Limited Liability Partnerships (LLPs) are one of the lesser-known forms of business entities. Originally, only two states recognized LLPs in 1992, but the Uniform Partnership Act of 1996 extended this structure to other US states.

That’s how LLPs became a recognized separate legal entity alongside its “cousin” limited liability company (LLC).

Today, LLPs and LLCs share similarities in formation, taxation, and personal asset protection, but they are operationally different.

There are no limits on the types of businesses that can form an LLC. On the other hand, LLPs are not recognized in all states and are reserved for certain professions.

What is a limited liability company (LLC)

To form an LLC, you need to file Articles of Organization with the local secretary of state and designate a registered agent. LLC members report business earnings on their personal tax returns (unless they select another tax classification).

LLC pros

- Easy to form and operate

- Flexibility in management structure

- Members can have personal asset protection

LLC cons

- Difficult structure for investors

- Members could lose asset protection

- Annual maintenance costs

Read our full comparison of LLC pros and cons.

What is a limited liability partnership (LLP)

Business partnerships come in different types:

- General partnership (GP)

- Limited partnership (LP)

- Limited liability partnership (LLP)

The limited liability partnership is an unincorporated business structure that allows partners to equally participate in running the business and pay income taxes on their share of profits.

An LLP must have at least one managing partner who assumes liability for the debts of the partnership. The remaining partners enjoy limited liability.

The above makes an LLP an attractive legal entity for groups of professionals at high risk of malpractice claims, such as doctors, accountants, and lawyers.

For example, if three healthcare practitioners form an LLP and one doctor gets sued, the other two doctors are personally protected from the lawsuit.

An exception to the above rule is if one owner commits any wrongdoing or illegal acts outside of business. If that happens, there is no personal liability protection. Partners may also sue each other for breach of the partnership agreement or if their acts harm the partnership in any way.

The LLP structure is available in some form in all 50 states and the District of Columbia. However, states such as New York and California only allow professional service firms to select this entity type.

It’s important when doing business in other states because if other state laws restrict the use of the LLP structure, a partner may not have the personal asset protection in that state.

LLP pros

- Partners have personal asset protection

- Profits passed through to partners' tax returns

- All partners can be involved in managing the business

LLP cons

- Varying LLP laws across states

- The partnership must rely on partner funding, not external capital

- Individual partner actions can harm the entire company

LLC vs. LLP: Main differences explained

The main difference between a Limited Liability Company and a Limited Liability Partnership is that an LLC extends personal asset protection to all business partners (owners).

But an LLP only offers protection to one or several partners. But someone must remain personally liable in some states. In others, all partners are protected against the wrongdoings of others but have unlimited personal liability for the overall business debts and other possible obligations.

Also, LLCs can be formed for almost any type of business. But LLPs are a more common choice for licensed professionals and service providers.

|

LLC example |

LLP example |

|

Online cosmetics store |

Small salon, ran by two estheticians |

| Photography business |

Joint legal cabinet by three lawyers |

The above sounds confusing at first. But you’d get a better grasp of the LLC vs. LLP differences when you understand how to form, run, and report on taxes for each structure.

1. Formation: LLC vs. LLP

Since both options are incorporated business entities, the company formation process begins with doing the paperwork.

How to form an LLC

To form an LLC, you need to file Articles of Organization with the local secretary of state and pay a filing fee. Apart from this document, you‘ll also have to appoint a registered agent, register with the state tax authorities, create an operating agreement, and file an annual report for your LLCs (unless except by the state).

Failure to renew yearly registrations can result in the LLC being dissolved.

How to form an LLP

In most states, partners must file a Limited Liability Partnership application and pay filing fees.

Depending on your business type, other steps may be required. For example, in California, only accountants, lawyers, and architects can form LLPs, and they must pay an annual state tax. Lawyers must register their LLP with the California State Bar before the secretary of state will approve their LLP formation.

Also, the key to long-lasting partnerships is having a legally binding partnership agreement from day one. This document should specify:

- How you’ll add or remove partners

- Each partners’ business stake

- Managerial duties and decision-making power

While you don’t have to file a partnership agreement with the secretary of state to form an LLP, having this document is integral to prevent any breaches in liability or other operational mishaps.

2. Operations: LLP vs. LLC

Both LLC and LLP owners must operate in the best interest of the business. Typically, these “interests” are defined in the operating agreements for LLCs and partnership agreements for LLPs. These legal documents lay out how the company will be run.

Both can also have unlimited members. The difference is that some states require LLPs to have at least one general partner with unlimited liability for partnership debts. LLC members have personal asset protection from the LLC but no protection from the negligence of other LLC members. LLPs are more beneficial because partners have immunity to other partners' negligent acts.

LLCs can be member-managed, where the LLC owners operate the business, or manager-managed — when a non-business owner oversees the business operations. LLPs don’t have such an option.

Both LLC owners and LLP members must also appoint a registered agent who resides or operates in the state where the business is registered. This individual or professional service company will receive legal and tax documents on behalf of the business.

3. Taxation: LLP vs. LLC

That means you’re not liable to pay any corporate taxes. Instead, LLC members and LLP partners pay self-employment taxes on their share of business profits and distributions.

- Single-member LLCs are taxed as sole proprietors, with profits included on Schedule C of the personal tax return.

- Multiple-member LLCs can choose to be taxed as a partnership or corporation. If taxed as a partnership, members will receive a Schedule K-1 detailing their profit or loss amounts and file Form 1065 for the whole entity.

How does an LLP pay taxes?

LLPs file federal taxes as general partnerships. As a general partner, you have to include business profits and losses on Schedule K of the personal tax return.

Then pay applicable self-employment taxes. However, as a limited partner, you can report your income as passive and thus enjoy some tax advantages.

4. Tax Benefits: LLC vs. LLP

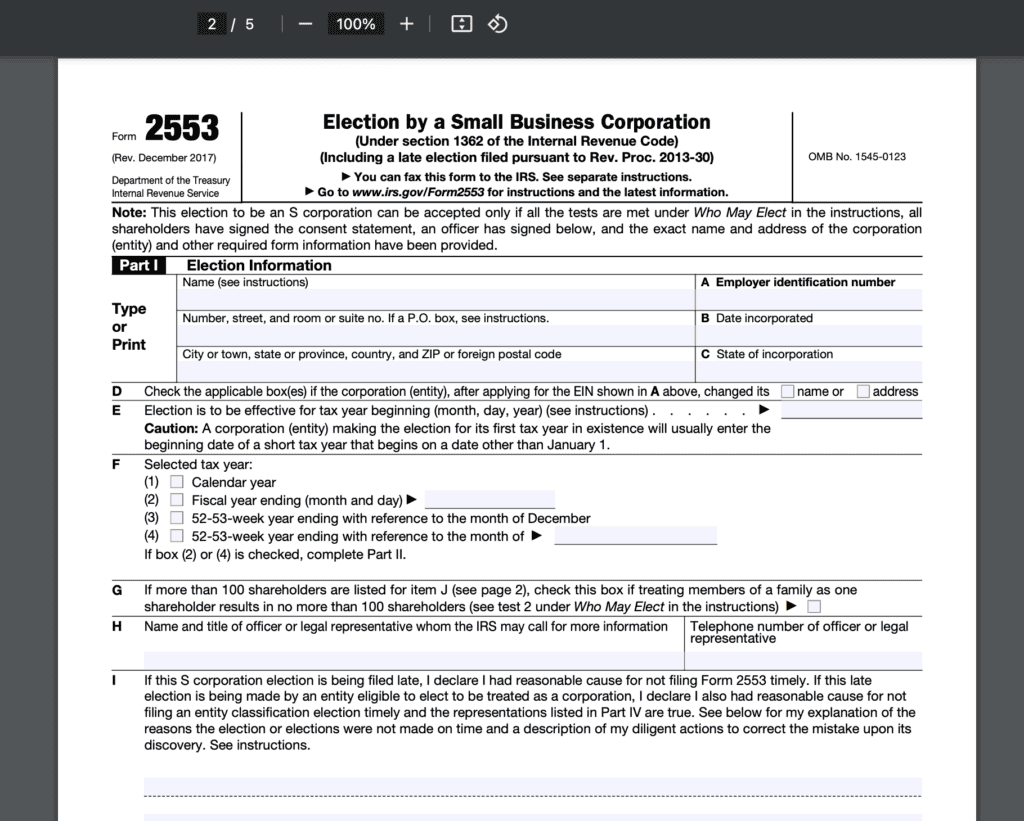

LLCs can elect to be taxed as an S-corporation on a federal level. Doing so means that LLC members pay taxes on their share of profits. Because S-corp members are considered employees of the entity, they're not subject to self-employment tax.

An LLC must file Form 2553 with the IRS to elect to be taxed as an S-corporation. In turn, this can result in some tax savings.

Unlike an LLP, an LLC can also choose to be taxed as a C-corporation. This decision requires the LLC to pay taxes at the corporate rate, which could be less than individual rates. The main benefit of taxing your LLC as a C-corporation is that the corporation pays taxes on earnings, but shareholders don't pay taxes unless they receive dividends.

The downside is if you do receive dividends, the same profits will face double taxation — once at the corporate rate and again at shareholders' personal rates.

Because of the different tax treatment options, tax rates vary amongst LLCs as members who could be paying corporate tax rates, individual rates, or both.

State Taxes: LLCs vs. LLPs

Some states impose minimal annual franchise taxes for LLCs and LLPs registered in this state. These include:

- Alabama: business privilege tax applicable to both LLCs and LLPs.

- Arkansas: franchise taxes apply only to LLCs, but not LLPs.

- California: franchise taxes applicable to both LLCs and LLPs.

- Connecticut: business privilege tax applicable to both LLCs and LLPs.

- Delaware: business privilege tax applicable to both LLCs and LLPs.

- Washington DC: franchise taxes applicable to both LLCs and LLPs.

- North Carolina: franchise taxes apply only to LLCs, reporting as C-corps.

- Rhode Island: franchise taxes apply only to LLCs, reporting as S-corps or C-corps.

- Tennessee: franchise taxes applicable to both LLCs and LLPs.

- Texas: franchise taxes applicable to both LLCs and LLPs.

- Washington: franchise taxes applicable to both LLCs and LLPs.

Always verify the information on taxation with your local state authorities too.

Conclusion: Which is better LLC or LLP?

Both options are reasonable starting grounds for incorporation. The formation costs and requirements are simple for both. However, an LLC offers better personal asset protection to all members plus has several tax advantages if you elect to be created as an S-corp.

An LLP is suitable for professional businesses that are more likely to deal with malpractice suits. It provides personal asset protection for partners, and each has a role in running the business. When one partner in an LLP is sued, the other partners are personally protected from that litigation.

However, unlike an LLC, for LLPs, it’s unusual to have “silent partners” on board — members who don’t actively contribute to the business.

Both should have paperwork that lays out how the business will be run and requirements for admitting new partners or dissolving the entity. Choosing an LLC or LLP depends on the industry, tax strategy, and level of personal protection that owners wish to have.