Business owners have several options for forming an entity legally separate from themselves. Sole proprietorships or partnerships are often the first choices for small businesses.

Later, however, many switch to a Limited Liability Company (LLC) or Corporation (Inc).

An LLCs or a corporation is a legally separate business entity from the respective owner. LLCs and corporations offer business owners protection of their personal assets for business debts.

Both business structures are registered with the state and governed by applicable local and federal laws. But they are also different – so which one should you choose?

Comparing LLC with Corporation:

- What is an LLC?

- What is a Corporation?

- LLC vs. Corporation: Comparison Table

- Conclusion

- FAQs about LLC vs. corporation

What is an LLC?

A Limited Liability Company (LLC) is a business entity structure that extends liability protection to every company member (owner).

Unlike a standard partnership or sole proprietorship, this legal structure protects business owners’ personal assets for the business's debts, similar to a corporation.

However, LLCs are viewed as a “pass-through” legal entity for tax purposes, meaning that there’s no extra corporate tax applied. To register an LLC, you’ll have to complete filings with the state, similar to a corporation.

But LLCs face fewer regulations and filing requirements. Here’s why business owners choose to form an LLC include:

- Protection of personal assets or protection of liability for business debts

- Pass-through taxation — no double-income taxes

- Simpler filing requirements than a corporation

- Lower annual maintenance costs

- Flexible management structure

- Multiownership possible

- Maintain a personal stack instead of passing ownership to shareholders

What is a Corporation?

Corporations are another type of business entity that also require filing certain documents with the state of incorporation. The specific requirements are governed by state law.

Like an LLC, they are a legally distinct entity from the business owners. They also can protect from personal liability for the business debts. However, corporations are owned by shareholders, whereas an LLC is owned by the members (or business owners). Corporations also must comply with more requirements than LLCs, and they are taxed differently.

For tax purposes, corporations are classified as:

- C-corporation. The most common and default tax status for registered corporations. The business entity is taxed at the corporate rate for federal and, if applicable, state purposes.

- S-corporation. Another type of tax classification, you can choose to elect with the IRS. In this case, your corporation will be treated as a pass-through tax entity for federal income tax purposes. However, a corporation must meet certain requirements to qualify as an S-corp. Note: LLCs can also elect to be taxed as an s-corp.

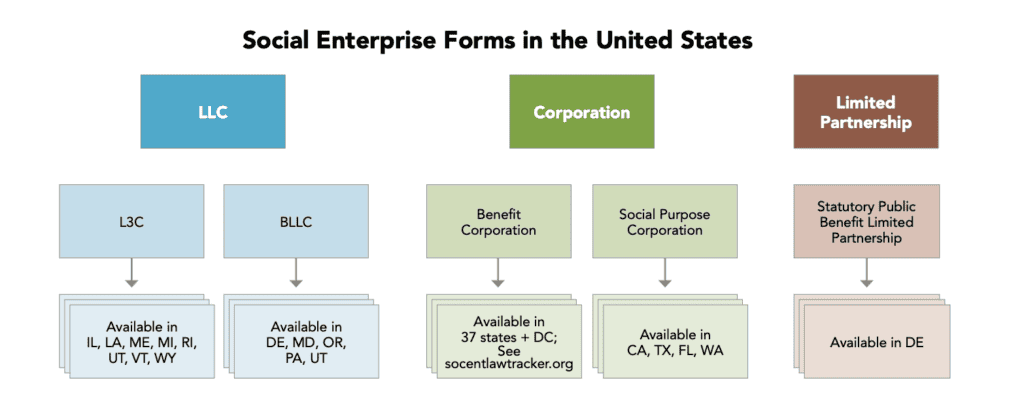

- B-corporation. Companies certified by B Lab, an independent certification organization, provide positive benefits to employees, the community, or the environment. These companies receive special tax treatment but are not recognized in every state.

When should you form a corporation?

The following factors make it worthwhile to consider forming a corporation:

- Ability to attract outside investors by issuing stocks.

- The decision to transfer ownership to another person (e.g., appoint a CEO)

- Easily transferable shares to retain employees and investors.

- Ability to establish an advanced management structure (such as the board of directors)

LLC vs. corporation: Comparison table

Both offer liability protection. Here’s a table showing a few ways that they differ.

|

LLCs vs. corporations |

||

| LLC |

Corp |

|

|

Taxes |

|

|

|

Maintenance |

|

|

|

Management |

|

|

1. Ownership Differences

LLCs offer more flexibility than corporations in assigning ownership percentages and exercising control over individuals’ stakes. LLC members' ownership percentage is spelled out in the operating agreement. It depends on:

- Members’ capital contributions

- The role that they will have in the LLC

- A mix of the above

Corporations allow more granular separation between owners, managers, and other contributors. Your company can have shareholders that may not have a role in the business.

Instead, they may just provide financial investments into the business in exchange for a share of the ownership. As an owner, on the other hand, you don’t have to take on a managerial role. Also, shares can be granted to managers, directors, and employees as part of the compensation package.

With corporations, on the other hand, many shareholders (including owners) often limit their participation by providing some financial capital without having an executive role. Some shareholders may be on the board of directors and govern the business. However, you can also give stock options to lower-level employees as part of their compensation package. In publicly traded corporations, any person who’s not affiliated with the company can purchase and then own a portion of the company.

2. Incorporation Differences

Both business structures assume undergoing a formal company establishment process.

Forming an LLC:

An LLC is formed in line with the legal state requirements, typically formalized by the local secretary of state (or a similar body). Forming an LLC usually includes the following steps:

- Business name selection and registration

- Articles of organization (incorporation) filling

- Payment of applicable state fees

- EIN registration (if there are multiple members or employees)

- Operational agreement preparation and signing

The requirements for forming an LLC will vary on the state's rules.

Overall, LLCs are easier, cheaper, and faster to set up than corporations since fewer requirements bind them. Still, it’s a step-up from operating as a sole proprietorship or partnership.

Forming a Corporation:

The rules of the state also govern the corporation formation process that it is incorporated in.

Forming a corporation typically requires:

- Filing formation documents, such as articles of organization, with the SOS

- Paying applicable state fees

- Registering a new business name

- Establishing a board of directors

- Preparing bylaws to oversee the business operations

- Registering stocks (if publicly traded)

The costs to form a corporation are somewhat higher. Since apart from state fees, you’ll likely require legal assistance for operational documentation.

3. Taxation Differences

An LLC is treated as a pass-through entity for tax purposes (unless you elect another tax classification).

The income or profit distributions that each member receives each year are reported on that member’s personal income tax return. As a member, you'll need to report company income on your personal income tax return and pay your respective dues. Taxation rates vary based on where the LLC member lives and how much income they receive from all other sources in a taxable year.

In contrast to corporations, LLCs do not face double taxation due to their pass-through structure.

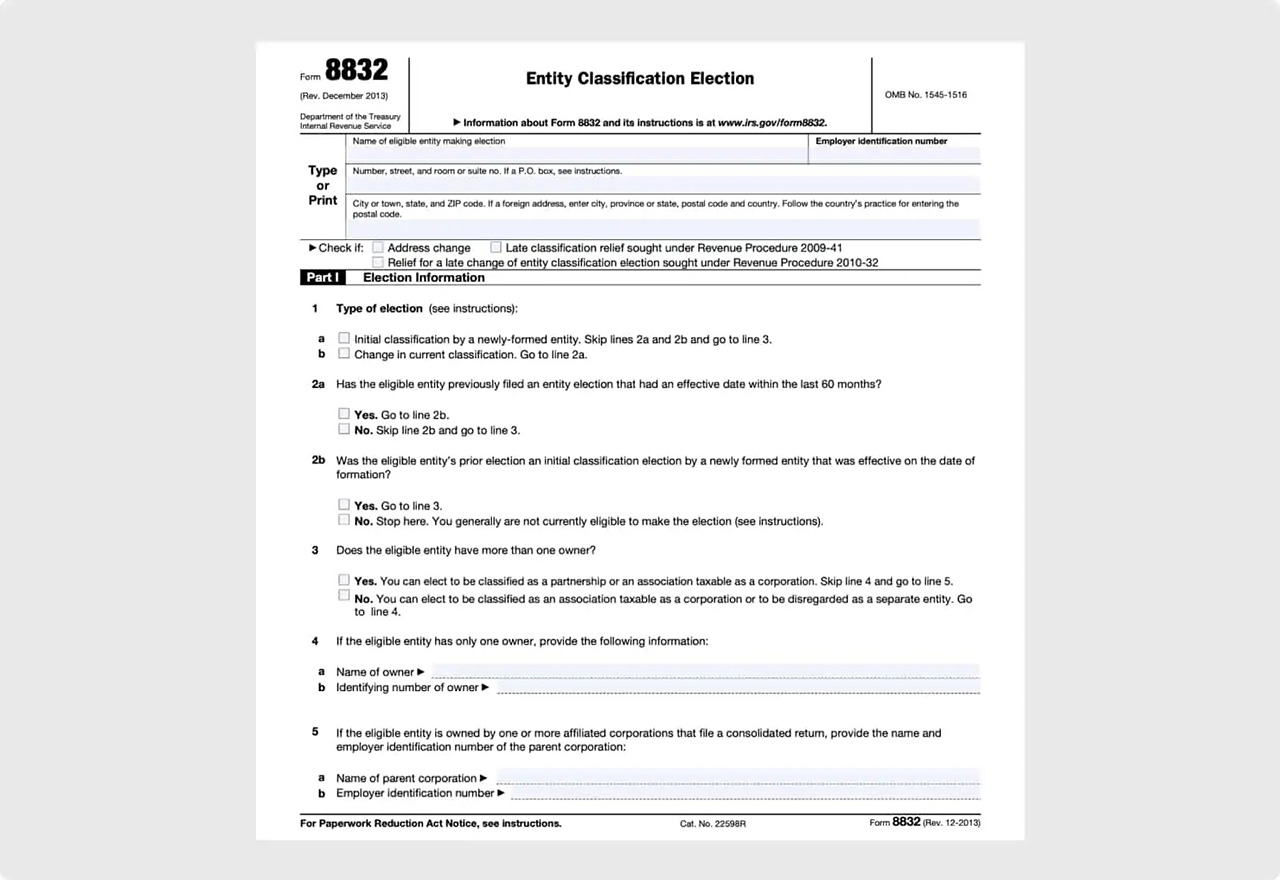

However, LLCs can also file a Form 8832 with the IRS to change how they are treated for federal tax purposes. For example, you can elect to be taxed as an S-corp rather than a sole proprietor.

Taxation of corporations

Corporations are taxed as separate legal entities at the corporate level. The business income is taxed at a corporate tax rate established at both the federal and state level. In the U.S., the federal tax rate as of 2024 is 21%. Some states, such as South Dakota and Wyoming, apply no corporate tax rate on top, so only federal corporate tax rates apply.

The payroll taxes are also withheld from any person receiving income throughout the year. Corporations pay half of social security and Medicare taxes of any employed persons. LLCs are not required to do so.

Separately corporate profits are often subject to double taxation — taxes on the income received and taxes on dividends issued to shareholders.

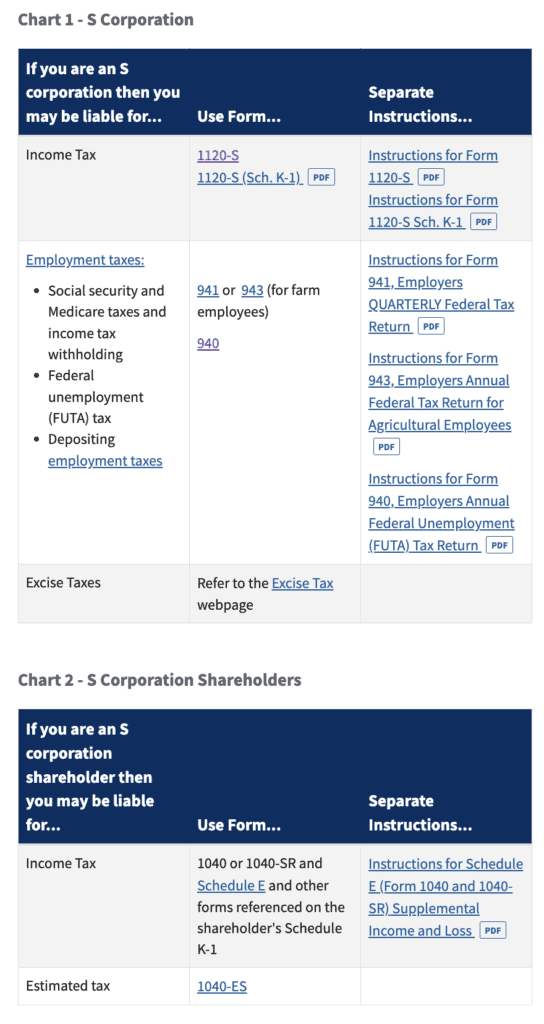

S Corporations and taxation

S Corporations, a federal tax classification used by the IRS, have different filing requirements for both the entity and the owners.

The IRS provides two helpful charts outlining these requirements:

4. Maintenance Differences

To maintain an LLC or a corporation, a business owner (or owners) typically need to file the following:

- An annual or biannual report with the state in which the business is formed

- Any filing fees required by all states for which the LLC conducts business

- Franchise taxes, if applicable, to the states that require such taxes for running a business in their state (which may include multiple states, depending on where the LLC operates business)

- Tax filings at the federal, state, and local level

- Other registrations as required by state laws

While LLCs tend to face fewer requirements than corporations, you should remain vigilant when it comes to your obligations. For example, some states will require fewer filings to stay up to date, and some will not require state income tax filings at all for either a corporation or an LLC.

Franchise taxes

Additionally, some states tax LLC members’ income and an additional state tax on the LLC’s income. Also, some states charge a franchise tax, annual fee, or registration renewal fee. These range from about $50-$500 per year, depending on the state.

States charging LLCs some variations of minimum annual franchise taxes include:

- Alabama

- Arkansas

- California

- Connecticut

- Delaware

- Rhode Island

- Tennessee

- Texas

- Washington

- Washington, DC

Annual Reports and General Requirements

Generally, for both LLCs and corporations, states require some annual form to be submitted. They also may require some other fees, taxes on the entity’s income, and a registered agent and office maintenance.

For corporations, some states also require the payment of annual fees to maintain their good standing. For example, in Florida, corporations must submit an annual report and pay a $150 state fee. Late submission will result in a penalty of an extra $400.

5. Management Differences

Overall, the two business entity types are managed similarly. Yet, there are several significant differences to remember for each.

LLC management

LLC operating agreements define the company management. A single-member LLC may not need to create an operating agreement unless they wish to hire extra managers.

Typically, you can appoint any LLC member as a manager or define a similar type of role for them in the operating agreement. LLC is pretty flexible when it comes to designating different roles for members.

Corporation management

Corporations are primarily managed by an established board of directors, comprising of select shareholders. Also, most corps need to create and file annual reports, plus hold annual shareholder meetings. It enables every member to participate in the company management.

Separately, you can designate different people for managerial positions. These persons may or may not be owners of the corporation, so they may not have shares of stock in the corporation.

Also, the class of stock can sometimes determine how much control a person has in managing a corporation.

6. Profit Distribution Differences

For LLCs, the profit distributions are typically agreed upon in the operating agreement among the business owners. The share will depend on the member’s role or the capital contribution, or some other reason, as the members decide.

With corporations, the profits are distributed to the owners as well. However, the owners are shareholders. And as such, the profits are distributed to shareholders in proportion to the stock interest that they hold. They may also receive dividends when the company is profitable and at the board of directors’ discretion.

Conclusion

Both an LLC and a corporation extend limited liability protection to your operations. Fewer complexities bind the LLC formation process, and taxation is straightforward if you stay within the default tax category. The above makes the LLC structure better suited for new startups, small businesses, and mid-market companies.

Corporations have a more formal management structure and greater flexibility in ownership, fundraising, but at the cost of extra recordkeeping and compliance requirements. On the other hand, S-corps have more favorable taxation in some cases. Yet, the above strongly depends on your type of business and where you are located.

Evaluate the laws in the state where you plan to set up your company. Consult with a qualified CPA or attorney should you need extra clarifications. Then make your decision.

FAQs about corporation vs. LLC

Here are some frequently asked questions about the differences between a corporation and an LLC.