Thinking of creating an LLC in South Carolina? Wise choice.

One of the advantages of forming an LLC in South Carolina is that the state does not require LLCs to file annual reports, reducing ongoing administrative burdens and costs for business owners.

South Carolina’s strategic location along the East Coast provides businesses with access to major markets, including the Northeast and the Southeast.

And the state offers access to many skilled employees, courtesy of local educational institutions. Also, the South Carolina Community Development Division offers many programs and resources for new LLC owners.

So by all accounts, South Carolina is an ideal place to form your LLC.

Ready to form your new LLC? Let's get started!

Steps to Create an LLC in South Carolina

- Step 1: Choose a name for your new South Carolina LLC

- Step 2: Appoint a registered agent

- Step 3: File the South Carolina LLC Articles of Organization

- Step 4: Collect certified copies of your LLC formation documents

- Step 5: Create an LLC operating agreement

- Step 6: Get an EIN (Employer Identification Number) from the IRS

- Costs to set up an LLC in South Carolina

- Final steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Choose a Name for Your New South Carolina LLC

South Carolina law has several specific naming requirements for LLCs:

- The LLC's name must include the words “Limited Liability Company” or “Limited Company” or any of its abbreviations (LLC, L.L.C., Ltd. Co., etc.).

- There can’t be any restricted words in the LLC's name (i.e., bank, attorney, insurance) or any words that imply government affiliation like “treasury”, “federal,” or “CIA.”

- The selected legal name must be available in the state and be different from other registered business names.

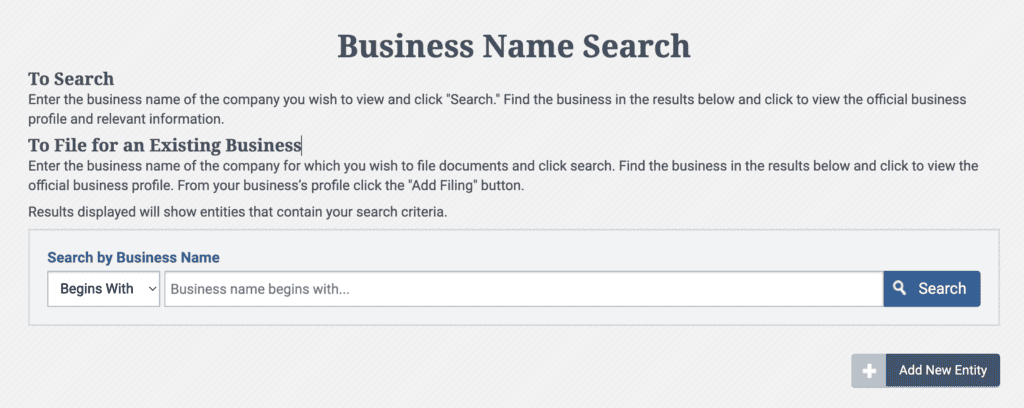

You can use the South Carolina Secretary of State's business name search tool to determine whether a name is available:

Name reservation (optional)

If you've decided on a name and want to prevent any other legal entity from using it, you can file for name reservation with the South Carolina Secretary of State. It gives you extra time while you get your business ready to operate.

Name reservations are valid for up to 120 days and cost $25.

Step 2: Appoint a Registered Agent

In South Carolina, every type of incorporated business must have a registered agent. LLCs are no exception.

A registered agent in South Carolina is an individual or business entity you appoint to receive legal documents on behalf of your LLC.

The appointee must have a physical presence in the state (no P.O. Boxes accepted) and be available during regular business hours in case of service of process.

Essentially, you have two options:

- Appoint an individual who lives in South Carolina (yourself included)

- Hire a professional registered agent service provider

Serving as your own registered agent saves you money up front. But there are several valid reasons why using a professional provider makes sense:

- You must include your registered agent's contact information in your formation documents. So if you're running a business from home, your home address becomes public. Goodbye, privacy — hello junk mail and unsolicited offers.

- Receiving service of process documents in front of your family, neighbors, or customers can be embarrassing. Likewise, there may be severe consequences if you miss an important legal document like a subpoena.

- If you move, you don't have to worry about updating your address with the Secretary of State and paying extra fees.

If you don't want to be your own registered agent, you can hire one for about $99-$200/year in SC.

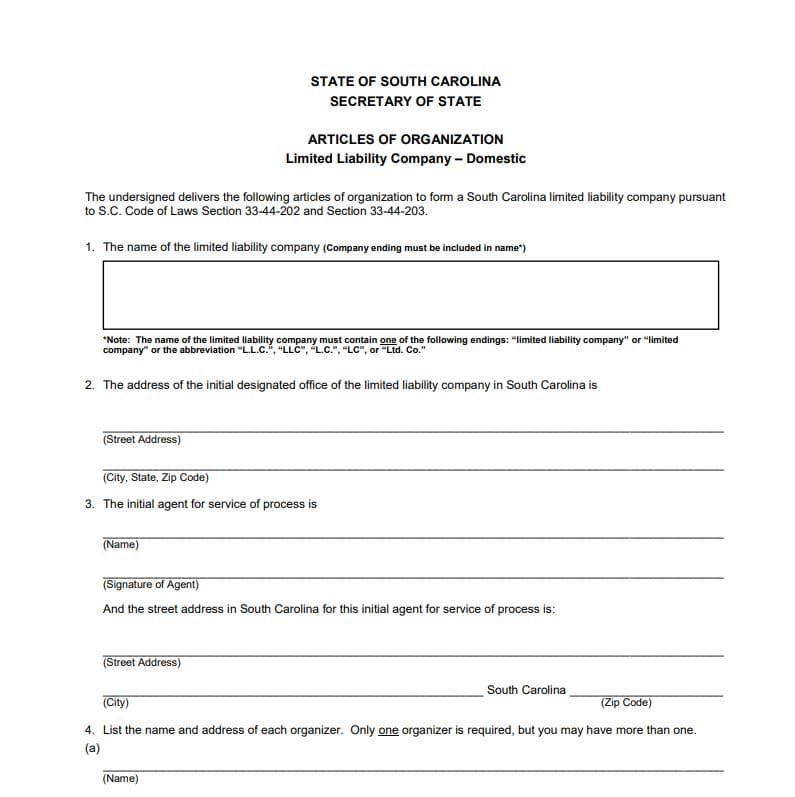

Step 3: File the South Carolina LLC Articles of Organization

Once you've decided on a name and appointed a registered agent for your LLC, you can file Articles of Organization with the South Carolina Secretary of State. This document specifies:

- Your LLC's legal name

- Registered address

- Lists of the LLC members (owners)

- Registered agent contact information

- Company management structure

The LLC management structure clause is important because it tells the state how your LLC will operate. Some LLCs are managed by their owners, who are called members. Others elect to hire an external person instead of the members to manage the business.

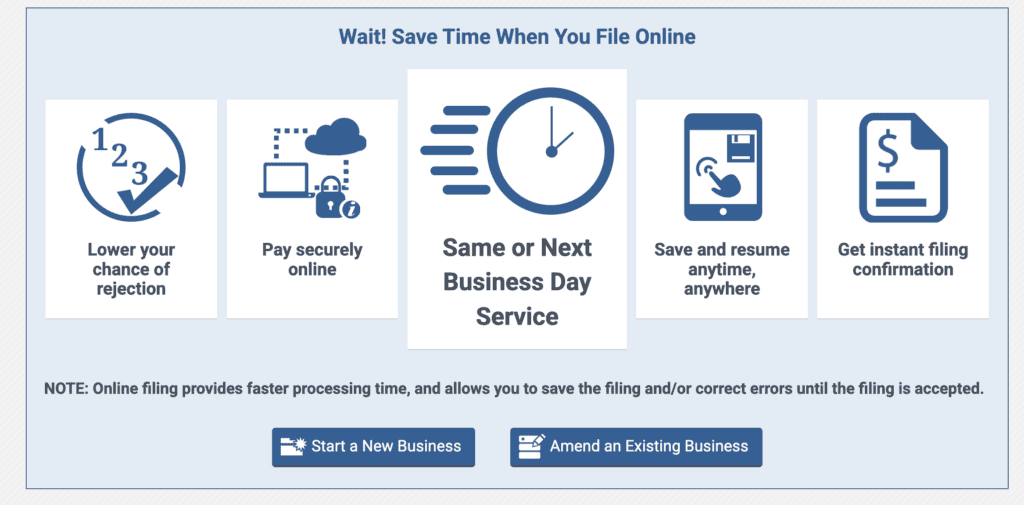

The cost to file Articles of Organization in South Carolina is $110. You can file by mail or save time by filing online. Online filing allows you to pay by debit or credit card and receive same-day or next-day service, along with instant filing confirmation.

Step 4: Collect Certified Copies of Your LLC Formation Documents

Once the South Carolina Secretary of State approves your LLC's Articles of Organization, it's a good idea to obtain an official certified copy for your business records.

Certified copies may be required when opening a business bank account, applying for certain licenses, or conducting other official business.

Having a certified copy readily available ensures you're prepared when such situations arise.

In South Carolina, document copying fees start at $3 per page, and you can request certified copies from the Secretary of State's office.

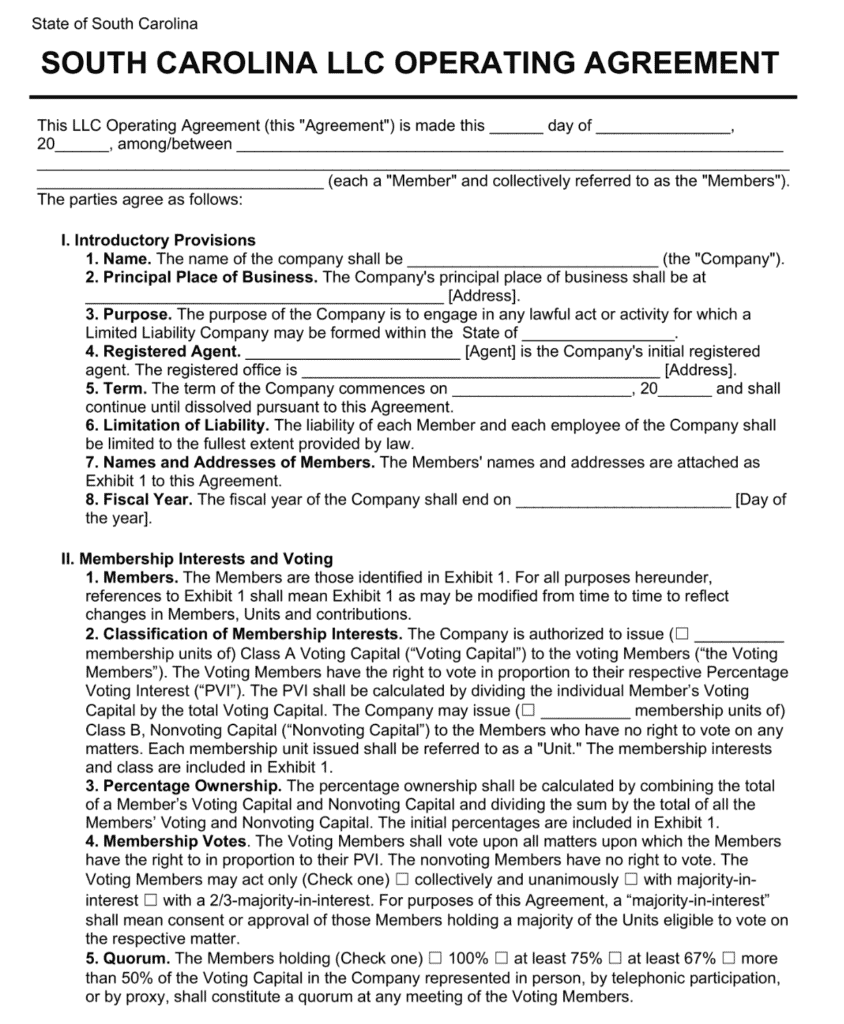

Step 5: Create an LLC Operating Agreement

Whether you're a single-member or multi-member LLC, you’ll want to create an operating agreement.

South Carolina, like most states, doesn't require you to file an operating agreement with the Secretary of State, but it's highly recommended to have this document internally. A company's operating agreement lays out the baseline company management principles around:

- Adding and removing members

- Capital contribution

- Profit-sharing

- Voting rights

- Managerial responsibilities

In case of a sale or dispute about corporate matters, the operating agreement decides how you’ll resolve disagreements among members.

The benefits are obvious for multi-member LLCs, but what if you're a single-member LLC?

You may not need it now. But if you ever become incapacitated or decide to add more members, your operating agreement lets others know how to maintain your business while you're unable to. If you don’t have an operating agreement, any issues in your LLC will be decided according to South Carolina law, which may not be in your favor. You can find many templates online to draft a simple operating agreement. This is also something a professional service provider or corporate attorney can help you with.

Step 6: Get an EIN (Employer Identification Number) from the IRS

LLC members will need to get an Employer Identification Number (EIN) from the IRS to handle federal taxes. An EIN is like the Social Security number for your business and will be needed to file federal income taxes and in most cases, state taxes.

If you plan on having employees, your EIN is how the Internal Revenue Service will track your payroll taxes and employment activities. As a single-member LLC without any paid employees, you can skip this step for now.

Obtaining an EIN is free and takes only a few minutes.

You’ll need to answer several questions about your business — the type of business structure, industry, state of incorporation, and contact information. Once done, you’ll get your EIN instantly online.

Costs to Set Up an LLC in South Carolina

The total costs to set up your SC LLC will vary depending on its complexity and whether you use professional services. To help you budget, here's a summary of the potential costs:

- Name reservation (optional): $25

- Professional registered agent service: $99 – $200 annually

- Articles of Organization filing fee: $110

- Certified document copies: $3+ per page

- Operating agreement (optional): $0 – $1,000 (depending on whether you draft it yourself or hire a professional)

Final steps

You're almost ready to go. There are just a few more administrative steps to finish.

A business that sells taxable goods in South Carolina must obtain a retail license (also known as a sales tax registration) that costs $50. This license is a one-time registration and does not require renewal, provided there are no changes in ownership or location.

It also applies to sales made online if you sell more than $100,000 of goods in a year. If you have multiple retail locations, each location must have a separate retail license.

You'll need to register with the South Carolina Department of Revenue on the MyDORway portal as either a new South Carolina business or a remote seller. This registration also applies to any business that needs a local tax ID to report other state taxes.

Unlike a sole proprietorship, personal and business finance commingling is a big no-no. Doing so can result in the loss of personal liability protection the LLC grants you as an owner.

So, open a business bank account as soon as you get your Articles of Organization approved.

Banks tend to offer incentives to business owners like reduced monthly fees, interest earned on balances, or discounted lending.

Here are some local South Carolina banks that offer small business bank accounts with affordable account opening fees:

- Bank of America

- SC State Credit Union

- Bank of South Carolina

Lastly, depending on the nature of your business, you may need additional licenses or permits at the local or state level. It's essential to consult the South Carolina Business One Stop (SCBOS) resource guide for specific licensing requirements related to your business activities.