The beautiful state of Idaho is a wonderful place to start a new LLC.

High GDP (gross domestic product) and a growing workforce make Idaho an even more attractive option for new business incorporation.

A limited liability company (LLC) is a popular type of business entity among local entrepreneurs. Why? Because LLCs combine minimal administrative overhead with personal liability protection.

If you’re wondering what it takes to open an LLC in Idaho, this guide provides a structured walkthrough of the company formation process.

Steps to Create an LLC in Idaho:

- Step 1: Pick a name for your Idaho LLC

- Step 2: Appoint a registered agent

- Step 3: File the Idaho LLC Certificate of Organization

- Step 4: Get certified copies of your LLC formation documents

- Step 5: Create an LLC operating agreement

- Step 6: Get an EIN (Employer Identification Number) from the IRS

- Costs to set up an LLC in Idaho

- Last steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Pick a Name for Your Idaho LLC

Chances are you’ve already thought of the perfect name for your new business. That’s a good start. But you’ll also need to ensure it meets Idaho’s requirements.

Every Idaho LLC name must:

- Be unique and not already in use by an existing business

- Include Limited Liability Company, Limited Company, or an abbreviation like LLC or L.L.C.

- Avoid terms associated with government agencies or regulated fields like medicine and law, unless authorized

Idaho doesn’t allow two entities to operate under the same or even a similar-sounding name. Your LLC’s name must be distinguishable from all other registered names.

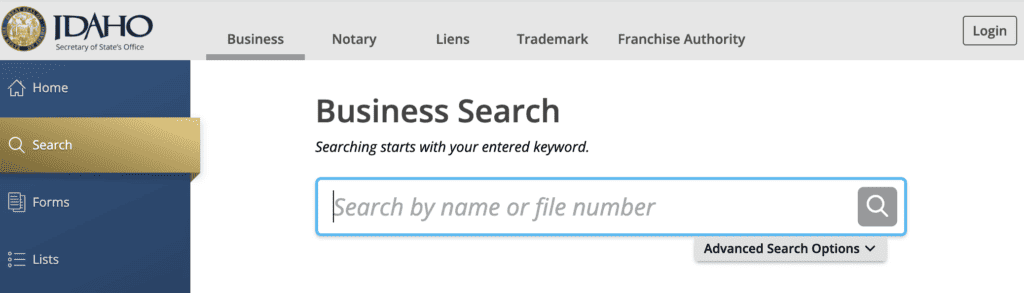

To check if a business name is available, use the Idaho Secretary of State’s database. It’s free.

Tip: When searching through business names, use different search terms with and without abbreviations like LLC and Ltd. Otherwise, you may not receive a complete list of results.

Name reservations (optional)

Once you find an available name you like, you can apply to reserve an LLC name for four months. This option can come in handy when you need time to prepare other formation documents. Online filings and paper applications are $20.

Assumed name – DBA (optional)

You can operate your business under a name that’s different from the LLC’s legal name. Idaho calls this an assumed name. It’s also known as a “doing business as” (DBA) name or a trade name.

Assumed names make sense when:

- The legal name doesn’t represent your brand well

- You want to offer multiple products or services

- Sole proprietorships want to use a company name different from their first and last name

An assumed name registration costs $25 in Idaho when filed online. Paper filings (via mail or in person) are $45.

Step 2: Appoint a Registered Agent

The Idaho Secretary of State requires all LLCs to appoint a registered agent.

This is a contact responsible for receiving important tax notices and legal documents.

A registered agent in Idaho must:

- Be at least 18 years old

- Have a physical street address in Idaho (no P.O. Boxes allowed)

- Be available during regular business hours

Anyone who meets the above requirements can act as your registered agent. You can appoint yourself or a trusted employee. If you don't want to be your own registered agent, you can hire one for about $46-$175/year in Idaho.

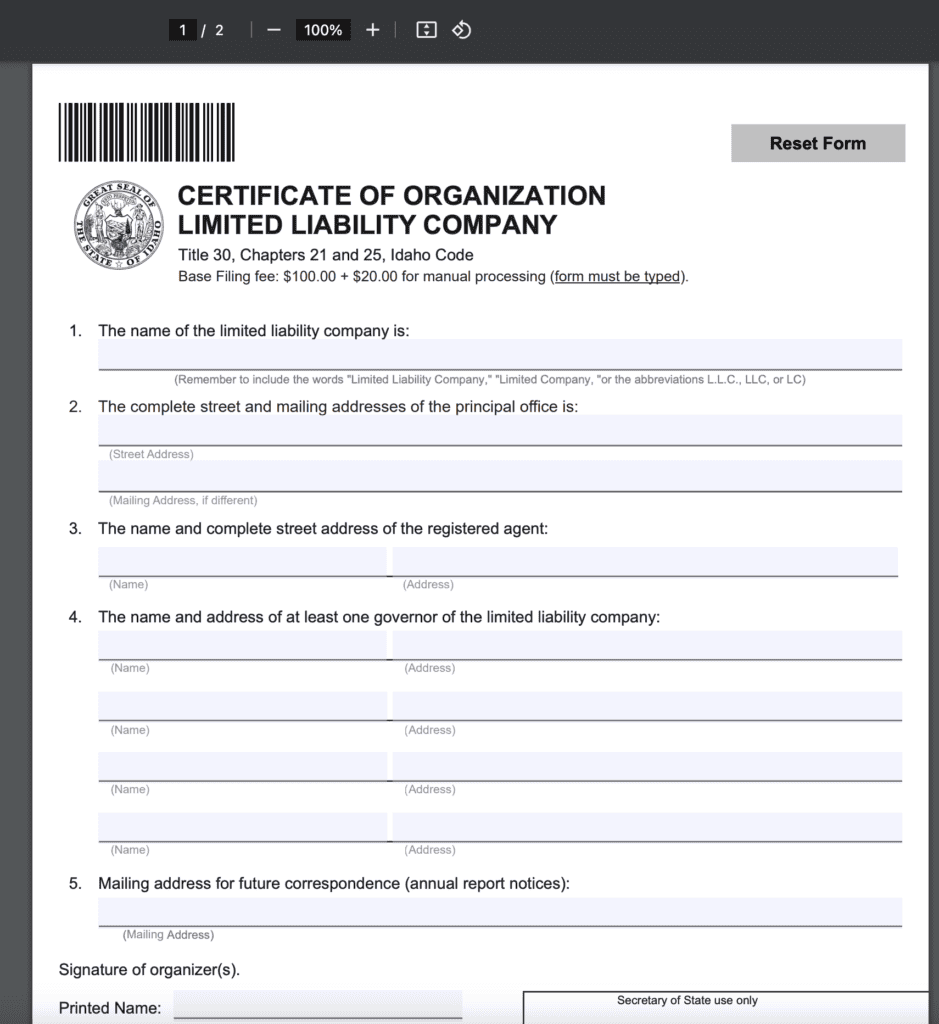

Step 3: File the Idaho LLC Certificate of Organization

Now’s a great time to pay attention.

This step is what officially transforms your business idea into a legal entity.

When you’re ready to launch your LLC, it’s time to file your Idaho Certificate of Organization.

Preparing this filing is simple. You’ll need to add the following business information:

- LLC name and address

- Contact information for the registered agent

- Contact information for at least one member of the LLC

Idaho offers two different filing options:

- Online registration for $100 + $4 (credit card processing)

- Paper applications by mail or drop-off are $120

To submit your LLC formation documents in Idaho via mail or in person, please use the following address:

Office of the Secretary of State

450 N 4th Street

PO Box 83720

Boise, ID 83720-0080

Please note that filing a paper form incurs an additional $20 manual processing fee, making the total filing fee $120. Ensure all forms are typed, as handwritten forms may not be accepted

In a rush? No problem. Idaho offers expedited processing for an extra $40. This takes 7-10 business days for online submissions and around 2 weeks for mailed-in filings. You can also get same-day processing for $100 more.

Step 4: Get Certified Copies of Your LLC Formation Documents

After the Secretary of State approves your Certificate of Organization, you're an official business. Congratulations!

You'll want to have certified copies of the approved documents for your records.

You may need to provide certified copies when opening a business bank account or applying for business credit.

Certified documents from the Idaho Secretary of State start at $10 per document.

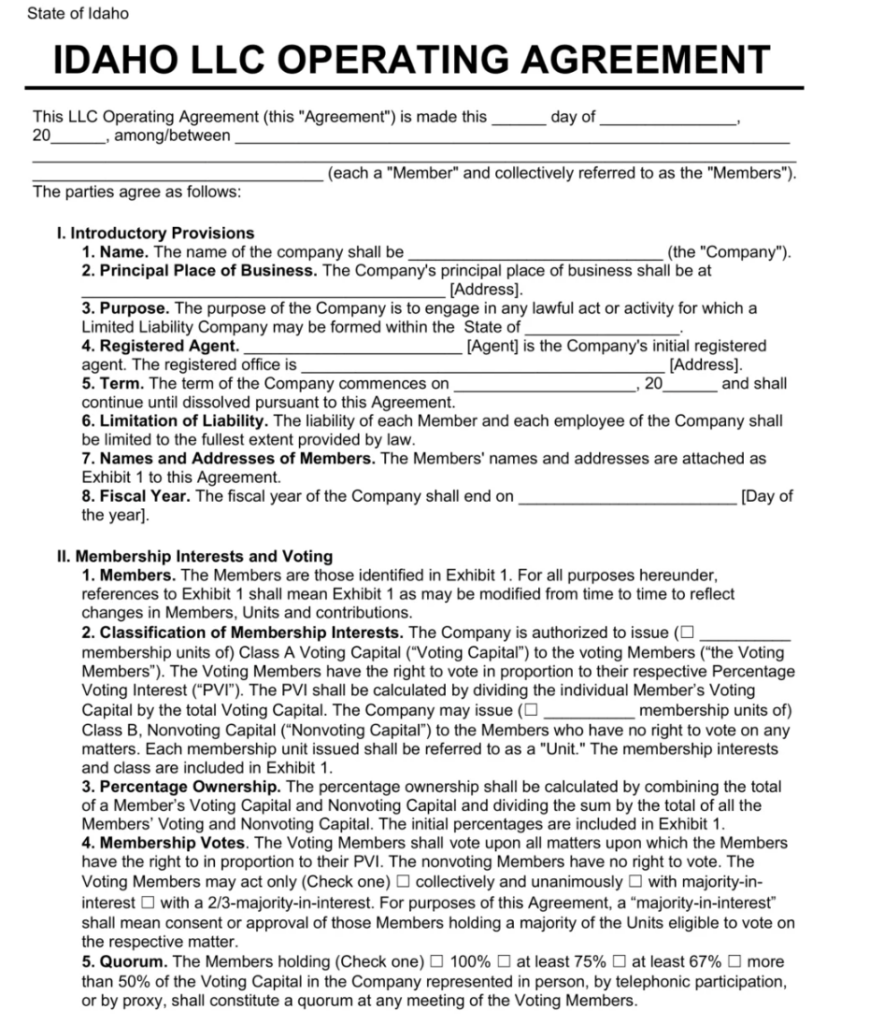

Step 5: Create an LLC Operating Agreement

An operating agreement outlines how your business functions. It’s an internal agreement between LLC members that helps ensure everyone is on the same page.

Without one, your business structure will be subject to the local laws to resolve disputes. That could lead to surprising and undesirable outcomes.

Idaho doesn’t require an operating agreement. But experienced business owners use them to protect their interests. They are essential for multi-member LLCs.

Operating agreements typically include:

- Name and purpose of the company

- Rights and duties of members and managers

- Member ownership percentages and contributions

- Distribution of profits and losses

- How to add or remove members

- Method for dissolving the LLC

You can find operating agreement templates online. Or you can have an attorney write one for you (expect to pay up to $1000 or more depending on the complexity of the agreement).

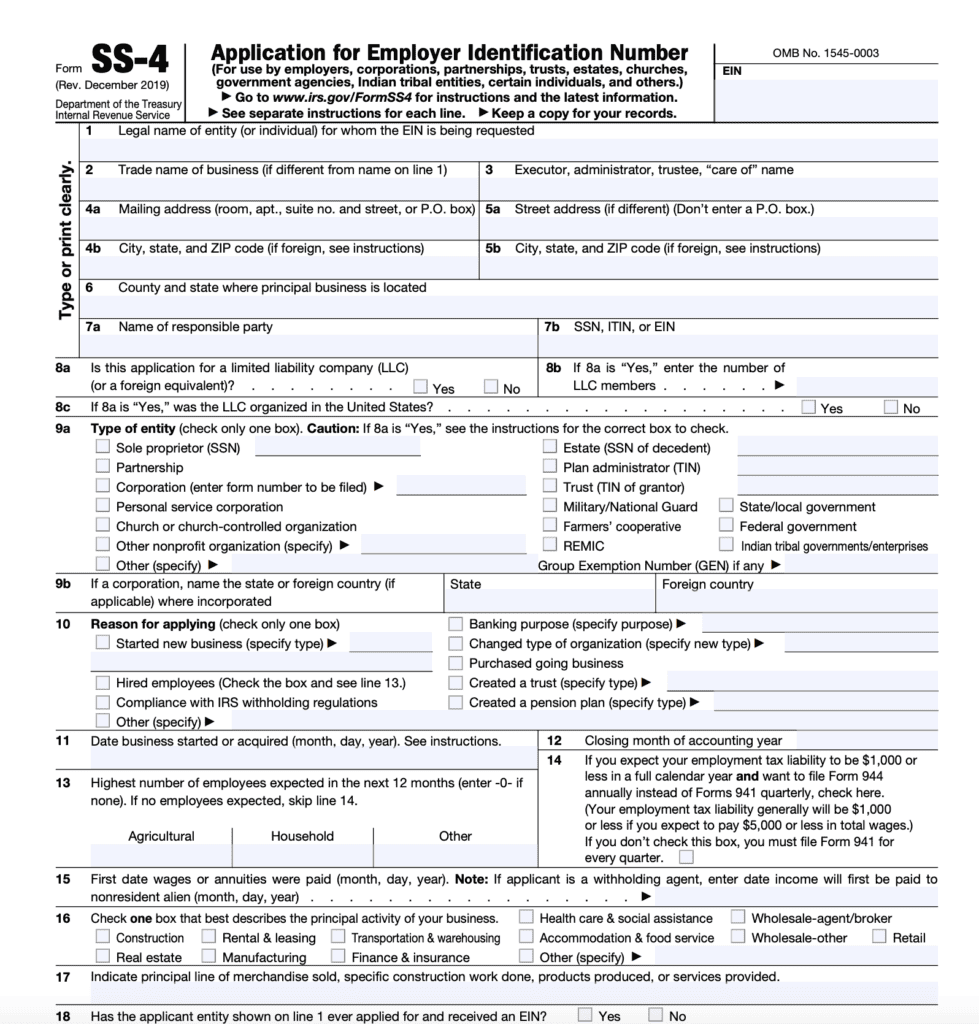

Step 6: Get an EIN (Employer Identification Number) from the IRS

The next step is getting a federal Employer Identification Number (EIN) from the Internal Revenue Service (IRS).

An EIN is a unique nine-digit identification number that acts like your company’s Social Security number. The IRS uses them to track tax information for businesses.

The IRS requires an EIN if your LLC:

- Has more than one member

- Files taxes as a partnership or S-corporation

- Hires employees

- Falls under other specific situations

How to apply for an EIN?

Getting your tax ID number is easy and free. Fill in the online application form. The IRS will issue your number within minutes.

You can also apply using the paper Form SS-4, but it can take up to eight weeks for the IRS to process it.

Costs to set up an LLC in Idaho

Each LLC is unique. The costs to form your LLC in Idaho will vary based on its complexity and how much professional help you use.

The minimum cost to form an LLC in Idaho is $100 + $4 (credit card fee) to file the Certificate of Organization online. It’s $120 to file the paper version. You should also set aside $10 to get a certified copy of the formation document.

Other optional LLC formation costs include:

- Name reservation: $20 (online), $40 (mail)

- Trade name/DBA: $25 online filing, $45 paper failing

- Professional registered agent: $46 – $175/year

- Expedited processing: $40 – $100

- Other certified document copies: $10+

- Drafting operating agreement: $0 – $1,000

Last steps

At this point, you’ve formed an LLC and are almost ready to open your new business. Here are the last few bits to wrap up before launching.

Complete the Idaho Business Registration (IBR-1) application

Some companies will need to complete an Idaho Business Registration. This registers your LLC with appropriate state authorities.

An LLC must file this form if it:

- Hires employees

- Makes retail sales

- Provides lodging

Registration is free and quick when you apply using the Idaho Business Registration System. You can also head over to the State Tax Commission TAP portal.

Open an Idaho business bank account

Another important part of starting a company is opening a business bank account. It helps to:

- Prevent the commingling of personal and company funds

- Provide an image of legitimacy for your business

- Simplify tax planning

Without one, your personal assets could be at risk if your business gets sued.

Business bank account fees typically range from free to about $25 per month, depending on the deposit amount and account services.

Local licenses and permits

Your LLC may also need to get other licenses or permits. These can come from state, city, and county authorities.

Start by heading over to the Idaho Business Wizard to see what your LLC needs.

Make sure to check with your local authorities too. For example, the City of Boise and the City of Meridian offer business licenses and permits for certain activities. County authorities may have similar needs.