Looking to start an LLC in Iowa?

As the heart of the Midwest, Iowa is filled with beautiful countryside. It’s also a great state to start an LLC for your new business venture.

Forming an Iowa LLC is a great idea as it has one of the highest startup survival rates in the nation. You can take advantage of low formation costs and a favorable regulatory system.

This straightforward guide will walk you through everything you need to know to start an LLC in Iowa with ease:

Steps to Create an LLC in Iowa:

- Step 1: Choose a name for your LLC

- Step 2: Appoint a registered agent

- Step 3: File the Iowa LLC Certificate of Organization

- Step 4: Create an operating agreement

- Step 5: Get an Employer Identification Number from the IRS

- Costs to set up an LLC in Iowa

- Further steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Choose a name for your LLC

Choosing a name for your new LLC is the first step. While this can be a fun and creative task, you also need to understand the legal requirements.

The name of your Iowa LLC must:

- Be distinguishable from existing business names

- Include Limited Liability Company or an abbreviation (LLC or L.L.C.)

- Avoid words that suggest it’s a government agency

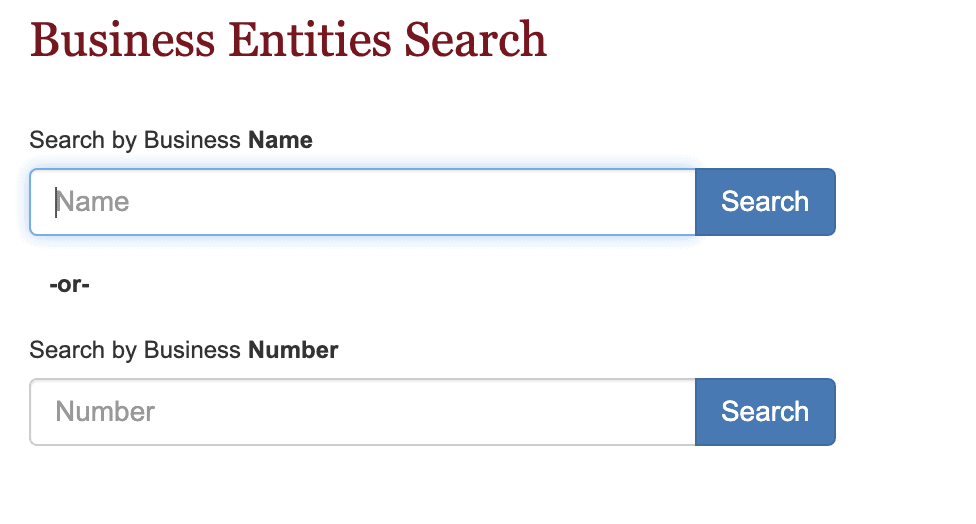

Brainstorm some names for your new LLC, then check your selection for availability using Iowa’s business entities search tool.

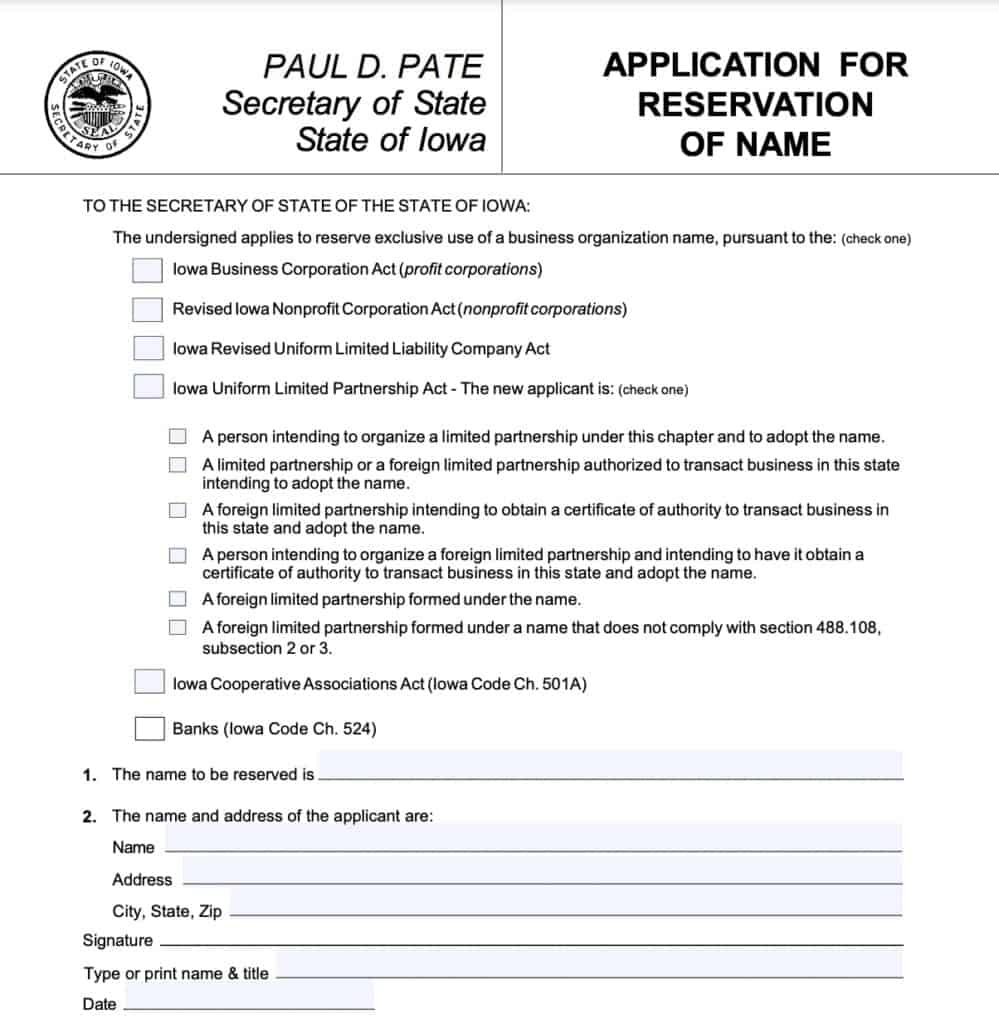

Name reservation (optional)

In Iowa, you can reserve an available LLC name for up to 120 days. This gives you extra time to prepare other company formation documents.

You can reserve a name online or complete an Application For Reservation of Name. A $10 fee applies.

Trade name (optional)

You can operate your LLC under a name other than the legal name. Many business owners use this technique to get flexibility with branding and marketing. It’s especially useful if your LLC has several product lines.

This is commonly known as using a trade name, assumed name, or doing-business-as (DBA) name. Iowa calls this a fictitious name. To use one, file a Fictitious Name Resolution form with the Iowa Secretary of State. You may also file it online. The filing fee is $5.

Step 2: Appoint a registered agent

In Iowa, an LLC must appoint a registered agent who fulfills certain criteria. The key requirements for a registered agent in Iowa are as follows:

- Physical Address: The registered agent must have a physical street address in Iowa (P.O. Boxes are not acceptable).

- Availability: The registered agent must be available during standard business hours to receive legal documents and official state communications.

- Resident or Authorized Entity: The registered agent can either be an individual resident of Iowa or a business entity authorized to conduct business in the state.

- Consent to Serve: The registered agent must agree to serve in this role.

The role of a registered agent is essential as they ensure that the LLC receives important legal and tax documents promptly. Failing to maintain a registered agent can result in penalties or administrative dissolution of the LLC.

In case you don't want to be your own registered agent, you can hire one for about $99 – $150/year in Iowa.

Step 3: File the Iowa LLC Certificate of Organization

The Certificate of Organization is the legal document that creates your LLC. It breathes life into your new venture. Other states call it the “Articles of Organization”. The standard filing fee is $50.

The Iowa Certificate of Organization form asks for basic information such as the name of the LLC, street address, and the registered agent's address. You may include some optional information, such as the names of the members or the purpose of the LLC.

Iowa doesn’t provide a sample Certificate of Organization. You will have to create your own.

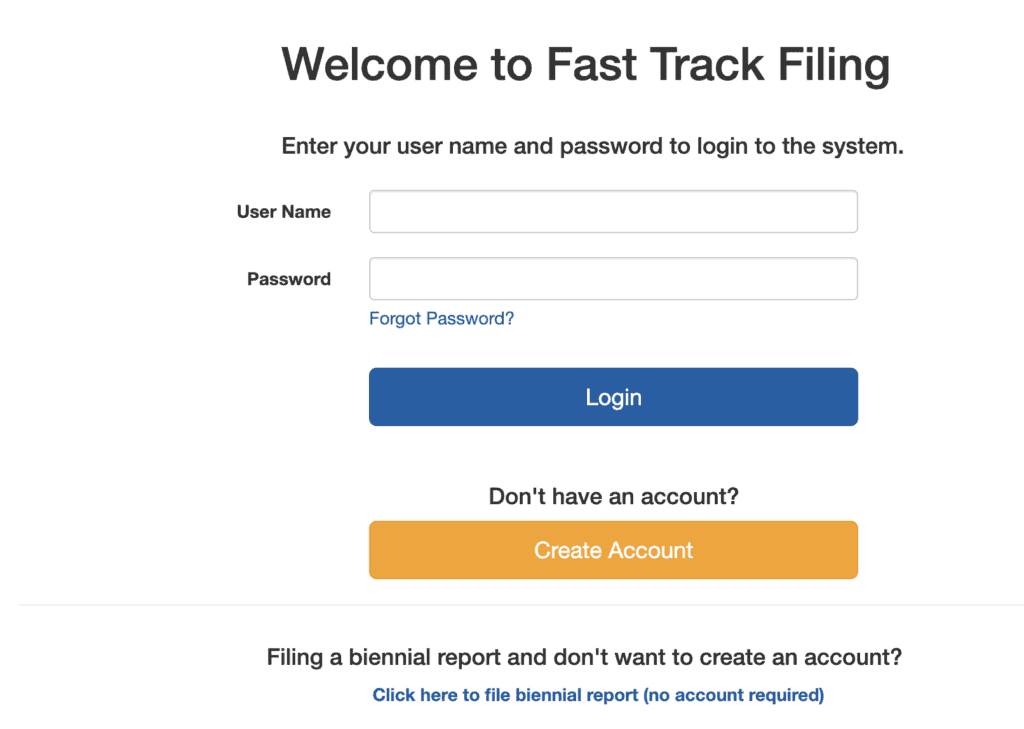

But the online LLC formation system makes the process easy. It’s also the fastest processing time:

You can file by mail, but it can take up to three weeks to process. It’s possible to speed up the processing of your filing by paying additional fees.

The online system usually processes applications within 1-2 business days, but mail filings can take up to three weeks.

If you still wish to file by mail, draft a Certificate of Organization and send it along with the $50 filing fee (payable to the “Iowa Secretary of State”) to:

Iowa Secretary of State Business Services Division

Lucas State Office Building,

1st Floor 321 E. 12th St.

Des Moines, IA 50319

Once your LLC Iowa is approved, get a Certification of Existence for $5. This should be kept with your business records.

Step 4: Create an LLC operating agreement

An operating agreement is a document governing the rights and obligations of the LLC members. It’s an internal agreement between members that lays out how the business functions.

Iowa law will step in when an operating agreement is absent or insufficient. This can lead to unexpected results that may not align with your desires. Savvy business owners use operating agreements to protect their interests and make sure everyone is on the same page.

A well-drafted operating agreement includes:

- Member identities, ownership amounts, and contributions

- Rights and duties of managers and members

- How business activities are to be conducted

- How to add or remove members

- Allocation of profits and losses

- Distribution terms

- LLC dissolution procedures

Iowa doesn’t require one and you don’t need to file it with the Secretary of State. It’s an internal agreement.

A copy of the operating agreement should be given to all members of the LLC and kept with the LLC records. Whether your LLC has one member or multiple members, a written operating agreement is strongly recommended.

You can use free or low-cost online templates to create an operating agreement. Or you can hire an attorney for $1,000 or more to customize one to your needs.

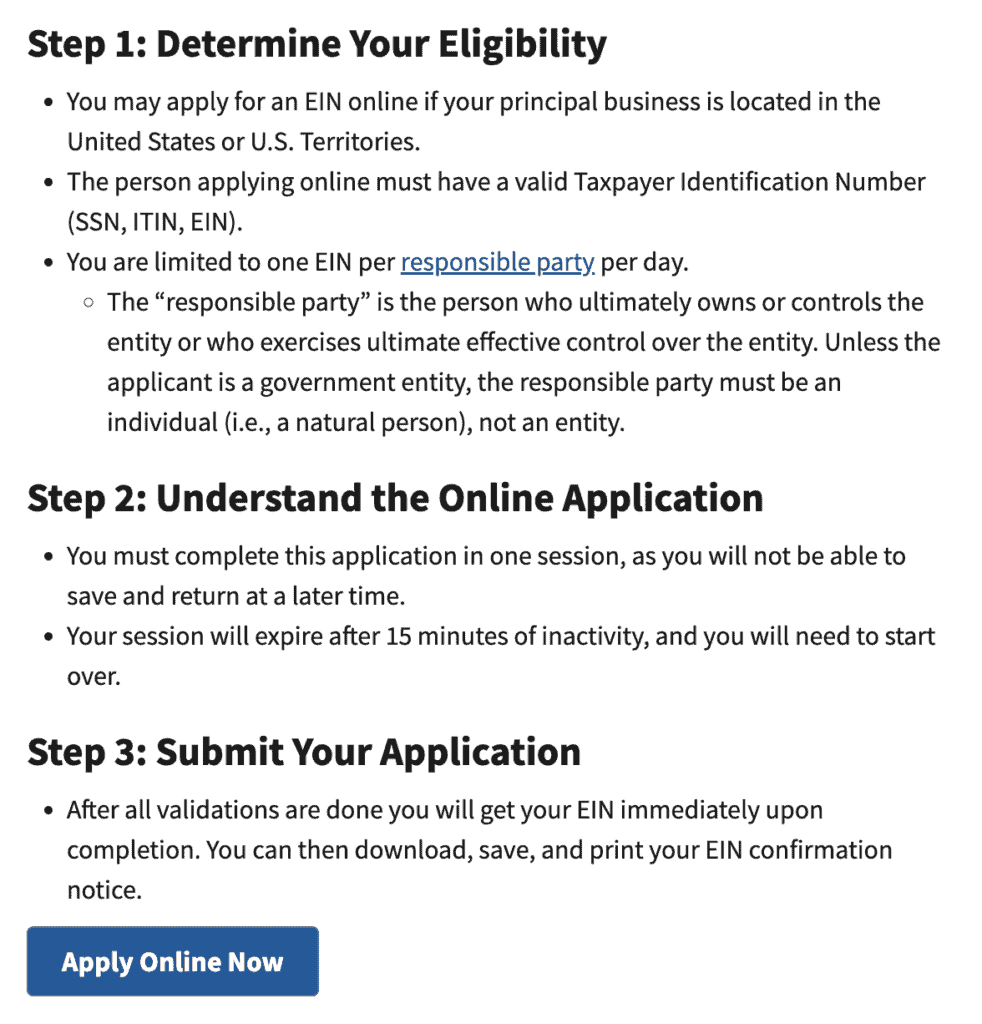

Step 5: Get an EIN (Employer Identification Number) from the IRS

Once your new entity is formed, you should get an Employer Identification Number (EIN) from the Internal Revenue Service (IRS).

The IRS uses EINs to track tax information. It’s like a Social Security number for your LLC.

An EIN is necessary if your Iowa LLC:

- Has more than one member

- Hires any employees

- Falls under other specific rules

Some single-member LLCs can use your personal SSN. But it’s best practice to get one anyway. Some banks and local authorities may require one.

The application process is easy and free. Apply online with the IRS and get your EIN in less than 10 minutes:

Costs to set up an LLC in Iowa

Starting an LLC in Iowa is a fairly simple and cost-effective process. The initial filing of the articles of organization is $50. This is lower than many other states.

There are numerous optional fees that a business owner might pay for, including registering a trade name ($5) and reserving a business name ($10). If you need to hire a third-party, commercial registered agent, you can expect to pay around $100-$150 per year.

Additionally, LLCs in Iowa must file a biennial report which can be filed online or on via mail – due by March 31 of every odd-numbered year (e.g., 2025, 2027). The cost to file is $30 online or $45 via mail.

Further steps

You’re nearly ready to start doing business with your LLC. Before you do, it’s worth tackling a few more administrative items.

Open a business bank account

Opening a business bank account is another crucial step for maintaining LLC protections. Without one, you may fail to show that the LLC is a separate entity. If your LLC gets sued, your personal assets could be at risk.Business bank accounts also help with accounting and tax needs.

To open a business account, you will usually need an ID, plus the LLC’s Certificate of Formation and EIN. Some banks offer business accounts for free, while others charge a modest monthly fee of $50 or less.

Local taxes, licenses, and permits

Depending on the nature of your business, you may be required to collect and pay taxes to the Iowa Department of Revenue. This applies to activities like car rentals, hotels, and paying employee withholding.

Certain businesses will also need to get additional licenses and permits. These can come from state, city, and county authorities. Many professional services and other business activities need to get a state license or permit. City and county licenses and permits are usually for things like zoning, alcohol sales, or other regulated businesses. For example, the City of Des Moines and Cedar Rapids require certain activities to get approval.

Other resources

Another important item is purchasing the right insurance coverage. A general liability policy can step in to save the day in many different situations. And workers’ compensation insurance may be necessary. Successful entrepreneurs understand the value of learning from others. If you want to discover techniques to help your new venture, reach out to the local business community. Connect with organizations like:

This material is provided for informational purposes only. The provision of this material does not create an attorney-client relationship between Paul Donovan and/or Donovan Legal PLLC and the reader and does not constitute legal advice. Legal advice must be tailored to the specific circumstances of each case, and the contents of this article are not a substitute for legal counsel. Do not take action in reliance on the contents of this material without seeking the advice of counsel.