Forming a Limited Liability Company (LLC) in Washington State is a smart choice for entrepreneurs and small business owners who want to protect their personal assets while maintaining operational flexibility.

Washington’s lack of a state income tax makes it especially attractive for small businesses. The state also supports a thriving startup ecosystem, home to both innovative small enterprises and major tech players. Even better, creating an LLC in Washington is a straightforward process.

An LLC offers the liability protection of a corporation with fewer formalities and simpler management. One of its biggest advantages is shielding members’ personal assets from business liabilities — providing peace of mind as your business grows.

This step-by-step guide will walk you through everything you need to know to get started.

Steps to Get an LLC in Washington:

- Step 1: Name Your Washington LLC

- Step 2: Appoint a Registered Agent

- Step 3: Draft and Submit the Certificate of Formation

- Step 4: Obtain a Certificate of LLC Registration

- Step 5: Create an Operating Agreement

- Step 6: Get an Employer Identification Number (EIN)

- Costs to Set Up an LLC in Washington

- Last Steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Name Your Washington LLC

The first step in forming an LLC is to decide on a name. That may seem easy enough, but it is one of the most important things you will do for a new business.

Remember, the name will need to reflect not just your business today, but it should also reflect the company you ultimately hope to build, so avoid things that are too trendy or tongue-in-cheek.

Washington requires that an LLC name end with the acronym or the words “Limited Liability Co.”

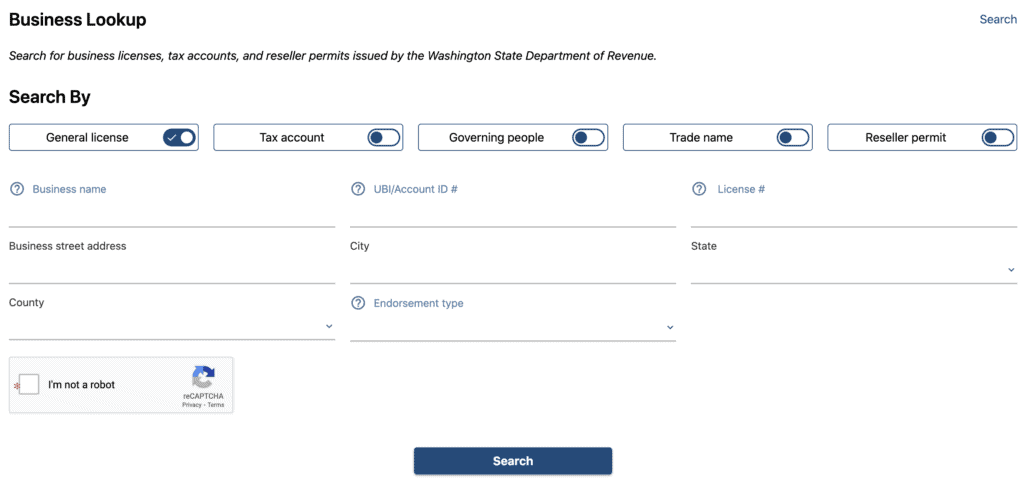

The name should give an idea about what goods or services you provide, be easy to remember, and be web-friendly. It should be unique, so use the Washington Department of Revenue business lookup to make sure the name (or something very similar) is not already in use.

The name must be distinguishable from other business entities registered in the state. By law, adding something like LLC, PC, LP, or LLP is not enough to make it distinguishable.

You can reserve a business name for your LLC by filing a Name Reservation form with the Secretary of State. The standard fee for this service is $30. If you need expedited processing, an additional $50 fee applies, totaling $80 for faster service.

Once approved, the name reservation is valid for 180 days, giving you plenty of time to finalize and submit your LLC formation documents. This is optional, however.

Step 2: Appoint a Registered Agent

Once you've decided on a name, you need to determine who will be your LLC's registered agent.

In Washington, all LLCs must have a registered agent.

The registered agent for your LLC can be either an individual or a professional service provider. The registered agent is responsible for accepting tax documents, legal notices, and service of process on behalf of the LLC. Choosing the right registered agent is an important step when filing the Articles of Organization.

As the business owner, you can serve as your own registered agent, or you can appoint someone else, provided they are at least 18 years old. Many businesses choose to use a manager or hire a professional registered agent service, allowing the owner to focus on running the company.

If you do not plan to act as your own registered agent, be sure to select someone you trust — missing important legal or tax documents could jeopardize your business.

Under Washington law, a registered agent must have a physical street address (P.O. boxes are not permitted). Keep in mind that the registered agent’s address becomes part of the public record, which may result in receiving a significant amount of unsolicited mail.

If you don't want to be your own registered agent, you can hire one for about $59-$249/year in Washington.

Step 3: Draft and Submit the Certificate of Formation

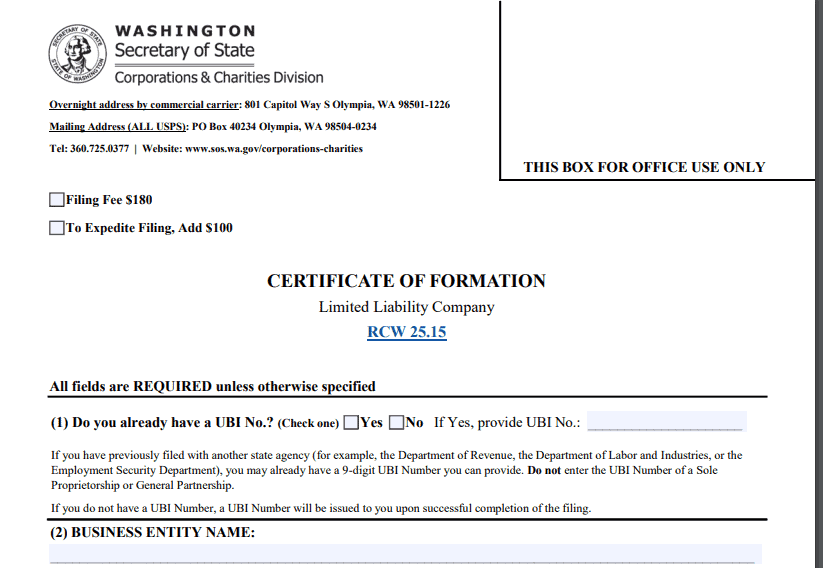

A Certificate of Formation legally creates your limited liability company in Washington. The filing fee, which is paid to the Secretary of State, is $180. For expedited service, it costs an extra $100. Within 120 days of filing you will also need to file an Initial Report within 120 days. If you file the initial report at the same time that you submit the Certificate of Formation, it is free to file. If you submit it later, it will cost $10.

You can download a Certificate of Formation form from the Secretary of State's website, and it should include the following information:

- Unified Business ID (UBI): You should receive this nine-digit number after filing for your business license. If you do not have a UBI number, select no. A UBI will then be assigned when the filing is successfully completed.

- Company Name: Remember that in accordance with the law, the words Limited Liability Company or LLC must be included in the name.

- Period of Duration: Most businesses will select perpetual duration, meaning that the business will be ongoing until it is dissolved. However, there are certain instances when a new business may want to select a specific duration, after which it will be administratively dissolved.

- Effective Date: Decide on the date the filing is to be effective. Typically, the “date of filing” is selected, and the Certificate of Formation will be effective on the date completed. Future dates cannot exceed 90 days from the date of filing.

- Registered Agent: Name your registered agent and provide a complete physical address.

- Principal Office Address: This is the physical address of your business and cannot be a P.O. Box.

- Executor information: The executor is the person forming the LLC. Make sure to include the name, address, and signature of the executor in the filing.

The form can also be filed online by creating an account with the Office of the Secretary of State.

Step 4: Obtain a Certificate of LLC Registration

After you have filed a Certificate of Formation, you will receive a Certificate of LLC Registration from the Secretary of State. It's official–you're in business. This important document allows you to perform several necessary functions of business, including:

- Enter into contracts on behalf of the LLC

- Obtain necessary permits and licenses

- Open accounts with banks and other lending institutions as an LLC

- Protect your personal assets from liability

- File taxes as a separate entity

- Distribute ownership interest to members and investors

The Certificate of LLC Formation will contain vital information about the legal state of your business, including the official name, UBI, the date of formation, and the executor of the LLC. You will need to submit copies to various agencies and institutions as proof of your LLC status while conducting business.

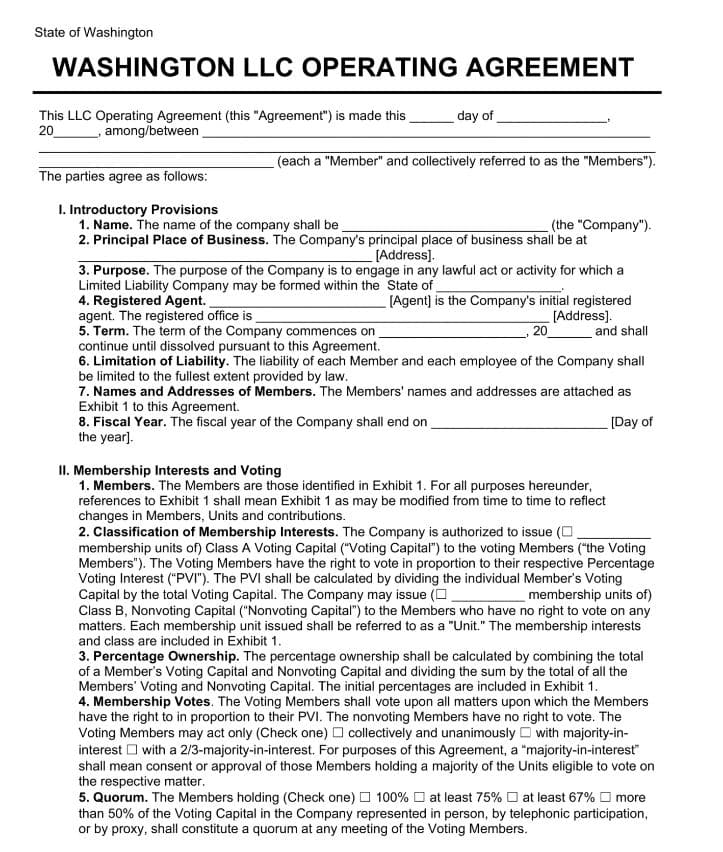

Step 5: Create an Operating Agreement

Washington, along with most other states, doesn't require you to file an Operating Agreement, but that doesn't mean it's not necessary. After all, an Operating Agreement (OA) is the governing document for your company and will determine how it is managed. It is an internal document that can be changed at any time by the members of your LLC.

A well-crafted operating agreement helps keep your LLC running smoothly by outlining how key decisions and potential challenges will be handled throughout the life of the business. Taking the time to thoughtfully structure this agreement can prevent misunderstandings, resolve disputes, and create a clear path forward when issues arise.

Ideally, your operating agreement should be easy to understand and include the following:

1. The LLC Members

Ownership of the LLC is laid out in the Operating Agreement (OA). Decide before drafting who the members are and include the full legal names and addresses. Include information about the ownership percentage of each member, what they contribute in exchange for their membership, and the rights and duties of each member. It is essential that the OA clearly state the rights and duties of each member. Lastly, you will need to determine how profit and losses will be shared.

2. Management

An Operating Agreement should outline the duties of management in a clear and concise manner. For new or smaller LLCs, a single member may fulfill multiple roles. The OA outlines the responsibilities associated with each role.

3. Admittance and Separation

The OA should clearly define how new members will be admitted and the procedure for members exiting the company.

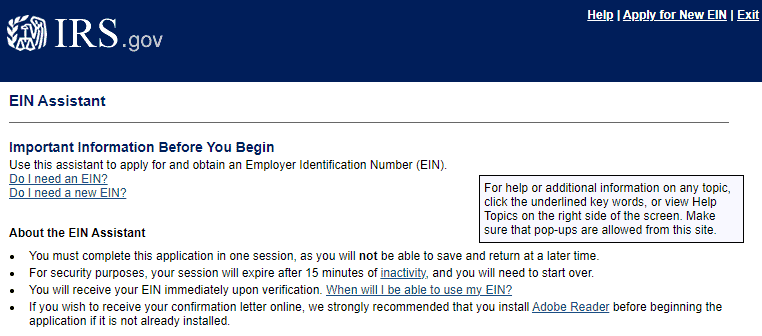

Step 6: Get an Employer Identification Number (EIN)

An EIN, also known as a Federal Tax Identification Number, is used to identify a business for tax purposes. It's an easy and straightforward process. Visit the IRS and use the online application feature.

Costs to Set Up an LLC in Washington

The costs of establishing an LLC in Washington will vary depending on how much you do yourself and which services you use. However, most people are pleasantly surprised to realize it's not a complex or expensive process.

Some costs will be one-time fees, and others will recur annually. The fees include:

- Certificate of Formation: $180–$200 (depending on whether you file online or by mail)

- Registered Agent Service (optional): $100-$150 annually

- $60 fee for filing an annual report

Given the potential tax savings, asset protection, and other benefits of establishing an LLC, the price to establish an LLC is minimal.

Last Steps

After legally establishing an LLC, the real work begins. You will want to keep a degree of separation between the funds earned and used by the LLC and any personal funds. The first step is to open a bank account in the name of the LLC and use its EIN.

The next step is to acquire any licenses or permits specific to your business.

To obtain licenses and permits for your LLC in Washington, you can follow these steps:

Washington State Department of Revenue:

- Business Licensing Service (BLS): The BLS is a one-stop shop for getting your state business license and any necessary endorsements. You can apply online through the Business LicensingW izard to find out which licenses and permits you need.

- Website: Washington State Department of Revenue

Washington State Department of Labor & Industries:

- If your business involves hiring employees, construction, or trades, you may need additional permits and licenses from the Department of Labor & Industries.

- Website: Washington State Department of Labor & Industries

This is also the time that you will want to file your first Annual Report to keep your LLC in good standing with the state of Washington. Once this is done, it's time to start planning your first annual member or shareholder meeting. While not required by state law for LLCs, it is a good business practice. If you stipulated an annual meeting in your Operating Agreement, failing to hold one could leave you vulnerable to legal issues.

Establish a solid accounting system that will keep your LLC compliant with all tax obligations, including sales, employment, and income taxes. Taxes are often complex, so consider consulting with a tax professional to ensure you take advantage of all tax benefits associated with an LLC.