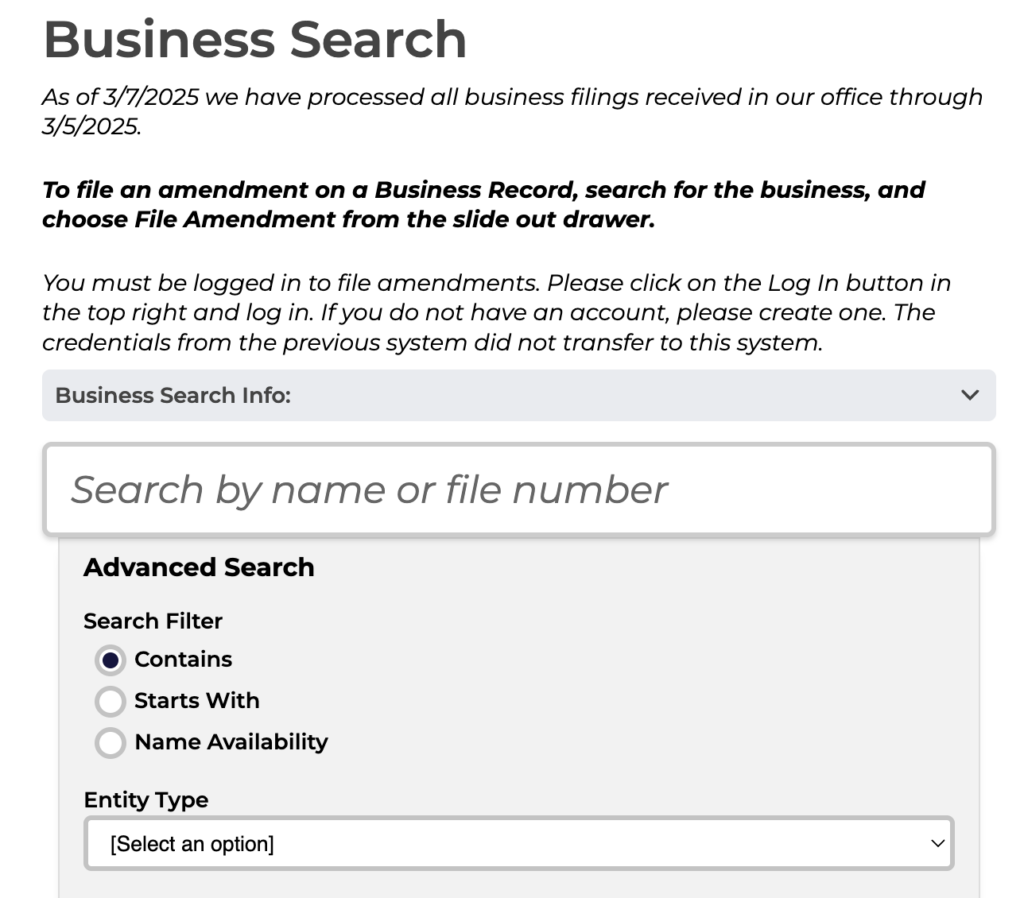

To check whether your desired business name is available, use the New Mexico Business Name Search tool:

Avoid names that people might confuse with an existing business. You want to stand out from the crowd and avoid legal problems.

It is also worth checking whether the name is already trademarked. To check if a business name is trademarked in New Mexico, you can search the New Mexico Secretary of State's Trademark Database or USPTO Trademark Search.

Name Reservation (optional)

If you have a company name but aren’t ready to complete your LLC formation in New Mexico yet, you can reserve a business name.

To secure your LLC name for up to 120 days, you can apply:

- On the New Mexico Corporations and Business Services Website

- By completing a paper form and sending it by mail

The mailing address is:

New Mexico Secretary of State Business Services Division

325 Don Gaspar, Suite 300

Santa Fe, NM 87501

The cost of a New Mexico name reservation is $20.

Step 2: Appoint a Registered Agent

New Mexico requires all LLCs to have a registered agent in the state. A registered agent agrees to accept tax notices, legal documents, and general correspondence for the LLC.

In New Mexico, the registered agent must be available during normal business hours to receive legal documents and official government communications.

Furthermore, NM requires the registered agent to be either:

- An individual resident of New Mexico (18 years or older) with a physical address in the state (not a P.O. Box);

- A domestic corporation, LLC, or a partnership; or

- A foreign corporation, foreign LLC, or foreign partnership

To use any entity as a registered agent, it must use the registered office as its place of business.

The cheapest option is to be your own registered agent. It’s free. However, there are some concerns in doing so.

You must list your address in the public record. That reduces privacy and increases junk mail.

Also, registered agents must be available during standard business hours. There can be serious legal consequences to missing a service of process delivery.

If you don't want to be your own registered agent, you can hire one for about $99-$199/year in New Mexico.

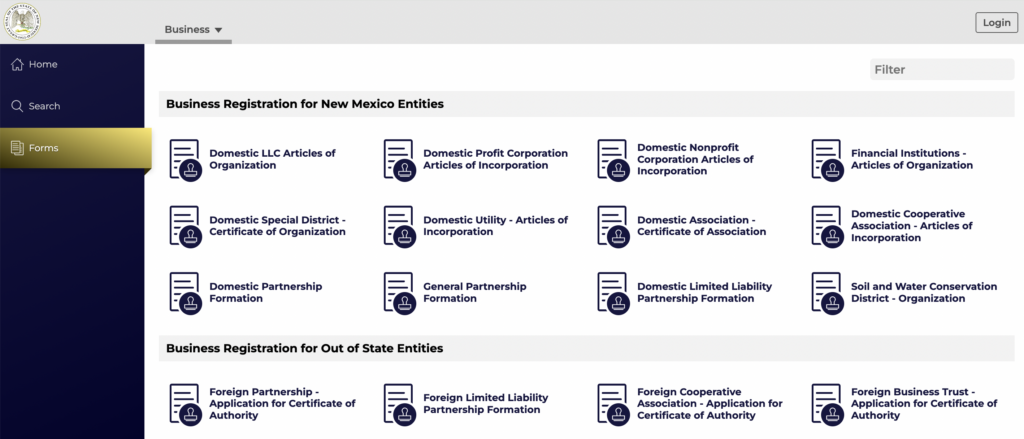

Step 3: File the Articles of Organization

When you’re ready to form a New Mexico LLC, this step is one to highlight. Filing the articles of organization establishes your new LLC and your business idea turns into a real entity.

The New Mexico Secretary of State offers online filings to make the process easy and fast. To file your articles of organization, you’ll provide:

- Company name and physical address

- Purpose and proposed duration

- Organizer Information

- Registered agent name and contact information

New Mexico charges $50 to approve your LLC documents.

You don’t have to list all LLC members’ personal details on the company documents. New Mexico gives you more privacy compared to some other states.

After the New Mexico SOS approves your LLC, order a Certificate of LLC Registration. You'll need to create an account on the state’s business system to request one. The fee for obtaining a certified copy of the Articles of Organization in New Mexico is $25, plus an additional $1 per page.

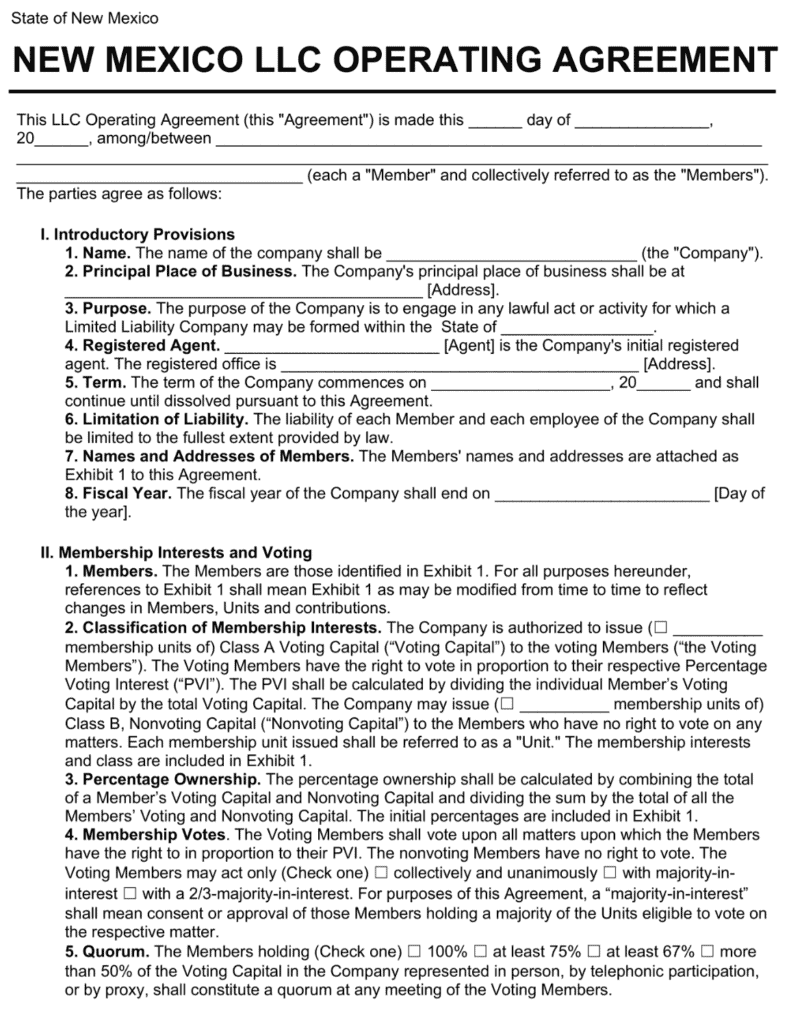

Step 4: Create an LLC Operating Agreement

New Mexico does not require LLCs to have an operating agreement, but it’s an important document that you should have anyway. An operating agreement is vital to run a joint venture with partners, and it helps protect your interests and validate your business.

An LLC operating agreement outlines things like:

- Ownership and management — key people, rights, duties, capital contributions

- How the LLC operates — decision-making power, voting procedures, day-to-day management

- How funds will be distributed — lists profit allocations, owners’ draws, salary payments

- Other important details – adding/removing owners, how to dissolve the LLC, ways to handle disputes

With an operating agreement, you prevent misunderstandings between members. It lays out many details to create predictability and provide certainty.

You can use an online operating agreement template or pay a lawyer to draft one.

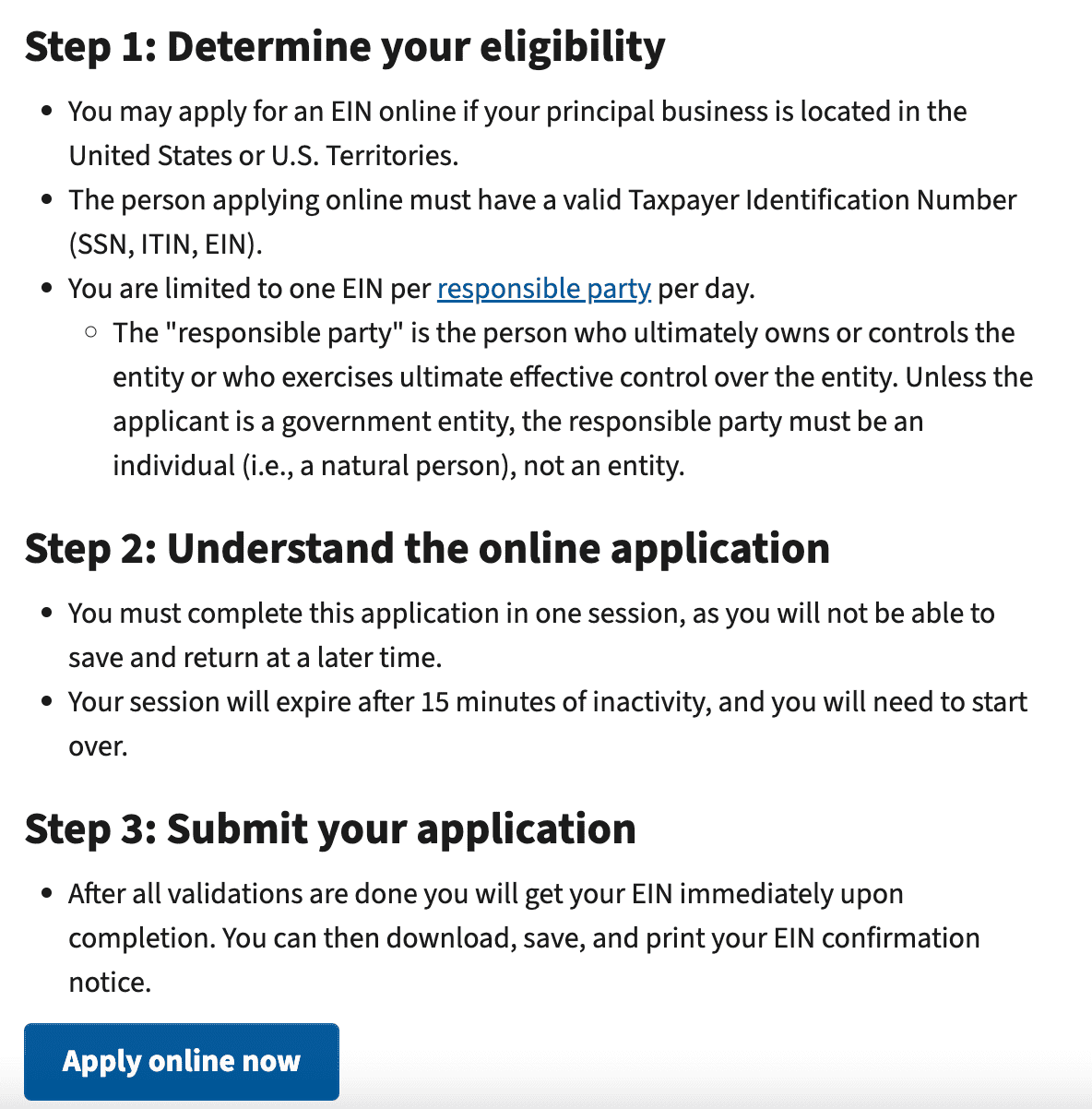

Step 5: Get an EIN (Employer Identification Number) from the IRS

If you have a multi-member LLC, hire employees, or use certain retirement plans, you need to get an Employer Identification Number (EIN).

The Internal Revenue Service (IRS) issues EINs to track tax information, such as income and employment withholding. It’s like a Social Security number for your business.

Some single-member LLCs can use the owner’s Social Security number, but an EIN can be necessary for opening a bank account, some state taxes, or certain lending opportunities. Head to the IRS website to get an EIN in minutes. Or mail in a paper application (Form SS-4). Both options are free.

Costs to Set Up an LLC in New Mexico

The costs to start an LLC in New Mexico are remarkably low. The standard fee for filing the Articles of Organization is $50.

Extra (optional) fees may also include:

- $25 to get a Certificate of LLC Registration

- $20 to reserve a name

- $50 to file a trademarked name

- $99 to $199 per year to hire a registered agent

- $0-1,000 or more for an operating agreement (The cost varies depending on whether you draft it yourself, use templates, or hire an attorney)

Note: New Mexico does not require LLCs to file annual reports or pay associated fees, which is indeed a cost-saving advantage.

Further Steps

Open business bank account

You might be tempted to mix personal and business finances, but this can lead to serious problems. Your LLC needs a dedicated business bank account.

If you don’t separate your business finances, courts can use that as evidence your LLC isn’t a separate entity. This could result in your personal assets being at risk during a lawsuit.

Local tax, licenses, and permits

Every New Mexico LLC must apply for a New Mexico CRS Tax ID number. You’ll need this for all New Mexico business taxes. The Business Portal application process is quick and easy.

Some LLCs also need to get licenses or permits. Liquor sales, construction, and finance professionals are common examples. The New Mexico license and permits page can help you tackle your state needs. Once your finished there, check with your local municipality. If you have questions, contact the agency to get pointed in the right direction.

Other resources

Speaking with a qualified insurance agent is a great idea. A workers’ compensation policy and general liability coverage can be vital.

Owning a business can feel like you’re on a deserted island, alone without help. But it doesn’t have to be that way. Get no-cost counseling and training from the New Mexico SBDC. And don’t overlook all of the amazing financing opportunities and business networks.