Are you ready to transform your passionate idea into a real business? Then it’s time to start an LLC in New Hampshire.

This easy-to-follow guide is here to lead the way. We’ve cut out the legal talk and are ready to help you form a New Hampshire LLC. In return, you’ll gain personal liability protection and a streamlined tax structure.

Deciding to start a business in New Hampshire is full of benefits. The straightforward regulatory structure combines with a variety of small business programs to let your LLC thrive. And there’s a modern online system that makes the LLC formation documents a breeze.

Let’s walk through the steps to start an LLC in New Hampshire.

Steps Needed to Create an LLC in New Hampshire

- Step 1: Choose a Name for Your LLC

- Step 2: Appoint a Registered Agent

- Step 3: File the Certificate of Organization

- Step 4: Create an Operating Agreement

- Step 5: Get an Employer Identification Number (EIN)

- Costs to Set Up an LLC in New Hampshire

- Last steps

Step 1: Choose a Name for Your LLC

Before you can get to the heart of forming an LLC in New Hampshire, you need to decide on a name. You might have some ideas floating around. But you’ll need to make sure they meet New Hampshire LLC naming laws.

There are three things you need to keep in mind when naming your LLC:

- Unique: Your LLC name must not match or be too similar to an existing business

- Identify as an LLC: You must include Limited Liability Company, L.L.C., or LLC

- Avoid restricted words: Don’t indicate you’re a government organization or conducting regulated activities, unless you have the appropriate permission

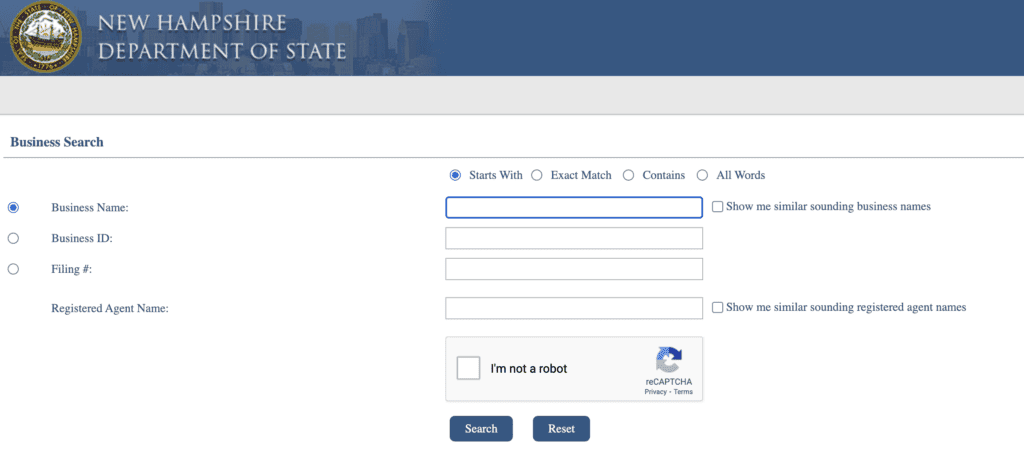

Use the New Hampshire Business Search to see what’s already taken. Try different variants to verify your LLC name isn’t too similar to another business.

Name reservation (optional)

You can reserve an LLC name in New Hampshire for 120 days. Securing the name can take a load off your mind while you prepare other New Hampshire LLC formation documents.

The NH QuickStart online portal makes the name reservation easy. And it’s what you’ll use for most of the process to start your LLC. You can also file this Application for Name Reservation.

There is a $15 fee to reserve a name.

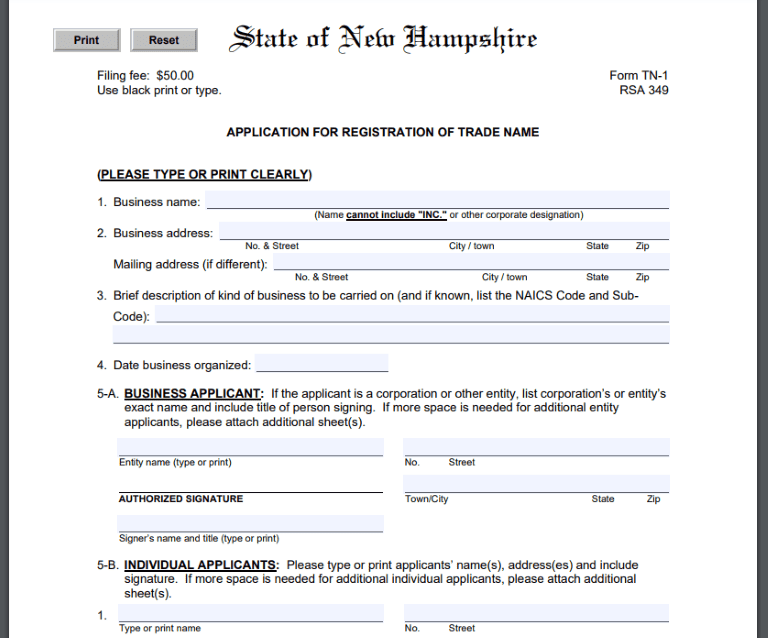

Register trade name (optional)

Have you noticed that certain businesses use a brand name that’s different from their company’s legal name? You can do that too. It’s known as using a trade name. Some places call it a doing-business-as (DBA) name, fictitious name, or assumed name.

To use one, register a trade name with the New Hampshire Secretary of State. This allows you to sell products or services under a trade name that’s different from the LLC’s name. You can even register multiple trade names under one LLC.

You may want a trade name to:

- Sell different lines of products or services

- Use a brand name that works better for marketing and advertising

- Expand your operations under the same LLC ownership

There is a $50 fee for each trade name registration.

Step 2: Appoint a Registered Agent

One crucial role of every LLC is the registered agent. This serves as the main contact for your New Hampshire LLC. When officials, courts, and lawyers want to get in touch with your LLC, they’ll reach out to the registered agent.

The registered agent receives things like legal notices, tax documents, and other official correspondence.

Every New Hampshire registered agent must:

- Be a New Hampshire resident or a business authorized to operate in NH

- Use a residence or business office as the registered address (not a P.O. Box)

You can appoint yourself or a person you trust (employee for example). But experienced business owners often hire a registered agent service.

Hiring a service means you can keep your address out of the public record. You also don’t need to worry about being around during regular business hours. And you are much less likely to receive a lawsuit in front of your customers.

If you don't want to be your own registered agent, you can hire one for about $99-$199/year in NH.

If you form an LLC with Northwest, they'll give you a free registered agent for the first year. After that, it's $125 per year.

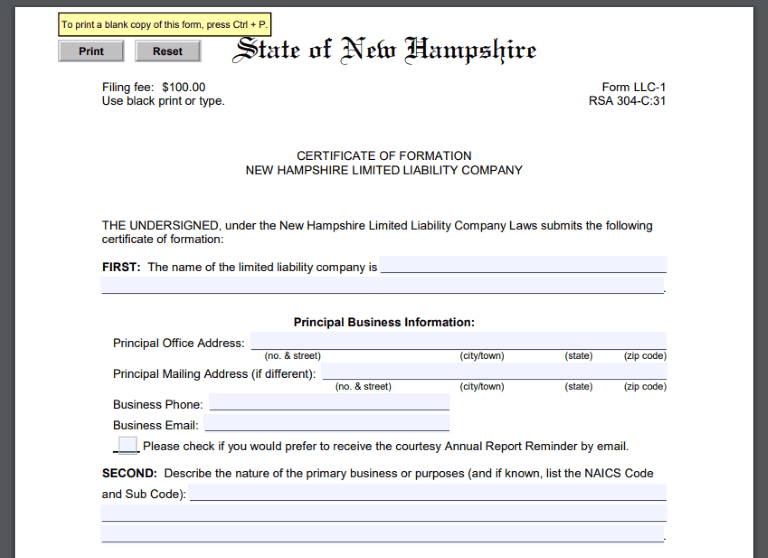

Step 3: File the Certificate of Formation

If there is one step to forming a New Hampshire LLC that you need to pay attention to, this is it. Filing the Certificate of Formation will take your business idea and turn it into a legal entity. Other states call this the articles of organization.

To file your New Hampshire Certificate of Formation, you need:

- LLC’s name and principal address

- LLC’s purpose and the NAICS code, if available

- Registered agent’s name and address

- Whether the LLC is member-managed or manager-managed

- List of any managers or members you want on record

- Signature of the member or manager who files the document

It’s easiest to use the NH QuickStart online portal to file. But you can also use the Certificate of Formation form to file by mail or in person.

There is a $100 fee to file your New Hampshire LLC Certificate of Formation.

The processing time is 10 to 15 business days. If you need it faster, you’ll have to go in person where you can request expedited service for $25 extra.

Once processed, New Hampshire will send a filed-stamped copy within 30 days. You should also request a certified copy of your Certificate of Formation through the online portal. Keep these with your LLC’s records. You might need to present them to open a bank account, get business licenses, or accept certain lending offers.

Certified documents cost $5 plus $1 per page.

Step 4: Create an Operating Agreement

An operating agreement outlines the way your LLC functions. It also lists ownership information. New Hampshire doesn’t require one, but it’s wise to have one anyway.

Without one, your LLC is governed by New Hampshire LLC laws. These may not resolve disputes in the way that you want. Instead, you can use an operating agreement to ensure that your LLC functions as you intend. And it helps avoid many conflicts in the first place by getting everyone on the same page.

Operating agreements for LLCs cover things like:

- Ownership percentages and contributions

- Rights and duties of members and managers

- Allocation of profits and losses

- Adding or removing members

- Dissolving the LLC

If you want to keep expenses down, you can customize a free or low-cost online template. But hiring an attorney will do a better job at making sure your interests are covered, especially if you have a multi-member LLC. Attorneys can charge $1,000 or more for this task.

Step 5: Get an Employer Identification Number (EIN)

Your next step while forming a New Hampshire LLC is getting an Employer Identification Number (EIN). The Internal Revenue Service (IRS) uses EINs to track your LLC’s tax information.

All multi-member LLCs and any LLC with employees must get an EIN. Some single-member LLCs can use the owner’s Social Security number instead. But it’s ideal to get an EIN anyway since some banks or investors might require it.

You can take this quick IRS quiz to see if you need an EIN.

If you need an EIN, it’s surprisingly easy. You can apply for an EIN online and get one in minutes. And it’s free.

Costs to Set Up an LLC in New Hampshire

The minimum cost to start an LLC in New Hampshire is $100. This is the filing fee for your Certificate of Formation.

Other optional costs that can be part of your New Hampshire LLC process include:

- Name reservation: $15

- Trade name registration: $50

- Registered agent service: $50 to $200 per year

- Expedited processing: $25

- Certified document request: $5 plus $1 per page

- Attorney-drafted operating agreement: $1,000 or more

Every New Hampshire LLC must also file an annual report. This will cost $100 per year when the time comes.

Last steps

Are you itching to open your business? That’s great! Wrap up these last steps and you’ll be ready to roar.

Business banking

Your New Hampshire LLC needs to get a business bank account. It’s useful for accounting and tax purposes. But there’s another reason why your LLC needs its own bank account.

If you mix personal and business finances, you can lose some of the legal benefits LLCs offer. This could be disastrous if your LLC gets sued. Instead of sticking to LLC assets and liability, you might be held personally liable.

Avoid this problem by opening a business bank account and keeping your finances separate. It shows the world that your LLC is truly a different entity.

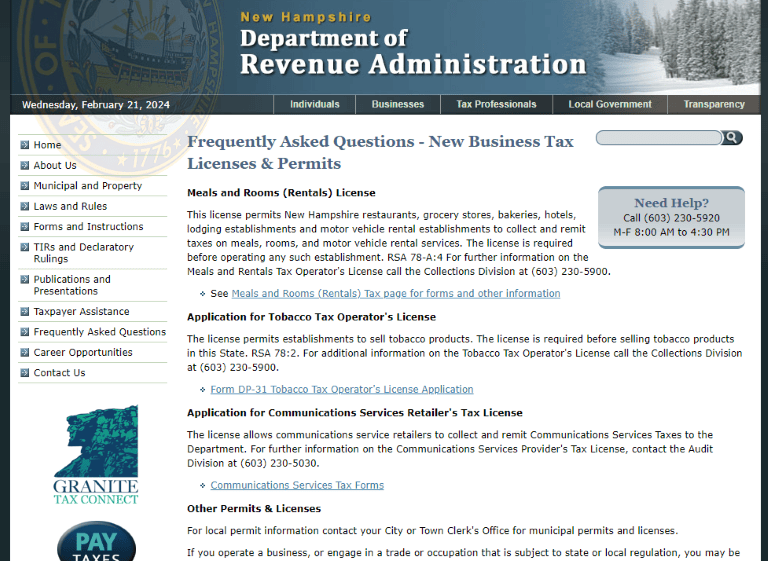

New Hampshire taxes

Some LLCs need to register with the New Hampshire Department of Revenue Administration. This depends on your operations. Things like lodging, food service, and tobacco sales must register and deal with state tax requirements.

If you want to hire employees, head over to the NH Department of Labor. Your LLC must handle workers’ compensation insurance and other employer-related issues.

Local licenses and permits

You’ll also need to get any needed licenses or permits from city or county authorities. Check with your local municipality to see what your LLC needs, if anything. For example, the City of Concord has a list of activities that need a license. Many places, including Nashua, require permits to construct or change a building.