Thinking of starting an LLC in Connecticut?

Connecticut is home to over 350,000 small businesses, making it one of the national hotspots for entrepreneurs. Connecticut is home to many of today’s most prominent brands, such as Aetna, Xerox, ESPN, and Subway.

Whether you're launching a new venture or formalizing an existing business, forming an LLC in Connecticut offers flexibility, liability protection, and tax advantages.

To help you navigate the process, we've put together this step-by-step guide to ensure a smooth and hassle-free LLC formation.

Steps to Create an LLC in Connecticut:

- Step 1: Select a name for your LLC

- Step 2: Appoint a registered agent

- Step 3: Draft and submit the Connecticut LLC Certificate of Organization

- Step 4: Get certified copies of the LLC's registration certificate

- Step 5: Create an LLC operating agreement

- Step 6: Get an EIN (Employer Identification Number) from the IRS

- Costs to set up an LLC in Connecticut

- Last steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Select a name for your LLC

Operating a limited liability company (LLC) comes with many perks. Two of the top ones are personal asset protection and diminished personal liability.

But before you can reap the benefits, you’ll need to complete your company registration.

It starts with naming your new business.

Connecticut LLC naming rules

Apart from selecting a unique, memorable business name, Connecticut LLC names must:

- End with “Limited Liability Company,” “LLC,” “L.L.C.,” or “Ltd.”

- Avoid using names related to government agencies, such as Treasury or FBI

- Steer clear of terms like bank, attorney, or insurance, unless authorized

- Don’t use words reserved for corporations, such as “corporation,” “incorporated,” or “inc.”

- Reflect the purpose of your business

- Not conflict with existing companies in Connecticut.

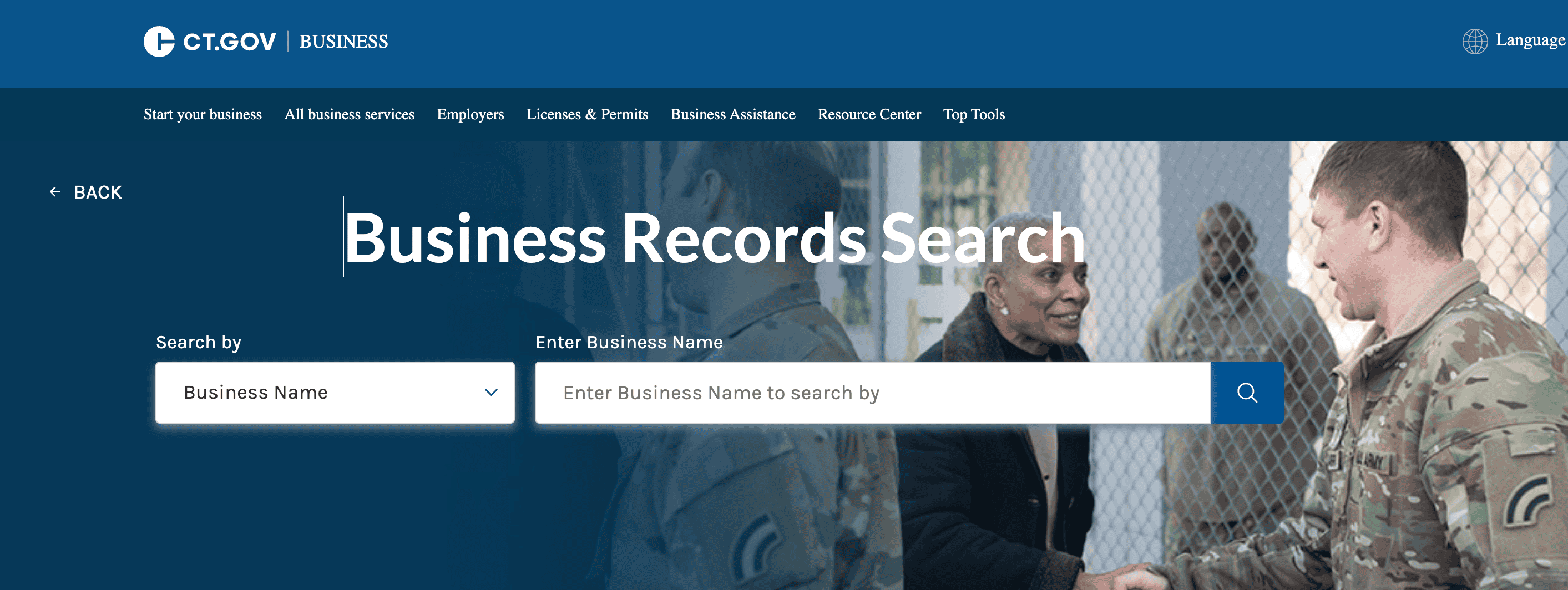

Once you have some options, run a business records search on the Connecticut Secretary of State’s website. The tool will tell you if a specific name is available for registration:

Name reservation (optional)

You can reserve an LLC name before you’re ready to form it. Prepare an Application for Reservation of Name along with a check for $60. Then submit it to the CT Secretary of the State (SOS) online, by mail, or in person.

This isn’t a required step. It secures your LLC’s name while you prepare to form your LLC.

Trade name (optional)

Many business owners choose to operate under a name different from the legal name. This is known as using a trade name or doing-business-as (DBA) name. You might want to use a trade name to:

- Rebrand your company

- Focus on many lines of business

Connecticut law requires anyone using a DBA to file a Trade Name Certificate. You can file with the town clerk’s office in the city where they conduct business by mail or in person. Fees can vary depending on the municipality.

Step 2: Appoint a registered agent

You’re required to appoint a registered agent when you form your Connecticut LLC.

A registered agent receives and accepts official legal communications. These can include tax documents and regulatory notices. The agent also receives any service of process (e.g., summons) if your LLC gets sued.

Connecticut requirements for a registered agent:

- Is over 18 years of age

- Has primary residence in Connecticut

- Has a street address in Connecticut (not a P.O. Box)

- Is available during regular business hours

You, an employee, or a trusted friend can act as a registered agent. If you don't want to be your own registered agent, you can hire one for about $99-$199/year in CT.

How to appoint a registered agent in Connecticut

Appointing your registered agent is part of your Certificate of Organization application (next step). There is no fee for this initial selection.

To change the registered agent, use the Change of Agent form. Submit it to the Connecticut SOS with a $50 filing fee. Your new Connecticut registered agent must also sign a paper form.

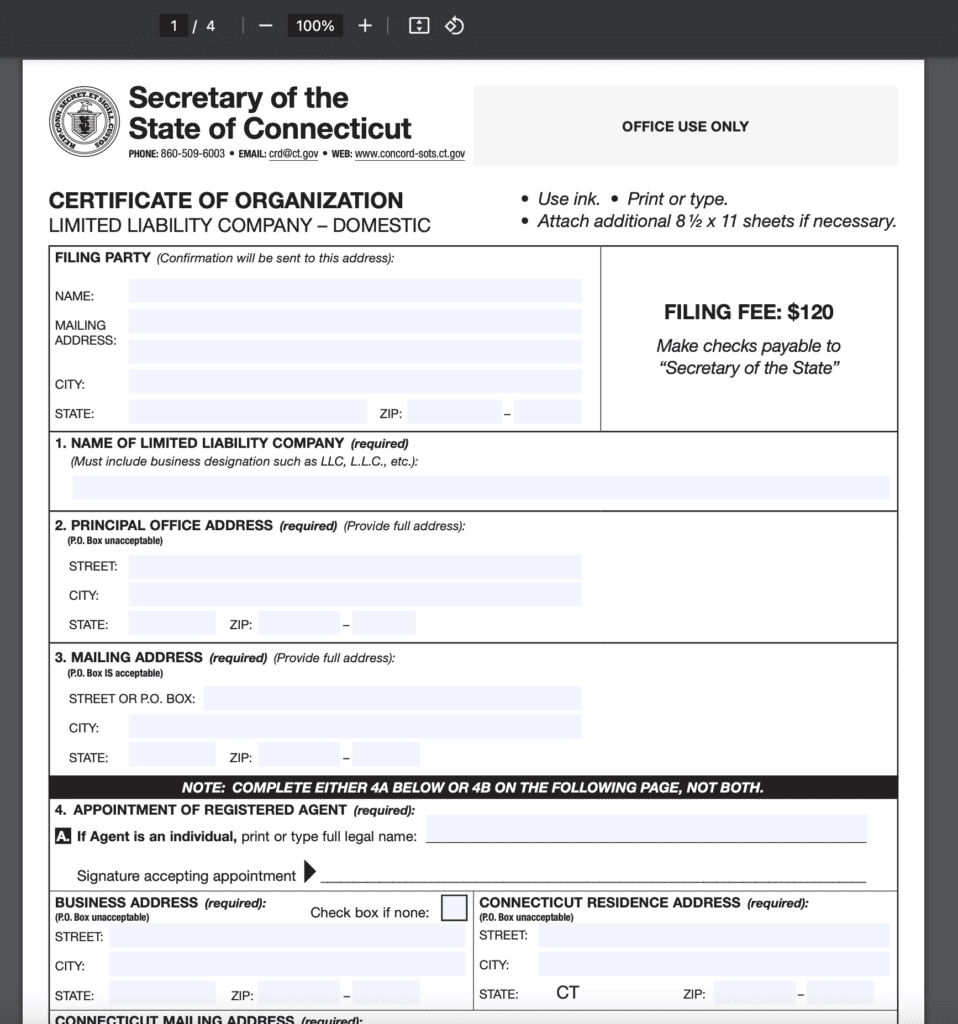

Step 3: Draft and submit the Connecticut LLC Certificate of Organization

When you’re ready to form your Connecticut LLC, you’ll fill out and file the Certificate of Organization. Other states call this the Articles of Organization.

It is the legal document that creates your LLC. And it’s one of the most exciting steps.

Download and submit the Certificate of Organization form online. Or you can submit a hard copy by mail (Connecticut Secretary of the State Business Services Division 30 Trinity St. Hartford, CT 06106) or in person. A $120 fee applies.

Connecticut has a complete list of what you’ll need to file your Certificate of Organization. It includes:

- LLC name and address

- Registered agent contact details

- Founders of the LLC

- Managers of the LLC (even for single-member LLCs)

Step 4: Get a certified copy of the LLC's registration certificate

After the SOS approves your LLC's Certificate of Organization, you want to get a certified copy of the registration. The cost for certified copies is $55 per document.

Keep this in your LLC’s records. You may need this to open a business bank account or take out a business loan.

Step 5: Create an LLC operating agreement

You don’t need an operating agreement for your Connecticut LLC, but it’s good practice to have one.

Without one, your LLC will use state law to determine the outcome of disputes. This may not align with your desires and can have unexpected outcomes.

Instead, protect yourself and make sure your LLC operates as you intend. An operating agreement covers items such as:

- Members’ names, contributions, and share of ownership

- Who contributes money if the business needs more

- How and when to distribute profits among owners

- How members can join or leave the LLC

- When and how to dissolve the company

- Other decision-making and executive powers

You can use a free or low-cost template online. Or consult a business attorney to help you draft a customized operating agreement.

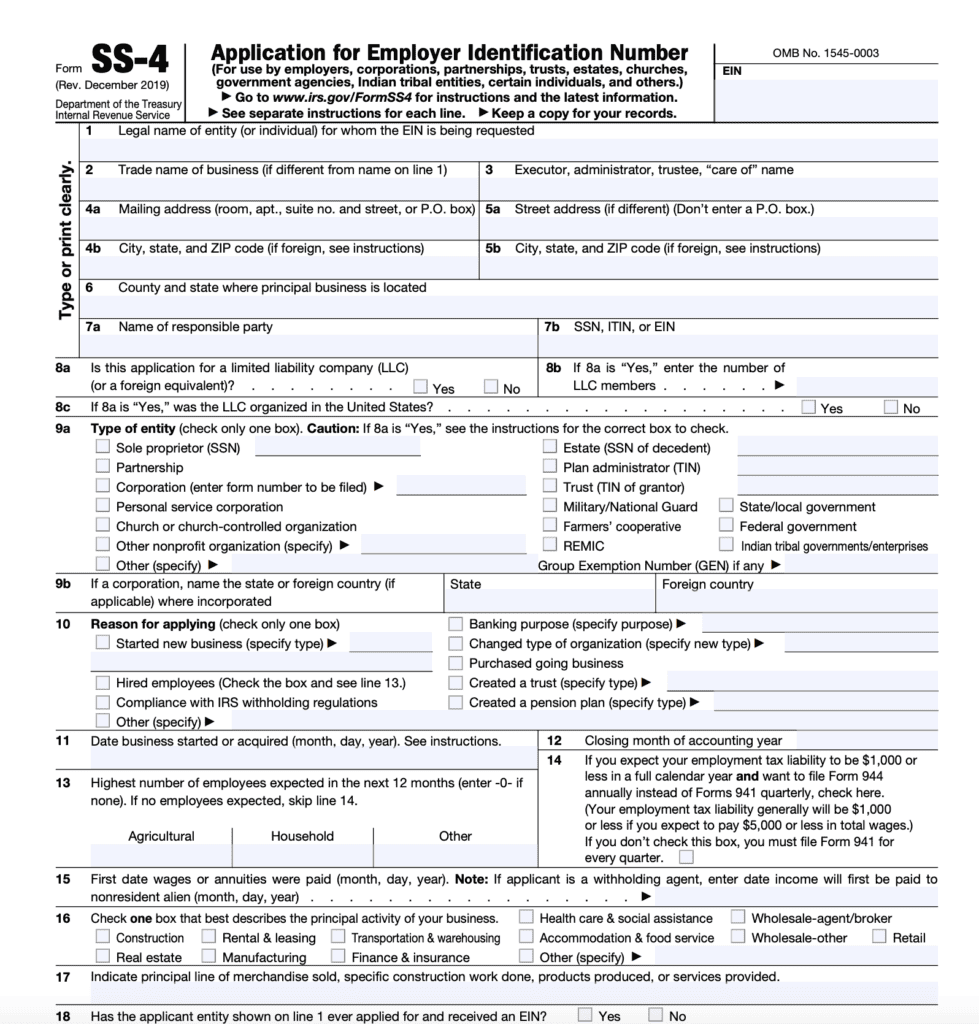

Step 6: Get an EIN (Employer Identification Number) from the IRS

Some LLCs will need to apply for an Employee Identification Number (EIN). All multi-member LLCs must get one.

An EIN is a unique nine-digit number like a social security number. The Internal Revenue Service (IRS) uses them for tax returns and reporting. An EIN is also needed for hiring employees and paying federal taxes.

Single-member LLCs filing taxes as a sole proprietorship with no employees are not required to get an EIN.

You can apply for and get your EIN using a paper Form SS-4. But it’s free and much faster through the IRS website.

Fill out the basic information on the form and get your number in 10 minutes or less.

Costs to set up an LLC in Connecticut

Costs to set up a Connecticut LLC vary depending on complexity and the amount of professional help.

At the least, the formation costs for a new Connecticut LLC start at $120. This is the cost of filing the Certificate of Organization. Getting a certified copy for $55 is recommended, bringing the total minimum cost to $175. Optional costs of forming your LLC in Connecticut include:

- Reserving a business name: $60

- Registering a DBA: $100

- Hiring a professional registered agent: $99 – $199 per year

- Drafting an LLC operating agreement: $0 – $1,000 (attorney fee)

Further steps

You're almost done starting your Connecticut LLC. There are a few steps you should take before launching your new business.

Register with the Connecticut Department of Revenue Services

You may need to register with the Connecticut Department of Revenue Services (DRS). This is how you pay applicable state taxes.

You can complete registration online. Or you can register using a paper Form REG-1, Business Taxes Registration Application. The DRS collects a one-time fee of $100.

Open a business bank account

Opening a business bank account is essential for record-keeping. It’s also a crucial part of making sure the LLC retains its legal benefits. Combining business and personal finances may put your personal assets at risk during a lawsuit. Monthly service fees range from $0 to $50, depending on the bank and type of account you choose.

Licenses and permits

Your Connecticut LLC may need to get licenses and permits.

Connecticut offers a personalized new business checklist that helps identify what your LLC needs. Cities like Hartford and New Haven also have lists of licenses and permits. The needs depend on business activities. Things like construction, food sales, and transportation services often require approval.

Annual reporting

Connecticut requires LLCs to file an annual report with the Secretary of State. The filing fee for this annual report is $80.

Other resources

You’re almost ready to open the doors to your new business.

Before you do, consider getting adequate insurance coverage. If you hire employees, you need to get workers’ compensation insurance. A general liability policy can also provide essential protection. Learning from experience can propel your business forward. You can get free counseling from the Connecticut SBDC. Connecting with groups like CBIA can expand your network and knowledge base.