Deciding if incorporation is the right move for your new business is a tough choice. While a small business can easily operate as a sole proprietorship, forming an LLC provides hard-to-ignore benefits, including vital legal protections.

This detailed lowdown of LLC vs. sole proprietorship will help you understand the implications of incorporation and whizz through the filling formalities.

What is an LLC?

A limited liability company, or LLC for short, is the simplest business structure you can use to establish business operations legally. It’s a popular choice for business owners because an LLC is easy to set up and operate.

Owners of LLCs are called members, and an LLC with one owner is called a single-member LLC. Also, LLCs can have an unlimited number of owners, and each member enjoys limited personal liability.

When to use an LLC?

Opting for an LLC makes sense when you:

- Want to limit your personal liability

- Envision bringing on investors in the future

- Plan to expand your business beyond your home state

- Want to build a business brand

What is a sole proprietorship?

A sole proprietorship is the simplest form of business ownership, also known as self-employment. It generally doesn’t require registering your business with your state unless you’re in a regulated industry that requires a professional license. Think of attorneys, doctors, or accountants.

Although this is the easiest business structure to set up and maintain, it comes with drawbacks — most notably, unlimited personal liability.

Because there is no legal separation between you, as the owner, and your business, you can be personally held accountable for any business wrongdoings. That means your personal assets are not protected if your company should fall into legal or financial trouble.

When to use a sole proprietorship?

A sole proprietorship is an operational structure most new entrepreneurs and freelancers go for at first. Specifically, it’s a common choice for:

- Early-stage bootstrapped startups

- Side-hustles and part-time work

- Low-risk small businesses

Is a single-member LLC the same as a sole proprietorship?

No, from a legal standpoint, they aren’t the same thing. A sole proprietorship is a type of business entity with one owner who has unlimited liability. A single-member LLC is a type of business entity with one owner who has limited liability.

LLC vs. sole proprietorship: main differences

Having a sole proprietorship is the easiest way to get your business up and running. You don’t need to do anything but getting started with work. There’s no paperwork involved unless you require a professional license in your state (e.g., you work as an independent lawyer, medical professional, electrician, etc.).

Forming an LLC requires a bit of up-front work to register your business with your state’s Secretary of State (SOS).

Here are the key differences between LLCs and sole proprietorships summarized:

Key differences between LLCs and sole proprietorships | ||

| LLC | Sole-proprietorship | |

Liability | Limited | Unlimited |

Business name protection | Full | None |

| Ongoing costs | $$ | Minimal |

| Taxation | Pass-through | Pass-through |

1. Registration process differences

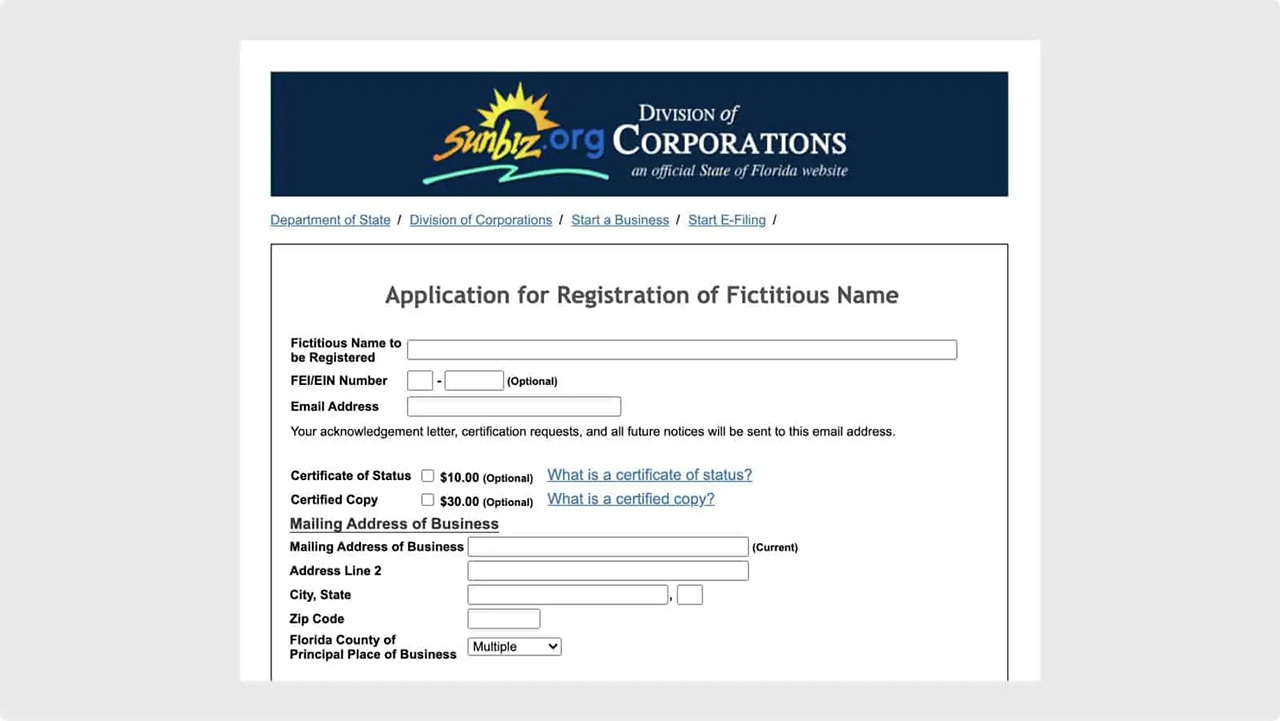

Forming an LLC requires registering your business with your state’s Secretary of State. The process is pretty straightforward.

You will need to fill in applicable state forms (e.g., articles of organization, operating agreement, etc.), appoint a registered agent, and pay state filing fees.

This initial registration process typically costs a few hundred dollars and takes several days (occasionally weeks) for the authorities to review your application. Once your state approves your formation documents, you’re legally allowed to do business.

Sole proprietorships don’t need to register with their state. But your local municipality (e.g., county or city) may require your business to have a business license. Additionally, if your profession requires a license, you should make sure that you possess it.

2. Liability protection differences

Sole proprietorships offer no personal liability protection for the business owner. That means all of the owner’s personal assets are at risk should the business falter financially or legally.

For example, if the sole proprietorship defaults on a loan, the lender can come after the owner’s personal assets to satisfy the debt. That’s because there is no legal separation between the business and the business owner. Legally, they are considered the same.

The most valuable benefit an LLC provides its owner(s) is limited liability. Each LLC member’s liability is capped or limited to their investment in the company. And if the LLC comes into legal or financial trouble, only the LLC’s assets are at risk.

Assume an LLC has assets of $50,000 made up of cash in a bank account, inventory, and equipment. The LLC is sued for $100,000 for breach of contract, and the LLC loses the lawsuit. The winning party can only recover $50,000 because that’s all the LLC has. The LLC’s members’ assets are off-limits due to the limited liability the LLC provides them.

3. Branding and trademarks differences

An LLC offers better branding benefits. That’s because your company will be a separate legal entity from you and, respectively, can have a registered brand name, also protected by trademarks if needed.

As a sole proprietorship, you can only operate by your personal name. That is unless you separately apply for a fictitious name, also known as a DBA (Doing Business As), with your Secretary of State. In this case, your sole proprietorship’s name will still be your legal entity, but you’ll also be allowed to operate under your DBA name. It can provide some limited brand recognition and protection.

Generally, registering your DBA name is less complicated and cheaper than forming an LLC, but it doesn’t provide you with the same legal protections as an LLC will.

4. Maintenance costs

Because LLCs are registered businesses with your state’s Secretary of State, you’ll need to file an annual report in all states except Alabama, Arizona, Missouri, New Mexico, Ohio, Pennsylvania, South Carolina, and Texas (unless there were any changes to your business).

An annual report is filed to provide up-to-date information about your company. Any address changes, ownership changes, and registered agent changes must be communicated on the annual report.

The annual report filing fee varies by state, but you can expect to spend up to a couple of hundred dollars per year. If you forget to file your annual report on time, you may have to pay a late fee to get your LLC back into compliance.

By contrast, sole proprietorships don’t have any ongoing maintenance costs with their Secretary of State. The only ongoing costs might be for any local business permits you need to maintain.

5. Taxation differences

While we’ve been speaking mainly about the legal differences between LLCs and sole proprietorships, it’s also important to acknowledge the tax differences between the two.

Taxation of sole proprietorships

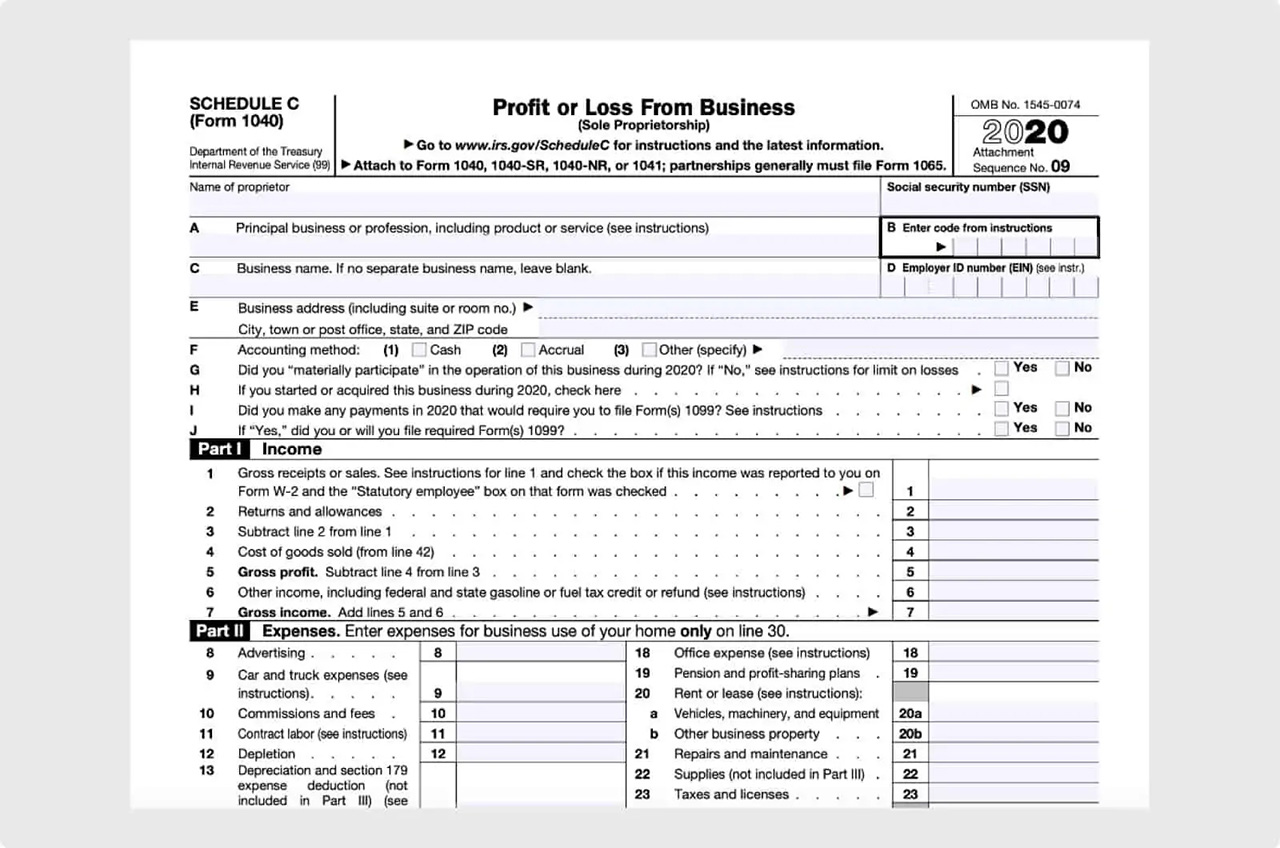

For tax purposes, sole proprietorships aren’t viewed separately from the individual owner. That means all the business’ profit is taxed on the owner’s personal tax return via Schedule C.

Taxation of LLCs

The default tax treatment for LLCs depends on the number of members it has.

Federal taxation of LLCs | ||

Number of members | Default federal taxation | Tax return due date |

1 | Sole proprietorship | April 15 |

| 2+ | Partnership | March 15 |

How do taxes work for a sole proprietorship?

As a sole proprietorship, the IRS reviews you as a disregarded entity. That means, for business tax purposes, your business is disregarded, and all company profits are treated as if earned by you, not the business. The business profits will pass through to your personal tax return on Form 1040, Schedule C.

In addition to paying income tax at your personal income tax rates on your business income, you’ll also have to pay the 15.3% self-employment tax. This tax represents the 12.4% Social Security and 2.9% Medicare taxes.

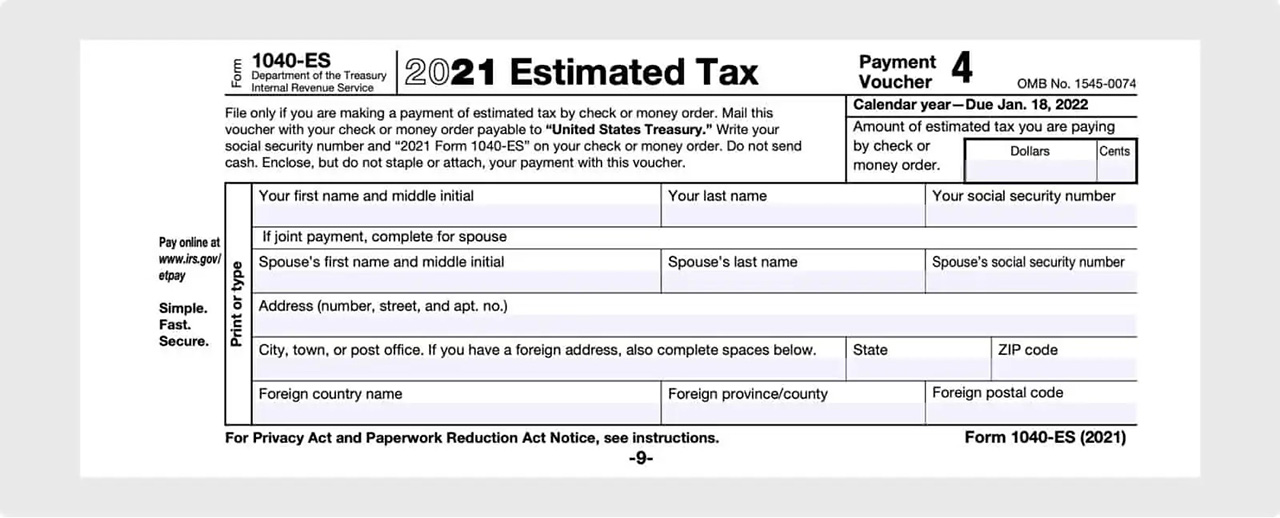

And since you’re considered self-employed, and the U.S. uses a pay-as-you-earn tax system, you’ll need to make quarterly estimated tax payments to pay your federal tax bill throughout the year.

Don’t forget about state income tax returns and state unemployment tax. As a sole proprietorship, you’ll need to pay state taxes too. Check with your state’s Department of Revenue for details on what and when you need to pay.

Do I need to file quarterly taxes as a sole proprietor?

There are few quarterly taxes you’ll need to pay as a sole proprietor.

- Federal income tax estimated tax payments, using Form 1040-ES, Estimated Tax

- Due January 15, April 15, June 15, and September 15

- State income tax estimated payments. These vary from state to state

- State unemployment tax payments. Vary from state to state

Be sure to check with your state’s tax authorities to find the correct tax form and the due dates.

How is LLC income taxed?

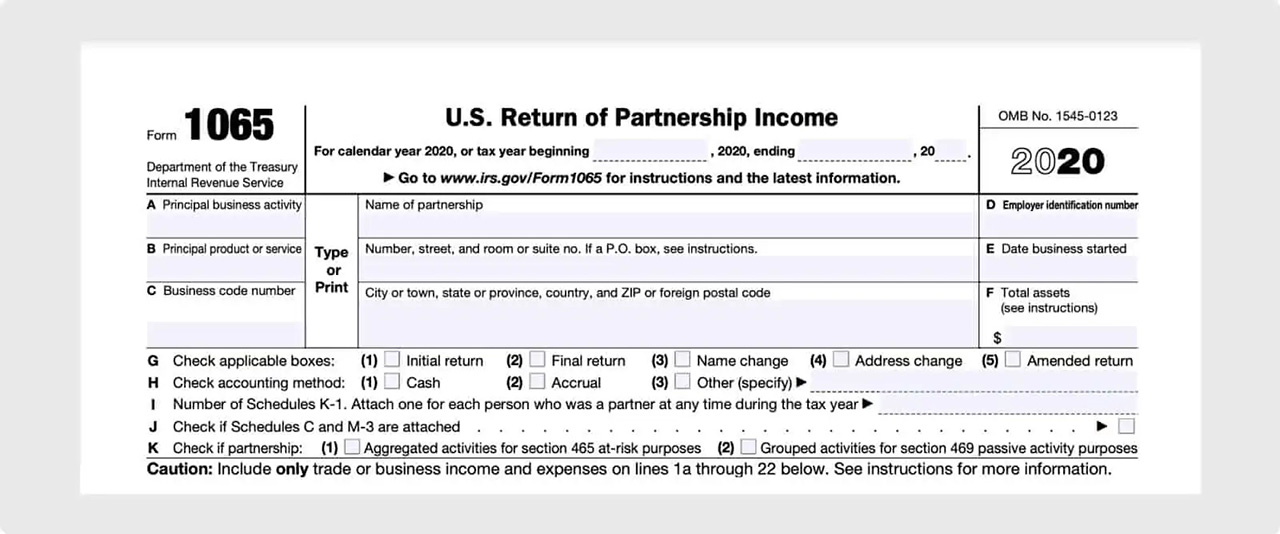

LLC income is taxed at the federal level based upon the number of members it has. A single-member LLC (SMLLC) is typically taxed the same way as a sole proprietorship. LLCs with more than one member is taxed as a partnership for federal income tax purposes. Instead of the business income directly flowing through to your personal Form 1040, a partnership tax return is required. That means a partnership tax return will need to be filed using Form 1065, U.S. Return of Partnership Income.

Each member will receive a Schedule K-1, Partner’s Share of Income, Deductions, Credits, etc., for their share of the business income to be used when preparing the individual tax returns.

Generally, members of multi-member LLCs pay self-employment taxes on their share of the business profits, just as SMLLCs do.

Is an LLC better for taxes?

Generally, an LLC offers no significant tax benefits over a sole proprietorship. Tax benefits arise when you elect to have your LLC taxed as an S-corporation. On the other hand, if you choose to get taxed as a C-corporation, you will need to pay a corporate tax rate on your business income.

Conclusion

Sole proprietorships are best suited for small one-person businesses which aren’t risky (i.e. you’re unlikely to get sued) and don’t intend to grow very large. They require minimal administrative upkeep, and the operating costs are minimal.

LLCs offer legal protections not granted to sole proprietorships. For the small initial investment and recurring annual fees, the limited personal liability you’ll receive operating as an LLC may outweigh the costs.

FAQs about LLC vs. sole proprietorship

Below are some of the most frequently asked questions (FAQs) regarding the differences between an LLC and a sole proprietorship.

LLC Formation Service

Best LLC Service 2023

- Formed 1,000,000+ LLCs

- $39 formation includes registered agent service

- Fast formation & same day filing

- Exceptional customer reviews

Last updated: Apr 2024

Last updated: Apr 2024