Successful LLC formation doesn’t mean the end of paperwork for you. You’re required to file an annual report with your state's Secretary of State as part of operating your LLC.

Due dates, forms, and filing fees vary, but one thing remains the same across the board — failure to file an annual report on time can lead to hefty late fees, fines, and even loss of your company registration.

This guide explains how to maintain good standing and remain compliant year-round.

Table of contents

- What is an annual report for LLC?

- How to file an annual report for an LLC in 3 steps

- Step 1: Check the state requirements

- Step 2: Fill in the annual report forms

- Step 3: File the annual report before the deadline

- Annual report fees: state by state in 2023

- Key takeaways

- FAQ Commonly asked questions

Let’s get started!

What is an annual report for LLC?

While annual reports may have different names like an annual statement, biennial statement, statement of information, or periodic report, they all aim to do the same thing — keep your LLC’s corporate details up to date with your state.

The annual report for your state is used to update any company information, like address, member names, and registered agent details.

Filing an annual report keeps your limited liability company in good standing with your state. That means you’ll be able to continue to transact business and receive the liability protection your LLC grants you.

Some states require a report each year, and some require them less frequently, like every two years or only when there are changes to the company that needs to be reported.

States requiring filing an annual report

In the US, 41 states require LLCs to file annual reports.

In most cases, you’re also expected to pay an annual report fee (varying from $10 in Colorado to $500 in Massachusetts). In Idaho and Mississippi, annual reports are mandatory but free to file.

States not requiring LLC annual reports

The following eight states, however, do not require an annual report. They only request you to file an update if there are changes to the company.

A reminder will be sent to your registered agent's address several weeks before the annual report is due.

How to file an annual report for an LLC in 3 steps

When it’s time to file your annual report, you have three options:

- Do it yourself

- Ask an accountant or attorney for help

- Use a document filing service

The latter two options are hassle-free. But come with a fee.

This 3-step DIY approach for preparing your LLC's annual report can save you some money.

Step 1: Check the state requirements

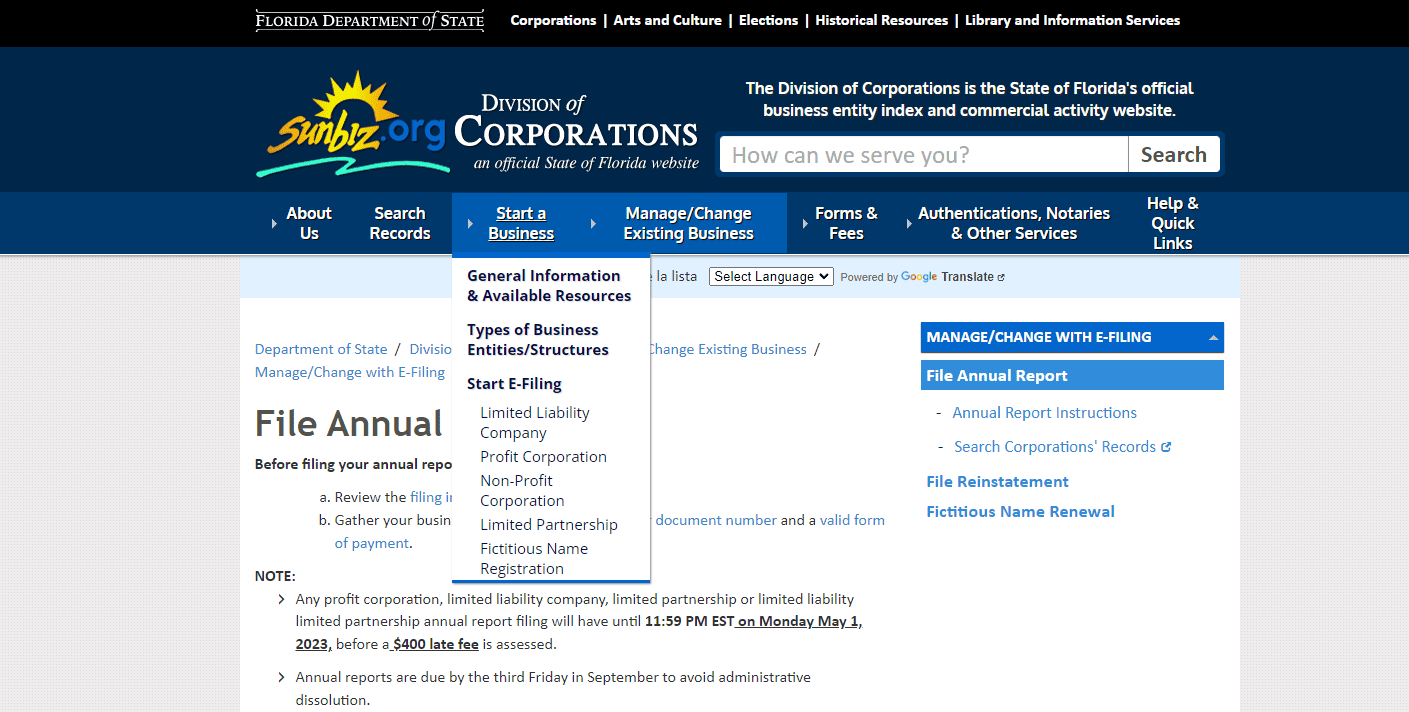

Each state has its own annual report filing requirements. While some states let you file online, others require you to mail paper copies.

Check with your state’s Secretary of State (SOS) for filing requirements. Be sure to get answers to the following:

- Do you need to file it annually/biannually/only when there are changes?

- When is the deadline?

- What is the filing fee?

- How is the report submitted (electronically or via hardcopy)?

- Are there any late fees?

- What else happens if you file late?

Your Secretary of State will have an online portal if they allow or require online filing. Often, filing online is cheaper than sending in a paper copy.

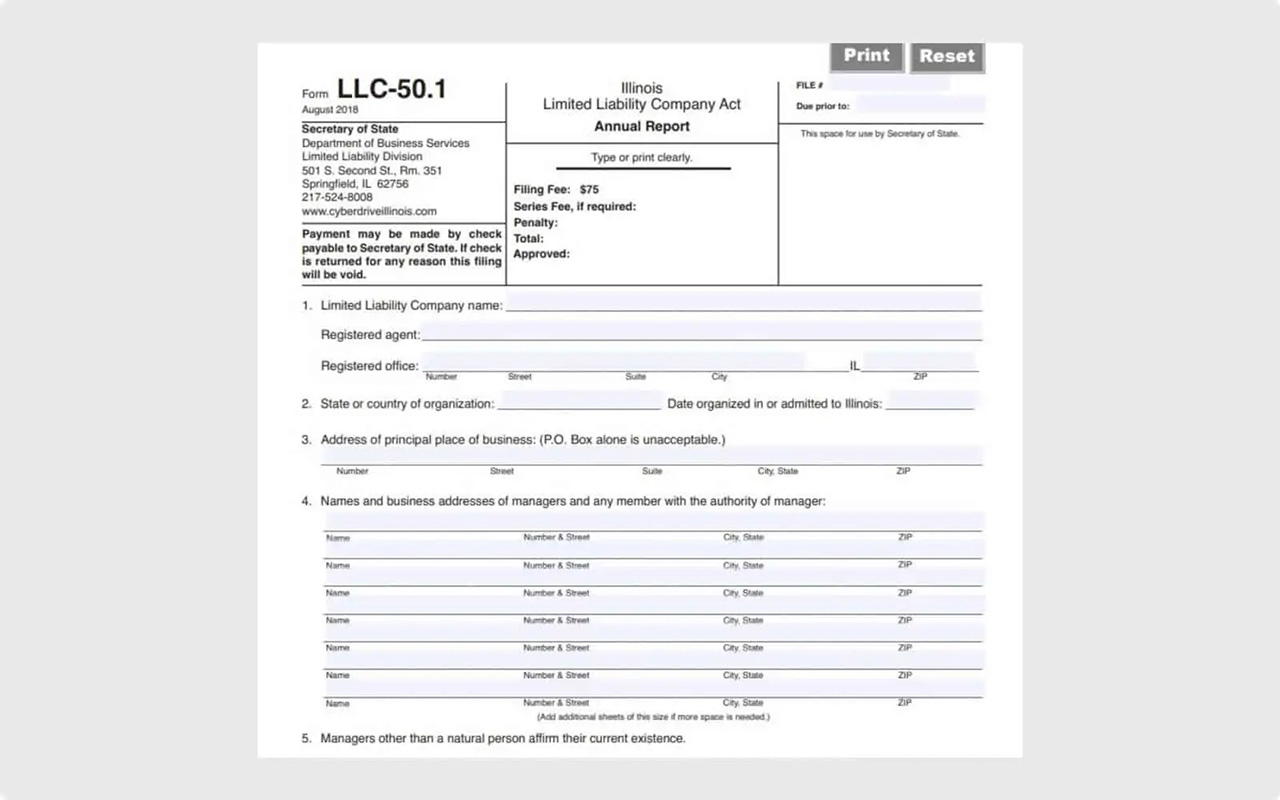

Step 2: Fill in the annual report forms

The annual report usually isn’t difficult to complete.

In most states, it will be similar to the Articles of Organization you filed to form your limited liability company. You don’t need any special legal knowledge. You should already know the information you’ll need.

Information you’ll be asked to update includes:

- Company physical and mailing address

- Registered agent name and address

- Member(s) names and contact information

If there were no changes to your company during the year, you’d still need to file an annual report in most states. Some reports will have boxes you can check, indicating that no information has changed.

Step 3: File the annual report before the deadline

It’s always best to file your annual report early to avoid late fees and prevent rejected submissions. Paper filed forms can be returned to you if your handwriting is illegible, so consider completing forms using your computer.

If your state requires or allows electronic filing, you’ll prepare and submit your annual report on the State's website and pay the filing fee with a credit or debit card. Most states accept Visa and Mastercard, and some may take American Express. Some states allow you to pay with ACH via direct debit from your business bank account.

If you’re mailing in your annual report, you’ll complete the report you found on your Secretary of State’s website by hand, or you may be able to fill it out electronically on your computer. Make a copy of the report and any other documents you submit for your records and write a check or purchase a money order for the filing fee.

What happens if you file your annual report late?

For example, in Florida, if you make a late filing even by just one day, you’ll have to pay a $400 late fee.

In addition to late fees, missing the deadline may also cause your company to be suspended until you file your report.

Some states provide a grace period that allows you to file your annual report after the deadline without incurring a late fee.

For example, Illinois charges a $100 late fee if you file your annual report more than 60 days after the deadline.

What happens if you don't file an LLC annual report?

Failing to file an annual report when you’re required to comes with harsh consequences.

Your LLC will be out of compliance, which usually leads to the administrative dissolution of the business entity. That means your company no longer exists or has the right to do business in your state.

As a result, if you have loans or other debt, you could violate the loan terms, leading to default and forcing lenders to demand immediate repayment.

To restore your LLC, you'll have to go through a lengthy reinstatement process that can come with a hefty price tag.

Fortunately, most states provide a grace period between the annual report deadline and the date your LLC will be dissolved.

Annual report fees: state by state in 2023

Filing fees for annual reports vary by state. Filing fees can be a flat fee or based on your yearly income and range from $10 to $3,000.

Below are the annual filing fees for each state:

State | LLC report filing fees |

| $15 | |

| California | |

| $10 | |

District of Columbia (D.C.) | $300 (biennial report filing fee) |

| Florida | |

| $50 | |

| Hawaii | |

| $250 (annual report filing fee; or $300 for paper-based reports) | |

| Iowa | $60 (biennial report filing fee) |

| $55 | |

| Kentucky | |

| $30 | |

| Maine | |

$300 (annual report filing fee, also includes a personal property return (PPR) for your LLC) | |

| $500 | |

| Michigan | |

| $25 (annual report filing fee; $45 for expedited filing) | |

| Montana | $15 (annual report filing must be done online) |

$10 (biennial report filing fee) | |

| $150 | |

| New Hampshire | |

| $75 +$3 for credit card processing | |

| New York | $25 (minimum annual report filing fee; the number is progressive, depending on the company’s gross income). |

North Dakota | $50 |

| Oregon | |

Rhode Island | $50 |

| South Dakota | $50 ($65 for paper-based reports) |

| $300 (minimal annual report filing for a single member, capped at $3,000 max) | |

| Utah | |

Vermont | $35 |

| Virginia | |

| $60 | |

| West Virginia | |

| $25 | |

| Wyoming | Starting at $50 (annual report license tax) |

Commonly asked questions (FAQ)

Below are some of the most frequently asked questions about LLC annual reports.

LLC Formation Service

Best LLC Service 2023

- Formed 1,000,000+ LLCs

- $39 formation includes registered agent service

- Fast formation & same day filing

- Exceptional customer reviews

Last updated: Apr 2024

Last updated: Apr 2024