Wyoming isn't just about rodeos, cowboys, and mountains. It's a perfect state to register your limited liability company (LLC) if you value your privacy. That's because Wyoming is one of a few states that doesn’t require LLC members’ names be publicly disclosed and listed on the Articles of Organization. Additionally, with no personal income tax and low sales tax rates, Wyoming reduces overall tax burdens, allowing business owners to keep more profits and reinvest in growth.

If this sounds interesting, keep reading to find out how to start an LLC in Wyoming.

Steps to Get an LLC in Wyoming:

- Step 1. Pick a Name for Your LLC

- Step 2. Choose a Registered Agent

- Step 3. File the Wyoming LLC Articles of Organization

- Step 4. Get certified copies of LLC formation documents

- Step 5. Draft an LLC operating agreement

- Step 6. Obtain an EIN (Employer Identification Number) from the IRS

- Total Costs to Set Up an LLC in Wyoming

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1. Pick a Name for Your LLC

The first step in forming a limited liability company is to select a name for your business.

Wyoming requires that all LLC business entities have any of the following in the legal name:

- Limited Liability Company

- Ltd.

- Liability Co.

- LC

- LLC

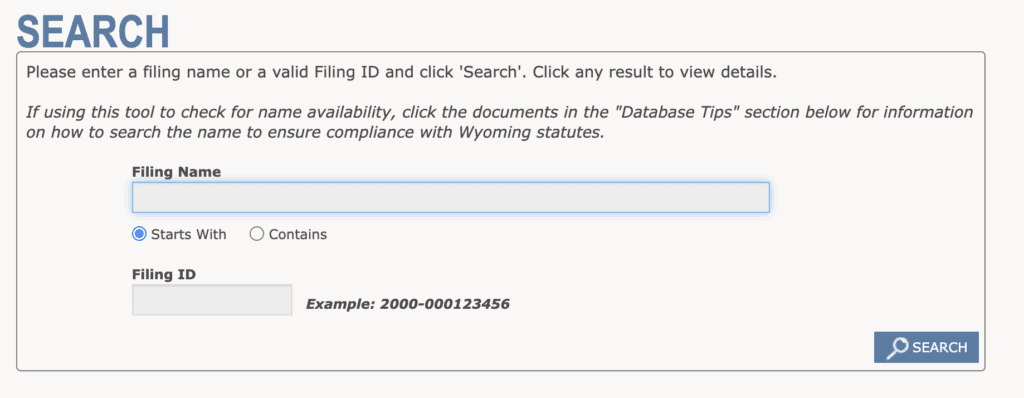

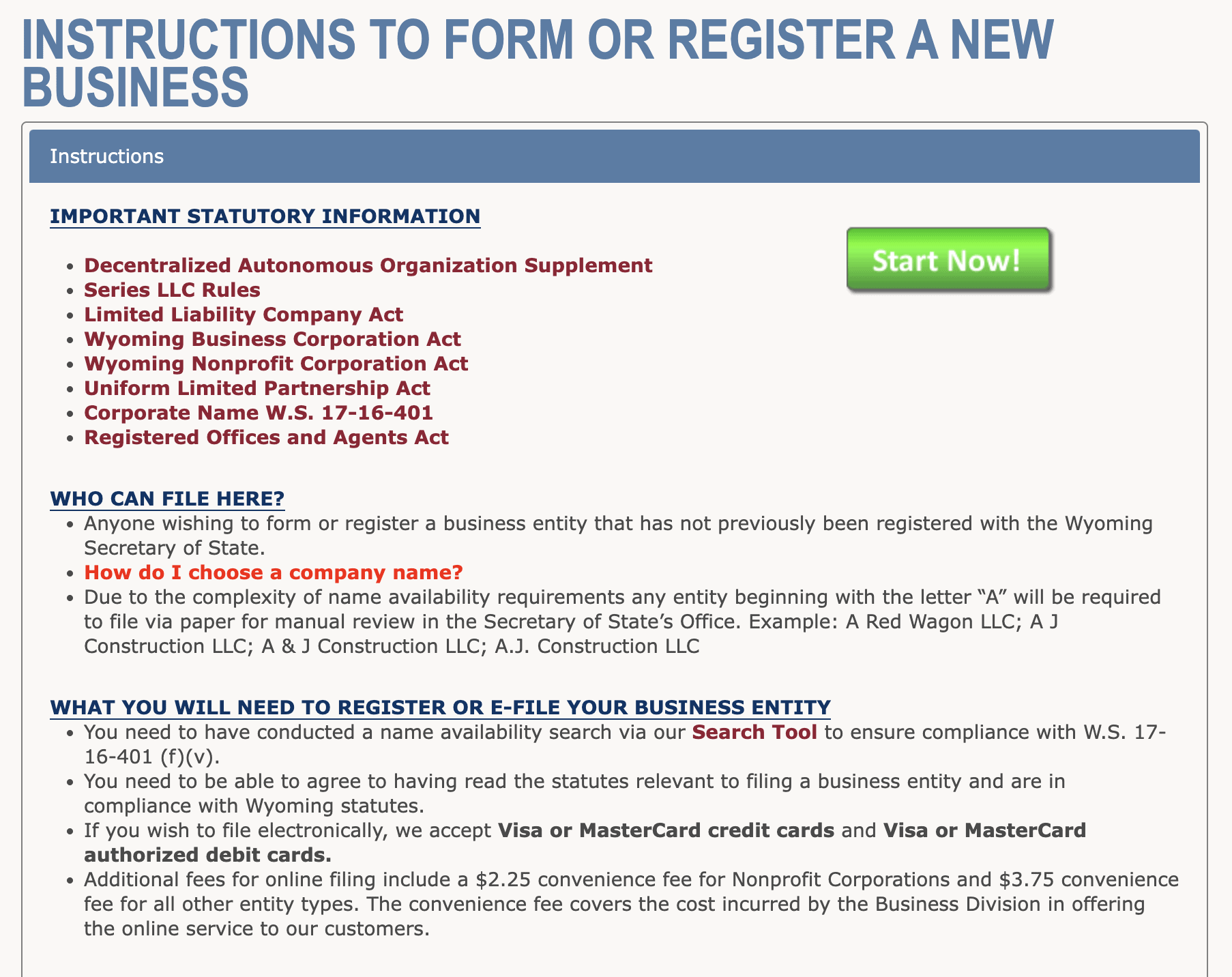

Next, check if the selected name is available by using the business entity search tool on the Wyoming Secretary of State website:

If the business name you want is available, your search will show “No Result Found,” which means you can use it for your LLC.

Name reservation (optional)

If you’re still undecided about proceeding any further or need more time, you can reserve the selected business name by filing the LLC Application for Reservation of Name. Once approved, your LLC name will be reserved for 120 days. The fee for reserving the LLC name is $60.

Trade name (optional)

If you plan to have multiple business locations or sell product lines under different names, adding a DBA to an LLC is a good idea.

A trade name — also called a doing business as name (DBA) — is an alternative version of your legal business name, registered with the state. An example might be Walmart, whose legal name used to be Wal-Mart, Inc., but changed to Walmart in 2018. Walmart may have wanted to have a DBA for both spellings during the transition.

Another DBA possibility would be if a company did business under multiple names. An example of this is Gap Inc., which does business under Gap, Old Navy, Athleta, and Banana Republic, even though all of those brands are just part of the Gap Inc. company.

To file a trade name in Wyoming, you must complete an application form with the Secretary of State and pay a $100 filing fee.

Step 2. Choose a Registered Agent

A registered agent is a person or company that maintains a physical office in the state of Wyoming.

Wyoming law defines a Wyoming registered agent as an individual (at least 18 years old) or business entity located in Wyoming appointed by a company to accept service of process and official legal documents on the company’s behalf.

Your registered agent must be available on business days (Monday through Friday) during business hours at your registered office address.

Agents are required to accept legal documents on behalf of clients. Having a document delivered to your registered agent provides proof that you have been legally notified about these documents, whether the documents are actually provided to you or not by your registered agent.

While you may be your own registered agent, you must have a physical address and be physically located in Wyoming to qualify. P.O. boxes are not accepted.

If you don't want to be your own registered agent, you can hire one for about $99-$249/year in Wyoming.

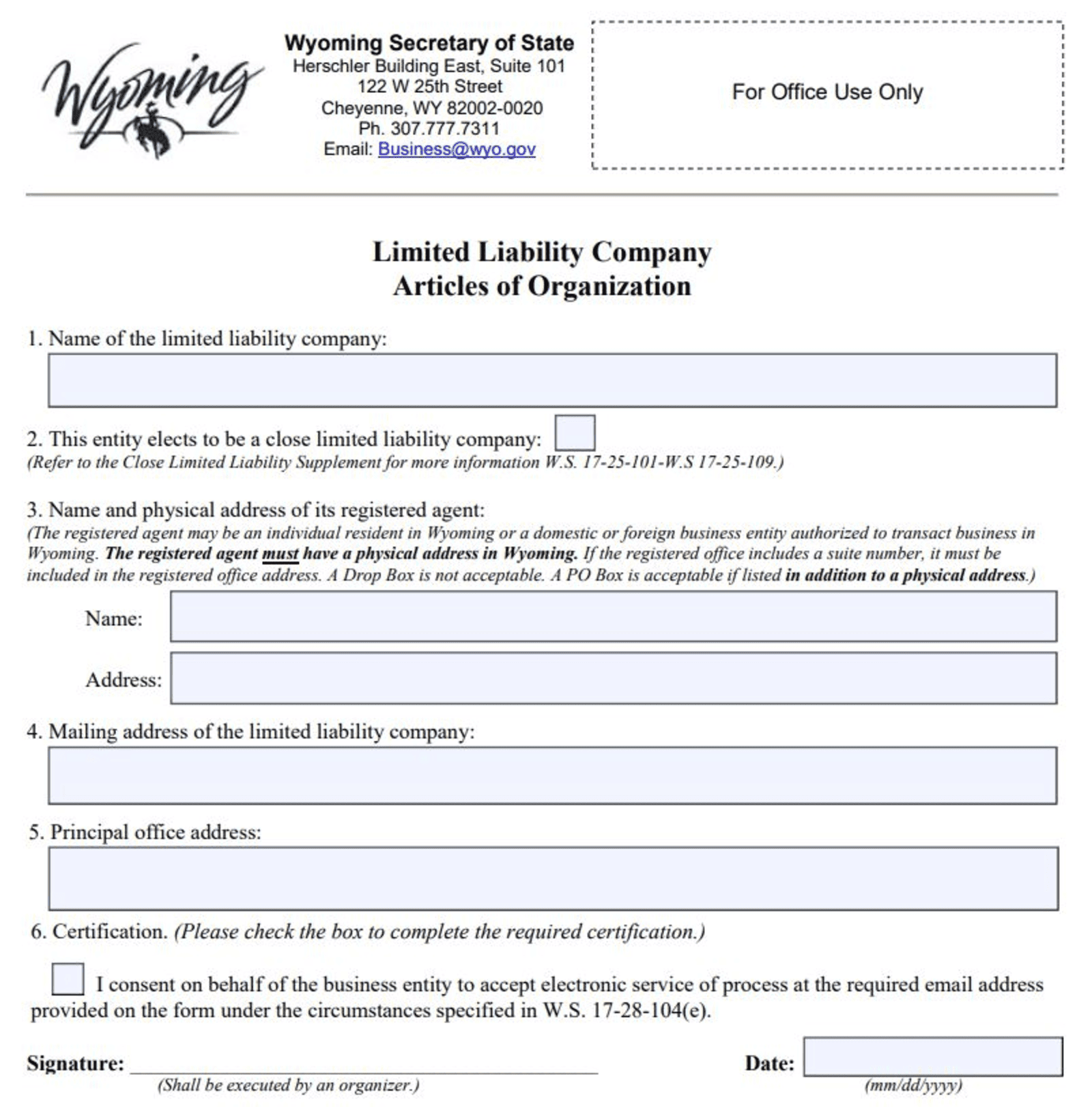

Step 3. File the Wyoming LLC Articles of Organization

Articles of Organization filing establishes your company with the state.

In Wyoming, you can file online or by mail. Regardless of how you file your Articles of Organization, the filing fee is $100.

Wyoming Articles of Organization is a two-page application and must contain the following information:

- LLC name

- Name and physical address of the registered agent

- Company mailing address

- Principal office address

- The signature of the organizer authorized to sign on behalf of the company

The processing time for the articles is up to 15 business days from the filing date when submitted by mail. Online filings are handled much faster — within a few days. (Note: there is an additional $2 convenience fee for online filings, making the total cost $102.)

Unlike some other states, Wyoming doesn’t offer an expedited filing service.

To submit paper filings for business entities in Wyoming, please send your Articles of Organization document to the following address:

Wyoming Secretary of State Business Division

Herschler Building East 122 West 25th Street, Suite 101

Cheyenne, WY 82002-0020

Phone: 307-777-7311

Step 4: Get Certified Copies of Your LLC Formation Documents

After the Secretary of State approves your LLC's Articles of Organization, be sure to get a set of certified copies of the approved documents.

It's a good idea to keep a copy with your corporate (LLC) records. You may need to show them to the bank when opening a business bank account or applying for a loan.

In Wyoming, the fee is $10 for documents totaling ten pages or less, and can only paid by check or money order.

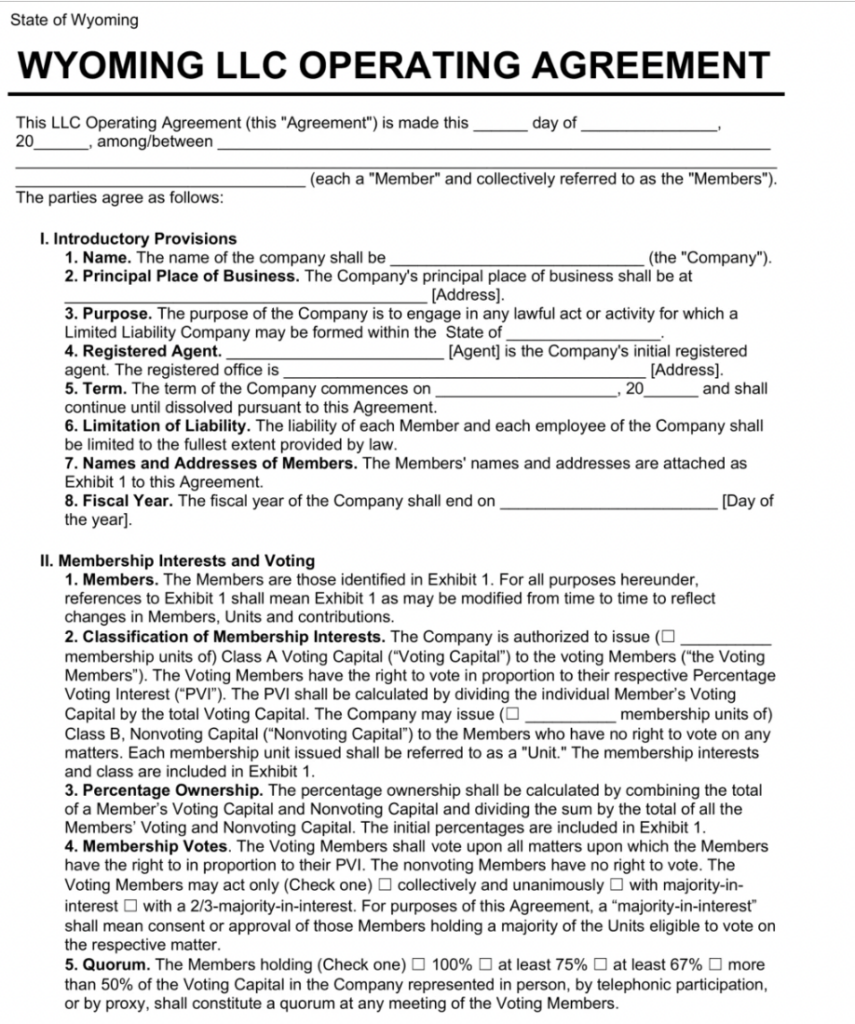

Step 5: Draft an LLC Operating Agreement

In Wyoming, an operating agreement is not legally required to form an LLC. However, it is highly recommended to have one.

Single-member LLCs can skip this step (for now). But multi-member LLCs should consider it. The operating agreement lays out the terms of LLC such as the following:

- The manager of the LLC

- Officers of the LLC

- Voting rights of the members

- Members' rights to distribution of income and capital

- Capital accounts of each member

An operating agreement may be drafted by an attorney licensed to practice law in the State of Wyoming. Additionally, there are online websites offering operating agreement templates. Make sure that your operating agreement complies with Wyoming laws.

Step 6: Obtain an EIN (Employer Identification Number) from the IRS

You may need an EIN for your LLC.

It's a unique 9-digit identification number for your business — similar to your Social Security number.

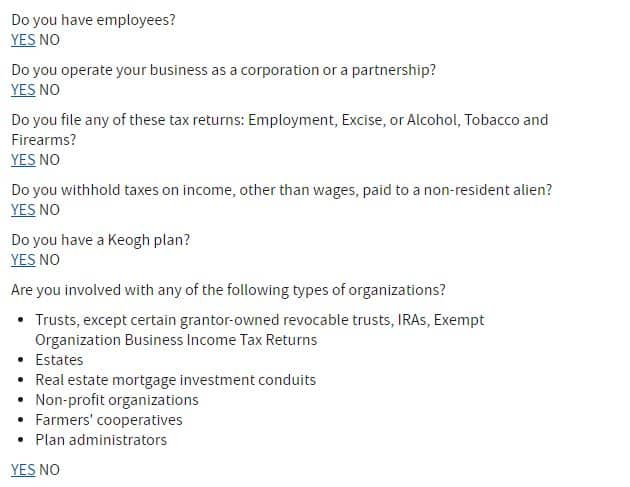

The Internal Revenue Service (IRS) website provides a questionnaire to determine if you need an EIN for your LLC.

Specifically, your Wyoming LLC may require an EIN if:

- Your LLC has more than one member, or

- Your company has employees

Otherwise, you can use your Social Security number to file federal tax returns.

Total Costs to Set Up an LLC in Wyoming

Wyoming is a cheap state to set up your LLC. Initial administrative costs will depend on your company's complexity and how much outside professional help you use.

Some of the formation costs you may incur to start your LLC in Wyoming include:

- Articles of Organization: $100

- Certified document copies: $10+

- Professional registered agent service: $99 – $249/annually (optional)

- Operating agreement: $0 – $1,000 (optional)

- Trade name/DBA registration: $100 (optional)

- Name reservation: $50 (optional)

Further Steps

After you've registered your LLC and the other administration tasks mentioned above, there are a few more things you should consider.

1. Open a Wyoming business bank account

Maintaining a separate bank account for your LLC is important for preserving members’ limited liability in the event of a lawsuit or insolvency. LLCs provide a layer of asset protection from creditors to all members. So it’s best to get a separate business account as soon as all your company formation documents are approved.

2. Register with the Wyoming Department of Revenue and Department of Workforce Services

The State of Wyoming charges a 4% sales tax. Additionally, counties may charge up to an additional 2% sales tax.

If your LLC needs to collect sales tax, you need to register with the Wyoming Department of Revenue. You can find more information on Wyoming’s Excise (Sales & Use) Tax Division site. Also, any business in the State of Wyoming that hires a Wyoming resident must register with the Department of Workforce Services to determine if workers' compensation or unemployment insurance is needed.